2013 Channel Champs: Overall Winners

The Best Of The Best

For 23 years CRN has conducted its Channel Champs survey, seeking to identify which IT vendors are at the top of their game in meeting the needs of their channel partners. This year's winners were recognized in a ceremony at the XChange Solution Provider 2013 conference in Orlando last month.

The Channel Champ scores are based on a survey of more than 4,000 solution providers across 30 technology categories, including three new areas this year: Network Connectivity Services, System Management/Network Management and WAN Optimization/Acceleration. Solution providers were asked to grade vendors in the areas of technical satisfaction, support satisfaction and financial factors.

In addition to defining which vendors are leading the way in partner satisfaction, the scores – including year-to-year comparisons – also provide an interesting snapshot of the competitive dynamics in each technology category. Who's up and who's down? Take a look.

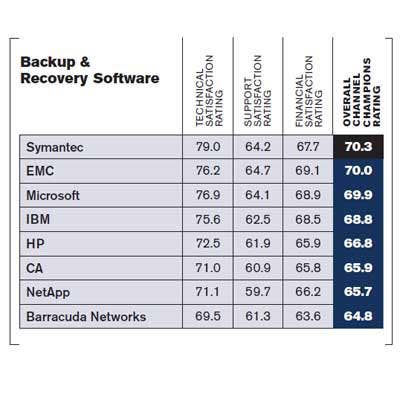

BACKUP & RECOVERY SOFTWARE

Symantec

Symantec eked out a narrow win in the Backup and Recovery Software category, edging out EMC by just 0.3 points and Microsoft by 0.4. The company, which won this category last year but finished well back in the pack in 2011, scored impressively on technical satisfaction. But it was behind EMC in support and also several competitors in financial satisfaction.

Symantec thrives because its two major product lines, NetBackup for the SMB and midrange Windows market and Backup Exec for the multiplatform enterprise market, give it market coverage second to none with a heavy channel focus. The company reports strong growth with its data protection appliance line, which is available only through channel partners.

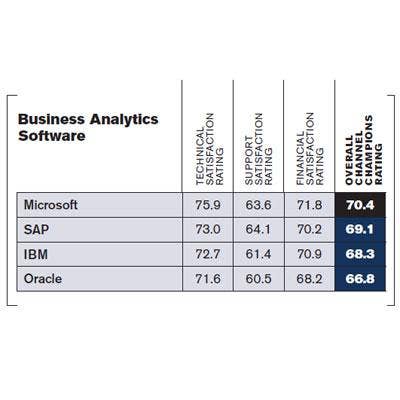

BUSINESS ANALYTICS SOFTWARE

Microsoft

Microsoft was this year's winner in the Business Analytics Software category, taking the top spot over competitors SAP, IBM and Oracle, just as it did last year and in 2011. Microsoft's standing may have received a boost from new releases of the company's PowerPivot, Power View and other business intelligence tools built into the new SQL Server 2012 database engine.

Still, Microsoft's overall score of 70.4 was down from last year's 76.6 as channel partners gave the vendor lower scores for technical support and financial satisfaction. They also gave lower scores to Microsoft's competitors, with the biggest drops coming in the support satisfaction ratings.

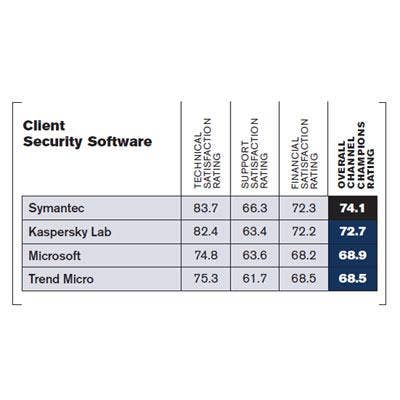

CLIENT SECURITY SOFTWARE

Symantec

Symantec remains champ of the Client Security Software category, recording the highest overall score for the third year in a row. And it's putting a little more breathing space between itself and competitors Kaspersky Lab, Microsoft and Trend Micro. The company's five-point-plus gain in support satisfaction scores marked the biggest change in the company's grades.

