State Of The Market 2009: 10 Things To Know

It's hard to discuss the VARBusiness 2009 State of the Market survey without first addressing the gorilla in the room: the economy. The Web-based study fielded during November by the Institute for Partner Education & Development (IPED), analyzed responses from 350 North American solution providers weighing in on where they think the IT market is going in 2009. IPED is the research arm of Everything Channel, which also owns ChannelWeb. And the economy was top of mind, leading off our list of the 10 key takeaways.

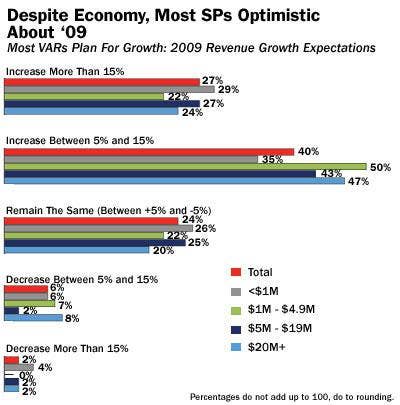

VARs say global recession, weak consumer spending and the credit crisis all trouble them going into next year. But despite their concerns, solution providers aren't retreating or retrenching. Instead, SOM results indicate that VARs are identifying areas of opportunity and aggressively pursuing them. VARs listed the global recession, weak consumer spending and the credit crisis as their top three concerns. But waiting in the weeds are rising unemployment numbers -- the Federal Reserve late last month said the prospects for weaker economic activity will push up unemployment. The Fed projected that the national unemployment rate will rise to between 6.3 percent and 6.5 percent this year. The rate in October was 6.5 percent, and last year the rate averaged 4.6 percent. Next year, the Fed expects the jobless rate to climb to between 7.1 percent and 7.6 percent—also higher than its summer forecast.

But some solution providers see opportunities in the unemployment numbers, especially if customers trim ranks in their in-house IT support staffs.

"We are seeing the services part of our business pick up," said Don Richie, CEO of Sequel Data Systems, an Austin, Texas-based solution provider. "The bottom line is that companies that have to cut back on their infrastructure are coming to us and asking if we can provide a person two days per week to manage their data center, and pay us $200 per hour vs. paying someone's salary."

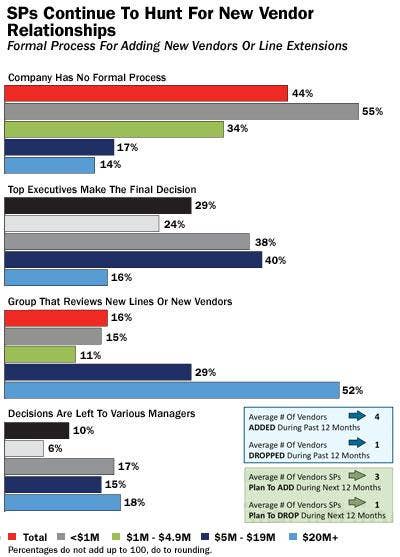

The need for better, more robust solutions and the quest for higher profit margins are driving solution providers to add new technology and new vendors. In a business climate where IT investments must bring quick returns on investment, solution providers are constantly on the lookout for new vendors that can provide building blocks to their business solutions.

Solution providers of all sizes, from those with annual revenues under $1 million to those with annual sales in excess of $20 million, agree that client need for new technology and better margins are the top two motivators when adding new vendors.

Dan Evans, president of Nexus Information Systems, a Minnetonka, Minn.-based solution provider, said that he doesn't sign up new vendors on the basis of "having the next cool thing." Rather, he adds companies and products based on whether they can fill a niche in his existing toolbox of solutions. "We are pretty content with what we have and typically bring vendors on to fill a niche or to improve what we already have," he said. "Or we add new partners when one of the vendors we work with becomes complacent."

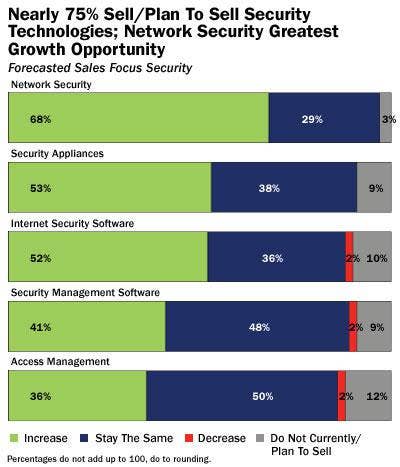

Solution providers say demand for security solutions won't skip a beat in 2009. VARs responding to Everything Channel's 2009 SOM survey picked network security, security appliances and Internet security software as solutions where they expect 2009 revenues to exceed those in 2008.

Driving the need for data security solutions are compliance issues in health care, government and business.

