The 20 Coolest Cloud Software Vendors Of The 2014 Cloud 100

Coolest Cloud Software Vendors For 2014

Fifteen years after Salesforce.com introduced its cloud CRM apps, cloud computing is quickly becoming the de facto method for delivery applications to users. Businesses are turning to the cloud for software capabilities without the headaches of on-premise applications. And software vendors, from established players like Oracle and SAP to startups such as FinancialForce and Insightly, are rushing to meet the growing demand for cloud apps.

Here are the coolest cloud software vendors on this year's Cloud 100 list.

Acumatica

CEO: Yury Larichev

Acumatica has been giving the established ERP vendors a run for their money with its cloud ERP applications. The company has been aggressively recruiting channel partners, doubling its partner roster in 2013 to 270 and recording 350 percent revenue growth last year.

Avalara

CEO: Scott McFarlane

Dealing with local sales tax rates and rules across the country is a major headache for small businesses. Avalara's cloud software automates the tax compliance process, including calculating the correct tax for every transaction and paying state and local authorities, simplifying a business' cash flow in the process.

BetterCloud

CEO: David Politis

IT managers get nervous when employees start using productivity applications outside the firewall. BetterCloud offers the FlashPanel cloud management and security tools, built within the Google App Engine, for bringing a measure of IT control to Google Apps and improving the user experience.

Birst

CEO: Brad Peters

Birst develops on-demand business intelligence and analytics tools for public and private clouds. Advocates of cloud BI say it can be deployed more quickly to a broader range of users than on-premise tools. In December, Birst debuted Birst Visualizer, a visual discovery tool that boosts Birst's "self-service" capabilities.

Cloudability

CEO: Mat Ellis

Worried about losing control of your IT with cloud computing? Cloudability is a cloud usage analytics tool that helps businesses monitor, manage and communicate their cloud costs. The company estimates that 10 percent of Amazon Web Services customers use its product.

FinancialForce

President, CEO: Jeremy Roche

FinancialForce.com develops back-office applications, built on Salesforce.com's Force.com platform, including accounting, billing, human capital management and professional services automation software. The apps are linked to Salesforce applications, and given that company's rapid growth, that's a good place for FinancialForce to be.

CEO: Larry Page

Sure, Google has self-driving cars and Web-enabled spectacles. But even without those bleeding-edge projects, Google maintains a high "cool" quotient with its mainstream business offerings like Google Apps, Android, Chrome Management Console and more. Coolest of all are the plans to launch a channel program for the Google Cloud Platform this year.

Insightly

CEO: Anthony Smith

Insightly offers online CRM applications (on a "freemium" basis) that are integrated with Google Apps/Gmail, Outlook 2013/Office 365, and social media sites -- all with the goal of helping small businesses closely track interactions with prospects and customers. And the apps are accessible from iOS and Android devices.

Intacct

President, CEO: Robert Reid

Intacct offers cloud-based accounting, financial reporting and financial management software. The company has been on a strong growth path: It reported a 150 percent increase in sales bookings in its first fiscal quarter ended Sept. 30. And the company said a great deal of that growth is coming from its VARs.

Jaspersoft

CEO: Brian Gentile

While Jaspersoft's popular open-source business intelligence tool is available for on-premise deployment, the Jaspersoft BI for Amazon Web Services is what caught our attention, with its pay-by-the-hour service and no limits on data volumes. The company recently shipped Jaspersoft 5.5 for AWS with new reporting and analytical features. The software could reduce analytics software costs by two-thirds, according to Nucleus Research.

Marketo

President, CEO: Phil Fernandez

Marketo's cloud-based marketing automation applications help businesses create and track online advertising campaigns. But is it possible to be too cool? After Salesforce bought ExactTarget in July and Oracle acquired Responsys in December, Marketo's stock soared on speculation the company could be the next acquisition target.

