Bad Apple: An Inside look At The Rotting Relationship Between Apple And Its Partners

When Mike Hadley, president and CEO of iCorps Technologies, heard the news about Apple and Cisco Systems teaming up on enterprise deals, he wasn't excited. He was apprehensive.

iCorps Technologies, a Boston-based Apple partner for 21 years, has seen its revenue from Apple products and services shrink from 100 percent to less than 10 percent of its overall business over the past five years, due in part to what he says is Apple's lack of attention to the channel. Hadley is no alone—his situation is indicative of a larger trend reported by solution providers across Apple's channel ecosystem.

"We haven't seen much of a focus on our partnership from Apple," said Hadley. "Hopefully, they'll see that's not a good approach because we're the ones who can build relationships. Apple's whole channel focus has changed, but there's still a good [number] of partners working with businesses to create Apple deals and pushing Apple products."

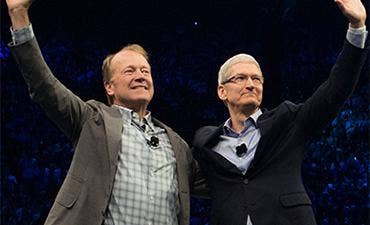

Cisco and Apple on Aug. 31 disclosed a partnership to optimize Cisco networks for Apple iOS-based devices and apps, as well as work together to make the iPhone a better business collaboration tool in Cisco voice and video environments.

The deal, a follow-up to Apple's widely publicized enterprise-targeted partnership with IBM last year, is yet another step from Apple to drive deeper into the corporate market, relatively unfamiliar territory for the consumer-centric Cupertino, Calif.-based company.

[Related: Apple Partners Speak Out On Channel Conflict]

But solution providers worry Apple's enterprise odyssey will snub the true pioneers of large corporate business sales—the channel—and instead focus on direct sales.

Apple's relationship with the channel has been rocky for many years, and partners say it has not gotten noticeably better in the four years since CEO Tim Cook took the reins, a disappointing turn of events given that Cook is actually a channel man. He previously served as COO for the PC reseller division at Intelligent Electronics, and later headed Apple's Macintosh division, where he is credited with continuing the development of strategic reseller and supplier relationships.

Now the onetime channel champion seemingly has become channel-agnostic, solution providers said. One channel source, who worked with Cook at Intelligent Electronics, said he finds Cook a channel paradox.

"I think it is fascinating that a channel guy like him could run one of the most important companies in the world," he said. "He is not a technologist. He came into Apple to do supply chain management. I'm not surprised he hasn't made a big channel move. I don't think the channel matters that much to Cook and Apple."

Fifty-eight percent of solution providers said that the channel's relationship with Apple under Cook's leadership has either stayed the same or gotten worse, according to a June CRN Intelligence survey of 150 solution providers. Three percent of those surveyed said the channel's relationship with Apple has gotten much worse under Cook. Thirty-seven percent of solution providers said their relationship with Apple has gotten better under Cook, according to the survey.

Meanwhile, 55 percent said Apple's overall ability to build mutually profitable third-party partnerships under Cook's leadership has either stayed the same or gotten worse.

In a separate September CRN Intelligence survey of 175 Apple partners, 55 percent of solution providers said Apple's direct sales force has competed with them in enterprise accounts in the last 12 months, with 46 percent rating enterprise direct sales channel conflict with Apple as either medium or high during that period.

Steve Lieberman, Apple's manager of corporate reseller channel, did not respond to a request for comment. An Apple spokesperson declined to comment.

Apple has faced a blowout blitz of success this year, closing in on a $750 billion market cap in February, and smashing sales records for its newest smartphone models, the iPhone 6s and iPhone 6s Plus, with 13 million sold just three days after their September launch. But between constant competition with Apple retail stores and low margins, the company's authorized resellers aren't getting a big bite of Apple's wealth.

"Apple continues to steadily march toward cutting the smaller independent dealers completely out," said one Apple partner, who wished to remain anonymous.

"We're out here in the trenches converting PC users to Mac users. But there's no money to be made with Apple products. ...If I bought Apple stock instead of reselling Apple products, I'd be retired by now."

The partner, who said he makes roughly 6 percent to 8 percent gross margin reselling Apple's products, operates his business in largely rural areas, where customers don't want to drive hours to go to an Apple retail store. Despite selling Apple products for nine years, he said his Apple profitability has shriveled from 90 percent of his net income at the start to about 10 percent of his net income in more recent years.

"The number of resellers is shrinking dramatically, and partners are going out of business, or getting cut for not meeting Apple's expectations," said the partner. "It's utterly insane. Apple's strategy is to sell through retail stores or directly to consumers so they control the end-to-end experience."

Looking ahead, partners are concerned that Apple will take a similar channel-unfriendly path as it tries to push its products into the enterprise. The company's July 2014 partnership with IBM allowed IBM to resell Apple hardware, as well as develop a new class of made-for-business iOS apps running on iPhones and iPads.

More recently, Apple made its products themselves more business-friendly, revealing in September a bigger, 12.9-inch iPad Pro that includes important enterprise third-party accessories such as an Apple Pencil stylus and keyboard, as well as multitasking operating system functionalities.

Cook noted last month that the company generated around $25 billion in revenue from its enterprise operations in the 12 months ended in June.

As Apple's enterprise ambitions intensify, some partners feel left in the dark about Apple's long-term enterprise strategy and what role the channel plays in building Apple solutions for large corporate accounts—particularly as it relates to the Apple-Cisco partnership. In addition to building iOS-friendly networks, the deal calls for Cisco to optimize collaboration tools such as Cisco Spark, Cisco Telepresence and Cisco WebEx for Apple devices, allowing the company to deliver business services across mobile and cloud environments.