And those scores should rise. At UBM Tech Channel's XChange Solution Provider 2013 conference last month, John Belle, Symantec's senior director of commercial and SMB channel, pledged an incremental $50 million to fund additional support for partners and customers. The company also plans to spend $3.5 million more on its inside sales organization to help deliver more leads to partners.

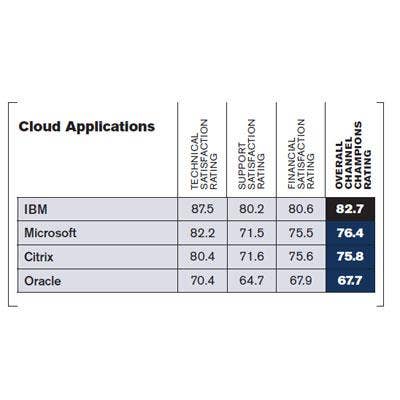

CLOUD APPLICATIONS

IBM

IBM, a newcomer to the Cloud Applications category this year, soundly beat Microsoft-last year's cloud application winner-as well as Citrix and Oracle. The company scored especially well on the technology side with a 87.5 technical satisfaction rating.

Cloud computing has been one of IBM's strategic initiatives in recent years, and in 2012 cloud-related sales grew 80 percent. The company's SmartCloud product lineup includes Infrastructure-, Platform- and Software-as-a-Service offerings, and cloud security tools. Last year the company launched its SmartCloud Enterprise-Plus public and managed private cloud offerings for large companies.

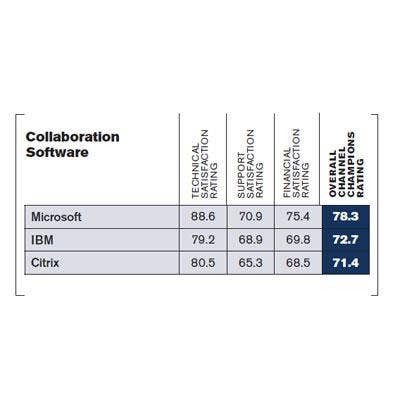

COLLABORATION SOFTWARE

Microsoft

Repeating its successes of 2011 and 2012, Microsoft is once again the Channel Champ in the category of Collaboration Software. This year Microsoft beat out archrival IBM as well as Citrix, which was added to the category this year.

Microsoft's technical satisfaction ratings soared this year (to 88.6 from 80.8 last year), likely due to the 2013 release of its SharePoint flagship collaboration software in late 2012. That edition offered a swarm of new capabilities, including search improvements and e-discovery tools, social media news feeds, cloud administration tools and development capabilities based on Microsoft's cloud application model.

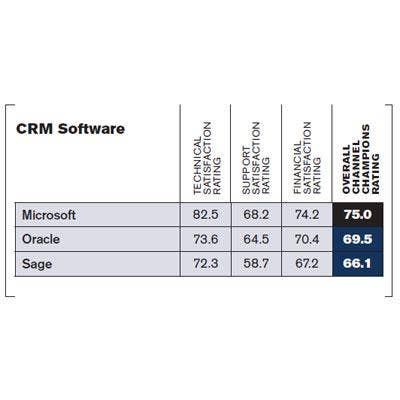

CRM SOFTWARE

Microsoft

Microsoft held onto the top position in the CRM Software category with its Dynamics CRM application, beating out rivals Oracle and Sage. Microsoft turned in about the same total score for partner satisfaction as last year, boosting its technical score by several points but slipping several points in support.

Microsoft has been making steady progress in gaining market share in the hotly contested CRM application arena, especially since making the Dynamics CRM Online cloud version of the product available worldwide in early 2011. (It launched in North America in 2008.) At its Convergence conference last month Microsoft said it has 39,000 Dynamics CRM customers with more than 3 million users.

