Commvault CEO Sanjay Mirchandani: Subscription Model Has Spurred Stronger Partner Relationships

‘I think we have the strongest relationship we’ve had with our channel in a long, long time. With a subscription, you have constant engagement. You have a constant way of engaging your customers, your channel, the upsell, solving problems together,’ says Commvault CEO Sanjay Mirchandani.

Commvault On A Roll

Data protection and data management software developer Commvault exemplifies the changes occurring in the storage software industry. The Tinton Falls, N.J., company, which just a few years ago was known as a dependable data backup vendor, is now a nimble provider of technology for protecting and managing data on-premises and across public and private clouds.

Nothing shows the changes that Commvault has seen more than the company’s most recent financial quarter. The company reported late last month that, while total revenue grew 8 percent year over year, annual recurring revenue rose 12 percent and total recurring revenue rose 20 percent during the same time period. Subscriptions accounted for 81 percent of the company’s total revenue in the quarter.

Commvault CEO Sanjay Mirchandani told CRN in an exclusive interview that his company has been on a three-year journey to move nearly all of its revenue to a subscription basis. That journey, Mirchandani said, has been helped with the introduction nearly three years ago of Commvault Metallic, a SaaS-based data protection technology targeted exclusively at small and midsize businesses through channel partners.

[Related: THE 20 COOLEST CLOUD STORAGE COMPANIES OF THE 2022 CLOUD 100]

“As customers are accelerating to the cloud, the desire to provide a subscription or a utility model is a catalyst,” he said. “And when we offer our customers the option to have these workloads on-premises and these workloads delivered through Metallic, subscription is an actual choice for the software.”

That choice is also important for Commvault’s channel partners, who account for about 90 percent of the company’s total revenue, Mirchandani said.

“In the perpetual world, you have a lot more up-front activity, and then either the partner or us or the customer takes the lead position on how they want to roll it out at the time frames they want to roll it out. ... But in the subscription world, we’re far more engaged with our partners because it’s an ongoing journey where customers have to renew it at different points in time,” he said.

Mirchandani also had a lot to say about the competition, the importance of developing one’s own intellectual property, and the changing talent shortage. Here’s a look at the data protection world through the eyes of Commvault.

How do you describe Commvault?

We are in the business of protecting our customers’ data. That’s what we do. We’re a data protection and data management company. We don’t profess to do 50,000 things. And we like to think internally that we let our customers sleep well at night. That’s a side benefit of what we do. And that’s the business we’ve been in for 26 years. We do it both as software and as SaaS. And we deliver it through either medium. We call it the ‘Power of And.’ We have the best on-premises software combined with the best SaaS-based technology as a single pane of glass.

You mentioned data protection and data management. What does Commvault do on the data management side?

Most customers are going through a journey into hybrid IT, different types of clouds, different types of public and private capabilities. And we help do a few things. First, we allow that journey to be fairly transparent. In other words, you want to move data into the cloud, re-create it, you want to back up your data in the cloud, to archive your data with the cloud, you want to go cloud-to-cloud. So the transformation of that data, the movement of that data, we facilitate that. Conservatively, we think we’ve moved in excess of 2.7 exabytes of data for customers into the public cloud. That’s a conservative number. Probably a lot higher today. And we’re helping customers spin down virtual machines here, spin them up in the cloud to get their data. So transforming the data.

Second is, we do things like sensitive data management [such as] do we have credit card information somehow backed up? Do we have any kind of identifiable information we don’t want openly available in the data so we can query against that? We do a lot of file optimization for our customers. Because we have a highly patented indexing engine and capability on our backup, we’ve got great metadata capabilities that we can then do other things with.

Commvault remains an indirect channel-only company, right?

We are. Ninety-plus percent of our business goes through our channel partners.

Commvault seems to have had a good first fiscal quarter 2023. Subscription versus perpetual revenue, recurring versus non-recurring revenue, very strong moves over the last couple years. What’s behind Commvault’s subscription and recurring revenue success?

