The 10 Biggest Microsoft Stories Of 2012

What A Year

Windows 8, Windows Phone 8 and Surface: Those three product introductions summed up Microsoft's triumphs and challenges in 2012. Windows is Microsoft's flagship product and cash cow, and the new release seeks to maintain the company's desktop dominance while supporting efforts to move into mobile computing. Windows Phone 8 and Surface represent the company's efforts to become a player in smartphones and tablet computers -- two areas where the company badly lags competitors.

Those weren't the only Microsoft news stories in 2012, of course. Executives came and went, some voluntarily, some not so much. New products were launched, and the company accelerated its efforts to migrate channel partners to the cloud. Here's what we think were the top Microsoft news stories for the year.

10. Microsoft Upgrades Products Across The Board

Windows 8 and the Surface tablet computer were clearly Microsoft's big product announcements in 2012. But with the company upgrading nearly every one of its major products in a period of little more than a year, there was a lot happening on Microsoft's technology front.

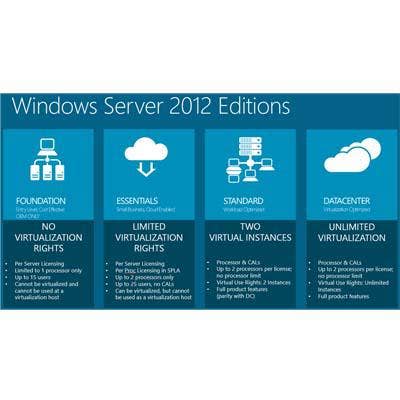

Partners eagerly awaited the April 1 availability of SQL Server 2012, the long-awaited upgrade of Microsoft's database software. Partners had to wait a little longer for the September shipments of Windows Server 2012, with its added cloud and virtualization capabilities, and Visual Studio 2012. Exchange Server 2013, Lync 2013 and SharePoint 2013 have been released to manufacturing and are expected to be generally available early in the new year. Microsoft also just upgraded its Dynamics AX, GP and CRM applications. But Partners were really gearing up for Office 2013, the next release of the company's personal productivity application suite that's designed to work with Windows 8 and due in the first quarter of the new year.

9. Ups And Downs In Server And Tools

Windows and desktop applications have long been Microsoft's main revenue producers. But fiscal 2012 (ending June 30) growth in the company's Server and Tools division demonstrated how much of the company's revenue today is coming from such data center-centric products as Windows Server, SQL Server and System Center.

Server and Tools sales reached $18.7 billion in fiscal 2012, up 12 percent from the previous year -- the first time the division's revenue exceeded the Windows and Windows Live Division, which reported a 3 percent drop in sales to $18.4 billion

But the division suffered a blow early on when 15-year Microsoft veteran Robert Wahbe, the corporate vice president who managed Server and Tools, left the company in January. Today Wahbe, according to his LinkedIn page, is CEO of Seattle-based startup Highspot Inc.

8. Taking Kinect Beyond Entertainment

Microsoft's Kinect has been a hit on the video game and entertainment front. But in 2012 it became clear the voice, movement and gesture recognition technology has huge potential in a wide range of applications in such industries as healthcare, manufacturing and retail.

In February Microsoft released Kinect for Windows 1.0 SDK (software development kit), a toolset that programmers use to create Kinect-based products. CEO Steve Ballmer unveiled the software in a keynote speech at the Consumer Electronics Show in January: More than 200 customers were already working with the technology then, including American Express, Telefonica, Toyota and United Health Group.

In October the company shipped a new release of Kinect for Windows that allows programmers to use it to build applications for Windows 8. It also gave Kinect expanded access to sensor data, including infrared sensors and accelerometers.

7. Migrating Channel Partners To The Cloud

Microsoft has been aggressively developing cloud-computing products for several years now, from Dynamics CRM Online to Windows Intune to Office 365. But 2012 was the year the company really made a push to get its channel partners on board the cloud bandwagon. At the Worldwide Partner Conference in July Microsoft announced an additional $200 million for cloud incentives for partners in fiscal 2013 -- a 40 percent increase -- bringing overall partner incentives spending to $4.2 billion.

Throughout 2012 Microsoft expanded the cloud components of its partner assistance, training and certification programs. Late last month the company made it easier for partners to sign up for its Cloud Essentials initiative, enlisting 14,000 partners within a week, and in December added the Cloud Deployment program. Channel chief Jon Roskill (pictured) urged partners to take advantage of free licenses Microsoft offers partners for Office 365, Dynamics CRM Online and other products. "Use the cloud to sell the cloud," he said.

