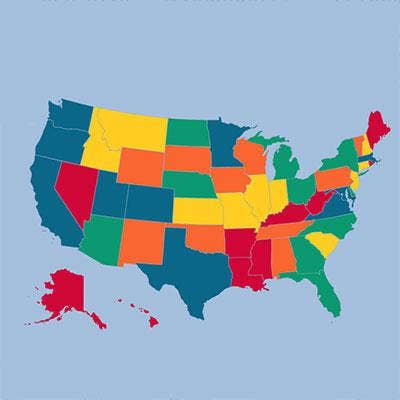

The 10 Worst States For Channel Growth

Uphill Battle

Solution providers can have the best strategy in the world, the best mix of products and services, and the best team of executives and engineers. But a lot of factors out of a solution provider's control, based on the states and regions where a company does business, can have a significant impact on a solution provider's growth prospects.

CRN has analyzed data on all 50 states on worker education and experience, labor and business costs, taxes and regulations, growth and innovation potential, business opportunities and other criteria to identify the states with the best and worst environments for solution provider growth.

Here are the 10 states that have the least to offer when it comes to boosting a solution provider's growth prospects, starting with No. 41 (out of all 50 states) and concluding with the worst state (No. 50) for growth.

No. 41: Tennessee

Tennessee ranks No. 23 for its moderate labor costs. But that's offset by its poor ranking (No. 43) for workforce education and experience.

The Volunteer State is ranked an impressive No. 7 for its business-friendly regulatory environment and the state's corporate income tax is a moderate 6.5 percent. But high property taxes and the highest combined state and average local sales tax rate (9.45 percent) in the country reduce the overall tax and regulatory ranking to a mediocre No. 33.

Our analysis ranks Tennessee at No. 31 for innovation and growth and for business opportunity -- the latter takes a hit from a poor (No. 43) job growth rank by Stateline -- Moody's Analytics Job Growth 2014.

No. 42: Nevada

Nevada isn't a great place to find talented workers. The state ranked a poor No. 48 in our analysis for the level of education and experience of its workforce. That included a rock-bottom No. 50 rank for the state's education system by CNBC America's Top States for Business 2015, and a No. 50 rank in a 2014 report from The Information Technology & Innovation Foundation for the low percentage of managerial, professional and technical jobs as a share of the total private-sector workforce.

The Silver State is ranked No. 24 for its tax and regulatory burden -- despite its lack of a corporate income tax and low property taxes. (The state's 7.94 percent combined state and average local sales tax rate is on the high side among the 50 states.)

The Great Recession hit Nevada hard and the Forbes Best States for Business report ranks the state last for economic climate. The state's real GDP grew 1.0 percent in 2014.

No. 43: Alaska

Alaska can be an expensive place to do business with limited opportunities across its vast expanse. Our analysis ranks Alaska No. 49 for business opportunity: Its bottom ranking (No. 50) for the number of businesses in the state means that building a customer base can be a challenge. The CNBC America's Top States for Business 2015 ranks Alaska's economy at No. 49, not surprising given that the state's real GDP declined 1.3 percent in 2014 -- the worst economic performance of any state.

Alaska's 9.4 percent corporate income tax is among the nation's five highest.

The Last Frontier State ranks No. 44 in overall labor and employment expenses (including high energy and electricity costs). But on the plus side, it does rank fairly high (No. 15) for the experience and education level of its workforce.

No. 44: Wyoming

Wyoming is another state whose taxes and regulatory environment ranking (No. 27) benefits from the lack of a corporate income tax and a moderate 5.47 percent combined state and average local sales tax rate. But the state's No. 41 regulatory ranking by Forbes Best States for Business is surprisingly poor.

Despite Wyoming's healthy real GDP growth of 5.1 percent in 2014 (behind only North Dakota and Texas and tied with West Virginia), poor scores for other criteria such as the sparse number of businesses and poor job growth put the state dead last in business opportunity.

The Equality State's No. 49 rank for information technology jobs (employment in IT jobs in non-IT industries as a share of total private-sector employees) pulls down the overall innovation and growth ranking (No. 44).

No. 45: Rhode Island

Rhode Island, dead last in our 2014 rankings, has moved up five spots this year. But in our analysis the Ocean State still has a long way to go in offering a solid business environment for growing solution providers.

The state is still ranked No. 50 in taxes and regulatory environment. Its corporate income tax and combined state and local average sales taxes, both 7.0 percent, are on the mid to high side.

Despite its location in the busy New York-Boston corridor, Rhode Island's rankings for both business opportunity and innovation/growth are stuck at No. 42. The CNBC America's Top States for Business 2015 study ranks Rhode Island a poor No. 45 for economic expansion and development potential.

On the plus side, Rhode Island did rank No. 13 for its experienced, educated workforce. And its 1.2 percent real GDP growth in 2014 put it around the middle of all 50 states.