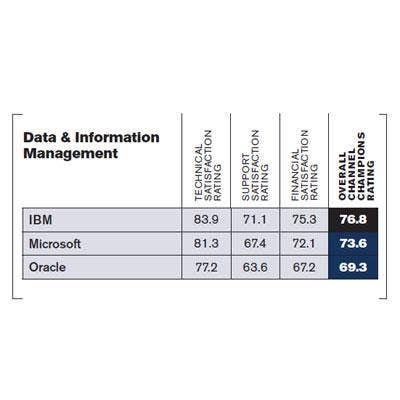

DATA & INFORMATION MANAGEMENT

IBM

Over the years the vendor rankings in the Data and Information Management category have shifted between the three major players: IBM, Microsoft and Oracle. This year IBM takes the top spot, significantly increasing its technical and financial satisfaction scores and boosting its overall rating by seven points.

IBM's technical rankings likely got a boost when it released DB2 10 and InfoSphere Warehouse 10, new editions of its core database and data warehouse software with new capabilities for handling "big data" and tools for automating data management chores. Microsoft's technical satisfaction scores also rose this year-the company's SQL Server 2012 database release was popular in the channel-but not enough to overcome IBM's gains.

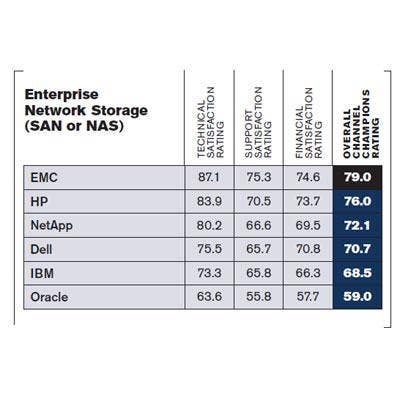

ENTERPRISE NETWORK STORAGE (SAN OR NAS)

EMC

EMC takes the top spot in the volatile Enterprise Network Storage category this year, soundly defeating Dell, last year's winner, and NetApp, which took the top prize two years ago. EMC can thank its astounding increase in technical satisfaction scores, from 75.2 last year to 87.1, for its win. It also significantly improved its support and financial satisfaction ratings.

EMC has enjoyed the fastest overall growth rate of its peers in the past couple years, meaning it almost singlehandedly accounts for the market's growth. And that growth isn't coming through direct sales. The company has become a model on how to transform an aggressive direct-sales-only organization into one that brings the channel into nearly every sale.

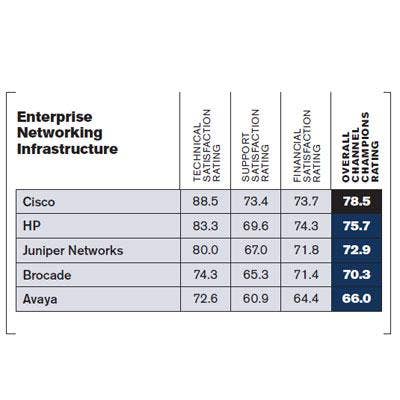

ENTERPRISE NETWORKING INFRASTRUCTURE

Cisco

Cisco continued its networking dominance this year with a big win in the Enterprise Networking Infrastructure category. Cisco won two of three subcategories by significant scores, ceding only the financial satisfaction subcategory to Hewlett-Packard by a slim margin, and won the overall Channel Champ award by nearly three full points. Cisco won this category last year as well, followed by Juniper and HP-although all three vendors boosted their overall scores.

For Cisco, the win is a validation for the refocused and restructured company, which spent much of 2012 rallying around the core businesses that made Cisco the networking leader. While competition and pricing pressure have increased in recent years, Cisco has kept its enterprise routers and switches at the top of the hill.

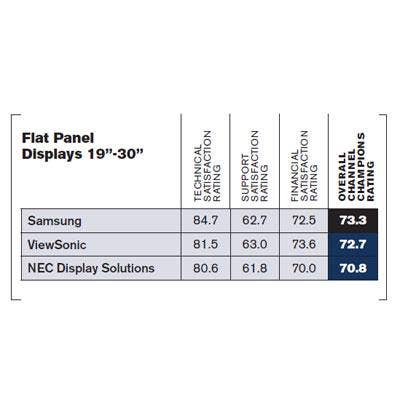

FLAT PANEL DISPLAYS 19"-30"

Samsung

Samsung is this year's Channel Champ in the Flat Panel Displays (19"-30") category, beating ViewSonic, last year's winner, by less than a point.

