The 10 Biggest HP Stories Of 2008

1. HP retains its place at the top.

In 2006, it became official: Hewlett-Packard had passed IBM to become the largest technology company in the world in terms of global revenues. The next year it got better for HP -- the computing giant officially held on to its top spot, fending off a challenge from Samsung. As 2008 comes to a close, HP looks every bit as dominant. Under CEO Mark Hurd's leadership, the company is competitive in all of the main markets and product categories it is involved in -- HP is the No. 1 vendor of servers and personal computers globally, enjoys the biggest presence in the Top 500 Supercomputer List and even ranks as the fifth-largest software company in the world.

2. HP counters rivals' acquisitions with its own strategic buys.

Dell looked to throw HP for a loop with its January acquisition of storage vendor EqualLogic. HP took several months to counter its rival, but in early October the computing giant revealed its hand -- the acquisition of an iSCSI brand of its very own, LeftHand Networks, in a move seen as a direct response to Dell's EqualLogic play. The acquisition of systems integrator Electronic Data Systems was another strategic move, with HP aiming to bolster its enterprise clout against IBM's global services.

3. HP's superior channel efforts pay off.

Thanks to the personal touch of CEO Mark Hurd and channel chief Adrian Jones, pictured, HP's partner relationships are the best in the biz. Hurd and Jones both made ChannelWeb's list of the Top 25 Executives of 2008 in addition to earning numerous other awards and accolades from CRN and VARBusiness throughout the year. What's HP's secret? Aside from great products and increased investment in partner programs, in 2008 execs like Hurd and Jones actually rolled up their sleeves and worked face to face with partners. In an age of aristocratic CEOs, the idea that the boss of the world's largest technology company would hit the road to connect with partners large and small is simply astounding -- and a huge reason for HP's continued success.

4. The channel king mystifies VARs with its CDW deal.

HP struck a deal in August with computer reseller CDW to co-fund 110 new HP-only CDW salespeople selling HP products into accounts with 499 or fewer employees. That fresh effort to synergize the two companies' SMB sales efforts was good news for CDW, HP's largest North American reseller partner. But for HP's smaller reseller partners, the deal raises major questions. One such partner who asked not to be named said at the time, "We have begged [HP] for leads and help and nothing has come of it. It kind of destroys our efforts of alliance." Another opined that the HP-CDW alliance could provide longtime channel pariah Dell with an opening to quickly build upon its nascent partner-building efforts. The jury's still out on this one, but the partner backlash ought to be giving HP pause.

5. HP's belt-tightening includes laying off 24,600 employees.

It all depends on your perspective. If you're an HP investor, you've got to love Mark Hurd's early December announcement that HP's three-year-old cost-cutting plan is on track to save the company $1 billion annually. HP has pulled that off in part by consolidating its legacy data centers, reducing its networking sprawl and slashing IT spending from some 4 percent of revenue in 2005 to less than 2 percent projected for 2009. If you're an HP employee -- particularly somebody coming on board from recently-acquired EDS -- you've got to be extremely nervous about the second part of the cost-cutting story. HP in September said that it will be laying off 24,600 employees from the companies' combined workforces, or about 7.5 percent of the total headcount worldwide. And if you're a solution provider, you were probably already nervous about the IT services gorilla let loose by the HP-EDS hook-up -- now you've got to worry about nearly 25,000 potential independent competitors entering the IT channel.

6. HP's boffo fourth quarter defies dismal tech sector performance.

Even as tech giants like Intel were slashing their fourth-quarter revenue expectations in the face of the economic crisis, HP ran counter to the prevailing gloom and offered an early teaser for surprisingly strong Q4 numbers. A week later, HP made it official -- the company actually grew its year-on-year revenue by 19 percent for the quarter, and also increased total yearly sales by 13 percent over fiscal year 2007. "These results demonstrate an ability to execute in a difficult environment. We believe we held or gained share in every segment," said HP CEO Mark Hurd, pictured, whose leadership is tipped by ChannelWeb as one of five main reasons HP continues to outperform the market.