No. 46: Maine

Maine boasts having a relatively well-educated, experienced workforce (No. 18 in our analysis). The Pine Tree State's overall ranking suffers from low grades in innovation and growth potential (No. 45) and business opportunity (No. 46) -- the latter for a poor economic climate (No. 48, according to Forbes Best States for Business) and job growth (also No. 48, according to Stateline -- Moody's Analytics Job Growth 2014 report). Maine's real GDP grew a paltry 0.2 percent in 2014.

Adam Victor, operations director at Systems Engineering, a solution provider based in Portland, Maine's biggest city, notes that the state's southern coastal region is thriving. (The state's sparsely settled northern and western regions pull down its overall economic ranking.)

"There's plenty of opportunities," Victor said in an interview. "Maine's a great place to do business." While he acknowledged that hiring qualified engineering talent can be tough, he's noticed more people who grew up in the state and moved away are now moving back to raise their families.

Maine's ranking for overall taxes and regulatory environment (No. 44) is weighed down by its 8.93 percent corporate income tax rate, among the 10 highest in the U.S., and high property taxes. On the plus side, its 5.5 percent combined state and average local sales tax rate is among the lowest.

No. 47: Arkansas

Arkansas ranks No. 18 in overall labor costs and related expenses, but it loses points for its relatively high unemployment insurance burden (ranked No. 44). Its 2014 real GDP growth was 0.8 percent.

The Natural State is ranked No. 45 for the education and experience of its workforce and it's No. 50 among all states for attracting people from elsewhere within the country. It ranks very low (No. 46) in innovation and growth, and in business opportunity (No. 39).

And Arkansas ranks a surprisingly poor No. 42 in taxes and regulations: Its corporate income tax rate is 6.5 percent and combined state and average local sales tax rate is 9.26 percent -- among the highest in the country.

Although solution provider ClearPointe is based in Little Rock, most of its business comes from midmarket customers outside Arkansas. But founder, President and CEO Jeff Johnson said his company is making a bid to snag more business within its home state. "Arkansas is very aggressive with economic development and the Chamber of Commerce is very active in bringing in new business," he said.

No. 48: Hawaii

Hawaii has come in near the bottom of our analysis each year and this year it slipped three places. The state ranked No. 49 on overall labor and employment costs and was dead last in the labor costs -- cost of doing business ranking in the CNBC America's Top States for Business 2015.

"It's just extremely expensive to do business in Hawaii," said Gordon Bruce, president and CEO of Honolulu-based solution provider Pacxa. But he said Hawaii has 27,000 small businesses that provide a potential customer base for solution providers.

That same study ranked Hawaii's education system No. 45 among the 50 states. Still, the Aloha State managed a respectable No. 23 in our analysis for the overall experience and education of its workforce -- probably because it's No. 10 in attracting workers from elsewhere in the country.

Hawaii ranks No. 25 in overall taxes and regulations because its relatively low taxes (a 6.4 percent corporate income tax rate) balances out the fact that Forbes Best States for Business judged its regulatory environment to be among the most onerous in the nation. And real GDP growth in 2014 was an anemic 0.8 percent.

No. 49: Mississippi

Mississippi, No. 50 among all the states in the education and experience of its workforce, is a challenging state to find the IT talent needed by a growing solution provider.

The Magnolia State also ranks poorly (No. 48) in innovation and growth prospects -- it's last in the share of the private sector employed as scientists and engineers, last in the number of awarded patents, and last in information technology jobs. The state also ranks No. 48 in business opportunity given the low scores for its overall economic climate, not surprising given the state's 1.2 percent decline in 2014 real GDP -- the second-worst economic performer behind only Alaska.

At $35,521, Mississippi has the lowest median household income in the country.

Mississippi does rank No. 2 among the states for its low labor costs, relatively low unemployment insurance taxes and other expenses. But it's a surprisingly poor No. 40 in overall taxes and regulations: The state has a relatively low corporate income tax (5.0 percent), but high property taxes and a combined state and average local sales tax rate of 7.07 percent.

No. 50: West Virginia

West Virginia, which scored the lowest among all 50 states in this year's analysis, can be a tough place to make a living as a solution provider.

The state was No. 50 in innovation and growth: Despite robust 5.1 percent real gross state product growth in 2014, West Virginia scores low in other criteria such as entrepreneurial activity, issued patents and the share of the private sector employed as scientists and engineers. West Virginia ranks No. 45 in business opportunity, which covers economic climate, job growth and the number of businesses in the state -- including fast-growing businesses -- that provide potential customers for a solution provider.

Advanced Technical Solutions, based in Scott Depot, W.Va., provides a range of IT services to customers within the state, including IT infrastructure, voice communications and virtualization. But President and CEO Gary Sims acknowledged that in-state business has been "kind of flat. There's not a lot of new opportunity in the marketplace, not locally anyway."

ATS has been looking outside the state for new opportunities, especially with its Cisco Authorized Technology Provider business. "That's where we focus our growth," Sims said.

The Mountain State was a poor No. 47 in our analysis of available educated, experienced workers. (A 2014 report from The Information Technology & Innovation Foundation gave the state poor grades for workforce education.) The state did score well (ranked No. 7) for its low labor costs. But West Virginia's June unemployment rate, 7.4 percent, was the nation's highest.