5 Companies That Dropped The Ball This Week

Criticism Grows For Dell's Proposed $24.4B Proposed Buyout

Dell's plans to go private through a $24.4 billion buyout became increasingly messy this week as criticism from shareholders and employees grew louder.

Southeastern Asset Management, the company's biggest investor with 8.5 percent of outstanding shares, had already said it won't vote to approve the buyout. This week another big investor, T. Rowe Price, expressed dissatisfaction with the proposed $13.65 per-share buyout price.

There were also reports employees with stock options with share prices higher than $13.65 -- which will be worthless under the current buyout price -- were becoming increasingly vocal about what they see as a raw deal. By week's end there was a growing sense that Dell may have to up the ante if it's going to proceed with its privatization plans.

Microsoft Struggles To Get Surface Pro On Store Shelves

Microsoft made a big deal about its plans to offer the Surface Pro tablet, released Feb. 9, through retailers such as Best Buy and Staples. But this week the company admitted it was having difficulty keeping retailers supplied with the new tablet computer.

Microsoft launched the Surface Pro tablet and the earlier Surface RT tablet in an effort to compete with Apple's iPad and Android tablets. The products themselves have met with mixed reviews. But the company has been criticized for bypassing its traditional channel partners in favor of selling the tablets through its own website and retail stores.

Microsoft has reportedly spent $1.5 billion marketing Surface and Windows 8. But that money may be wasted if the products aren't there when -- or if -- customers want to buy them.

Adobe Vulnerabilities Open Users To Targeted Attacks

Alerts about dangerous vulnerabilities in popular software products seem to be a weekly occurrence these days. But the threat level was cranked up a notch this week because of a serious flaw in Adobe Reader.

Earlier this week researchers detected a pair of dangerous zero-day vulnerabilities in Adobe Reader that were being actively exploited in a series of targeted attacks with malicious PDF files. The vulnerabilities were the result of coding errors in every version of the software, including Reader X and Reader XI.

That incident came just after Adobe issued its second update in less than a week to its Flash Player to repair 17 critical vulnerabilities.

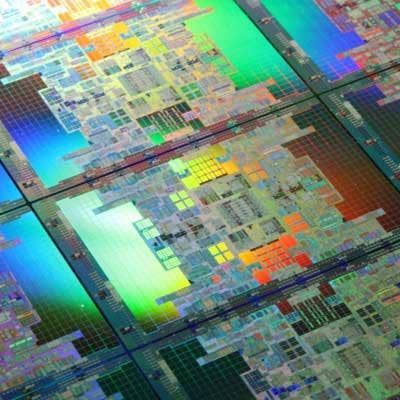

HP Unix Servers In Jeopardy As Intel Changes Itanium Plans

Word leaked out this week that Intel has quietly changed its road map for the next version of its Itanium processor, code-named Kittson, putting the future of Hewlett-Packard's Integrity and Superdome server lines in doubt.

HP's use of Itanium has been the subject of a bitter lawsuit between HP and Oracle concerning Oracle's plans to stop developing its software for Itanium systems. Oracle argued that Itanium was nearing the end of its technological life while HP portrayed Itanium as a viable technology.

Intel tried to remain neutral in the dispute. But this week came news that the chip maker dropped plans to manufacture Kittson using its advanced 22-nanometer technology and will use its 32-nm manufacturing process instead. Intel also said it's re-evaluating the modular model under which Kittson was expected to be socket-compatible with future Xeon processors. All this raises the question: Has HP committed to a dead-end processor technology?

Apple May Lose iPhone Naming Rights In Brazil

Marketing missteps are a rarity for Apple. So it came as something of a surprise this week when The Wall Street Journal reported that Apple may not be able to use the lucrative "iPhone" name in Brazil -- one of the world's fastest growing economies.

The story said Apple's bid to trademark "iPhone" was rejected Wednesday because IGB Eletronica SA, better known as Gradiente, already owned rights to the name. Gradiente applied for the iPhone trademark in 2000 and under Brazilian trademark regulations trademarks are awarded on a first-come basis, unlike in the U.S., which considers such factors as brand recognition.

At week's end the Brazilian company was indicating it was open to letting Apple use the iPhone name -- for a price.