Samsung won on the strength of its technical satisfaction ratings-scoring more than three points higher than ViewSonic. But as with last year, ViewSonic scored higher in partner satisfaction in both the support and financial subcategories. The difference was that Samsung's edge in technical satisfaction this year was large enough to give it the overall top score.

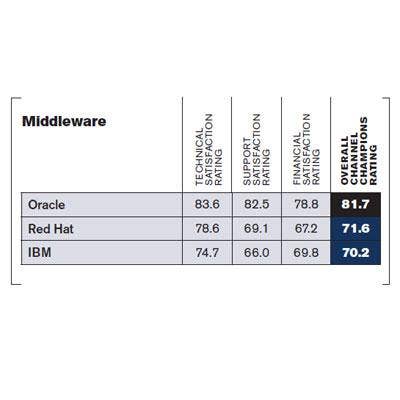

MIDDLEWARE

Oracle

Riding a nearly eight-point gain in its overall channel satisfaction rating, Oracle came out on top in this year's Middleware category, marking a significant jump from the company's third-place finish last year. While the company's scores improved markedly in technical and financial criteria, most impressive was the 10-point gain in Oracle's grade for partner support satisfaction.

Oracle has been stepping up its rewards for partners who become certified or "specialized" in specific Oracle products, including such middleware products as Oracle Business Intelligence Foundation, Oracle Application Grid and Oracle Services-Oriented Architecture. Oracle has put more emphasis on selling integrated systems in recent years and its middleware is a critical component of that effort.

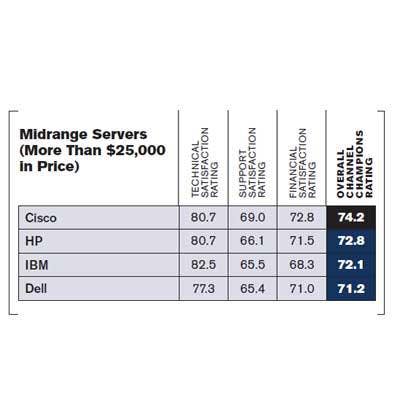

MIDRANGE SERVERS (MORE THAN $25,000 IN PRICE)

Cisco

Cisco may be the server newcomer, but it is moving into the data center at warp speed thanks to its large networking presence and to solid partnerships with storage behemoths EMC and NetApp. Cisco's strategy of focusing less on selling a server and more on selling a solution including servers, networking and storage appears to be paying off for the company in the channel.

It was voted Midrange Servers Channel Champ over its much older and larger competitors including HP, IBM and Dell. Solid support and financial satisfaction ratings overcame a tie with HP for second place after IBM in the technical satisfaction ratings.

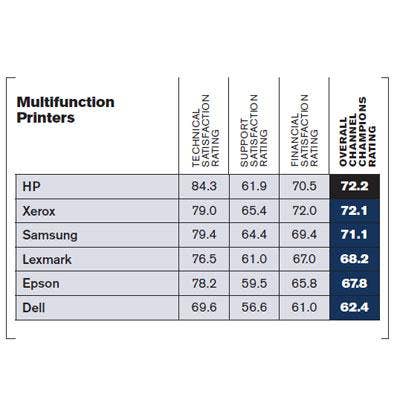

MULTIFUNCTION PRINTERS

Hewlett-Packard

For the second year in a row, Hewlett-Packard stole the top spot in the Multifunction Printers (MFPs) category, continuing its reign after stealing the crown from Xerox in 2011.

