Supercharged: How Solution Providers Are Moving The Needle In Today's Innovative IoT Market

Luis Alvarez started what he calls the "IoT journey" after noticing that something unexpected was happening with some of his customers.

The president and CEO of Alvarez Technology Group, a Salinas, Calif.-based managed service provider, said two years ago his customers in the agricultural sector began asking for help with operational issues—such as analyzing soil and hydration metrics in greenhouses, or monitoring milk production in cows—instead of the back-end office issues they traditionally grappled with. Alvarez jumped on the opportunity and began working with customers to implement connected sensors in their fields, helping them monitor crops and water utilization.

Fast forward to today, and IoT solutions make up approximately 10 percent of Alvarez Technology Group's services business—and the executive gets two to three calls a week from vendors looking to partner with him, opening up opportunities for his business to expand.

[CRN Presents: The IoT Channel Chronicles]

"Vendors are actually looking for partners who can bring them opportunities," said Alvarez. "[Vendors] want to get involved—but they don't know how. They need us because we have those connections to the customers. We've always been a regional player, and now because of these linkages we have a future role as a global company."

Alvarez Technology Group is one of many solution providers leading the charge for customers and vendors in the burgeoning IoT arena. Although IoT is still a fairly nascent market, solution providers are already building practices around the technology and bringing in IoT revenue.

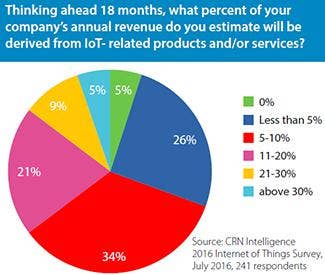

In a recent CRN Intelligence survey of 241 solution providers, 26 percent of respondents said 11 percent or more of their company's revenue currently comes from IoT-related products and services, with 12 percent saying IoT drives 21 percent or more of their revenue today.

Those figures grow as solution providers look to the future. More than 35 percent of respondents said IoT will contribute 11 percent or more of their company's revenue in 18 months, with 14 percent saying IoT will drive 21 percent or more of their revenue by that time, according to the survey.

Industry powerhouses including Intel, Cisco Systems, IBM and a host of others have been staking claims in the IoT space, which market research firm IDC predicts will grow to $1.7 trillion in 2020, up from $655.8 billion in 2014.

Channel partners with loyal customer relationships, comprehensive understanding of vertical markets, and in-depth managed services expertise are in prime position to drive IoT sales, said Stephen Lurie, vice president of IoT solutions at solution provider Zones, Auburn, Wash.

"We're on the front lines, we're getting the requests from customers," Lurie told CRN. "The channel is taking the lead in the IoT space, and vendors are starting to see that now."

Understanding Customers And Lines Of Business

With an array of new routers and switches, sensors, analytics and data management software, vendors across the board have made strides in bolstering their IoT technology portfolios.

However, solution providers are bringing the key piece of the IoT puzzle to the table—working closely with customers at the line-of-business level to solve vertical-specific issues with IoT solutions.

Tony Shakib, vice president of Cisco's IoT Vertical Solutions Engineering segment, said during the CRN IoT Roundtable in August that channel partners play an important role—one that vendors can't fulfill—through the level of customization that they bring to IoT solutions.

"I think channel partners can play a huge role in the verticalization, the customization and the systems integration and delivery of [IoT] capabilities because large companies cannot," he said. "I think that's where the channel partners … come in, take a lot of the common blueprints and the common platforms and then do that last 20 [percent] to 30 percent of customization to appeal to that customer and to solve their specific problems."

Zones' Lurie, who noted that IoT is a "significant part" of the company's business, said solution providers have flexibility to bring in their knowledge of vertical markets and deepen the line-of- business conversations with customers in those markets. When Zones talks with customers about IoT projects, 90 percent of those discussions typically revolve around line of business, while only 10 percent revolve around the actual IT, said Lurie.