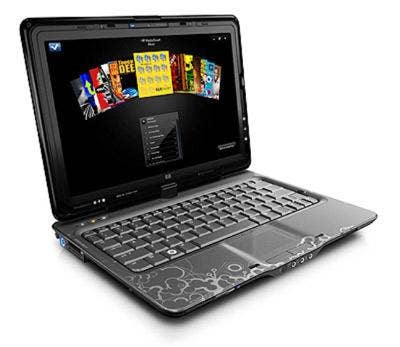

7. HP jumps on the netbook bandwagon with the Mini-Note.

On the heels of Asus' stunning success with its Eee PC, in April HP joined rivals like Dell and Acer in introducing its own netbook, the HP 2133 Mini-Note PC. HP tapped another company, VIA, for low-voltage C7-M central processors but in October unveiled a next-generation Mini-Note based on Intel's 1.6GHz Atom chip. HP's early returns on netbooks weren't stellar -- Acer and Asus are the market leaders -- and some analysts' bullish netbook outlook is tempered by reports in North American markets that retailers are experiencing high rates of returned product. With makers of smartphones, MIDs and UMPCs offering nearly netbook-class computing power in even smaller packages, you almost have to wonder how long the form factor is for this world. HP, for its part, is now marketing its latest Mini-Note as less of a computer and more of an accessory -- literally. The flowery new "Digital Clutch," pictured, by renowned designer Vivienne Tam, isn't a computing tool, it's a fashion statement targeted not at geeks but at accessorizing divas.

8. HP provides touch-screen magic to the masses.

Apple gets all the touch-screen ink for its deservingly buzz-worthy iPhones, but HP's efforts are just as notable for bringing mainstream, tactile computing to larger desktop and notebook form factors. The TouchSmart tx2 launched in November is particularly exciting -- a swivel-hipped AMD Turion-powered touch-screen notebook that weighs less than 4.5 pounds, also functions as a Tablet PC and costs a very affordable $1,149. Along with the TouchSmart desktop PCs, HP's high-end Voodoo brand and continued improvements to the bread-and-butter Pavilion line, the company is simply running on all cylinders from a client systems standpoint. And just wait until you see what HP is about to unleash at CES.

9. HP sells fewer printers but more supplies -- and likes it.

Back when HP was anxiously reshaping itself to compete in the PC market, the company could always count on its peripherals. Now that the computing giant has come to dominate the overall systems space across the major client and server categories and in both consumer and commercial markets, one thing hasn't changed -- HP's massive installed printer base. With such a large and loyal customer base -- the overall installed base supplies HP with more than half its overall profits -- the company was actually able to nearly offset lower fourth-quarter printer sales this year against the fourth quarter of 2007 with more sales of supplies and services. Factors include the three extra ink cartridges needed in newer color printers vs. older black-and-white units, and the extra servicing required for laser printers. According to CEO Mark Hurd, despite the overall drop in printer sales, HP is increasing its market share, which is making it easier to make an extra buck or three in recurring revenue for maintenance.

10. HP bears the brunt of Microsoft's "Vista Capable" shenanigans.

It all went down nearly three years ago, but Microsoft's Windows Vista marketing mess is the gift that keeps on giving and an industry-wide debacle that touches every major player in the IT arena, even Hewlett-Packard. Check that -- especially HP. Microsoft internal e-mails released as part of the ongoing class-action lawsuit over the 2006 "Vista Capable" marketing campaign reveal that if the software giant stuck it to any of its peers, it was HP.

That's because HP, in the run-up to Microsoft's pre-launch sticker campaign for Vista, apparently spent millions of dollars to ready its PCs with the Windows Device Driver Model (WDDM) hardware support needed to run the forthcoming operating system. So when Microsoft in January 2006 quixotically opted to remove its requirement for such WDDM compatibility in PCs getting a Vista Capable logo, HP was livid.

Here's what HP Senior Vice President Richard Walker had to say in an e-mail to his Microsoft counterparts. HP had spent considerable time and money setting up new systems that were WDDM compatible, and Walker's frustration was evident. "I hope this incident isn't a foretaste of the relationship I will have with Microsoft going forward, but I can tell you that it's left a very bad taste with me and my team. The decision you have made has taken away an investment we made consciously for competitive advantage knowing that some players would choose not to make the same level of investment as we did in supporting your program requirements."