HP's victory was a narrow one, having ceding both the support satisfaction and financial satisfaction categories to Xerox. But when it comes to technical satisfaction, HP won by a landslide, with solution providers particularly praising the reliability and rich feature sets of HP's MFPs. Last October, HP shook up the MFP space with the launch of its LaserJet Enterprise flow M525c. In addition to advanced document-processing and sharing capabilities, the M525c helps enterprise users manage their overall print environments, save on energy costs, and print from smartphones and tablets.

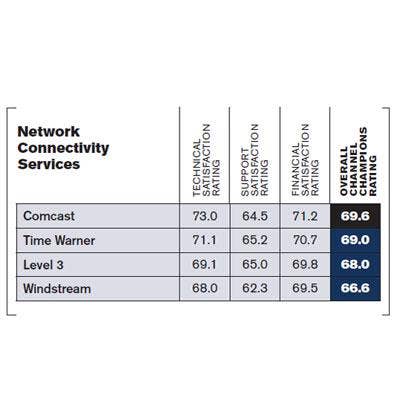

NETWORK CONNECTIVITY SERVICES

Comcast

Comcast was crowned Channel Champ of the new Network Connectivity Services category this year, thanks to its strong technical and financial satisfaction ratings.

Solution providers-who especially applauded Comcast for the richness and reliability of its connectivity services have become an integral part of Comcast's go-to-market strategy over the past two years. With the launch of the Comcast Business Class partner program in 2011, Comcast turned to the channel to help increase its relevance among SMB and midmarket accounts.

Solution providers, meanwhile, have been drawn to Comcast because of the opportunity for recurring revenue streams, and to cash in on the growing chorus of customers who want both their IT and connectivity services from a single source.

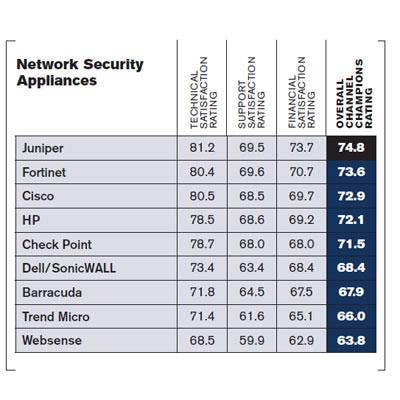

NETWORK SECURITY APPLIANCES

Juniper

Juniper Networks beat out incumbent Channel Champion Cisco this year to nab the top spot in the Network Security Appliances category.

Beating out a long list of competitors in both the financial and technical support satisfaction subcategories, Juniper was catapulted to the top seat with partners specifically cheering the vendor's product margins and post-sales support.

The win is an especially important one for Juniper, whose reputation in the security space has been less-than-glowing over the past few years. But partners' perceptions seem to be changing, and Juniper's security portfolio continues to grow, most recently with the launch of two new SRX services gateways aimed at 4G networks.

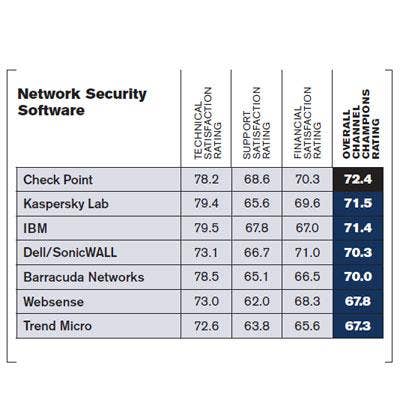

NETWORK SECURITY SOFTWARE

Check Point

Check Point Software Technologies, among those joining an expanded list of vendors this year in this category, is this year's Channel Champ in Network Security Software. Check Point beat out last year's participants: Kaspersky Lab, Trend Micro and McAfee, as well as other newcomers: IBM, Dell/SonicWALL, Barracuda Networks and Websense.

Check Point has made significant investments in the channel this year, Check Point President Amnon Bar-Lev recently told CRN. That includes the addition of 300 regional employees to help partners with logistics problems, new marketing campaigns and other partner assistance. New deal registration was introduced, something the company lacked before, Bar-Lev said.

