NetApp Introducing Channel Rules Of Engagement, New Entry-Level FlexPods

NetApp is setting new rules of engagement as part of a three-year strategy to grow its storage business via indirect channel partners.

The company is also engaging with one of its top distributors, Avnet, on a new series of FlexPod converged infrastructure solutions, including versions starting at under $60,000, said Bill Lipsin, vice president of global channels for the Sunnyvale, Calif.-based storage vendor.

The moves come on top of NetApp's recent acquisition of all-flash storage array developer SolidFire, which Lipsin said gives the company the chance to become the market leader in the fast-growing all-flash storage market.

[Related: Q&A: NetApp, SolidFire Execs On NetApp's SolidFire Integration, Competition, Flash Storage Future]

Lipsin, speaking before an audience of solution providers at this week's XChange Solution Provider Conference in Los Angeles, said NetApp needs its channel to help fire up sales.

"The relevancy [of the channel] is so critical now, probably more than ever at NetApp, because we're a $6 billion company this year," Lipsin said. "We were also a $6 billion company last year. Now, that's not good."

About 80 percent of NetApp's worldwide revenue, and 79 percent of its U.S. revenue comes from indirect sales channels, Lipsin said.

NetApp still keeps a direct presence in a couple of areas, including a professional services team for handling "bleeding-edge" technology and in working with Global 50 companies. "Other than that, we are moving all of our sales plans and resourcing to our partners to be the primary services organization," he said.

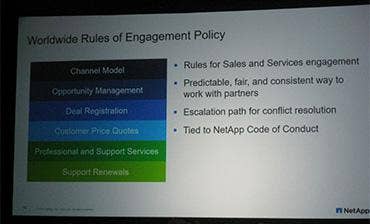

NetApp in January did an internal rollout of a new channel rules of engagement policy, Lipsin said. "We've tried this before," he said. "The difference between this one and the one we did before is there's teeth in this one."

The rules of engagement are based on NetApp's code of conduct, Lipsin said. Every employee must go through annual training on the channel, and compensation depends on working with channel partners.

"We've got some very proscriptive ingredients here," he said. "If you do this, this could happen. If you do this, this will happen. ... These rules of engagement are critical in terms of how we deal with deal registration, opportunity management and support, as well as lots of other things."

NetApp is also making channel partners a part of its annual company sales kickoff, slated for early May, Lipsin said.

NetApp employees have been quietly discussing the new rules of engagement, said John Woodall, vice president of engineering at Integrated Archive Systems (IAS), a Palo Alto, Calif.-based solution provider and NetApp channel partner.

"Some of NetApp's partners have nationwide and worldwide operations, and without controls in place, it's easy for NetApp or other partners to sell into the wrong territory," Woodall told CRN. "This leads to channel and pricing conflicts. I think NetApp is at a point where it has to streamline operations and eliminate issues like this."

NetApp's bringing channel partners into its sales kickoff is also an excellent idea, Woodall said.

"NetApp has its Insight conference," he said. "But that's more of a tech and sales event. But when NetApp's sales teams come in for its annual sales kickoff event, it's important to have partners there as well. This gives partners the same messaging and communications, and lets everyone know what everyone is doing. It will help us know where we fit in."

NetApp has also laid out a three-year strategy for the channel, Lipsin said. Under the plan, fiscal year 2016 will see NetApp focus on strengthening partnerships, including driving value-add opportunities, improving the partner focus, and accelerating growth of its all-flash, converged infrastructure and Clustered Data Ontap solutions. The company in 2017 will focus on accelerating channel growth with new business opportunities, developing next-generation channels, and doubling down on flash and FlexPod solutions. And in 2018, NetApp will optimize ecosystems with more self-sufficiency capabilities and services for partners, he said.

Lipsin said NetApp is seeing several areas of growth, thanks to partners, including flash storage, which he said is the largest opportunity for growth, and converged infrastructure.

Both are important in developing the hybrid cloud, Lipsin said. "How do you take advantage of, and exploit, the public cloud [with] all the technologies that you sell today, and then tie it together in such a fashion that your customers can have their data anywhere they want, whenever they want, and managed in that fashion," he said.

On the flash storage side, NetApp has a three-tier strategy that competes with the best solutions offered by the company's top competitors, Lipsin said.

For performance, NetApp offers its EF series of all-flash storage arrays, which competes with EMC's XtremIO and DSSD and with IBM's FlashSystems offerings. For enterprise-grade applications, NetApp offers its All-flash FAS solutions, which provide a wide range of storage services and compete against Hewlett Packard Enterprise's all-flash 3PAR.

The third is simple, scalable solutions, where NetApp's recently acquired SolidFire all-flash storage, which competes with Pure Storage.

"As you look at it, that's a pretty strong group of competitors to deal with," Lipsin said. "What we're planning at NetApp here is to make sure that, at the very least, [we have] the No. 2 market share. And we're shooting for No. 1."

For NetApp, flash storage has become a $600 million business, with a growth rate of 45 percent, he said.

NetApp's FlexPod converged infrastructure solution is also a fast-growing business, with total revenue in the past five years reaching over $6 billion from more than 7,100 customers and 1,100 channel partners.

NetApp is bringing its flash and converged infrastructure solutions together, Lipsin said.

"We took that all-flash capability and we tied it [with] converged infrastructure together, and now we have a brand new offering: All-flash FAS on FlexPod. ... We've taken the top two fastest-growing areas of the business -- flash and converged infrastructure -- and we're putting more and more opportunities behind this," he said.

As part of its strategy, NetApp is offering a new series of eight FlexPod solutions configured by Phoenix-based distributor Avnet. These include three models reaching different capacity levels, versions of those three that include flash storage, and two new entry-level models with list pricing starting at less than $60,000, he said.

Dave Yeary, NetApp's director of worldwide channels for converged infrastructure solutions, later told CRN that the entry-level configurations, while still built with Cisco UCS servers, do not include switching technology built in.

"We're working with Cisco on lower-end models that start with a half-rack of flash and a small amount of UCS," Yeary said. "It's a seed program for customers looking to start small."

Yeary said NetApp is not trying to compete directly with hyper-converged infrastructure solutions. "We're adding a lot of functions to FlexPod that simplify the solutions like hyper-converged infrastructure does," he said. "But our solution is still flexible and scalable, unlike hyper-converged infrastructure."

Under the new Avnet partnership, an Avnet registration desk will ask channel partners a few questions about requirements and then use a configuration tool to select the right models and capacity in a few minutes, Yeary said.

"Partners get an immediate quote, and the solution can be shipped within 13 days," he said. "But if partners need custom configurations, they can still get it."

Lipsin told CRN that NetApp's other primary North American distributor, Centennial, Colo.-based Arrow Electronics, does not have such a capability. However, he said, NetApp is looking at new ways to invest in its Arrow relationship.

NetApp is already putting in play many of the things Lipsin talked about, said Kevin Goodman, managing director and a partner at BlueBridge Networks, a Cleveland, Ohio-based solution provider that both resells NetApp solutions and uses the vendor's technology to build its own BlueBridge cloud offering.

NetApp has been like a Swiss Army knife, with a whole bunch of different pieces that are cool but that most people can't use, Goodman told CRN. "But now NetApp is changing, and putting the pieces together," he said.

Goodman cited as an example NetApp's three-tiered flash strategy, which he said makes a lot of sense with the acquisition of SolidFire.

"SolidFire was a brilliant acquisition," he said. "We're very enthused about it. This kind of forward thinking is important for us. SolidFire will allow NetApp to compete with born-in-the-cloud flash storage startups."