The Best-Selling Vendors Of 2011

HP, Cisco Lead The Way

Hewlett-Packard and Cisco Systems were among the big winners in terms of dollars sold through distributors last year, according to the NPD Group's research.

Here's a look at the best-selling vendors in 2011 in several categories, ranked by their dollar volume market share as compiled by the NPD Group's Distributor Track sales database (which aggregates sales data from members of the Global Technology Distribution Council). The following pages also highlight the vendors' share change compared to 2010.

Monochrome Laser Printers, Single Function

HP held on to its share in single-function monochrome printers in 2011, and what a share it is. HP earned more than three-quarters of all dollars spent in the category through distribution last year, according to the NPD Group.

Monochrome Laser Printers, Multifunction

HP's dominance in monochrome multifunction laser printers was not as pronounced as single-function but was still enough to be a solid No. 1. Canon gained share last year to tie Brother for the third spot.

Color Laser Printers, Single Function

HP gained share from its two closest competitors in single-function color laser printers and generated more than 69 percent of the total dollars spent in the category through distributors last year, according to the NPD Group.

Color Laser Printers, Multifunction

HP also gained share in multifunction color laser printers to give it a clean sweep of the printer categories. Brother also gained share to pass Xerox for third place.

Desktops

Lenovo gained some ground on HP but still had less than half of HP's dollar volume share generated through distribution last year, according to the NPD Group.

Notebooks

Despite uncertainty around a possible sale of its Personal Systems Group, HP gained significant share in the notebook category last year. Apple was the only other company among the top eight to see a share increase compared to 2010.

Network Security Hardware

Cisco and Check Point Software Technologies saw minor share increases in the Network Security Hardware category. Blue Coat Systems, third in 2010 sales, fell to fourth last year.

Wired Routers

Cisco and its Linksys unit dominated this category and gained even more share in 2011 at the expense of competitors including Adtran and Packeteer.

Wireless Routers

Cisco/Linksys also captured the wireless router category, but the networking giant lost some ground to Netgear, which vaulted from fourth place in 2010 to second place in dollar volume share last year, according to the NPD Group.

Access Points

Cisco held a dominant position in this category but lost some ground to a competitor. In this case, Aruba Networks moved up from fourth place to second with a big share shift through distributors.

Switches

Cisco basically held its share in the switches category, while HP put some distance between itself and third-place finisher F5 Networks.

Hard Drives

Western Digital retained its lead in the hard drive category, but Seagate pushed closer to its top rival. Seagate had been No. 1 in this category for several years until 2010. Shaking up the landscape in the future, however: Western Digital early last month finally completed its acquisition of Hitachi Global Storage Technologies.

Tape Drives

Quantum became the best-selling tape drive vendor in the channel, according to the NPD Group, thanks to a big share gain in 2011. Last year's top company, Oracle, fell to third.

SAN

HP lost share in the SAN category last year and Cisco gained ground, thanks to its MDS 9000 family of products.

Displays, 19 To 40 Inches

Sony gained the No. 1 spot in the 19- to 40-inch display category, taking the top spot away from Samsung, which held the No. 1 position in 2010. LG also gained share, as did Panasonic, which finished fourth.

Displays, 40 Inches Or Greater

Sony also took the 40-inch-and-greater display category away from Samsung, which was the best-selling vendor in 2010 too. Similar to the smaller-display category, LG was a solid third.

Document Scanners

Fujitsu has owned this category for several years and saw its dollar volume share increase in 2011 at the expense of its two nearest competitors, Canon and HP.

UPS

The top two companies in the UPS category, American Power Conversion (APC) and Tripp Lite, lost some minor share to three up-and-comers: Eaton, Cyber Power Systems and Liebert.

External Disk Drives

Western Digital's My Passport and My Book drives have long been staples with solution providers and continued to drive the company's success in 2011 sales through distributors. The company lost some share, however, to Seagate, which was less impacted by Thailand flooding last year than competitors.

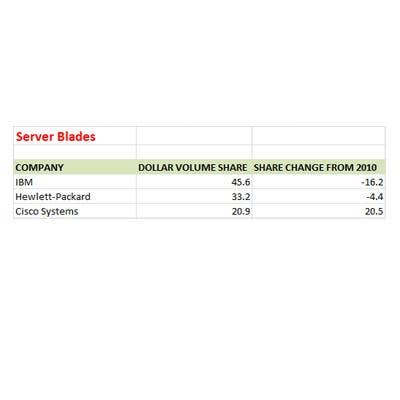

Blade Servers

As Cisco made inroads into the channel with its blade servers, it did so more at the expense of IBM than HP in 2011. Still, IBM held a comfortable lead in terms of dollar volume share through distributors, according to the NPD Group.

Rackmount Servers

HP and Cisco took share in the rackmount server category away from IBM and Oracle, which finished fourth.

Security Suites

While McAfee and Trend Micro gained some ground in security suites, the big mover was Kaspersky Lab, which finished fourth with a 12.2 percent share, up 3.2 points compared to 2010. Symantec claimed the No. 1 spot.

Relational Databases

The Big Three remained the The Big Three in relational databases, with IBM and Oracle gaining minor share at Microsoft's expense in 2011, according to the NPD Group.

Storage Management Software

The storage management software category saw some significant share shifts in 2011 as IBM and VMware saw gains, while Veritas and CA Technologies saw their dollar volume share fall.

Virtualization

It's no surprise that VMware dominated this category more than any other vendor dominated any category in 2011. Parallels saw its dollar volume share nearly double compared to 2010, but it's got a long way to go to catch VMware.

Business Software

IBM grabbed some dollar volume share away from Microsoft in the business software category, which is defined as office-oriented applications, Internet browsers, fonts, and small- and home-office applications.

Last Year's Big Winners

The Heavy Hitters Of 2010:

The Best-Selling Products Of 2010

The Best-Selling Vendors Of 2010