Channel Best-Sellers

When it comes to measuring success, it's hard to fake a best-sellers list. After all, if solution providers don't like a vendor's products or programs, they'll quickly take their money elsewhere. On the other hand, solid trust and loyalty from a vendor is justly rewarded with a greater share of wallet.

So it should come as no surprise that this year's Best-Sellers Survey is studded with the glitterati of the IT world. Well-known and well-liked vendors such as Cisco Systems, Hewlett- Packard, IBM and Symantec earned significant market share as measured by data gleaned by the NPD Group/Distributor Track, which aggregates sales through members of the Global Technology Distribution Council.

Those companies are best-sellers because solution providers believe they have quality products and are truly engaged with the channel. Never underestimate the power of partnering.

As Symantec's vice president of global channel sales, Julie Parrish, says: "Our partners are going to be a very strong continuation of our growth going forward." And that's all solution providers want to hear.

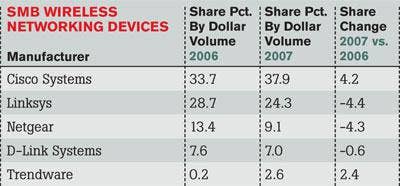

SMB WIRELESS NETWORKING

Where Cisco Systems dominates the enterprise wireless market, the networking giant is double-trouble in SMB. Cisco and the Cisco-owned Linksys Group last year were tops in SMB wireless market share and, separately, the pair also dominated. Despite this, other wireless networking vendors maintained a strong share of the market, with Netgear, D-Link Systems and Trendware in the mix.

While D-Link dropped a fraction of a percentage point, it is confident in its channel sales and appeal to the SMB. "We're positioned as an alternative to Cisco," said Keith Karlsen, executive vice president."We know we can beat them at the edge."

Brad Faizy, president of Tech On Web, Addison, Texas, agreed. "A lot of times when we get requests for Cisco routers and switches,we offer D-Link as an alternative," Faizy said. "The price points D-Link offers are a no-brainer."

Linksys, for its part, said VARs like the breadth of its portfolio." We offer a way to really tie together our products," said Ivor Diedrichs, product manager for the Linksys Connected Office Business Organization. "We've built out our portfolio over the last two years focused on this specific space, the SMB." [READ MORE]

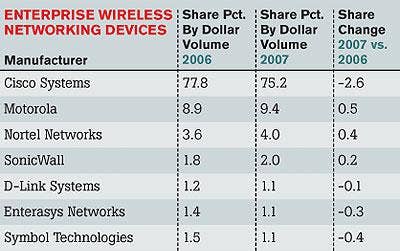

ENTERPRISE WIRELESS NETWORKING

Cisco Systems continued its hold on the enterprise wireless networking market. No other vendor even came close, with Motorola, Nortel Networks, SonicWall and D-Link Systems rounding out the top five.

Alex Thurber, Cisco's senior director of technology go to market, said their are several contributing factors: advancements like 802.11n, Cisco delivering on its 1999 acquisition of Airespace with its Aironet line and its ability to deliver an end-toend, full brand portfolio. "If the stuff doesn't work -- if it's not ready for prime time -- VARs are only going to sell it once because they're going to get burned," Thurber said.

Nortel shows great promise and growth, which Product Marketing Manager for Wireless Joanne Lennon said is in part due to the increased sales of converged network components and the growth of Voice over WLAN.

Scott Davis, executive director of Broken Arrow, Okla.-based Xeta Technologies, said, "We are seeing a lot of Nortel customers, especially the data customers, trying to get all at once. Nortel is very aggressive about bundling solutions together and showing where the Layer 2 switches tie in with other tools." [READ MORE]

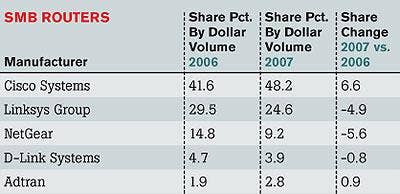

SMB ROUTERS

Cisco Systems' big SMB push seems to be paying off. The company devoted much of 2007 to revamping its Integrated Services Routers and launched a new Select certification for channel partners that cater to the SMB market. Both solution providers and customers seemed to notice.

Cisco's Linksys division also continued its reign among the Channel Best Sellers, wooing solution providers on the strength of its business router portfolio and its channel ties. Austin Smith, president of Digital Son, I.T. Services, a VAR in Lawrenceville, Ga., said Linksys is his brand of choice for small-business customers. "I prefer Linksys. I like to be flexible and their products [let me do that]," Smith said.