Zones, for its part, specializes in verticals such as manufacturing and transportation, and Lurie said he has made sure to flesh out his sales team to better specialize in these verticals by hiring facility managers; supervisory control and data acquisition (SCADA) operators; heating, ventilation and air-conditioning (HVAC) specialists; and lighting technicians.

With these specialists on staff, Zones recently implemented an elevator access control solution to increase building safety. The solution used a Cisco Physical Access Gateway to connect elevator doors to a security system, which is maintained by building managers, so that certain employees can only enter specific floors. To deploy the solution, Lurie said, his team collaborated with Cisco as well as with Intel, but also needed to speak the language of elevator manufacturers, architects and building managers.

"What a partner like us has to do is have a dedicated practice within the organization—not someone who sells an IoT SKU," said Lurie. "[When I'm hiring] I want someone who understands boilers and chillers, HVAC systems and lighting systems and variable control valves. You can't have that conversation if you're a traditional Cisco, [Hewlett Packard Enterprise], or Dell kind of integrator."

Grant Sainsbury, senior vice president of strategic services at Dimension Data Americas, said IoT is a "natural space for a client-oriented, industry-aware player like ourselves."

Over the past year, New York-based Dimension Data has worked with Cisco to design and deploy the Connected Conservation project, which aims to protect rhinoceroses in an unnamed South African private game reserve.

While Cisco created the plan to build the IT infrastructure, Dimension Data went beyond the technology level to work closely with the reserve and come up with a solution that allows officials to track and monitor individuals who enter and exit the reserve gates—including potential poachers. As part of the IoT solution, Dimension Data worked to deploy a secure reserve area network and Wi-Fi hot spots and integrated CCTV, drones with infrared cameras, thermal imaging, vehicle tracking sensors and seismic sensors.

Sainsbury said that solution providers can offer the right level of vertical market expertise to solve line-of-business problems, just as Dimension Data did in addressing the problem of poaching.

"It's the imagination around how to solve the problem. That's why IT service providers and system integrators will not only survive, but thrive in the future," he said.

Managed Services Is Key To IoT Success

Another important element solution providers bring to IoT is managed services expertise. Take Dimension Data's work at the wildlife preserve, for example, which included remote network monitoring capabilities, gathering and managing big data, transforming the data into easy-to-consume statistics, and other services for IoT.

Solution providers view installation and maintenance of IoT hardware and software as one of the largest channel opportunities in IoT, second only to sales of that hardware and software, according to the CRN Intelligence IoT survey.

Scott Jamison, vice president of services at Watertown, Mass.-based BlueMetal, an Insight company, said managed services, like network and data monitoring, are essential to successful IoT projects.

"We offer managed services, so once a customer has a solution up and running, we have 24/7 help-desk support for active maintenance and monitoring, and we help customers upgrade and monitor that solution over time," he said.

Alvarez said the services that solution providers bring to the table are crucial, such as installing and monitoring data analytics tools and security services.

"The greatest opportunity is in the services side because that is really the differentiator for me in how IoT is going to be deployed in our clients' world," he said. "Whether you're in the SMB space or the enterprise space, it will be all about services."

Alvarez Technology Group has been working with Netherlands-based Floricultura, which transports orchid seedlings to San Francisco to be grown in a greenhouse. The solution provider has connected the greenhouse so that robots drop plants into larger cups as they grow and add more dirt—a process that Alvarez said is completely automated and controlled at the back end. But one of the main profit drivers in this solution is the managed services agreements through which Alvarez Technology Group maintains the system and makes sure that nothing goes down.

Data analytics represents another big IoT opportunity, Alvarez said. He has established a data analytics unit for IoT within the company, which he expects to be one of its fastest-growing segments. "[Data analytics] is helping our clients make smarter decisions based on giving them more actionable intelligence, and helping them aggregate all that data that they're collecting and doing something useful with it," he said.

