Dell VARs: Going Private Provides Breathing Room To Focus On Enterprise

Solution providers are relieved to see the cloud of uncertainty over Dell's immediate future lifted after Dell shareholders voted to approve the company's privatization plan.

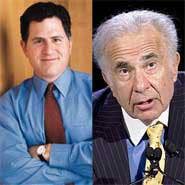

Dell shareholders on Thursday agreed to CEO Michael Dell and his investment partners' plan to take Dell private in a deal worth nearly $25 billion, beating back investor Carl Icahn's moves to block the leveraged buyout.

The vote now lets Dell proceed with plans to move from a PC focus to an enterprise focus without worrying about Wall Street scrutiny or Carl Icahn disruptions, solution providers said.

[Related: Dell Execs Behind The Scenes: We Can't Flip-Flop On Strategy ]

"We're finally rid of the shackles of Carl Icahn," said Paul Clifford, president of Davenport Group, a St. Paul-based solution provider and Dell partner.

Clifford said he's pleased to hear about the vote. "The whole cloud hanging over this privatization from Carl Icahn has not been good for the company, not good for customers. It left a cloud over Dell's technology direction. And, now it's gone!"

Dell has the best IT vision in the industry, Clifford said, thanks to a series of smart acquisitions such as Compellent and EqualLogic in storage, data compression technology developer Ocarina, Quest Software, and more.

"Now Dell is free to restructure itself," he said. "When you look at the acquisitions Dell has made in the last three to four years, they're not point products. Dell is always saying, everything is 'better together.' Well, guess what? It is."

Michael Dell has always remained true to his roots, open and available, and willing to adapt to meet customers' needs, wrote Douglas Grosfield, president and CEO of Xylotek Solutions, a Cambridge, Ontario-based solution provider and Dell partner, in an emailed response to CRN.

"[Things] can only get better without [Dell's] vision in the tech industry being hampered by the realities of running a massive and leading edge tech firm as a [publicly] traded company," Grosfield wrote.

Thomas Echevarria, CEO of Xatacom, a Dell partner based in Fort Worth, Texas, called the vote exciting news.

"We have always championed Michael Dell over Carl Icahn," Echevarria said. "We look at Michael Dell as the leader of the company in the same way Steve Jobs was to Apple. Now, Michael has the strength and leadership to do what he wants."

The IT industry is changing rapidly, and companies need to keep pace with those changes, Echevarria said. "If Michael can change the direction of Dell faster without having to worry about the monkey of Wall Street on its back, than that's a good thing," he said.

For many solution providers, the big news actually happened when Carl Icahn gave up his fight over the future of Dell.

"We are as surprised as anyone that Carl Icahn has stepped back from his efforts to keep Dell from going private, which has been an interesting battle to follow in the news at CRN," Grosfield said.

NEXT: Vote Anti-Climatic, But Solution Providers See Exciting Changes Ahead

In a way, Dell's Thursday announcement seems like old news, said Michael Tanenhaus, principal at Mavenspire, an Annapolis, Md.-based solution provider and Dell partner.

"People pretty much already felt this was a done deal after Icahn ended his battle," Tanenhaus said. "So there was no surprise."

Scott Winslow, president of Winslow Technology Group, a Boston-based solution provider and Dell partner, felt similarly.

"The vote was a little anti-climatic," Winslow said.

But, no surprise does not mean no excitement, solution providers said.

Tanenhaus and Winslow on Thursday were among a couple hundred partners and users attending the Dell Healthcare Partner Forum, which, by coincidence, was being held the same day the shareholder's vote was scheduled.

"People here are glad it's over," Tanenhaus said. "Now Dell can focus on how to go to market and not focus on politics."

Winslow said that, after the vote, a Dell executive walked on stage and announced "Dell is now the largest startup in the U.S."

Prior to that, Tanenhaus said, Dell executives seemed to be in a "huddle room" waiting for the results and then deciding what to say.

Dell has a lot to do now that the vote is done, solution providers said.

Priority No. 1 is to continue integrating its various acquisitions, Winslow said.

"Dell has to put everything together," Winslow said. "But it didn't need to do that while worrying about Wall Street and its short-term focus. This will give Dell a long-term focus, and allow them to create value for customers."

Dell has the solution set to make it happen, Winslow said. "As an integrator, I can look my customers in the eye and say, we have the best server architecture with Dell. I couldn't look customers in the eye four years ago and say that. But, now I can say I have the best server products, have switches as good as those from Cisco and Hewlett-Packard, have great storage, have the best security technology. I think Dell will be a force to be reckoned with."

A Dell executive on stage at Winslow Technology Group's Dell user conference explained what Dell was trying to do by using a hockey analogy, Winslow said.

"The exec told us, 'It's like hockey. Wall Street looks at where the puck is, but you have to go where the puck will be. Going private allows us to do that,'" he said.

Dell's focus has been diluted a bit while the technology industry changes quickly, and Michael Dell has been fighting to take back his company, making the final vote an exciting time, Xylotek's Douglas wrote.

"Far too few large tech manufacturers remember what the little guy needs, the local or regional VAR, to say nothing of the actual end customer," he wrote.

Kristin Bent and Tom Spring contributed to this story.

PUBLISHED SEPT. 12, 2013