NetGear, D-Link Systems and Adtran rounded out the category. Adtran was the only other vendor to increase share in 2007. [READ MORE]

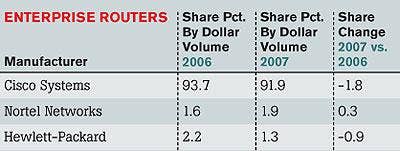

ENTERPRISE ROUTERS

Despite losing some ground, Cisco Systems remained firmly on top of the enterprise router market in 2007.

With all of the services embedded in network infrastructure, customers turn to Cisco for enterprise routers because they're dependable performers, said Brett Rushton, vice president of network strategy and infrastructure at Calence LLC, a solution provider in Tempe, Ariz. "Customers have a need for simpler solutions that work holistically across their networks," he said.

Cisco has already noted slower sales growth to some of its U.S. enterprise customers due to the softening economy, which could explain the slight market-share drop. Some customers also might have been waiting for Cisco to launch its Aggregation Services Router line, which debuted earlier this month. "It's probably all of the above," said John Growdon, director of core and data center technologies for worldwide channels at Cisco.

Cisco wasn't the only Best-Seller to see a dip in share. Hewlett- Packard also saw a small decline. Nortel Networks was the only one of the top three to see any growth, and it was small at that, indicating that Cisco customers aren't the only ones concerned about the status of the economy. [READ MORE]

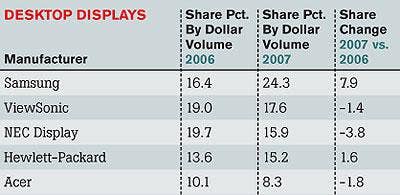

DESKTOP DISPLAYS

In the cutthroat world of desktop display sales, margins for vendors and resellers are squeezed as vendors battle to provide the best features at the most aggressive price points. Todd Swank, director of marketing at Burnsville, Minn.-based system builder and solution provider Nor-Tech, bets onView- Sonic and NEC Display Solutions.

"They tend to really look at the overall market and help the channel find new opportunities," Swank said. "That's important [as] we really have to separate ourselves because the bigger players have the volume to compete in price structure."

Samsung was one of the few vendors to post a substantial gain in market share in 2007. Vice President of Marketing and Commercial Sales for the IT Division Chris Franey attributes that to strong product and channel propositions. "Let us help you sell larger displays that have a higher [average selling price], products that offer unique solutions, like high-resolution displays with unique features," he said. [READ MORE]

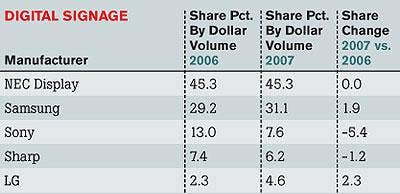

DIGITAL SIGNAGE

The digital signage market is a tough space -- literally. However, advances in touch-screen technology and larger-than-life screen sizes have kept the market moving up.

"It's attracting a lot more competition because a lot of the companies in the desktop space want to move up that scale because there's more opportunities and better margins with digital signage," said Pierre Richer, president and COO of NEC Display Solutions America.

From the Mayo Clinic to Madison Square Garden, digital displays providing information, education and advertising (sometimes all three) offer vendors like NEC, Samsung and LG opportunities for growth. They, in turn, reach out to the channel.

"We've been doing national road shows on a regional basis," said Don Fasick, director of business development, digital signage, at LG. "Last year we brought channel partners into events so that people could have at their fingertips the ability to get more detailed information of what's needed out there to deploy digital signage." [READ MORE]

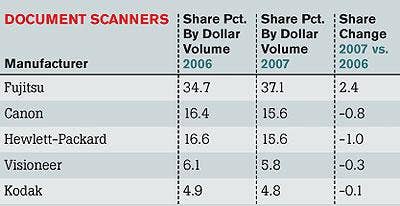

DOCUMENT SCANNERS

Fujitsu America dominated the market this year, with Canon and Hewlett-Packard jockeying for position. Said Scott Francis, senior director of product marketing at Fujitsu: "At Fujitsu we have a very core philosophy behind our document imaging scanners. They focus on three core things: the quality of the image that we capture, the paper handling itself and overall reliability so that the scanner simply will not break down."

Jack Roberts, co-founder of Cutting Edge Solutions, Kansas City, Mo., is a Fujitsu fan. "The value you get for the cost of the scanner and the quality is very good, and their actual scanner line works," Roberts said.

