Start Your Engines: Custom Systems Best-Sellers

When it comes to building custom systems, staying at the forefront of technology is crucial. The very nature of these jobs is complex: There is no such thing as a standard solution. Different customers require different solutions.

Solution providers, therefore, have come to rely on particular vendors for certain product expertise. Here, we look at the market dynamics driving VARs to particular vendors in the following categories: x86 chips, motherboards, CD/DVD drives, notebook memory, desktop/server memory, keyboards, speakers, power supplies, hard disk drives and video cards. [READ MORE]

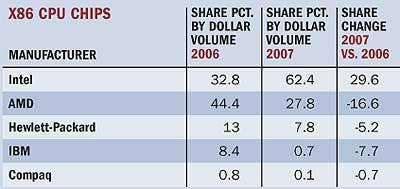

X86 CHIPS

What a difference a year makes. When 2006 was winding down, Advanced Micro Devices Inc. was riding high. It had shipped dual-core Opterons and Athlons ahead of its giant rival and was cutting into Intel Corp.'s market share in the x86 market. Those gains were reflected in The NPD Group's numbers, but the wheels were already starting to come off AMD's magic bus. Intel, like a championship team that mailed it in for a few quarters before turning it on for the win, raced ahead of AMD to quad-core and then hit 45nm first in third-quarter 2007.

Meanwhile, Intel's solid relationships with its white-box channel were paying off, even as AMD came under fire in the early part of 2007 for a dubious deal with Dell Inc. With numerous delays to quad-core Opteron server chips and newly branded Phenom desktop chips, the die was cast for AMD to lose the share it had gained. [READ MORE]

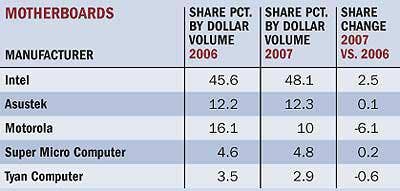

MOTHERBOARDS

Motherboard manufacturers have spent much of the past year in transition, encountering a landscape that included a product mix increasingly tilting toward quad-core systems on the server as well as the desktop side.

For Super Micro Computer Inc., that meant a shift toward its X7 motherboards, which support quad- and dual-core, 64-bit Xeon processors. At the same time, Super Micro reported lower sales of its X6 lineup of boards, which primarily support dual-core Xeon processors.

Like Super Micro, Asustek Computer Inc. maintains a broad lineup that includes desktop and server boards that support both Intel and AMD platforms. [READ MORE]

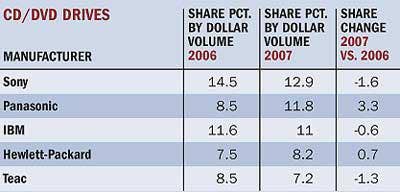

CD/DVD DRIVES

When it comes to optical drives for custom desktops and notebooks, a system builder's first criteria is reliability.

"The optical drive is one of the components going into a computer that has moving parts. Most of the systems we do we offer with a five-year warranty, so as you can imagine the chances for an optical drive to go bad are even higher than something like memory or a CPU, which don't have moving parts," said Michael Chang, president of Houston solution provider Prime Systems.

Chang first turns to market leader Sony Electronics Inc. when choosing drives. "We offer as much selection as we can. Sony traditionally has been one of the better-performing brands in the space. Sony typically is a little bit higher on price, so if we're building a system where the user is sensitive on price we may or may not choose Sony," he said. [READ MORE]

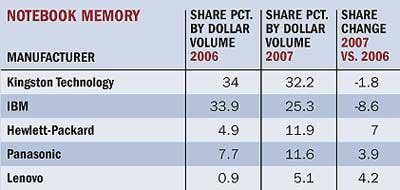

NOTEBOOK MEMORY

With the increased interest in running desktop databases, video and photo editing software, and other memory-intensive applications, system builders are increasing their systems' capabilities. Kingston Technology Co. Inc. continues to dominate the notebook memory space in market share, but Hewlett-Packard Co. showed some real gains. IBM Corp., Panasonic Corp. and Lenovo rounded out the top five.

"Memory prices are low so customers are putting in more," said Steve Maser, vice president of product management at system builder Seneca Data, Syracuse, N.Y.

But memory vendors have to pay particular attention to the chips and components being used in the card and whether they fit the configuration required by the rest of the hardware. "You can't work with a brand where you get something different each time you place an order," Maser said. [READ MORE]

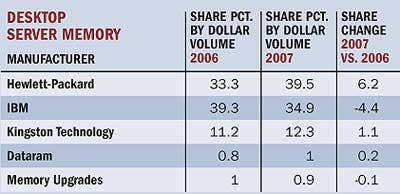

DESKTOP/SERVER MEMORY

The fast adoption of server virtualization and new chip technologies are leading to a shift in the amount and types of server and desktop memory system builders will be buying.

Compatibility issues between memory and system motherboards has not been an issue during the recent past, but, as memory speed moves from 667MHz to 800MHz to 1,000MHz to 1,333MHz, those issues are coming back, said Joe Toste, vice president of marketing at Equus Computer Systems, a Minneapolis-based custom-system builder.

