Dell's Long Road To Channel Distribution

In December of 2007, the possibility of Dell inking deals with big, two-tier distributors seemed like a pie-in-the-sky idea. Ingram Micro CEO, Greg Spierkel, said at the time that he'd be surprised if Dell did anything with distribution in North America.

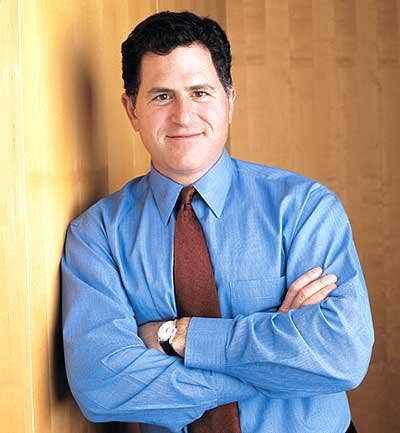

Greg Davis (pictured left), then Dell's North American channel chief and current global channel chief, said he wouldn't be doing his job if he wasn't talking about the possibility of taking the company through distributors, but indicated the channel shouldn't hold its breath.

"It's just a matter of prioritizing. I've got my hands full doing what we're doing now. But we're very open to talking about it in the future," Davis said.

That future Davis referred to is here -- and it only took the Round Rock, Texas-based computer manufacturer 15 months after launching its partner program to get there. But most solution providers would say the move to distribution was 25 years in the making.

In 1984, University of Texas biology major Michael Dell left school early and went on to found one of the biggest computer manufacturers in the world. Dell built his company on a direct sales model that delivered computers to customers at a price too competitive to be ignored. But over the next 25 years, Dell would come to be despised by some channel partners who saw the manufacturer interfering with their sales, oftentimes undercutting them in order to bring revenue to the company.

In August 2003, CRN reported that Dell had something of an image problem. The computer manufacturer was trying to pitch partners, telling them that it was embracing the channel sales model. But channel partners weren't buying, saying they couldn't trust Dell.

Through much of its history, Dell claimed to be a direct-sales company that oftentimes wouldn't give the channel the time of day. The problem, according to a CRN source, was that Dell wanted to start selling through the channel but feared it would jeopardize its direct-sales Wall Street message.

Nevertheless, Michael Dell earned induction into the CRN Industry Hall of Fame that same year for the supply chain advances his company brought to bear in the IT market. Even though his company was often described in a less than positive light when it comes to the channel, Dell argued that his company was "a channel company too."

Pictured: The CRN Industry Hall of Fame Class of 2003 with entertainer Bill Cosby (back row, left). Dell is in the back row, second from the left.

In December of 2007, Dell officially jumped into the channel. The move came after 23 years of operating as a direct-sales company and raised more than a few eyebrows.

But the launch of an online portal dedicated to partners shortly thereafter didn't smooth over all the hard feelings that the channel felt toward Dell. After all, it's hard to forget the channel conflict that marred the relationship that Dell had with solution providers. Partners were rightfully skeptical, wondering about being undercut by a direct sales force and openly questioning Dell's commitment. The computer manufacturer responded by unveiling a deal registration program to help protect partners.

A month after the launch of its channel program, Dell made an overture to partners to show it was listening to them. In January of 2008, the computer manufacturer slashed the minimum amount required to register a sale from $75,000 to $50,000.

In July of 2007, Dell made its managed service play with the acquisition of MSP platform vendor Silverback Technologies. Silverback became attractive to Dell after becoming a major player in the channel by aggressively pricing its remote IT management and monitoring technology for partners. Reaction from Silverback partners was mixed. At the time, some partners believed Dell would infuse its vendor with cash and take it to the next level. Others simply said: Nothing good will come from this.

Six months later, Dell closed a $1.4 billion purchase of the Nashua, N.H.-based EqualLogic. Depending on whom you listened to, the deal was to either solidify Dell's storage and virtualization offerings or to get its hands on a company with an established channel program that knew how to work with partners. It was clear, however, that the channel-only sales model used by EqualLogic had Dell executives licking their chops, hoping to create a channel program they could nurture and grow over 2008.

In March 2009, Dell's channel program came together with Ingram Micro and Tech Data to begin offering a limited product supply through distribution in the U.S. and Canada. While the deal isn't expansive or far-reaching, it's a start. The distribution kickoff currently only includes preconfigured Vostro desktops and notebooks, but the computer manufacturer says it has plans to "rapidly expand" product offerings in the coming months.

Also excluded from Dell's distribution deal, at least currently, are higher end-service products like servers and storage. Instead, channel partners will have access to the preconfigured Vostro desktops and notebooks, which will be available within a 24- to 48-hour turnaround time.