Dan Rotelli, president of Business Imaging Systems, Oklahoma City, Okla., is on board with Canon. "They're very feature-rich and, being an authorized support partner for them, they provide us with really good training and good parts resources to be able to provide good service," he said.

HP, meanwhile, wins for Ed Greenberg, vice president of sales at IT Access, Westford, Mass. "The low-end scanners, they're all about the same in terms of quality, but the quality is excellent on their high-ends. And the cost is very competitive." [READ MORE]

MULTIFUNCTION PRINTERS

Service and quality products kept longtime favorite Hewlett- Packard at the top of the MFP category once again, but Lexmark International and Xerox gained some ground.

Said Mark Quiroz, HP's director of sales strategy and channels, global enterprise business, Imaging and Printing: "We've always been regarded as building industry-leading products, and it's always been our core strength. We build very capable products that last a long time and provide value to the end users." He sees HP's drop in market share as just a blip.

But Lexmark and Xerox are chipping away.

Xerox introduced three MFPs and expanded its IT Advantage program last year, which helped it grow, said Gary Gillam, vice president of Xerox North America Channel Operations. "Products are definitely part of it, and the products themselves create an upsell opportunity with higher ASPs," Gillam said. [READ MORE]

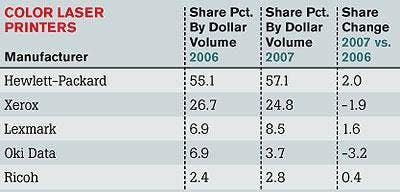

COLOR PRINTERS

Hewlett-Packard continued its domination in the color printing segment, with Xerox, Lexmark International, Oki Data Americas and Ricoh in the mix as well. "Last year saw a slowdown a bit for all vendors in the category," said Gary Gillam, vice president, Xerox North American channel operations. MFPs took some of the market share in color laser printers. We're driving growth through the channel with more features and higher performance."

"I would say that Xerox's channel program is currently the strongest in the printer business," said Michael Greenberg, president and founder of PrinTelogy, Denver. "[Xerox's] backend rebates, marketing programs and support are very strong."

The most successful VARs in the segment are not selling color laser printers based on price but are selling print solutions. "They're providing service, not just break-fix, but helping with any problem the customer has," said Neal Durnil, senior manager of business development at Lexmark. [READ MORE]

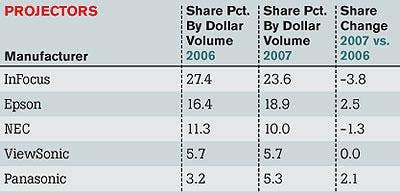

PROJECTORS

InFocus grabbed the most market share, but its share dropped in the first half of 2007 over the year-ago period,while in the No. 2 slot, Epson saw an increase.

But certainly don't count InFocus out. In September 2007, Bob O'Malley of Tech Data left the distributor to take the helm of InFocus. "As we look to the opportunity for 2008, we are seeing the beginning of a growth period for projection, driven by changing display requirements," O'Malley said.

Gus Chiarello, PSG manager at Brooklyn, N.Y.-based Atlantic Business Products, has been working with InFocus for six years. "They've been a staple in the projector business,whether it's residential or commercial," Chiarello said.

Meanwhile, NEC Display Solutions of America banks on its strong education focus -- 40 percent of all sales in the projector market are in the K-12 segment, said Pierre Richer, who was named president and COO last month. [READ MORE]

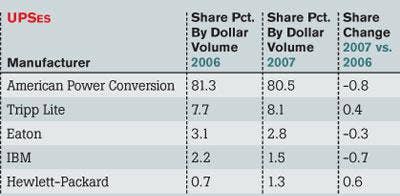

UPSes

The UPS industry has seen a lot of consolidation, but it's had little impact on the vendors' sales through distribution. APC, which last year was acquired by Schneider Electric, which also owns MGE, is by far the most commonly found UPS vendor in distribution. Its share of sales through distributors in 2007 is only slightly less than its share in 2006.Tripp Lite and Eaton, follow. Eaton also grew by acquisition last year when it acquired the low-end business of MGE from Schneider when the latter acquired APC.

About 95 percent of APC's sales are through indirect channels, and MGE is also now turning its sights on the channel after being a direct player so long, said Rob McKernan, vice president of Americas channels and alliances at APC.