Some partners view the Apple-Cisco partnership as a direct sales deal that leaves them out. San Jose, Calif.-based Cisco, for its part, has said the deal will include channel sales but has declined to provide details of the relationship and its partner go-to-market strategy.

"What we have done is given assurance that the current products in our portfolio all will be compatible to these new capabilities that we're going to jointly build with Apple...so our partners have opportunities to refresh their customers and get them onto this new platform," said Rowan Trollope, senior vice president and general manager of Cisco's collaboration group, who is leading the charge on Cisco's end of the partnership, in an interview with CRN.

A Cisco spokesperson said via email the deal includes both joint engineering and go-to-market efforts, asserting that the fruits of the partnership will be available through both the direct and indirect sales channels of both companies. An Apple spokesperson also maintained that solutions from the deal will be sold through resellers but did not provide further details.

Cisco did not provide a time line of the partnership or specific margin opportunities for channel partners, but stressed that plans are in place to train the channel to implement the new Apple-Cisco joint solutions.

However, partners CRN spoke with said they had no advance notice of the partnership and have yet to hear of product integration details or a time line. That doesn't sit well with some Cisco partners, who are used to more forthright communication from the vendor.

"I don't know how it's going to work or what it really means. Apple is not known for even being able to spell the world 'channel,' so I don't know how this will play for partners," said a top executive at a Cisco Gold partner ranked on the CRN 2015 Solution Provider 500 list, who declined to be identified. "What you're going to have here is arguably the most partner-friendly company in the market, which is Cisco, shaking hands and joining arms with the least partner-friendly company out there."

The CEO for another top Cisco enterprise partner, who did not want to be identified, said he sees the Cisco-Apple partnership as a direct sales play that is doomed because of the cultural differences between the two organizations. The CEO said Apple does not have the enterprise channel relationships and ties to make headway in the corporate market with the iPad and iPhone.

Other solution providers hope Cisco's channel-friendly tendencies might rub off on Apple as the two firms partner up. Kent MacDonald, vice president of converged infrastructure and network services at Long View Systems, a Calgary, Alberta-based solution provider who partners with Apple and Cisco, said the partnership will shine a spotlight on channel expertise on Cisco technology.

"Are we going to be supporting the consumer? No, but we're seeing a lot of Apple devices in the enterprise network and in the corporate network so [we're] making sure that they are integrated and secure and functional," said MacDonald. "As we see Apple mobile devices and Apple TV go into business networks, I would certainly say that the partners would bring value in Cisco expertise."

Apple has had a steadily declining relationship with a large portion of its partner base over the years, starting in 1992 when the company cut out channel partners reselling products to the education market, instead shifting toward a direct sales strategy, solution providers said.

One former Apple partner, who recently ended his relationship with the company because he lost faith in its channel focus, said Apple used to have a more progressive strategy that introduced partners to territory sales teams in the enterprise space.

"We did have visibility and connectivity to enterprise sales resources, [but] that dried up as well as other resources that helped us at least help our clients," said the former partner.

Apple's increased focus on its retail stores, which now number more than 265 across 44 states in the U.S., has forced other solution providers, such as Angela O'Donnell, CEO of W. O'Donnell Consulting in New York, out of the Apple business.

W. O'Donnell Consulting was an Apple reseller until 2013, focusing on managed network, product and support services as well as installation and asset management tracking in the server and storage space for corporate environments.

"Apple locked out hot items from resellers and raised sales quotas, eventually basically cutting us from being a reseller because we weren't making numbers,"

O'Donnell said. "At the same time, they were putting a lot of stores in New York City. People like to go to the store and have that retail experience, and it didn't leave a lot of room for a reseller like us. I felt that they took away our ability to serve those customers."

Not all Apple resellers are as disillusioned. Apple does offer programs and rebates to its VARs who work with enterprise customers, according to one partner.

The partner, who is one of what he estimates to be around 25 other resellers with large enterprise accounts, said over the past few years Apple has rolled out the Device Enrollment Program for partners to help businesses deploy their corporate-owned iOS devices, as well as the Apple Volume Purchase Program, which allows educational businesses to purchase apps and books in large volumes. Apple also recently launched a rebate program for VARs aimed at driving iPad and Mac products deeper into the enterprise by moving 2 percent of the iPad price and 1 percent of the Mac price to a back-end rebate incentive tied to new sales volume targets.

However, lack of communication continues to be a big problem as Apple continues its drive into the enterprise. "Apple's communications surrounding its road map has always been notoriously vague, and from a partner perspective it's not much better," said the large-enterprise Apple reseller. "We're left guessing through the rumor mill what kind of announcements will come out of [the Apple-Cisco deal]."

Another partner, who has worked with both large enterprise Apple customers and SMBs since the early 1990s, said he has seen Apple's communication with its VARs slowly disintegrate over time. The partner said the vendor's communication with partners is invaluable to enterprise customers, who need complete transparency of Apple's product road map.

"As an Apple partner in the early '90s, we had that openness. We were a part of Apple's perspective and could prepare our clients and keep them in the loop about Apple's road map," he said. "Now we don't have that openness. Apple doesn't tell us about future releases. And for an enterprise customer, when you have thousands of desktops and mobile devices, you need to know that road map so you can strategize around upcoming changes."

Mark Haranas contributed to this story.

PUBLISHED OCT. 12, 2015