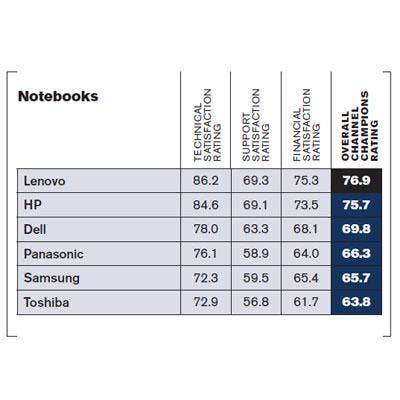

NOTEBOOKS

Lenovo

Receiving top scores in all three subcategories, Lenovo wrestled the crown away from last year's winner Hewlett-Packard to become Channel Champ of the Notebooks category.

The move underscores the incredible momentum Lenovo has seen in the PC market over the past year. In October, Gartner reported that Lenovo had surpassed HP to become the world's largest PC maker, with its soaring PC sales representing a rare bright spot in an otherwise embattled PC market. Lenovo attributes much of its success in the notebook market to its partners, and the feeling, it seems, is mutual. Solution providers praised the PC giant for perks ranging from high product margins to a recent increase in sales.

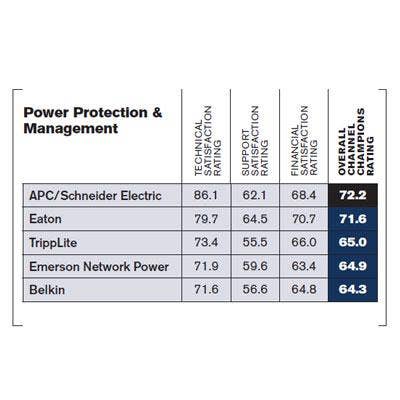

POWER PROTECTION & MANAGEMENT

APC/Schneider Electric

A strong affirmation by channel partners of APC Schneider Electric's technical prowess helped that company squeak by rival Eaton to become the Channel Champ in the Power Protection and Management category for the 20th consecutive year.

APC Schneider Electric blew past Eaton and its other rivals with a solid score in the technical satisfaction rating and a strong enough lead to make up for losing out to Eaton in both the support satisfaction and the financial satisfaction ratings.

The win goes far to solidify the company's reputation as a developer of a full range of power protection and management hardware and software for deployments from the desktop to the data center.

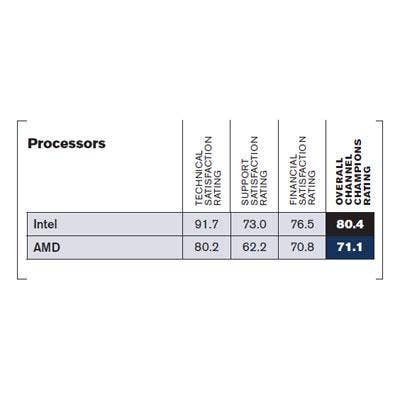

PROCESSORS

Intel

Reigning Channel Champ Intel maintained its winning streak in the Processors category this year, besting its rival AMD in all three subcategories.

Like most chip makers, Intel has been tasked with growing its relevance in new markets like mobility and big data, given today's embattled PC market. Through the launch of its Atom "Medfield" and "Clover Trail" processors for smartphones and tablets, Intel is doing just that, while also staking a claim in the burgeoning big data market with its own distribution of the open-source Apache Hadoop framework.

Intel partners are applauding these moves. The chip giant received a nearly perfect score in product quality and reliability, and also scored particularly well in technical innovation and ease of integration.

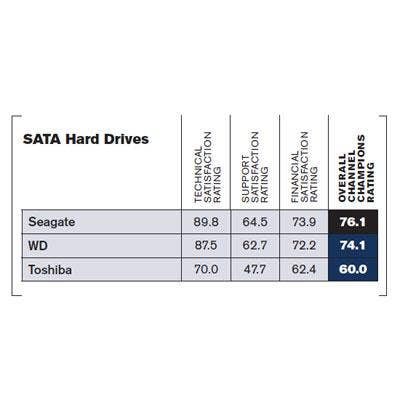

SATA HARD DRIVES

Seagate

Seagate retained its top perch in the SATA Hard Drives category, a position it has occupied for the last couple of years. The company managed to add nearly five points to its technical satisfaction scores over last year (89.8 vs. 85.0). But its support satisfaction scores, down nearly five points, could be a reason for concern.

