As Cloud Market Consolidates, dinCloud Looks To Upcoming Technologies, And Its Channel, To Continue To Thrive

The rapidly expanding cloud market is also rapidly consolidating, with hyper-scale powerhouses continually clawing out an even more massive share. In that environment, Los Angeles-based dinCloud is finding that a technological niche—backed by a vibrant channel—is the way a boutique provider can thrive.

For dinCloud, that means introducing new technologies, automating delivery of solutions, and adding enticements for solution providers such as high-touch support and white-label options, said David Graffia, vice president of sales at dinCloud.

The cloud provider recently introduced hyper-converged infrastructure through an evolving relationship with Nutanix aimed at delivering highly available, fault-tolerant environments. It also launched virtual desktop products, primarily leveraging Citrix technology, beefed up by monitoring and analytics modules. Those solutions are hosted in state-of-the-art Equinix data centers that connect to all network providers in their areas.

[Related: Cloud Computing: Now A $180 Billion Market]

Technological alliances, however, only go so far. The key to dinCloud's strategy is its channel, which constitutes about the entirety of the provider's go-to-market efforts.

"We’ve always been a channel-focused organization," Graffia said. But in the past, that mostly meant working through large distributors like Ingram Micro, Tech Data and Arrow—aggregators who would bring in regional partners to deliver services wrapped around dinCloud's infrastructure products.

Of late, "we’ve been going downstream, working for the smaller MSPs, medium-sized VARs," Graffia said. "Every month we're adding VARs and MSPs to the mix."

And that channel is bringing in much larger deals than it did in the past—new customers with hundreds of locations and thousands of users.

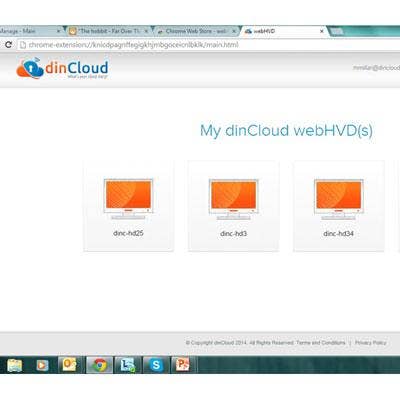

Those partner relationships have been enabled by homegrown automation software that simplifies for VARs the provisioning, delivery and management of cloud environments, especially VDI.

Virtual desktops, or Desktop-as-a-Service, is a technology that, after years of promise, is poised to see a surge in adoption, thanks to its ability to fulfill myriad use cases, he said. VDI extends the life of infrastructure, allowing older endpoints to be productive longer; it makes it easier to support remote offices, on-board contractors and seasonal workers; and to ensure business continuity and disaster recovery.

"The market is maturing before our eyes. VDI had a number of false starts," Graffia said. "What everyone has learned is it's not that simple. There are a lot of moving parts and a lot of complexity in getting it right. What we've learned is the trick is to automate as much as possible."

To lay the groundwork for that business, dinCloud built a storage and networking environment from the ground up for high-performance VDI, Graffia said.

The aim is to appeal to legacy solution providers that once focused on shipping hardware and licensing software, and have seen margins tumble for those practices.

"I think there’s been a paradigm shift occurring in the landscape," Graffia told CRN. "If you’re not making money in hardware and not making money in software, you really need to figure out a way to solve for those things."

And VDI provides resellers with a lucrative revenue opportunity, Chris Miller, director of IT sales and solutions at Pacific Office Automation, told CRN.

The nation's largest independently owned office equipment dealer, based in Portland, Ore, branched into managed cloud three years ago at the request of customers, Miller said.

The company first started delivering cloud with Amazon Web Services, but wasn't satisfied with the level of support provided by the cloud leader, since its own internal expertise wasn't extensive.

"We wanted a company to provide us with a truly turnkey solution that would also offer back-end support if we would run into a bump in the road," Miller said.

That led to an evaluation of a dozen cloud providers before selecting dinCloud based on the high-performance VDI delivery, security, and absence of added fees for file transfer and support.

Through its white-label program, dinCloud enables cloud solution providers to appear larger than they are while making available the technical resources that supplement gaps in those partners' expertise.

"Anytime we've run into something that's complex, they've been able to dedicate the resources to walk us and the client through the solution," Miller said.

While VDI is still not a great fit for more than half the market, Miller said, adoption is ramping because the use cases the technology satisfies are extremely valuable to many types of customers.

As the price comes down for Desktop-as-a-Service, it will become more mainstream, driving business to partners delivering the technology.

"They've got to get the price point down and customers have to have better internet. But it can take off because it delivers several advantages from deployment, administration and security standpoints," he said.