Margin Makers: Peripherals Stay Up In A Down Economy

This year, a number of events have also converged to make peripherals across the IT spectrum both attractive to end users and increasingly profitable -- or at least margin-steady -- for solution providers. For example, rising energy prices and increasing environmental consciousness have made power-efficient hardware both a must and an ROI no-brainer. At the same time, technology providers have reached new levels of success at integrating features like HD video, Wi-Fi, security and manageability into the whole range of peripherals from projectors to LCDs to printers.

Also, while inflation has begun to impact the U.S. economy, peripherals pricing has remained steady, making them an increasingly strong bargain compared to other non-IT goods and services.

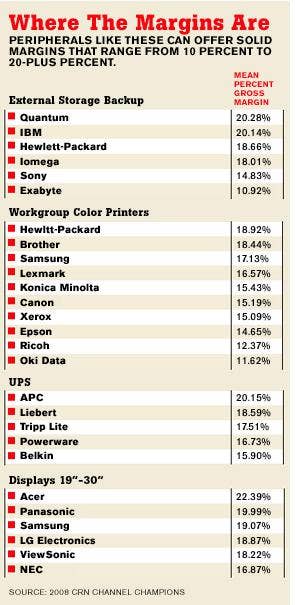

Out of this environment there emerges a picture of a healthy margin structure for peripherals, which the CRN Test Center details in this 2008 Margin Makers special report. And it's a picture that should hold while the market continues to adopt the new technical breakthroughs and usage patterns.

Add-on Storage

Last year, VARs began telling CRN Test Center researchers that desktop external storage had become a growing area of profit opportunity—at the same time that vendors like Western Digital Corp., Lake Forest, Calif., broke through the 1 TB mark and began adding technical functionality like remote access and encryption to their products.

Now, coupled with advances in storage virtualization and deduplication, VARs are continuing to point to data center add-on storage as a valuable margin opportunity. The 2008 CRN Channel Champions Survey found that top vendors provide them with product margin opportunities ranging from 10 percent to 20 percent—and from vendors whose offerings can range between $10,000 to $20,000 in street price. IBM Corp., Hewlett-Packard Co., Iomega Corp., Sony Corp., Quantum Corp. and Exabyte Corp., according to VARs, have all been offering double-digit margins even in an economy that had some fearing a recession earlier this year.

"My thoughts here are around the shift we're seeing—and driving—from product to solution sales," said Jerry Baldock, worldwide manager for IBM's Storage Channel Strategy. "One of IBM's value-adds is enabling partners to offer solutions that include IBM hardware, software and services, and that this ability for partners to be able to position themselves as a 'trusted adviser' to the customers is where the future lies.

"The second part would be understanding the market and our offerings. For storage attach there are [a number of] segments, with quite different needs and sales skills required," Baldock said.

Next: Printers Printers

Multifunction devices and print managed services are helping solution providers see higher margins when selling printers as a part of their total solutions.

Higher-priced MFPs are much more complex to install and maintain than simple plug-and-play single-function printers, allowing VARs to bundle lucrative installation, consumables and maintenance services into MFP price tags that drive up revenues.

The product is not high-margin but usually the installation that goes with it is, said Luigi Giovanetti, owner of CPU Sales and Service Inc., a solution provider based in Waltham, Mass. "When there's a device like that we always add on the extended warranty because when a piece of equipment fails, you're missing a lot."

Hewlett-Packard is throwing its weight behind MFPs with rebates for members of its partner programs, like the Office Printing Channel Partner Program, that can take a 10-point margin on an MFP and turn that into 40 points or more, according to Donna Waida, value channel program and development manager for HP's Imaging and Printing Group.

VARs in CRN's Channel Champions survey this year gave HP, Palo Alto, Calif., top marks for margin on workgroup color printers with an average of 18.92 points.

VARs reported that Brother International Corp., Bridgewater, N.J., had the second-highest average margin on workgroup color printers with 18.44. Brother's flagship product in the workgroup color lineup, the DCP-9045CDN, a digital color printer/copier, sells for $699.

Samsung, Seoul, Korea, which launched its $2,999 network-ready SCX-6345FN MFP earlier this year, also topped the margin chart with VARs, reporting 17.13 points.

Print managed services programs, or cost-per-page programs, like Xerox Corp.'s PagePack program, are also margin makers for VARs, and ones that bring steady revenue streams through multiyear contracts and bundling consumables.

"Managed print services allow you to put in a two- to five-year contract so you know what your revenue is going to be, and so that you can manage efficiencies in product and consumables. You have all the pieces locked in. They don't go buy some third-party crap somewhere that messes up the printer," said Paul Knowles, president, Atlantic Computer Innovations Inc., Tallahassee, Fla."It's a real slick way to get into managed services and figure out whether that's right for your company or not."

UPS And Cooling

With UPS and cooling product sales, solution providers are, as with other peripherals, making most of their money on services and installation.