Jan Baker, office manager at Systems Design, Sparks, Nev., said her company uses only APC UPSs. "We get a lot of support," Baker said. "Any time we have any issue, say a problem with a weird noise, they walk us through.They refer customers to us. And they never try to steal a customer." [READ MORE]

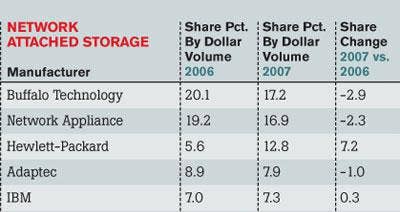

NETWORK-ATTACHED STORAGE

High sales volume has yet again put Buffalo Technology at the top of the NAS category,while higher sales prices kept Network Appliance and Hewlett-Packard in the top three.

Buffalo's share stems from its focus on home users and small businesses of up to about 250 users, said Erny Mezas, director of sales. NetApp and HP, on the other hand, focus on smallbusiness to enterprise customers.Their products have an average selling price of three times to six times that of Buffalo, Mezas said. "There's no question we're the volume leader," he said. "So we don't see them as direct competitors to us."

For NetApp, about half of U.S. sales go through channels, but a significant part is done directly with a handful of solution providers that do not buy through distribution, said Sajai Krishnan, general manager of the small and midsize business unit. Even so, Krishnan said, "We need to broaden our partner reach. Our growth has to be through partners."

HP's strength depends on NAS appliances built on its Pro- Liant server and All-in-One lines, said Harry Baeverstad, director of entry NAS. About 50 percent of HP's overall U.S. NAS sales go through the channel, but HP is focusing on increasing that with several growth-oriented channel campaigns, he said. [READ MORE]

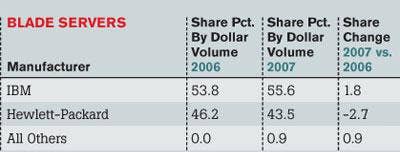

BLADE SERVERS

Competition remains fierce in blade servers, with perennial leaders IBM and Hewlett-Packard again topping the list. Alex Yost, IBM's vice president of the Blade Group, said he saw customers first begin to adopt blades about five years ago. "Customers were looking for servers that were more compact and integrated and could give them more computing power per square foot," he said. Now IBM is focusing on new offerings as its customers' needs have matured.

Said Jay Tipton, vice president and owner of Fort Wayne, Ind.- based Technology Specialists: "It boils down to the fact that IBM has not changed its blade server connection since inception. If you need to upgrade the chassis, if you want it bigger, better, faster, they can do it without a huge amount of disruption."

HP's Jim Ganthier, director of marketing for BladeSystem, said the company is focusing on ways for partners to capture new opportunities. He pointed to HP's first blade enclosure for midsize businesses—Shorty, or the HP BladeSystem c3000. "Shorty was built with the channel in mind because midsize customers rely heavily on their local resellers," Ganthier said. [READ MORE]

DESKTOP COMPUTERS

Mark Hurd, Adrian Jones and Co. continue to make the right channel moves at Hewlett-Packard.

When it comes to building desktop sales, HP has been steadily gaining ground over rivals for some time. Once again, HP's channel gains were reflected by Lenovo's losses. But the fourth-largest PC maker in the world continues to outpace No. 2 Dell and No. 3 Acer, at least in terms of channel desktop sales.

As for HP, partners like Rick Chernick, CEO of Camera Connecting Point, Green Bay, Wis., think they know the secret to the vendor's astounding channel success. "HP is getting their people out in front of customers [on partner visits]. No one else is doing that. Mark Hurd wants to be No. 1 in the U.S. and he wants HP partners to help him get there," he said. [READ MORE]

NOTEBOOK COMPUTERS

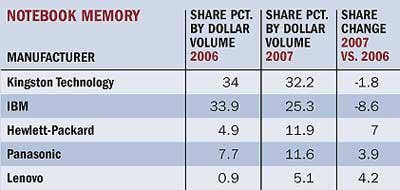

Lenovo remains the one to beat in notebooks, despite a nearly 8-point slide from last year. The company is aiming to be easier to do business with, said Steve Mungall, vice president of Americas channel sales. It requires no formal authorization process for partners to sell basic offerings and provides programs geared to specific customer-segments, such as SMB.

"Lenovo offers very compelling special-pricing programs -- and pricing -- and is very good about keeping us informed and armed with the latest information about their products," said Joshua Aaron, president and founder of Business Technology Partners, New York.