"Higher speed is a big issue, leaving less tolerance for error," he said. "No question about it. It's important that we use memory qualified by the motherboard manufacturers." [READ MORE]

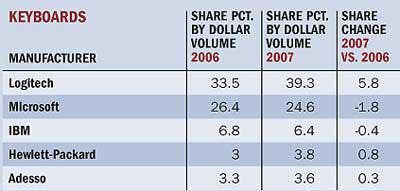

KEYBOARDS

Keyboards may not be first on the minds of custom-system builders, but they are the gateway through which customers interact with their machines. Customers have choices beyond black or white. Do they want wired or wireless keyboards? Do they have jobs where the function keys become a factor?

Those are some of the questions vendors Logitech Inc., Microsoft Corp. and Adesso Inc. face.

"We design our products for productivity, comfort and collaboration," said Huib Ponssen, product marketing director, business products group, at Logitech. "It's all about industry standard. It's also [a matter of] comfort and then it's all about the workspace. The workspace has been changing rapidly." [READ MORE]

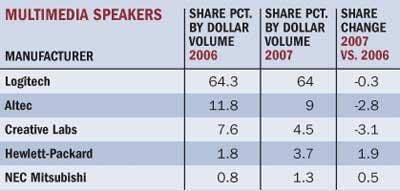

MULTIMEDIA SPEAKERS

For the second year in a row, Logitech International SA took the lion's share of the multimedia speaker market. Next was Altec Inc. followed by Creative Labs Inc., Hewlett-Packard Co. and NEC Mitsubishi.

Huib Ponssen, product marketing director, business products groups, at Logitech, said that, clearly, the business is all about the sound. "We see tremendous growth in the business environment because users need a better sound experience," he said. "More and more businesses are using laptops and sometimes their sound cards are not so great."

He also sees the market trend leaning toward business users who need speakers for collaborative work tasks, such as digital content, online training, Webcasts and podcasts. [READ MORE]

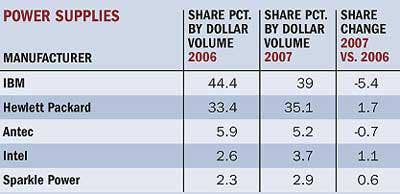

POWER SUPPLIES

You can almost hear Captain Kirk: "Scotty, I need more power!" It used to be that 300 or 500 watts were all a custom PC needed. But many custom-built PCs and workstations today are loaded with power-hungry multiprocessor motherboards and fast video and graphics cards for gaming and more. And such systems require power supply modules that provide 1,200, even 1,500 watts.

"More realistic graphics systems have really increased the power demands. We have to develop our product line to keep up with the times," said Scott Richards, senior vice president at power supply manufacturer Antec Inc.

That's to meet the needs of custom-system builders like Velocity Micro Inc., Richmond, Va., which buys "tens of thousands" of power supply modules every year, said CEO Randy Copeland.

But if demand for power is up, so is demand for power efficiency, driven by rising electricity costs and the need for desktop computers to be as "green" as possible. [READ MORE]

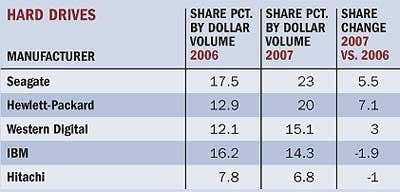

HARD DISK DRIVES

Higher capacity, lower power consumption and SAS have become the top drivers of hard disk drive sales.

"We have a new storage enclosure with 16 slots," said Todd Swank, vice president of marketing at Nor-Tech, a Burnsville, Minn., system builder. "We can now offer customers 1 Tbyte, 2 Tbytes, up to 16 Tbytes of storage. It's nice to be able to put in those kind of capacities."

Joe Toste, vice president of marketing at Equus Computer Systems, Minneapolis, said he also sees strong demand for 1-Tbyte SATA hard drives. However, he added, the demand is also building for larger-capacity SAS drives as well. [READ MORE]

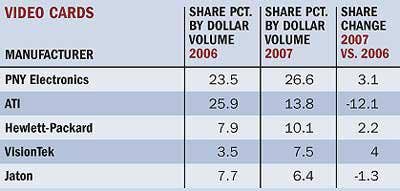

VIDEO CARDS

PNY Electronics, Parsippany, N.J., experienced the largest overall dollar volume share in the category, racking up the second-highest growth during the period. Nick Mauro, senior marketing manager at PNY, attributes that to the vendor's close relationship with Nvidia. The vendor doesn't market its own products, but instead enlists the aid of partners such as PNY.

"We launch new technology at the same time as Nvidia announces it. And we overclock and add our own tweaks to cards to keep them fresh and provide benefits to consumers who may not know how to overclock," Mauro said.

PNY works "very aggressively" with distributors, both internally as well as through Nvidia, and puts together monthly specials and promotions. "It's really just being on top of our core product line and being aware of seasonality and what distributors need," he said. [READ MORE]