So we started that journey about three years ago in a very concerted way to give customers the option of moving to a subscription-based model. That’s a well-understood model, at least in the U.S. And more and more, we’re seeing it across the rest of the world. Customers are leaning in that direction, and we have a really good offering there. On the other side, I also think externally, as customers are accelerating to the cloud, the desire to provide a subscription or a utility model is a catalyst. And when we offer our customers the option to have these workloads on-premises and these workloads delivered through Metallic, subscription is an actual choice for the software. So it’s a lot of both. We’ve been obviously pushing that direction, and the market’s also accepting it more.

So with subscriptions now accounting for 81 percent of the Commvault’s revenue, do you see a day where perpetual licensing might go away?

I think I can see a day when it will be much smaller. There are customers that still prefer in certain industries to buy that way. And we give our customers the choice.

So you don’t see it ever going away completely?

I mean, if we choose to stop selling it, it will go away. I’m not there yet.

With the rise in subscription revenue versus perpetual and the recurring versus non-recurring, how has that changed how Commvault works with its channel partners?

I think we have the strongest relationship we’ve had with our channel in a long, long time. With a subscription, you have constant engagement. You have a constant way of engaging your customers, your channel, the upsell, solving problems together. I think it’s a much more symbiotic sort of relationship because the partner, us, and the customer are constantly working in tandem to make sure things are working out. In the perpetual world, you have a lot more up-front activity, and then either the partner or us or the customer takes the lead position on how they want to roll it out at the time frames they want to roll it out. It’s not good, not bad. It’s just a different model. But in the subscription world, we’re far more engaged with our partners because it’s an ongoing journey where customers have to renew it at different points in time. So I think allows us to work better.

How’s the competitive environment?

It’s an industry that is very competitive. It’s also one where you have to be really darn good at what you do. I think there was a period of time where point solutions were fashionable. ‘Oh, we do databases really well.’ ‘Oh, we do Kubernetes really well.’ Or ‘We do Salesforce really well.’ But with ransomware and the move to hybrid IT, I think that’s a thing of the past. It’s only companies like ours that do a breadth of solutions, breadth of workloads, no workload left behind, with a highly flexible delivery model. You can have it on-prem, and/or you can have it through SaaS. And I think that combination of the breadth of workloads with the breadth of delivery models allows us to really elbow out the competition. And so customers are now saying, ‘I don‘t want point solutions because point solutions actually are the bane of my existence.’ Having multiple point solutions allows the bad guys to get through. Having a more consistent framework and delivery is healthier. It’s better.

So we’re winning with what I started up front saying about the ‘Power of And,’ our ability to back up any workload across cloud or on-prem. And we’re gaining market share. ... Our Metallic business, I didn’t disclose specifics this quarter, but I did disclose when we exceeded $50 million in ARR [annual recurring revenue] in six quarters. That’s our SaaS business. It’s growing like a weed. And I think that the competition has definitely taken notice.

Who do you encounter most in terms of competing for customers’ business?

We’re winning because of the breath [of our offerings]. The way I look at my competitors is really in two buckets: the erstwhile competitors, you know, the Veritases and the Dells of the world, and then the upstarts. And we’re taking share on both. We’re winning against both. And then when there’s SaaS involved, we really have an unfair advantage because most customers want SaaS and on-premises. They want the same solution. They don’t want two solutions. And I don’t know how many of my competitors can do what we do.

So you are not breaking out Commvault Metallic as a stand-alone in terms of revenue or growth, correct?

We’ve been giving a lot of data points. And when we hit what we thought was an internal milestone of $50 million ARR at the end of last quarter, not this quarter, we did share that. And we said in a matter of six quarters has gone from $5 million to $50 million, which is significant. And we’re on a trajectory to keep this up. This quarter, Metallic continued to perform the way we expected it to perform. …

