10 Things Microsoft Could/Should Talk About At WPC 2011

The WPC 2011 Agenda

Some 15,000 members of the Microsoft partner ecosystem will journey to Los Angeles next week for Microsoft's Worldwide Partner Conference.

Channel partners will be looking for insight into the goings on at Microsoft, from updates on new products such as Microsoft Windows 8 and Windows Phone 7, to the latest on the company's cloud strategy, to advice on working within the recently revamped Microsoft Partner Network.

The official agenda includes keynotes from CEO Steve Ballmer, COO Kevin Turner, channel chief Jon Roskill, and ultimate entrepreneur/Virgin Group president Sir Richard Branson.

Partner Network Update

Late last year Microsoft began a major overhaul of its partner program, eliminating the broad Gold and Certified partner designations in favor of Gold or Silver status within 29 distinct technology "competencies." The change means more stringent testing for partners and the need to have more Microsoft Certified Professionals on their payrolls.

All this means Microsoft partners must carefully plan how they want to commit their Microsoft-related resources.

Partners attending WPC will be looking for an update from Jon Roskill, corporate vice president, Worldwide Partner Group, on the Microsoft Partner Network changes. How many solution providers are certified today and how many have dropped out of the program? And are there additional changes in the works?

The Price Of Expertise

In April Microsoft disclosed plans to increase the cost of certification exams for partners to $150 from $125 beginning this month. That might not seem like much, but for partners that need to certify multiple sales and technical employees, it adds up.

"It's the wrong move at the wrong time," said one partner that has 16 employees who must be certified, noting that the economy remains sluggish and partners are adjusting to other changes in the Microsoft partner program.

Expect some partners to raise the issue at WPC.

Cloudy Outlook For Azure?

Microsoft launched Windows Azure on Feb. 1 last year, but after nearly 18 months Microsoft has said little about how many solution providers and ISV partners are working with the cloud computing platform.

Last month Microsoft dropped all charges for data ingress in an apparent bid to increase Azure adoption.

It's clear that Microsoft is serious about cloud computing and so far other key cloud computing products like the Office 365 on-demand application set that just went live last week looks like they will be popular. But Azure is a critical component of Microsoft's long-range cloud computing strategy and the Microsoft ecosystem needs to know how Azure is faring vs. Salesforce.com's Force.com, Amazon's Elastic Beanstalk and other alternatives.

BPOS Outages

Microsoft's Business Productivity Online Suite (BPOS) has suffered several service outages going back to early 2010, including a number of system failures last year, a series of outages in May and the most recent on June 22. That last outage also took out the Online Service Health Dashboard that's designed to provide customers and partners with information about the status of Microsoft's online services.

Microsoft is transitioning BPOS customers over to Office 365. But if partners and customers are going to commit to using the on-demand application services, they must know they can count on the applications being there when they need them.

Microsoft executives need to better explain the causes for the continuing BPOS outages and what they are doing to prevent them.

Office 365 Transition

Microsoft's long-awaited Office 365 cloud application set went live June 28 and the company is transitioning customers from BPOS and Office Live Small Business during the next 12 months.

But judging by some postings on Microsoft's TechCenter site, there's some confusion about just how BPOS customers can make the move.

"It's too bad that Microsoft can't help out their partners that sell the product," wrote jmull86. "I would love to transition BPOS over so I can give prospective clients a demo of a production Office365 environment. As of now, it looks like my only options are to sign up for a trial each time I want to do a demo or set up a separate company in Office 365 and pay for demo licenses."

Partners that currently resell BPOS services will be looking for more help to smooth their customers' upgrades to Office 365.

What The Skype Acquisition Means For The Channel

Microsoft is in the process of acquiring VoIP software developer Skype for $8.5 billion, its largest acquisition ever. At the time, CEO Steve Ballmer said the move will "define the future and what it's really going to look like" for rich media and communications.

While indicating that it plans to integrate Skype with Outlook, Lync, Exchange and other products, Microsoft hasn't offered many details about its Skype plans -- especially as it relates to business applications and the channel and how partners can make money with Skype.

Other questions include how vigorously Microsoft will support Skype on non-Microsoft platforms and what will happen to Skype's channel program. OK, we know the acquisition hasn't even wrapped up yet. But any additional information at WPC about Microsoft's Skype plans would be welcome.

Unified Communications Competency

In May Microsoft disclosed plans to split in two its existing unified communications competency, creating a new competency focused on Exchange (called "Messaging") and one focused on Lync and the company's UC suite (called "Communications").

The changes are scheduled to take effect in October and Microsoft has promised more details for channel partners who work with the Exchange and Lync products. WPC would be a good venue to provide those.

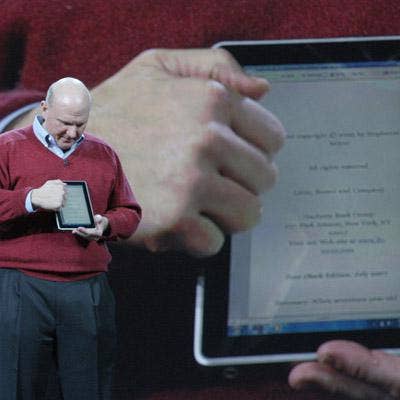

The Elusive Windows Tablet(s)

So what do we know for sure? Microsoft is developing a version of its in-progress Windows 8 desktop operating system to run on tablet devices. And the software will support System-on-a-Chip architectures built by Intel, AMD, Texas Instruments, Nvidia and Qualcomm.

But despite months of hints, promises and boasts, Microsoft's tablet plans remain elusive. There have been unconfirmed reports that Microsoft is mulling a Microsoft-branded tablet and/or that it plans to ask chip makers to each work exclusively with one device maker.

Partners, meanwhile, question whether Microsoft is too late to market and have mixed opinions about how much demand there will be for Windows-based tablets.

More details about just what Microsoft is thinking when it comes to tablets computers would be helpful.

Windows 8

Microsoft is planning to offer more details about Windows 8 at its Build conference for developers scheduled for Sept. 13-16 in Anaheim, Calif.

But partners at WPC will be looking for any new information about the next generation of the desktop operating system. While it might seem early to be discussing the next release of Windows, Windows 7 has been out for two years and Windows 8 won't debut until 2012. And Microsoft is trying to speed up its new-product release schedule.

Microsoft has demonstrated some aspects of Windows 8 and partners have generally liked what they've seen so far.

More Mango

Microsoft has offered some information about Mango, the next release of Windows Phone that's due this fall. But given the high interest around Windows Phone, partners are always hungry for more details.

An update on Nokia's progress in developing a Windows Phone smartphone, and a surrounding partner ecosystem for the product would also be welcome. The Nokia Windows device, due in 2012, is arguably Microsoft's best chance for Windows Phone to succeed in the marketplace.