6. The Microsoft-VMware War

The software industry is rife with bitter rivalries, but this year there was none more heated than the one between Microsoft and VMware. While VMware is the king of virtualization, Microsoft's been gaining ground with its Hyper-V technology. Throughout 2012 the two vendors engaged in claims and counter-claims to have the most cost-effective virtualization technology. Microsoft, for example, launched a VMware Costs More campaign early on, while VMware frequently fired back at Microsoft's competitive "trash talking." Microsoft went on the offensive with its new Hyper-V technology in Windows Server 2012. VMware spent part of the year on the defensive after it took heat from partners for its proposed vRAM licensing plan for vSphere 5 that customers said would boost virtualization costs. In August VMware backed off and dropped the plan in what was seen as an effort to stay cost-competitive with Microsoft. Microsoft also angered some partners when it added license requirements to Windows 8 Software Assurance that raised costs for companies that use Apple iPads and other non-Windows devices to access virtual desktop infrastructure.

5. Microsoft Suffers First Loss As A Public Company

In July Microsoft reported a bottom-line loss of $492 million for its fourth fiscal quarter ended June 30 -- Microsoft's first loss ever as a public company. That loss came despite a 4 percent sales gain in the quarter to $18.1 billion.

The loss came as no surprise: Microsoft had announced several weeks earlier that it would take a $6.2 billion write-down for the reduced value of assets the company acquired when it bought aQuantive, an online advertising business, for $6.3 billion in 2007. And sales for the quarter were reduced by $540 million because of deferred revenue related to Microsoft's Windows 8 upgrade offer. So, the red ink wasn't due to Microsoft's ongoing operations. Still, a loss is a loss, and the first one always hurts the most.

4. The Launch Of Windows Phone 8

Microsoft may dominate the desktop with its Windows software, but it's been an also-ran in the smartphone market that's dominated by Apple's iPhone and devices running Google Android. Windows-based smartphones accounted for a miniscule 2 percent of smartphone shipments in the third quarter of 2012, according to IDC.

To turn that around Microsoft debuted Windows Phone 8 in October, just days after shipping Windows 8. Unlike earlier efforts such as Windows Mobile, Microsoft's new operating system for mobile devices is based on the same core technology as the Windows desktop/tablet operating system.

Will it succeed? Microsoft has a huge amount of competitive ground to make up. And losing key executives such as Brandon Watson, head of Windows Phone developer experiences, won't help. An even bigger question is whether Microsoft will try again to develop and sell its own smartphone: Reports persisted that a prototype was being tested.

3. Steven Sinofsky's Sudden Departure

The spotlight had been on Steven Sinofsky all year as the clock ticked down to the launch of Windows 8. As president of Microsoft's Windows and Windows Live Division, it was Sinofsky's job to oversee the development of the next release of Microsoft's flagship product. And it was Sinofsky who got to share the stage with CEO Steve Ballmer at an Oct. 25 press event where the availability of Windows 8 was officially announced. So it was a shock when less than three weeks later Sinofsky suddenly departed Microsoft with no official explanation. Speculation centered on reported friction between Sinofsky and other Microsoft executives. (One report had Sinofsky making a power grab to bring Windows Phone development under his control, a report Sinofsky denied.) Some channel partners questioned whether enough effort had gone into recruiting third-party ISVs to Windows 8. Others wondered whether early Windows 8 demand was meeting expectations. In late November Microsoft said it had sold 40 million Windows licenses in its first month -- a number that some analysts called respectable, but not blockbuster.

2. Microsoft Unveils Surface

Microsoft surprised the industry in June when it unveiled its Surface tablet computers at a splashy Los Angeles press event. The move is a big gamble for Microsoft. With such failed products as the Zune and Kin, the company has a less-than-stellar track record for marketing consumer devices. Another wrinkle: Surface will compete with devices developed by Microsoft's OEM partners. But perhaps the biggest surprise was that Microsoft's vast legions of channel partners weren't part of the go-to-market strategy for Surface. Initially the company sold the ARM-based Surface with Windows RT only through its own website and retail stores. Just before the holidays distribution was expanded to include other retailers such as Best Buy, Staples and Amazon.com.

Near year's end, industry pundits were saying Surface sales were slow, hinting the tablet might join the list of other failed Microsoft devices. Microsoft wasn't disclosing any sales figures. Channel partners, meanwhile, remain hopeful they might get to sell the Surface tablet with Windows 8 Pro when it ships in January.

1. Windows 8 Finally Arrives

After more than a year of buzz, Microsoft launched the next generation of its flagship product in a surprisingly low-key press event in New York on Oct. 25. The software, arguably the most important product in several years for Microsoft and its partners, hit store shelves the next day.

Microsoft has struggled to regain its competitive edge in a world where smartphones and tablets are eroding the importance of desktop PCs -- the market it dominated for years. Windows 8 is something of a gamble because it's the first Microsoft OS designed to support "traditional" PCs as well as touch-screen tablets. Microsoft doesn't need Windows 8 to be the immediate success it needed Windows 7 to be after the Windows Vista disaster. But Windows 8 represents Microsoft's efforts to regain its mojo, and so its ultimate success or failure will have a greater impact on the company's long-term fortunes. Microsoft said 40 million Windows 8 licenses were sold in the first month of its availability -- a number that didn't exactly wow Microsoft watchers. Sales for the first year will be heavily dependent on PC industry sales.