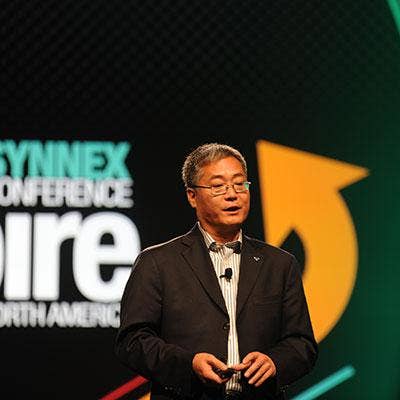

Synnex Reports Revenue, Income Growth As CEO Kevin Murai Prepares To Leave On A High Note

Strong business across the board and a successful acquisition of a rival distributor were among the highlights of Synnex's fiscal 2017.

The Fremont, Calif.-based distributor reported earnings on Tuesday and revealed that President and CEO Kevin Murai is retiring from the position he has held for the last decade. Murai will become the company's chairman.

Taking over for Murai will be Dennis Polk, Synnex's current chief operating officer.

[Related: Synnex President And CEO Kevin Murai Retires; COO Dennis Polk To Assume Distributor's Top Exec Role]

"The last 10 years at Synnex have been nothing short of spectacular, and I am so fortunate to have been able to work with such an incredible team and the best individual leaders in our industry," Murai said on the earnings conference call. "Together, we accomplished great things."

Synnex's revenue growth came from the distributor's products and services across its SMB, public sector, and retail markets. The only parts of the business with soft growth were on-premises software and components, Murai said.

Synnex executed the $830-million acquisition of Westcon Americas during the quarter, adding about $10 billion to Synnex's total addressable market. Murai said that Westcon and its Comstor subsidiary has already had an impact on the Synnex business, and brings the company an annual $2.2 billion in accretive margin revenue, particularly in the network, unified communications and collaboration, and security markets.

"The Westcon-Comstor team hit the ground running, and for Q4 experienced double-digit revenue … growth in the Comstor and security division," he said.

The company's Technology Solutions division had full-year revenue of $15.1 billion, up year-over-year by 20.7 percent, Murai said.

Concentrix, Synnex's business services division, recorded fourth-quarter revenue of $534.4 million, up 6.8 percent over last year, and a full year revenue of $2.0 billion, up 25.3 percent year-over-year, Murai said. That made it a solid No. 5 business globally in the business process outsourcing (BPO) and customer relationship management (CRM) space, he said.

"I'm honored to be the next CEO of Synnex, and I accept this role with gratitude," said Dennis Polk, on the earnings call. "And my commitment to our associates, customers, partners, and shareholders will be to continue to successfully navigate Synnex through an ever-changing and complex global marketplace."

Synnex on Tuesday reported revenue for its full fiscal year 2017, which ended November 30, of $17.0 billion, up 21.2 percent from fiscal 2016's full year revenue of $14.1 billion.

Income on a GAAP basis for all of fiscal 2017 was $301.2 million, or $7.51 per share, up from last year's $234.9 million, or $5.88 per share. On a non-GAAP basis, income for the year was reported at $355.6 million, or $8.86 per share, up from $281.2 million, or $7.04 per share.

For the fourth fiscal quarter, Synnex reported revenue of $5.3 billion, up 36.7 percent over fourth fiscal quarter 2016.

Net income on a GAAP basis was $91.1 million, or $2.26 per share, up from last year's $85.3 million, or $2.13 per share. Non-GAAP net income in the fourth quarter was $112.4 million, or $2.79 per share, up from last year's $102.9 million, or $2.57 per share.

Looking ahead, Synnex expects first fiscal quarter 2018 revenue of between $4.35 billion and $4.55 billion, up significantly from the $3.5 billion the company reported for the year-ago quarter.

GAAP net income in the current quarter is expected to be between $64.0 and $67.8 million, while non-GAAP net income is expected to be between $82.3 million and $87.0 million. This compares to the prior-year GAAP net income of $61.8 million and non-GAAP net income of $73.1 million.

During that time period, earnings are expected to range from $1.58 and $1.68 per share, up from $1.54 per share, while non-GAAP earnings are expected to range from $2.06 and $2.15 per share, up from $1.82 per share.