10 Software Industry Predictions For 2013

The Software Industry In 2013: Continued Innovation, More Winners And Losers

Big data, cloud computing, social networking and mobile computing are the big trends driving the IT industry today. They were responsible for many of the big news stories in 2012 and will likely drive many in 2013 as IT vendors and solution providers seek to maintain their competitive edge in the fast-evolving software market.

Can Microsoft leverage Windows 8 to make gains in mobile computing? Will vendors like Dell and HP continue to acquire software companies to expand their product lines? Will new technologies like HTML5 win acceptance while older technologies like relational databases decline?

Here's our thoughts on what 2013 might have in store for the software arena.

Tools For Managing The BYOD Dilemma Will Be A Major Growth Area

As many as two-thirds of all employees and managers who use smartphones and tablet computers for work are choosing their own devices, according to Forrester Research. The result: IT managers everywhere are pulling their hair out as they try to manage and secure those devices and the applications running on them while at the same time providing all those disparate devices with access to corporate systems.

Today the list of mobile device management (MDM) products is long and getting longer. Established vendors like SAP, IBM and Symantec offer MDM software, as do a number of young companies including AirWatch, Fiberlink, MobileIron and Zenprise.

IT managers spent 2012 wrestling the BYOD problem, but 2013 will be the year they really start shelling out big bucks to deal with it. That means opportunities for systems integrators, hosting companies and MSPs who work with these vendors and develop MDM expertise.

Slow Gains For Windows 8

When Microsoft said in late November it had sold 40 million Windows 8 licenses in the first month of the new operating system's availability, industry observers were quick to declare that pace mediocre at best, if not downright disappointing. Pundits, of course, have declared earlier editions of Windows to be busts shortly after their launch -- sometimes correctly, sometimes not. Our gut prediction is that Windows 8 sales will make steady gains in 2013, but they'll be far from blockbuster. Many businesses and consumers that adopted Windows 7 in recent years won't be in any hurry to upgrade. And, the new user interface is giving some pause.

Yes, there are still a lot of Windows XP users out there -- a whopping 40 percent of all desktop PC operating systems, according to Net Applications. Our guess is that most of those users will upgrade when they buy new PCs. That makes the success of Windows 8 very dependent upon the health of the PC market. And with lackluster PC sales projections for 2013 (Barclays is predicting a 4 percent decline), that will hinder Windows 8's sales.

SMBs Step Up Middleware Use

Middleware has long been seen as largely a technology for big companies with big IT systems in big data centers. But in 2013 middleware technologies such as business process management, application integration and data integration software, will increasingly be developed for -- and adopted by -- small and mid-size businesses.

Cloud computing is a big driver. As SMBs' IT systems take on a more hybrid cloud/on-premise look, their need for integration middleware will grow. At the same time cloud-based middleware will be more affordable for SMBs and easier to implement. Look for vendors to develop SMB-specific versions of their middleware products in 2013 or offer SMBs middleware that's more "componentized" and less monolithic.

Big Data Focuses On Analytics

Big data industry growth will continue to explode in 2013. Well duh! But, we predict the development of the big data scene won't be just a continuation of 2012. Recent years have seen an explosion of startups developing software around Hadoop, the de facto standard platform for developing distributed, data-intensive applications. Most of those startups have focused on technology for managing big data. In the new year expect a greater emphasis on technology for making use of big data, such as manipulating and analyzing it for business intelligence purposes -- especially in real time and for predictive analytics. Many of these solutions will be focused on specific vertical industries like retail and healthcare.

And look for the pace of acquisitions to accelerate in 2013 as big vendors like IBM, Oracle and SAP try to expand their big data offerings with leading-edge technology from startups. We'll also see more vendors and solution providers offering more complete big data solutions either through acquisitions or by bundling together multiple vendors software from multiple vendors.

Dell Will Continue To Make Major Software Acquisitions

Dell was on a shopping spree in 2012, acquiring such software companies as Wyse, SonicWall and Quest.

Look for Dell to stay on that acquisition track, particularly focusing on buying companies that develop systems and network management, security and virtualization software and other infrastructure-focused applications.

Rather than competing head-to-head with major software vendors like Oracle and SAP on a product-for-product basis, Dell seems more intent on bundling its software technologies with its hardware to offer integrated IT systems. But Oracle, IBM and other IT vendors are also adopting the "complete IT system" strategy. They will increasingly find themselves competing with Dell in the new year.