At UPS vendor Liebert Corp., Columbus, Ohio, part of Emerson Network Power, VARs can sign customers up for five-year service contracts that include on-site maintenance and repair, parts coverage and four-hour response time, provided by the vendor.

This helps VARs keep margins high, said Thomas Karabinos, of partner channels for Liebert. "Most service packages are inherently high-margin, he said. VARs reported average USP margins from Liebert at 18.59 points in CRN's 2008 Channel Champions survey. Meanwhile, cooling hardware is also inherently high-margin at Liebert, providing upwards of 20 points on most products, he said.

Vendors are also unveiling programs to help VARs make sales. Tripp Lite, for example, is rolling out its Power Project Audit program with some of its VARs. Tripp Lite's audit sheds light on a customer's power needs and then the company helps its VARs identify and go after additional sales opportunities the audit exposes. Tripp Lite, Chicago, had the third-highest mean gross margin in the Channel Champions UPS category with 17.51 points.

Customer needs in areas like virtualization, rising densities and green initiatives in the network and in the data center are all helping the category grow and become more profitable, according to Gordon Lord, director of global channel programs at American Power Conversion Corp., West Kingston, R.I. APC launched a revamped channel program this year, and Elite partners can get an additional five-point margin on products.

Next: Projectors Projectors

The number of projectors passing through the CRN Test Center this year with integrated Wi-Fi, smaller and lighter form factors and increasingly better presentation quality and performance has been noteworthy. From Panasonic Corp.'s new entries into this space, with wireless networking and compact design, to NEC Corp.'s NP3151W that takes advantage of wide-screen presentation, to ultraportables from InFocus Corp., manufacturers have been busy bringing new technologies and use patterns to the fore this year.

"We're better off because prices have come down, they're producing better-looking projectors, which produces some demand as people want to move to a smaller and lighter projector," said Dwight Gaut, owner of LawDesk Computers, a Seattle-based solution provider. Gaut said, by and large, projector margins "don't fluctuate up and down" and have been steady; his preferred vendor in the space remains ViewSonic Corp., Walnut, Calif.

LCDs

When this year's Channel Champions survey results were tallied, one of the more noteworthy set of results around any product or technology area were the margins connected to LCDs. Of the manufacturers whose display product lines we surveyed with resellers, margins on LCDs ranged anywhere from about 17 percent to 22 percent.

Why is that significant? Because, according to research firm DisplaySearch, Austin, Texas, LCD prices across the board began by midyear to encounter some pressure, largely due to significant new manufacturing plant capacity that's come online in 2008 and earlier. (In June alone, the firm said, LCD prices dropped by 8 percent.) So how are manufacturers providing VARs with margin opportunities in an LCD space with this dynamic?

One word: Options.

For example, Samsung this year has provided a range of new LCDs, 20 inches and up, with wide-screen, built-in Web cam and audio, tilt-to-vertical capabilities and HD functionality. Systems like the SyncMaster 275T Plus, a 27-inch, wide-screen system, are priced between $650 and $1,000 but provide many of the benefits of solid, dual-screen solutions but with the power consumption of a single system.

ViewSonic has ramped up its 22-inch to 24-inch solution set, also targeting much the same strategy. NEC executives say they've put extra effort into providing complete technical services for VARs and customers, providing HD image burn, and hardware and software modification prior to shipping—activities that can allow VARs to focus on the solution sale.

And then there are vendors like Hewlett-Packard and Acer America Corp., San Jose, Calif., which have in recent years seen their volumes of PCs climb tremendously; along with those volumes, their volume and share of LCD sales has also increased.

Scanners

As document-imaging solutions and electronic document processing become more common, scanners are playing a bigger role in customer networks, and VARs that play their cards right can see extra margin from the software and services that go along with networked scanners.

"There is some ad-hoc scanning going on, but more and more we find out that the resellers are involved in bigger systems implementations. If you have a scanner, you probably have a need for storage. They also have networking if they're moving images around a network. It's really a nice component to a very profitable system," said Don McMahan, regional business manager and vice president of sales,document imaging division, U.S. and Canada, for Kodak, Rochester, N.Y.

And in spite of ups and downs in the economy, scanners have been showing double-digit growth for the past 10 years as both enterprise and SMB companies deploy imaging solutions, he said.

Kodak makes its own Capture Pro imaging software, giving VARs the ability to make money both on the software and on installing and configuring it. "We find that software often leads the way in these big opportunities," McMahan said.

VARs partnering with Fujitsu Computer Systems Corp., Sunnyvale, Calif., can drive up margin by participating in the vendor's One Capture Alliance program, a tiered partner program that gives VARs rebates of 1 to 4 percent based on annual sales volume. VARs that sell $185,000 worth of Fujitsu scanner products in a quarter get 4 percent. At $50,000, VARs get 1 percent off.

Methodology

This 2008 Margin Makers report on peripherals is based on data from our 2008 CRN Channel Champions research from earlier in the year, combined with follow-up discussions with vendors and VARs, and an up-close look by CRN Test Center engineers at the technology platforms themselves.