EMC, NetApp Take Market Share From Server/Storage Peers: IDC

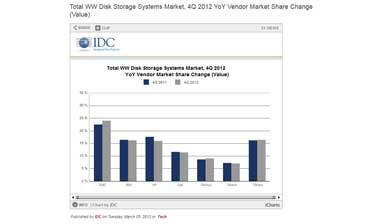

Top-tier storage specialists EMC and NetApp grew their storage revenue in the fourth quarter of 2012, a feat their server-and-storage brethren were unable to do, according to IDC's quarterly report on storage sales.

IDC Friday said that EMC grew its fourth-quarter 2012 storage revenue by 7.3 percent while NetApp's grew by 6.3 percent compared with the fourth quarter of 2011, while top rivals Hitachi, IBM, Hewlett-Packard and Dell saw year-over-year revenue drops.

For the fourth quarter of 2012, the storage industry shipped a total of 8 exabytes of capacity, up 25.3 percent over the same period last year. That figure counts both storage sold as part of a server and that sold external to servers. Revenue for that capacity, however, grew a mere 0.7 percent over last year to reach $8.6 billion.

[Related: Reports: 2012 Server Revenue Down, Shipments Mixed ]

IDC also said fourth-quarter revenue for external-only storage reached $6.7 billion, up 2.3 percent over last year.

For all of 2012, external disk storage capacity rose 27 percent over last year to reach more than 20 exabytes, while total external storage revenue rose 4.7 percent to $24.7 billion.

By any measure, EMC remained the top storage vendor in the fourth quarter of 2012. EMC's quarterly revenue of $2.1 billion, which rose 7.5 percent over last year, made it the leading vendor in the external disk storage market with a 30.7 percent share, and in the total disk storage market with a 24.0 percent share.

Of the six companies profiled in the IDC report, EMC's storage sales grew the fastest. EMC also was the leading open networked storage vendor with a 34.2 percent market share, the open SAN market with a 28.7 percent share, and the NAS market with a 48.2 percent share, IDC said.

NetApp was the only other top-six storage vendor to show real growth in the quarter. IDC said NetApp's storage systems sales grew 6.3 percent over last year to reach $780 million, giving it third place in the external disk storage systems market and fifth place in the total disk storage systems market. NetApp was also the second-largest NAS vendor, with a 28.3 percent share.

NetApp did not show up in the top ranking of the SAN market despite the fact that its storage systems all operate in both NAS and SAN environments.

NEXT: Server Vendors Lose In The Storage Race

The only other storage-only vendor in the top six, Hitachi and Hitachi Data Systems (HDS), saw its storage revenue drop 1.7 percent to $590 million, IDC said.

When both internal and external disk storage are counted, IBM was the second-largest vendor. IBM's external disk storage system revenue in the fourth quarter rose 1.3 percent to $1.0 billion, but revenue for both external and internal disk storage systems fell 0.4 percent to $1.4 billion.

Hewlett-Packard's external disk storage systems revenue fell 7.4 percent in the fourth quarter of 2012 to $626 million, while its total disk storage systems revenue fell 8.8 percent to $1.4 billion.

Dell saw a slight 1.1 percent drop in its total disk storage systems revenue to $983 million.

PUBLISHED MARCH 8, 2013