Affinity Index: Notebooks

Despite dire economic times, solution providers say they still expect customers to continue to buy laptops, more in the second half of the year than the first half--and Hewlett-Packard laptops more than any other--with the end user's brand preference and a vendors' ability to achieve targets as the most important factors, according to new research by the Institute for Partner Education & Development (IPED).

According to IPED's new Affinity Index, HP had the most share in terms of the dollar value of proposals written by VARs in the first half of the year, as well as the value of proposals closed in the first half and those expected to close in the second half of the year. But VARs' affinity for HP doesn't stop with market share. In the SMB laptop category, the Palo Alto, Calif.-based vendor achieved the highest Affinity Index score, which accumulates scores for 15 different factors. each factor weighed by importance by solution providers.

The following slides illustrate some results in the notebook category. ChannelWeb will provide further findings in other product categories throughout December.

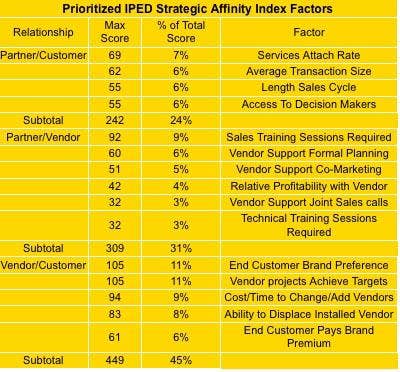

End-customer brand preference and the ability for vendor projects to achieve targets were the two most important factors chosen by solution providers, each scoring about 11 percent of the total score in the Affinity Index. Meanwhile, a vendor's support joint sales calls and technical training sessions were considered the least valuable of the 15 criteria used to score vendors, each scoring only about 3 percent of the total.

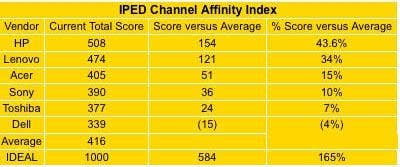

In addition to its value share dominance in the Affinity study, HP also finished with the highest Channel Affinity Index score in the category, with a total score of 508 -- 22.2 percent greater than the average score of 416. Overall, VARs seem to like what's coming out of HP. Lenovo was within striking distance with a score of 474 out of a maximum of 1000.

"HP has a proven record of investing in their channel partners. They have a large variety of notebooks from touch screen to workstation, which can serve a wide variety of customers," said Tom Lowry, senior partner with Corus Group, Norcross, Ga. "Furthermore, the HP Renew [refurbished] channel offers a greater flexibility in pricing and configurations for both new and Renew HP-authorized notebooks. Also, selling the authorized HP Renew notebooks can be great for all parties involved, as they sell products that may have been cancelled from another order and customers can take advantage of deep discounts."

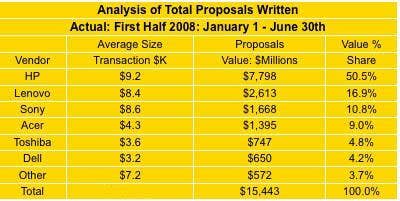

The research shows that more than half (50.5 percent) of the dollar value of laptop proposals that VARs extended to end users in the first half of the year contained HP as the vendor. HP also had the highest average transaction size for proposals in the first half, at $9,200.

Lenovo and Sony had the next greatest share of proposals, but combined they were barely half of HP's. But at least their average transaction size came close to HP, which Acer, Toshiba and Dell can't say.

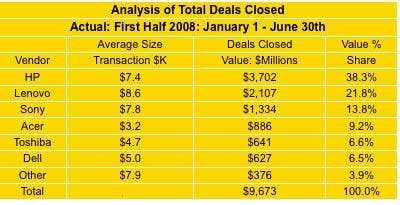

In getting customers to seal the deal, HP partners again stood out from the pack, reporting an impressive 38.3 percent of dollar share value derived from deals closed in the first half of 2008. Lenovo placed a distant second, closing 21.8 percent of first-half deals.

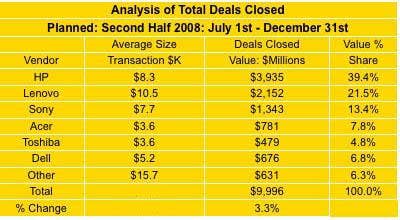

HP solution providers anticipate report even more market share growth in deals planned to close in the second half of the year. They expect 39.4 percent of dollar value to be derived from deals closed in the second half of the year.

Why is HP enjoying such success? "Our customers choose HP notebooks because of their stable platform, reliability, warranty support and overall quality delivering the best value when compared to the competition," said Chari Darneal, vice president of communications for Western Blue Corp., a Sacramento, Calif.-based solution provider.

Overall, VARs expect to close 3.3 percent more laptop sales in the second half compared to actual first half sales, a projected $10 billion compared to $9.67 billion in actual deals in the first half. In addition, the average transaction price is expected to increase 12.9 percent to $7,300, from $6,400, according to IPED.