NetSuite

President, CEO: Zach Nelson

While younger companies like Acumatica and Intacct are attracting attention in the cloud application space, cloud ERP, CRM and e-commerce software developer NetSuite continues to set the pace. Its October acquisition of TribeHR added human capital management apps to the mix. And in the channel, NetSuite has aggressively recruited Microsoft, SAP and Sage partners.

Oracle

CEO: Larry Ellison

Oracle could fit into several of our cloud categories with its SaaS, PaaS and IaaS products and services. In the cloud software department, the company offers its Fusion cloud applications and the Oracle Database Cloud Service, with other cloud products in the wings including the Oracle Cloud Developer Service and cloud-based business intelligence tools.

Paxata

CEO: Prakash Nanduri

Paxata in October launched its cloud-based Adaptive Data Preparation Platform that helps business analysts collect and combine raw data and prepare it for analysis. The software uses a set of pre-built data preparation services automated by machine learning, latent semantic indexing, statistical pattern recognition and text analysis. The company raised $8 million in Series B funding in October.

Salesforce.com

CEO: Marc Benioff

Salesforce could be considered the original cloud company. But it has expanded far beyond its on-demand CRM application beginnings, adding cloud marketing, service and social networking apps, and cloud development tools. Benioff's bluster might turn some people off, but it's hard to argue with the company's 30 percent-plus annual growth rate.

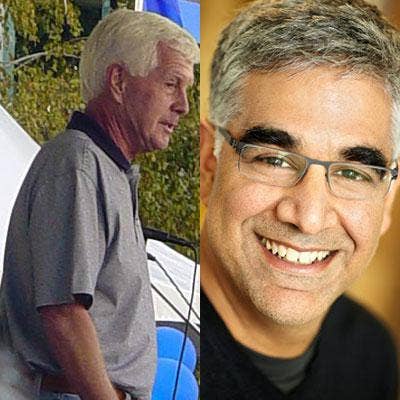

SAP

Co-CEOs: Bill McDermott, Jim Hagemann Snabe

As a leading purveyor of on-premise business applications, SAP is a company many cloud startups are gunning to replace. While SAP's Business ByDesign, its first cloud application set, didn't meet sales expectations, the company's cloud business now exceeds 1 billion Euros (about $1.37 billion) a year. And the company's HANA cloud platform represents a major opportunity in big data.

Star2Star Communications

CEO: Norman Worthington

Star2Star's cloud-based unified communications software brings together voice, fax, videoconferencing and instant messaging into a single, easy-to-use system. Along with its impressive technology, Star2Star's coolness quotient gets a boost from its highly regarded partner program that makes the company a channel favorite.

Tableau Software

CEO: Christian Chabot

Tableau, through its data visualization applications, is moving business analytics beyond the realm of data scientists and making it available to a far wider audience of users. Tableau Online, a hosted version of Tableau Server, can pull data and analytical results from cloud apps such as Salesforce.com and Google Analytics.

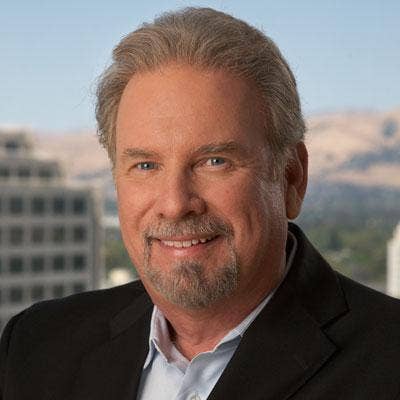

Workday

Co-CEOs: Dave Duffield, Aneel Bhusri

Workday has been shaking up the enterprise application market with its cloud-based human capital and financial management applications, putting competitive pressure on vendors like Oracle and SAP that sell on-premise HR apps. The recently launched Workday 21 relies on HTML5 to provide users with a more consumer apps-like experience.

Zoho

CEO: Sridhar Vembu

Scrappy cloud application vendor Zoho targets home users and small businesses with its growing portfolio of low-cost, easy-to-use cloud applications, everything from CRM and HR applications to collaboration and document management software to calendar and word productivity tools for word processing and presentations.