Panasonic has for the past 15 years offered a durable Toughbook product. "We develop, engineer and build our own products. Most others are sourcing out design and manufacturing to Taiwan," said Sheila O'Neil, senior director of channel sales. [READ MORE]

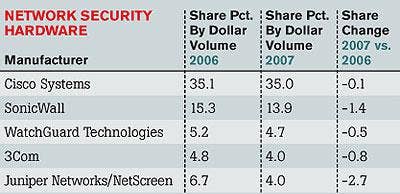

NETWORK SECURITY HARDWARE

The story in channel-based network security hardware sales can be summed up in one word: flat. Cisco Systems held on to its roughly 35 percent share of the distribution market for the second half of 2007. But the best that can be said is that it lost slightly less share than its competitors, including SonicWall. With Cisco, WatchGuard Technologies and 3Com. dropping less than 1 percent in share, it's tempting to say the numbers are statistically insignificant. But add up distribution share losses by the top five vendors, and you wind up with about a 4.7 percent chunk of channel market ceded to smaller rivals. That's not a huge number, but it's significant. And solution providers like Matt Briese think they know why it's happening.

"The big boys are falling down on the job," said Briese, owner of Rochester, Minn.-based Briese Computer Services, adding that he's been exploring other options of late. "I've been a pretty loyal 3Com and WatchGuard customer -- 3Com for 15 years and Watchguard for eight. When they were smaller, you got better service from them." [READ MORE]

VPNs

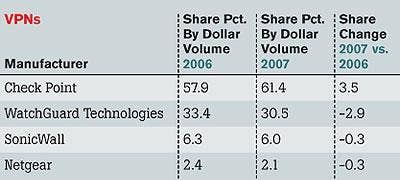

Sales of VPN solutions haven't been exactly going through the roof, as security vendors have been baking the technology into combined firewall and unified threat management offerings.

However, Check Point Software Technologies continues to be a force to be reckoned with, racking up the largest gains. "The reality is that we invest significantly in technology and play fair with the channel," said Marty Leamy, vice president of Americas field operations at Check Point. Neither has Check Point been snoozing when it comes to keeping its technological edge, and is continually working and investing to enhance performance of VPN and other security technologies with the help of longtime chip partner Intel, Leamy said.

WatchGuard in 2007 had "tremendous growth," said Mark Romano, director of global channel marketing. However, its VPN sales through distribution saw the biggest drop of any of the vendors in the segment. These figures could have been skewed somewhat by WatchGuard's larger growth outside the U.S., during the period between 2006 and 2007, said Romano. In addition,WatchGuard in 2007 made a concerted effort to promote and price its Firebox UTM line more aggressively, which may have affected distributors' reporting model, he said. [READ MORE]

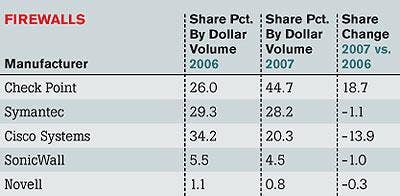

FIREWALLS

Check Point Software Technologies has long been known as an elite firewall vendor. So has Cisco Systems. So it's surprising to see the former's firewall sales through distribution jumping significantly while the latter's dropping precipitously.

Several security solution providers chalked it up to the decline of the stand-alone firewall, which many vendors have been adding to their unified threat management solutions. The Cisco Adaptive Security Appliance has replaced the Cisco Pix as its primary firewall, and more than 90 percent of Cisco's firewall sales now come through sales of the ASA, said Tom Russell, senior director of Cisco's Security Technology Group. Check Point, a relative newcomer to the UTM market, still sells stand-alone firewalls.

In firewalls, Check Point has been improving performance and adding new features, but the biggest attraction has been in hardware, where its UTM-1 and UTM-1 Edge appliances have been gaining in popularity, said Lou Rubbo, principal at DirSec, a Centennial, Colo.-based solution provider. [READ MORE]

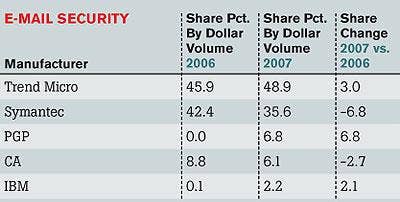

E-MAIL SECURITY

Holding its position as market leader, Trend Micro beat out Symantec in market share.

Nancy Reynolds, VP of Channel and SMB Sales, North America for Trend Micro, said, "We consistently hear from our channel partners that they enjoy doing business with Trend Micro more than our competition, and that the channel enjoys the choice of form factors Trend Micro gives them to sell."

"Everybody can claim to catch spam.These guys have some great research going on behind their product," said Stephen Nacci, regional account manager at TLIC Worldwide.