Larry Holzenthaler, executive vice president of sales and marketing at Total Tec Systems, an Edison, N.J.-based Hewlett-Packard Co. solution provider, noted that law firms and state government businesses are holding up well. "Their spending doesn't seem to be affected," he said.

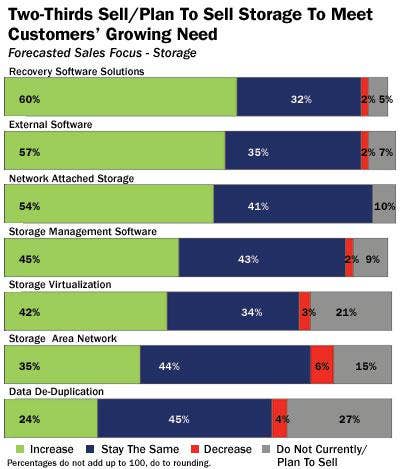

Storage software and virtualization technology could outpace storage hardware sales next year, but the entire storage arena is on an unmistakable growth curve. Sixty percent of the VARs surveyed for SOM forecast growth in data recovery software solutions, indicating data access is a key part of the storage equation.

External storage was tapped by 57 percent of the VARs as a market that should grow next year. And 54 percent of the solution providers said their NAS business would grow next year.

Storage management software and storage virtualization should also see gains next year, according to VARs responding to the SOM survey. Forty-five percent pegged storage management software as a growth market next year, while 42 percent said storage virtualization solutions would increase in 2009.

By contrast, only 35 percent of VARs predicted that SAN sales would grow in 2009, while 44 percent said their SAN business would stay flat compared with 2008.

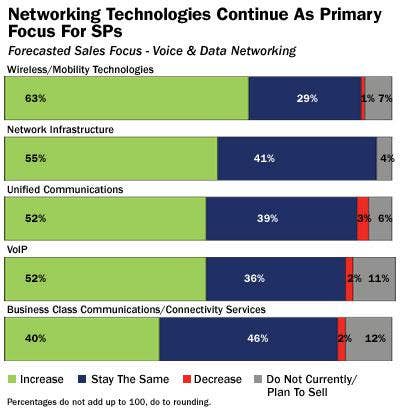

Voice and data networking technologies could be the hottest market in 2009, according to the 2009 SOM survey. Wireless technologies are expected to lead the charge with 63 percent of the VARs surveyed saying they expect demand for wireless solutions to grow next year.

That was followed closely by demand for networking infrastructure, as 55 percent of the solution providers predicting that market to grow in 2009.

And solution providers hope to cash in next year on demand for unified communications and VoIP technologies. Fifty-two percent of the VARs surveyed said they expect growth in unified communications, while 52 percent said demand for VoIP would grow.

Those predictions jibe with the cost-cutting, quick-ROI climate sweeping through businesses of all stripes in face of the unprecedented economic crisis. Many CEOs are targeting their voice and data communications as a way to quickly reduce costs. And the mantra many solution providers are hearing from their customers in VoIP/unified communications is, "I'm willing to spend money to save money."

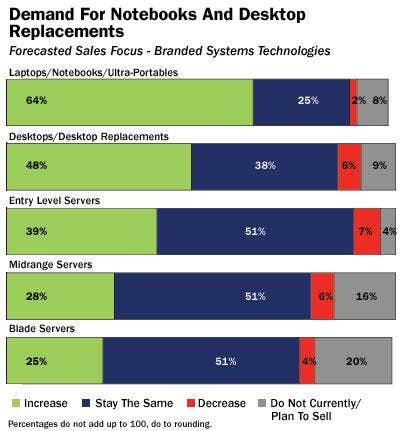

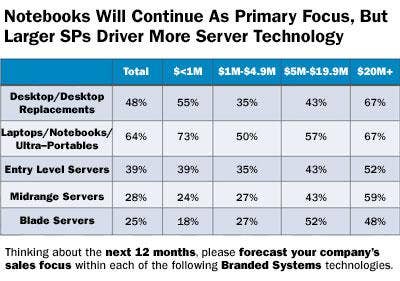

In an otherwise slow hardware market, solution providers see strong growth potential in laptop and desktop sales. Some 64 percent of the VARs surveyed predicted laptop sales would increase next year, while 48 percent anticipate growth in desktops.

VARs say the growth in laptops reflects an ongoing shift to mobile systems and the robust health-care vertical with its heavy reliance on mobile computing devices. Meanwhile, desktop growth could be spurred by a long-anticipated refresh cycle. And some solution providers that are active in both the commercial and consumer markets say retail business is holding up despite the dour economic outlook.

"People are still spending money," said Rick Chernick, CEO of Camera Corner/Connecting Point, a solution provider in Green Bay, Wis. "I'm focusing on areas like health care, where you know people are still going to spend money. Education is still spending money and small and medium business is still spending money."

