The 10 Biggest IBM Stories Of 2008

The IBM of 2008 looks very different from the IBM of previous years. One of the biggest shakeups of the year came in the company's hardware business with the retirement of 39-year IBM veteran William Zeitler. IBM chose Robert Moffat Jr. (pictured) as the new head of the Systems & Technology Group. The 30-year IBM veteran wasted no time in sharpening IBM's partner focus with a sweeping overhaul aimed at simplifying partner compensation and account engagement. Not only that, Moffat took the $100 million in savings from restructuring the group and promised to put it to work in new global go-to-market initiatives in 2009.

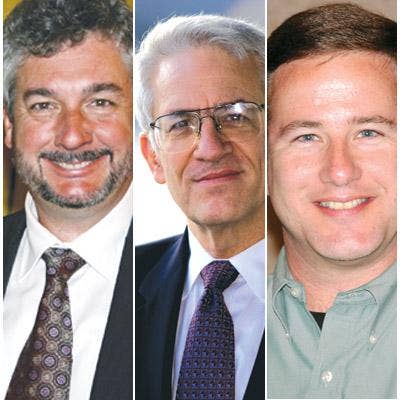

IBM's channel management ranks underwent some serious changes in 2008. In February, the company named Michael Gerentine its new vice president of global channel and solutions marketing, filling the vacancy created when Debra Thompson was named head of IBM's new Enterprise Software unit. In April, Richard Hume was named general manager of IBM global business partners, replacing Ravindra "Ravi" Marwaha (pictured), who announced his retirement at the IBM Business Partner Leadership Conference. Hume, a longtime IBM executive, was previously general manager of IBM's x86-based System x server division.

While the changes in channel management at IBM may have had a more direct impact on solution providers, the biggest ruckus came when Apple announced it had hired 25-year IBM veteran Mark Papermaster to oversee development of Apple's iPod and iPhone products. Papermaster replaced Tony Fadell, who departed Apple under contentious conditions with a nearly $9 million payout. But it only got uglier when IBM filed a lawsuit claiming Papermaster's move violated a non-compete contract. A judge ruled in IBM's favor, Papermaster countersued and the whole legal mess, which raises questions about how far non-compete contracts can reach, will go to trial in 2009.

In October, IBM dropped Synnex as a distributor for the vendor's System x line of servers in a move that shocked Synnex and disappointed the solution providers it supplied. The cutoff takes effect Jan. 16, 2009. IBM was mum on the reason behind its decision. "They really didn't have a lot of answers," Synnex co-CEO Kevin Murai said after a conversation with IBM executives. "What they said was they are losing share in the market, losing relevance in the channel and as a result, they felt the need to take capacity out of the channel." IBM later explained that the move was part of an effort to streamline its channel operations and sell through distributors with a global presence.

IBM drafted a set of "Principles of Engagement" spelling out when the company's sales representatives should and should not engage channel partners when closing a deal. The document also included a decision tree for determining when a sales opportunity should go direct and when it should go through a partner. IBM described the principles as an effort to develop a consistent approach across the company's product lines, brands and sales geographies. Topping the rules list: If a VAR is already in an account, IBM will not try to muscle in, said Lance Linden, director of competitive programs in IBM's Business Partner Organization. IBM also published a list of 100 named accounts where it would remain the primary fulfillment vehicle.

IBM licensed its x86 server technology to Lenovo, the same company IBM sold its PC business to in 2004, under a deal allowing the vendor to manufacture and sell Lenovo-branded servers. The agreement included one- and two-processor pedestal and rack-mount servers. IBM described the move as a bid to expand sales of its System x servers to a broader range of small and midsize businesses and vigorously denied that it was planning to exit the server business.

Still, IBM's software and services businesses accounted for most of its growth and profits this year -- hardware sales from the Systems and Technology unit dropped 10 percent in the third quarter, with System x server sales plunging 18 percent.

In 2008, IBM reminded everyone that at its heart it remains a technology company. In June, IBM's Roadrunner supercomputer set a world record of 1 petaflop or 1,000 trillion calculations per second -- equivalent to the combined computing power of 100,000 of today's fastest laptop computers. Roadrunner uses 6,948 dual-core AMD Opteron chips installed on IBM Model LS21 blade servers. IBM assembled the system for the Department of Energy's National Nuclear Security Administration at the Los Alamos National Laboratory in New Mexico.

IBM also snared the top three spots on the annual Top 500 Supercomputer ranking issued at the International Supercomputing Conference in Dresden, Germany. And in November, IBM announced that it was partnering with researchers at five universities to develop a computer that works like the human brain. A smart one, presumably.

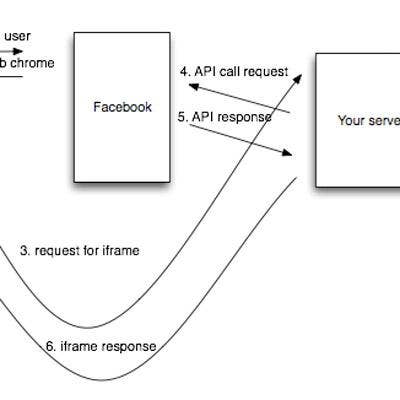

In another example of IBM thinking deep thoughts about IT, the company announced in September that it was creating a think tank called the Center for Social Software in its Cambridge, Mass., laboratory for developing social networking applications. IBM researchers from all over the world, along with partners and customers, will pull multiple cultural perspectives into the project and develop social networking applications geared to specific industries. The initiative also includes developing and testing Web 2.0 tools under the name 2moreO@Wrk.

IBM long ago shed its "not invented here" aversion to technologies developed outside of the company and it has been acquiring hardware, software and communications companies at a torrid rate since early this decade. That pace didn't slacken in 2008. IBM bought more than a dozen companies during the year, including business intelligence software vendor Cognos ($4.9 billion), software development tools supplier Telelogic ($845 million), virtualization software developer Transitive (price not disclosed) and business server software vendor Net Integration Technologies (price not disclosed). Rumors that IBM might buy AMD or Citrix, however, never proved accurate.

IBM's Lotus Notes/Domino may have fallen way behind Microsoft's Exchange/Outlook communications and collaboration platform in the market share race. But in 2008, IBM made some moves to broaden Notes' appeal and make it available to a wider audience. In September, IBM began offering a version of the software, dubbed IBM Lotus iNotes ultralite, for Apple's popular iPhone. IBM also teamed up with Nokia to offer Notes on Nokia S60-based mobile devices and smartphones. And in October, IBM began offering Notes/Domino as a hosted messaging service.