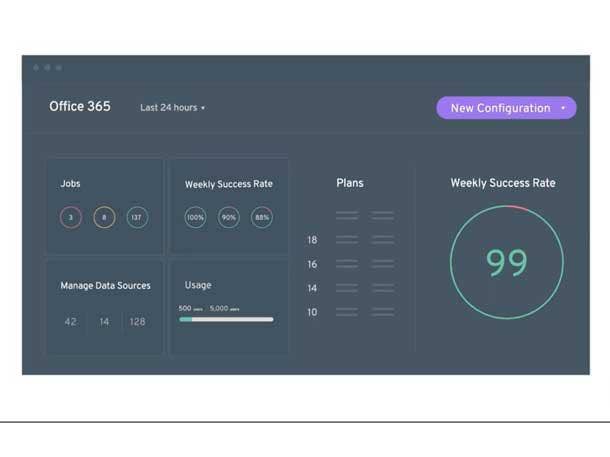

We are getting a lot of new customers through Metallic. Approximately 50 percent of the customers that we bring in through Metallic also have a Commvault software product attached to it. So the ‘Power of And’ is working. So they come in with SaaS, and then they quickly acquire a software capability, maybe for an on-premises thing or [specific] workload. Of the customers that are only Metallic, roughly 30 percent have more than one Metallic service. So they do Office 365 and Salesforce, or Office 365 and a virtual machine, something. They have more than one capability. So we’re sharing more and more details. And at some point, we’ll have an investor day where we will disclose a whole lot more. But right now, we’re foot to the gas, growing that business, investing in it. And we just announced a great partnership with Oracle. And we’re building on the partnership that we had with Microsoft. So now we’ve got two of the largest enterprise cloud providers with an engineered solution on their stack with Metallic. Native OCI support, native Azure support, obviously we do the other guys, too.

Commvault hasn’t really done a lot of acquisitions, right?

Prior to my coming in three years ago, we had never acquired a company. This was a company that built great IP [intellectual property] and continues to build great IP. When I came in, we bought a company called Hedvig, which was a software-defined storage layer which made its way into our HyperScale X technology, our converged infrastructure. And then in February of this year we bought a company called TrapX, which is now called ThreatWise. And that is very cool technology. It basically does threat deception. So you put decoys out in your infrastructure that look like your infrastructure. It is highly intelligent. If a signal from that hits your sensors, you basically get a very strong signal that says something’s amiss. [We’re] integrating that into making sure that customers can take a step and pause and say, ‘Hey, why is this being touched? Is my backup clean? Is my data clean? Or have I been infected, and I don’t know it?’

And so we’re changing the game because usually we get called in to restore. When something bad has happened, you need to bring your data back, then Commvault’s technology comes in to help restore your state. Over the years, we’ve also built great proactive capabilities to say, you know, how is the quality of data, and is the right data being backed up. And so then we build air-gapping and immutability into our file systems. And we’ve constantly evolved our ability to protect against cyberthreats. What this gives us is a whole new realm of capability that traditionally would have fallen between the security guys and the infrastructure guys. …

So people have asked me, does that make Commvault a security company? No, we’re a data protection company. And what I’m trying to do is bridge the gap between what is quickly becoming blurry between data security and data protection. And I don’t want my customers getting affected by the bad guys going through that chasm.

Do you expect Commvault to be more acquisitive going forward?

I’m always open to things that make sense for our customers. And if it gives me time to market or gives me unique IP, I’ll definitely look. But we have a really good innovation engine inside the company. It has held us in good stead. We have close to 1,100 patents. We’re a good engineering shop. But if there’s things we need that give us a competitive advantage or time to market, we will definitely look at it.

Last year, the biggest thing that people were talking about was the talent shortage. And now this year, all of a sudden companies, especially in high tech, seem to be laying people off. How is Commvault dealing with the people situation now?

I like to say that our assets go home at night. In this case, they stay home. It’s a dated expression, but you know what I mean. And our job is to make sure we motivate them and bring them back to do what they do best. And we’ve been quite successful as a company because we focus on what we do. We tried to create an environment where our employees feel like they can really shine

The talent shortage is real. But we’re a conservatively run company. If you look at our fundamentals as a company, we have cash on the balance sheet. We have no debt. We have lots of IP. We have lots of patents. We’re a conservative company in that sense. And we run it for the long term. And so we’re not usually in a hurry to hire and then scale back.

So are you still in a hiring mode?

We have open positions. Yes. At this point.

Has Commvault seen any impact from Russia’s war in Ukraine?

We did. And I think we said it had an annualized impact of $3 [million] to $5 million. We shut down operations in Russia. It’s a small number. It’s not massively material. It was a very small number. But it’s not so much just the Russian market. It’s the knock-on effect that it’s having on Europe. I mean, the cautiousness, the measure-twice-cut-once mindset that is naturally happening.