Solution providers predict a rough ride for server sales in 2009, especially for blades and midrange servers. Some VARs say the slowdown reflects anticipated weakness in the enterprise market.

Consolidation and virtualization also figure into the mix. Solution providers note that those services seek better utilization rates on existing infrastructure as a way to reduce the overall number of servers. While consolidation and virtualization can yield a quick ROI for the customer, they conspire against more unit server sales.

Only 25 percent of VARs surveyed predict an increase in blade server sales in 2009, while just 28 percent anticipate an increase in midrange servers. The one bright spot seems to be in entry-level servers, where 39 percent of the respondents to the SOM survey predict a sales increase.

Some VARs attribute this to more strength in the small-business market than in enterprise business.

"We are seeing some issues in the midmarket; it's uncertainty and people are just waiting," said Arlin Sorensen, CEO of Heartland Technology Solutions, Harlan, Iowa. "In SMB, we aren't seeing that at all. We had a good month in October; we haven't seen it in our numbers at all."

It could be a mixed bag for imaging and printing products as the market continues its shift from point products to networking solutions. Solution providers active in the market are now focusing on document management solutions. As such, the consolidation that is sweeping the server market is now spreading to printing and imaging.

Solution providers report that in large organizations, printer consolidation can lead to an 8-to-1 reduction in printers and additional savings in consumables and documents printed. Thirty-eight percent of the solution providers surveyed said they expect an increase in multifunction printing devices this year, but 47 percent predicted the market would stay the same in 2009 as it was in 2008.

Network color laser printer sales should increase, according to 34 percent of the VARs responding to the 2009 SOM study. But 50 percent said network color laser sales would remain flat. In a sign that monochrome printers may be going the way of the typewriter, 19 percent of the VARs said their sales of those products would grow next year, but 16 percent expected monochrome printer sales to decrease.

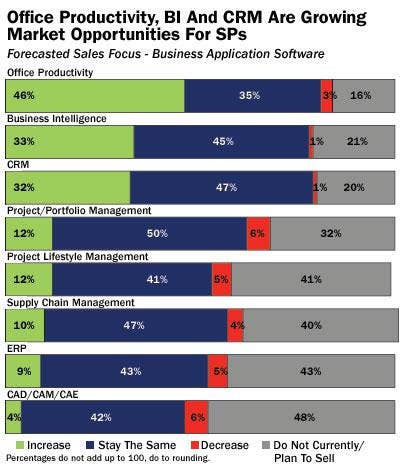

Solution providers planning to sell business application technologies in 2009 should focus on office productivity solutions. That's where VARs see the most growth next year, according to the 2009 SOM. Forty-six percent of the solution providers surveyed said demand for office productivity solutions would grow next year.

Business intelligence solutions and CRM should also see modest growth in 2009, with 33 percent and 32 percent, respectively, of the VARs surveyed expecting growth in those categories.

But sales of other business application technologies face an uphill fight for growth next year. Just 13 percent see growth in project management software while 50 percent of the solution providers said the market for that category of software would be flat. Only 9 percent see growth in ERP applications, while 43 percent predict a stagnant market and 5 percent say demand for that software category will decrease in 2009 over 2008.

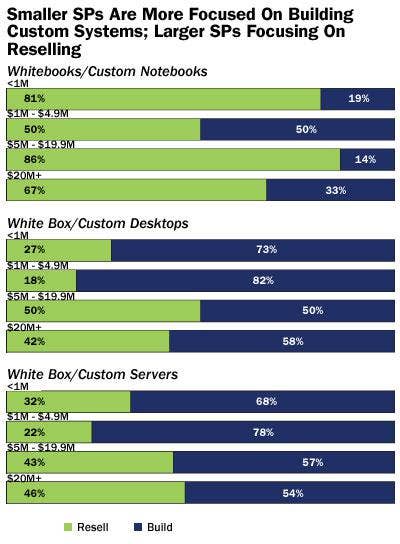

News of the demise of the custom systems market is premature. In fact, in spite of a narrowing gap between branded systems and custom system pricing, the market for custom systems appears ready for a renaissance led by notebooks.

Thirty-four percent of the VARs surveyed said they resell custom notebooks and another 11 percent said they build them. Those numbers are approaching the historical custom systems market share of desktops and servers sold and built by solution providers. Over half the VARs say they continue to build and sell custom desktops and servers.

What appears to be driving demand for custom systems is new processor technology, including Intel's new Core i7 chips and AMD's recently launched Shanghai chips. Intel's new Nehalem microarchitecture includes a "native" core architecture that features independent power supplies for better power management and less energy leakage.

The looming battle between AMD and Intel for the hearts and minds of systems builders will come down to performance, and which processors emerge as the leader in power consumption, solution providers say.