A Big Year For Healthcare Software

Look for the demand for healthcare-related software to soar in 2013 as businesses and government agencies gear up to meet provisions in the Affordable Care Act (i.e. "Obamacare") that kick in this year and next. The legislation offers incentives for doctors, hospitals and other healthcare providers to implement electronic healthcare records as a way of cutting costs and improving healthcare services.

Healthcare providers also will jump on the "big data" bandwagon this year and accelerate their adoption of healthcare-specific analytical applications. While only 10 percent of hospitals were using health data analytics in 2011, that number is expected to grow to 50 percent by 2016, according to a Frost & Sullivan study.

Another big driver: More doctors, nurses and other healthcare professionals are using tablet computers and other mobile devices in their day-to-day work and that's spurring demand for healthcare mobile applications.

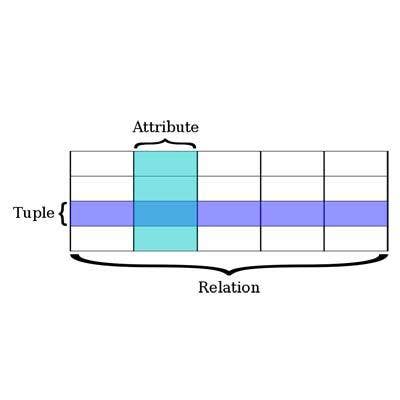

Death Of The Relational Database - Not!

Some pundits have been predicting the imminent death of relational database technology as other database architectures emerge. Of course similar predictions were made back in the 1980s and 1990s when object-oriented databases and other alternative technologies came on the scene.

Relational database management systems like the Oracle Database and Microsoft's SQL Server will remain the dominant database workhorse behind most IT systems.

But in 2013 we will see an increasing shift away from monolithic database systems, where relational technology has been dominant, toward database "ecosystems" where relational databases supporting transactional IT systems work alongside "NoSQL" databases, column-oriented databases, in-memory databases and others. More businesses will adopt such next-generation database software this year for more specific tasks such as analyzing "big data" and storing unstructured data.

Microsoft Will Debut Its Own Smartphone

Yes, this sounds like a hardware prediction. But Microsoft, the industry's largest software vendor, is struggling to become a major player in mobile computing with Windows 8 and Windows Phone 8. So its launch of the Surface tablet last year and rumored plans to offer its own smartphone in 2013 are just as much a software story.

The big question is how Microsoft will go about this. There have been reports that Microsoft has developed its own phone prototype and approached Chinese manufacturer Foxconn to produce it. Or, will Microsoft turn to Nokia, in which Microsoft has invested lots of time and money? Could it even acquire the struggling mobile phone vendor?

Microsoft's earlier effort to enter the mobile phone market with the Kin bombed. Can it do better this time? Microsoft's efforts to extend its software dominance on the desktop into the mobile computing world may depend on it.

HTML5 Will Make Slow Gains In Acceptance

Throughout 2012, the media was full of stories about the slow acceptance rate of HTML5, the latest standard for developing and presenting content on the Web. Some cited performance and security issues and reports that HTML5 was more difficult to work with than writing "native" applications for iOS and Android. Most skeptical was a Gartner report in August that said HTML5 was 5-10 years away from being a legitimate business tool.

We think it will catch on faster than that and become a development mainstay this year for Web development in general. But in the mobile space, application development will remain focused on native applications for some time -- and perhaps longer if Apple iOS and Google Android account for a disproportionate share of the market and developers have fewer platforms to support.

HP Will Shock The Industry With Another Big Software Acquisition

One of the biggest stories in 2012 was the blowup near year's end when Hewlett-Packard took an $8.8 billion charge for its 2011 acquisition of Autonomy, saying HP overpaid for the information management software company because "accounting improprieties" inflated the price.

One would think HP would think twice about spending more for additional software acquisitions after the Autonomy debacle. But, the fact remains that software accounted for only 3 percent -- less than $3.8 billion -- of HP's $120.4 billion revenue in fiscal 2012. (Personal systems, in contrast, accounted for 29 percent, printing 20 percent, and servers, storage and networking 16 percent.)

Fact is, HP has to become a bigger player in software if it's going to remain relevant. Look for CEO Meg Whitman & Co. to make another multi-billion software acquisition this year, perhaps a developer of middleware or applications to better compete with Oracle and IBM.