Report: Biggest Sellers, Biggest Share Gainers In 2009

The following slides represent the top-selling vendors through distribution in each of 19 product categories from January 2009 to December 2009, as reported by NPD Group. HP and Cisco led eight of the 19 categories, while other categories had a more level playing field.

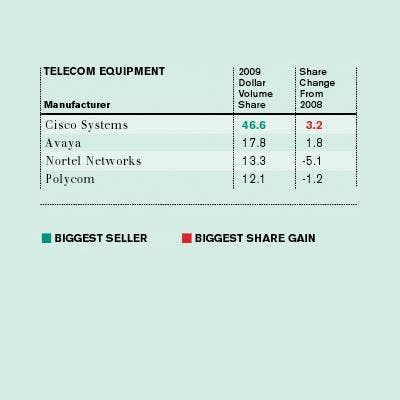

Cisco Systems increased its massive market-share lead in the telecom equipment category in 2009, which includes telecommunications-related hardware such as PBXes, telephone systems or telephony equipment. Cisco not only had the biggest share, but also gained the most share, particularly at the expense of Nortel Networks, part of which has since been acquired by Avaya.

Cisco had one of the biggest market-share advantages in this category, with almost two-thirds of the dollar volume share from last year, according to NPD. Some of Cisco's share shifted to its Linksys group, but D-Link and Adtran also benefited.

Seagate retains its title as biggest hard drive vendor, in terms of sales through distribution, but Hewlett-Packard and Western Digital are gaining ground.

IBM clung on to the top spot in this category, despite dropping 7.2 points in market share from last year. Sun Microsystems' share increased significantly from "0.0" last year because NPD didn't have full data to separate that vendor in 2008. Sun aside, Quantum gained solid share at IBM and Hewlett-Packard's expense.

Hewlett-Packard retained its significant share advantage in a category where there wasn't a lot of movement. Brother swapped places with Xerox from last year and Lexmark gained some modest share.

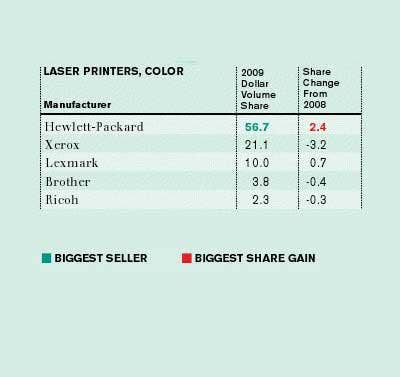

HP also retained the top spot in color laser printers, but this time it widened its market-share lead over Xerox, Lexmark, Brother and Ricoh.

Hewlett-Packard surpassed Samsung as the top market-share vendor in this category, according to NPD. In general, it appears that VARs might increasingly bundle a vendor's monitor with a system, as the two desktop vendors on the list, HP and Acer, took share from the display specialists, Samsung, NEC and ViewSonic.

Samsung gained massive share in this space, much of it at the expense of NEC Display Solutions and Sharp. Much of that increase is due to Samsung's strength in 50-inch and 52-inch TVs, according to NPD.

Fujitsu continued its domination in the scanner category, gaining share over four of its five closest competitors. Only Epson also gained some share compared to 2008 among the top vendors.

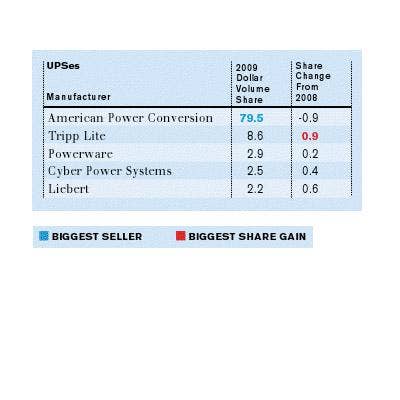

American Power Conversion kept its title for having the most dominant dollar volume share in any category, with almost 80 percent market share. It lost some modest share, particularly to second-place Tripp Lite.

Western Digital still tops the list for the largest dollar volume share, but Seagate made significant strides during 2009. Maxtor, now owned by Seagate, lost share.

The long-running battle between IBM and Hewlett-Packard is perhaps more fierce in this category than any other. IBM retained the most share, but HP is closing fast. Sun Microsystems remained a distant third.

Hewlett-Packard retained the most share in the desktop category and still gained a slight share increase. Dell, which opened distribution lines with Ingram Micro and Tech Data last spring, made its debut in NPD's annual survey with 0.9 percent share, which seems to come at the expense of Lenovo more than any other vendor. Apple also made a modest share gain.

The notebook category is much more fierce than the desktop category. Hewlett-Packard lost some share but kept the best-selling vendor title. Apple made the most impressive gain compared to 2008.

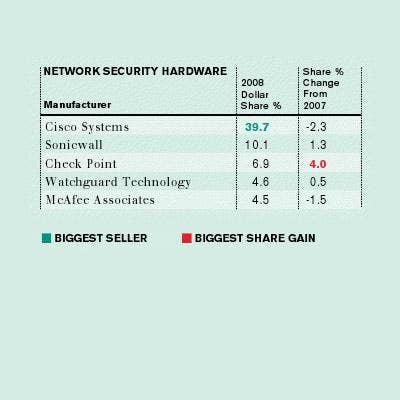

Check Point more than doubled its dollar volume share in this category, compared to last year, while SonicWall and Watchguard also gained some share on market leader Cisco.

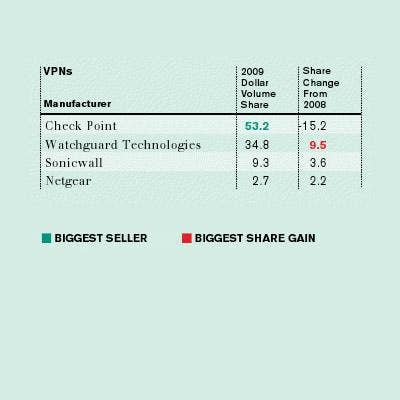

Where Check Point made great strides in the network security hardware category, it lost significant market share in the VPN category, where Watchguard, SonicWall and Netgear all posted increases last year compared to 2008.

Symantec fell below the 50 percent market-share threshold in security suites, where Trend Micro, McAfee and Kaspersky Lab all increased their share, the latter two making significant gains compared to the prior year.

Microsoft is still the dominant player in the relational database space, according to sales through distribution in 2009. But the software giant lost some modest share, as did Oracle and Filemaker, to IBM.

Symantec/Veritas lost some of its luster in 2009, dropping 7.6 market-share points, in the data protection/data management software category. IBM and VMware made the biggest strides, with CA and Acronis picking up share gains too.