Symantec has relinquished some share, but executives say that despite the small dip, it anticipates steady growth in light of its recent financial earnings."We have been and continue to be a channel-led company. The channel utilization remained constant," said Julie Parrish, vice president of global channel sales.

One up-and-comer to watch is PGP, which gained market share from 2006 to 2007. "Our products deploy as one platform, so you can add applications as the customers need them," said Phillip Dunkelberger, president and CEO. [READ MORE]

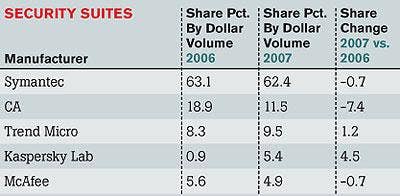

SECURITY SUITES

Symantec Corp. held fast to its position in security suite products, exceeding its nearest competitor, CA Inc., by more than 50 share percentage points. Despite its dominance, the company lost seven-tenths of a point in share from 2006 to 2007.

Executives attribute this to delayed releases when the company moved from antivirus solutions to its more comprehensive end-point protection product lines.

"People do have a tendency to wait when they hear something new is coming," said Julie Parrish, vice president of global channel sales for Symantec.

CA also experienced a market-share dip, as did McAfee.

"We've seen the opposite, that we've gained market share," said Dave Dickison, senior vice president of North American Channels for McAfee. "We find sales quite a bit ahead of the biggest competitor there," Dickison said.

Meanwhile, Kaspersky Lab executives say they have seen exponential growth recently due to the fact that they have relied on channel sales from the start. Partners also are bullish on Kaspersky's offerings.

"When we recommend Kaspersky, we put that on a customer's systems, and it immediately detects viruses or spyware that the previous product had missed," said Spencer Ferguson, president of Wasatch Software Inc. in Salt Lake City.

Meanwhile, Trend Micro said gains in the SMB market were due to increased adoption of its Worry Free line, and that enterprise share continues to grow. "Customers are looking to consolidate vendors and reduce complexity," said Nancy Reynolds, vice president of Channel and SMB Sales, North America for Trend Micro. [READ MORE]

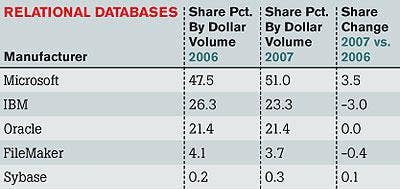

RELATIONAL DATABASES

You've got to give Microsoft credit. Most any other company selling an aging version of a software product with a new (and greatly hyped) release on the way would see sales drop off. But last year SQL Server 2005 managed to pick up share. How? Business intelligence is key, and VARs are tapping into SQL Server's built-in reporting and analysis tools. "We've heard from partners that they want to work with us around BI," said Kim Saunders, senior director of marketing for SQL Server.

Data showing IBM's share declined comes as a surprise to Bernie Spang, director of data servers. Spang said a "significant volume" of IBM database software goes through distribution and indirect channels and sales grew significantly in 2007. The flat results for Oracle may be a bit disappointing given the mid-2007 launch of itsVAD Remarketer program, which seeks to increase sales of database products through distributors.

But VARs will buy more through it as they better understand it, said Judson Althoff, vice president of Oracle's global platform and distribution sales. [READ MORE]

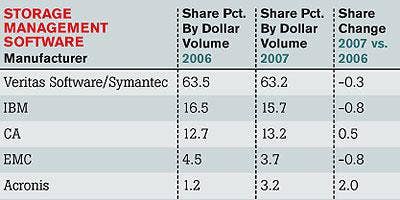

STORAGE MANAGEMENT SOFTWARE

As data volumes grow, so grows the demand for software needed to manage the systems that store and back up all that data. Symantec, remained far and away the leader in this category, but that share represented a drop of 0.3 points from 2006.

Part of the reason may have been that Symantec just debuted new versions of its flagship Backup Exec data protection and Backup Exec System Recovery disaster-recovery software -- the first major upgrades since late 2006. "A lot of customers don't upgrade unless there's a compelling reason to do so," said Randy Cochran, vice president of channel sales in the Americas.

Acronis Inc., meanwhile, picked up two share points. "Acronis is a fast-growing segment of our business," said Mike Piltoff, senior vice president of marketing at Champion Solutions Group, a Boca Raton, Fla.-based solution provider. Champion is a major implementer of VMware virtualization software and Piltoff said Acronis' storage management tools have "a lot of synergy with VMware." [READ MORE]