Dell, Cisco Pummel Competition In 1Q Server Market: Gartner

The server industry is heading for a shakeup as Dell, Cisco and the original design manufacturing vendors take major market share away from the traditional market leaders Hewlett-Packard, IBM and Oracle.

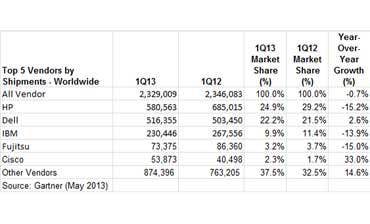

Worldwide server shipments fell in the first quarter 2013 by 0.7 percent, while revenue fell 5 percent, compared to the first quarter of 2012, according to Gartner, which on Tuesday released its quarterly server sales report.

Dell, as predicted in earlier CRN reports, was the big winner, with total server shipments for the quarter up 2.6 percent and total server revenue up 14.4 percent, bringing the company to within striking distance of No. 1 vendor HP.

[Related: Gartner Q1 Server Vendors: Winners And Losers ]

However, for sheer growth, the prize this quarter goes to Cisco, which saw server revenue grow by 34.3 percent over last year, and by the server self-build and ODM vendors which saw shipments grow by 34.7 percent and revenue by 34.5 percent, Gartner said.

The self-build and ODM category includes such ODM vendors as Quanta, Wistron Wiwynn and Synnex's Hyve solutions, as well as self-build companies in the cloud infrastructure space such as Facebook and Google.

The share shift comes at a time when the server industry as a whole is experiencing a drop due to three trends, said Jeffrey Hewitt, research vice president at Gartner.

The first is economics. Gartner said that the poor economic condition in Europe took a toll on server sales, which in the first quarter fell 9.6 percent in terms of revenue and 6.8 percent in terms of shipments.

"The server market is typically a trailing indicator of economic conditions," Hewitt said. "Asia-Pacific-Japan is growing the strongest, while the U.S. is showing some signs of growth."

The second trend is the strong growth of virtualization, which is letting businesses run increasingly more virtual machines with increasingly higher performance on ever fewer physical servers, Hewitt said.

The third is outsourcing and the cloud. "Small businesses are looking at what's happening with outsourcing and the cloud, and are saying, 'Hmmm, I gotta look at this,'" he said.

HP is still the largest server vendor in terms of shipments, while IBM keeps its title as the largest server vendor in terms of revenue, Gartner reported.

NEXT: x86 Server Market Dynamics Changing

The biggest part of the market, the x86-based server business, saw server shipments basically flat from last year at 2.3 million units, while revenue for this part of the business rose 1.8 percent.

HP remained the leader of the x86 server business, with a 25.1-percent share of shipments and 29.1-percent share of revenue. However, the company experienced a 15 percent drop in shipments over last year to 576,835 servers, which lead to a 10.9 percent drop in server revenue to 2.6 billion.

Dell's x86 server shipments, on the other hand, rose 2.6 percent to 516,355 units, pushing revenue for the quarter 14.4 percent to $2.1 billion.

IBM maintained its third-place position in the x86 server market with shipments of 212,516 million units, down 13.6 percent over last year. That equaled about $1.2 billion in revenue, down 9.1 percent. Should IBM's reported sale of part of its x86 server business to China-based Lenovo prove true, IBM could drop out of the top five x86 server vendors.

Cisco is the No. 4 x86 server vendor in terms of revenue, which rose a big 34.3 percent over last year to $450 million. However, the fourth spot in terms of shipments was taken by the self-build and ODM server vendors whose cloud and Internet infrastructure business caused their shipments to rise 34.7 percent to 167,200 units.

"We're seeing increasing competition from Cisco," Gartner's Hewitt said. "They're in every data center in the world. Offering Cisco servers is, and I really hate to use the analogy, as easy as asking, 'Do you want fries with that?' But they're also executing. Cisco is working with storage vendors EMC and NetApp."

The self-build and ODM vendors also took the No. 5 position with revenue of $434 million, up 34.5 percent over last year. Sales of competing servers from Dell and HP are included in those vendors' numbers, Hewitt said. "Dell has been selling to companies like Microsoft with scalable data centers and is used to high-volume market," he said.

HP's server sales are down in part because of a reorganization of its server business, Hewitt said. "HP has set the expectations that it is time to go forward and to get some market traction," he said.

NEXT: RISC/Itanium Server Market Continues To Plummet

Meanwhile, the market for RISC and Itanium-based servers continues to plummet.

Gartner estimated RISC/Itanium server shipments for the first quarter of 27,973 units, down 38.8 percent over last year. Revenue for those servers fell 35.8 percent to $1.4 billion.

IBM is still the leader in this part of the market despite an 18.9 percent drop in shipments and a 32.3-percent drop in revenue. Oracle saw its shipments dive by 60.4 percent to 7,459 units, with revenue falling 38.3 percent. HP's shipments fell 39.0 percent, with revenue falling 39.6 percent.

Rich Baldwin, CIO and chief strategy officer at Nth Generation Computing, a San Diego-based solution provider and HP partner, said the drop in HP server sales is really just a blip on the radar, and that HP is in position to strengthen its server business.

"It's true the industry is changing," Baldwin said. "I see the cloud taking share. But I also see Meg [Whitman, HP's CEO,] making the right changes and empowering her people. Moral at HP is high."

HP sales have had to contend with strong pricing competition from Dell, and HP is responding, Baldwin said. In addition, he said, Whitman has committed her company to win against Dell in the server market.

"HP is telling us, 'We're not going to lose on price,'" he said. "Some people are going to buy on price today, but HP is doing what it takes to respond."

While Dell's server sales are up, Dell's profits continue to bleed, Baldwin said. "Sure, you can grab share with lower profits, but that's not a sustainable business model," he said.

Gartner's Hewitt is not convinced that Dell is getting market share just by ignoring profits. "I see Dell's ASPs [average selling prices] growing. They're selling a viable server for virtualization. And they're selling in new geographies."

In the RISC/Itanium market, HP's Superdome and other Itanium-based servers risk becoming irrelevant despite HP's court victory vs. Oracle over Oracle's decision to stop developing software for HP's Itanium servers, Baldwin said.

"We are seeing big customers who buy Superdome servers placing fewer orders," Baldwin said. "And those servers are priced at around a million dollars. However, things are moving to industry-standard servers. HP's HP's Gen8 servers are doing well. In fact, they're doing so well that people don't need to buy as many. So the people who were buying Superdomes and now switching to ProLiant DL980s. Price for the DL980s are a magnitude of order less than Superdomes, but people buy multiple DL980s."

HP declined to discuss its falling server shipments and sales.

However, HP responded to CRN requests for more information with an email which read, "HP continues to be the No. 1 worldwide server leader for 17 years and now 68 quarters. As a leader in defining next-generation computing platforms for decades. HP recently unveiled the world’s first commercially available HP Moonshot system, delivering compelling new infrastructure economics by using up to 89 percent less energy, 80 percent less space and costing less than 77 percent compared to traditional servers."

PUBLISH MAY 28, 2013