The Channel Is The Glue

The channel is perfectly positioned to lead the way in IoT, pairing a deep understanding of customers with knowledge of a variety of vendors' portfolios to successfully build and deploy IoT solutions, BlueMetal's Jamison said.

"Because of the channel relationships we have, we really have an end-to-end full solution where we can bring servers for an on-premise installation, cloud offerings and subscriptions, sensor data, and any networking upgrades that customers might need," he said. "All of that is a growth area for us."

With hardware gateways, sensors, routers, switches, software and analytics tools, there are so many different moving pieces to IoT that many customers are left in the dark about where to start—and that can be where channel partners, with their tight relationships with multiple vendors—can help.

BlueMetal, the 2016 Microsoft IoT Partner of the Year, derives about 20 percent of its overall annual revenue from IoT. The solution provider most recently utilized Microsoft's Azure IoT platform to improve vaccine management for medical manufacturer Weka Health, helping more people be protected against diseases.

Part of that effort involved working with a variety of vendors to pull the whole solution together, said Jamison. BlueMetal worked with Weka Health to create sensor-equipped refrigerators, and with Microsoft, which provided the Azure IoT software and the Microsoft Surface devices for end users who wanted to view and analyze data.

"We're helping customers by writing software, and then implementing and pulling together the different vendor components," he said. "At BlueMetal we have designers and engineers on staff. And if we don't [have the right tools], we'll bring the hardware partners into the mix and be the company that pulls the whole solution together with all these different moving parts."

Stephen Monteros, vice president of business development and strategic initiatives at Ontario, Calif.-based solution provider Sigmanet, said that the company works to fine-tune vendors' products—including suppliers they have not yet worked with—to build IoT solutions based on what individual clients need.

For example, Sigmanet has been working over the past 18 months to plan, strategize and deploy solutions to digitize parts of the 21-mile Pacific Electric Trail in Rancho Cucamonga, Calif.

This solution, which utilizes cameras to track people on the trail, will help city officials set up a dual surveillance system that enables the city to accurately measure the number of trail users and analyze that data for transportation and safety applications.

It included Intel's Access Point tool to store, manage and distribute digital content, cameras from Bosch, as well as technology from Cisco and CradlePoint.

"Once you get the vendors together and you build the architectures, you just put it in and start fine-tuning it," Monteros said. "No one vendor will have an end-to-end solution. They want to work together for the most part."

The Time For Solution Providers To Invest In IoT Is Now

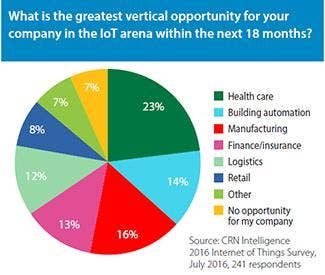

For as many solution providers that have jumped into the IoT arena, many others have yet to get on board, with 47 percent of respondents in the CRN Intelligence IoT survey saying that they see IoT as a minor opportunity for their company, and an additional 4 percent saying they see no IoT opportunity.

Alvarez, for his part, views that outlook as short-sighted, noting that solution providers of all ilks can find a hook into IoT in the same place he first started—at the customer level.

"We need to make customers aware that we want to play in that space, and that's where the channel is falling down," he said. "I think the best way to do it is by asking the same question: ’What are you doing to develop an Internet of Things strategy?'"

Alvarez Technology Group's IoT business is only two years old, but he sees it continuing to grow and plans to expand beyond the agriculture vertical into the health-care market in the coming year.

He stressed that IoT is "happening today," and it is opening a big opportunity for traditional VARs to jump in: "We look at the IoT opportunity as a global opportunity," he said.

Solution providers currently investing in the IoT space, such as Sigmanet's Monteros, said that now is the time to jump in or risk missing out on an important revenue opportunity.

"Channel partners should pick a pilot, come up with something interesting to them—they'll have to make a small investment, not big—and use it as a pilot to experiment with," said Monteros.

"We know IoT will take off; the devices are just getting smarter," he said. "The channel is going to have to embrace IoT."