The hard drive industry is unique in that it is completely dominated by three vendors who offer equally good products while competing fiercely against each other. Seagate has attained the market-leader position with strong channel support and a SATA hard drive product line that covers the full gamut of customer and channel partner requirements.

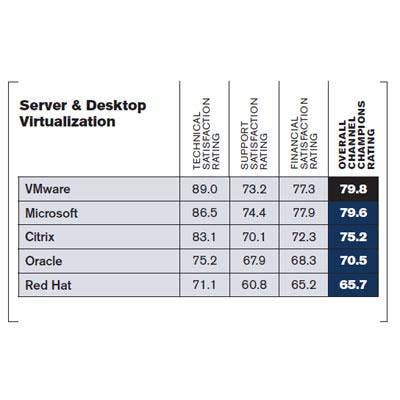

SERVER & DESKTOP VIRTUALIZATION

VMware

Virtualization powerhouse VMware is once again the winner of this year's Server and Desktop Virtualization category, riding a significant (5.8 point) increase in technical satisfaction over last year.

But the big news is that VMware beat out archcompetitor Microsoft by a paper-thin 0.2 points. Microsoft, which placed third last year behind VMware and Citrix, improved its overall score by nearly 10 points and is now nipping at VMware's heels. Microsoft's technical satisfaction score surged more than 15 points-evidence that Microsoft's Hyper-V technology has become a serious player in the virtualization market.

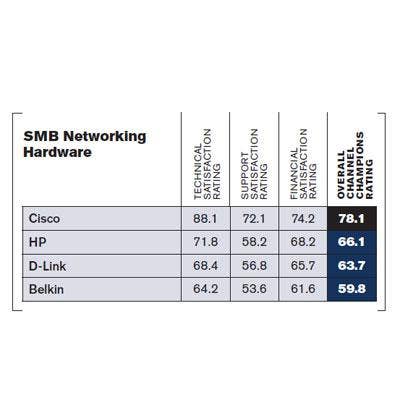

SMB NETWORKING HARDWARE

Cisco

Cisco's aggressive push into the SMB space seems to be resonating well with its partners. The networking giant beat out rivals Hewlett-Packard, D-Link and Belkin in all three subcategories this year to secure the overall win in the SMB Networking Hardware category.

Cisco's SMB strategy is anchored by the Partner-Led sales initiative it rolled out in 2011 with the goal of driving more of its midmarket-or, in Cisco speak, "commercial"-sales through the channel. Last year, Cisco defined that initiative through a new program called Partner Plus, which offers various incentives, rebates and customer intelligence data to partners targeting SMB accounts.

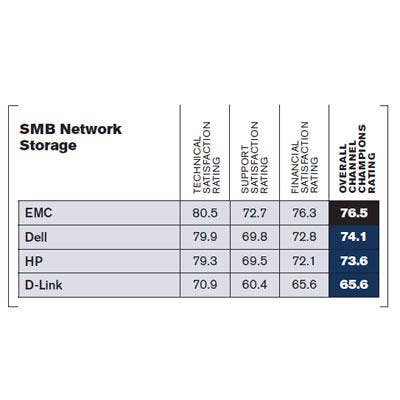

SMB NETWORK STORAGE

EMC

Just as it made significant gains in Enterprise Network Storage, EMC stepped up its game in SMB Network Storage this year, vaulting itself over rivals Dell and Hewlett-Packard to take the top spot. The company improved its overall performance by more than six points by boosting its technical, support and financial satisfaction scores.

A few years ago, EMC concluded that the real storage market growth would come from the SMB side and the only way to take advantage of that was a channel-only strategy. This past year, EMC expanded its SMB network storage business with the addition of not only new networking hardware, but also new reference architectures as part of its VSPEX offerings.

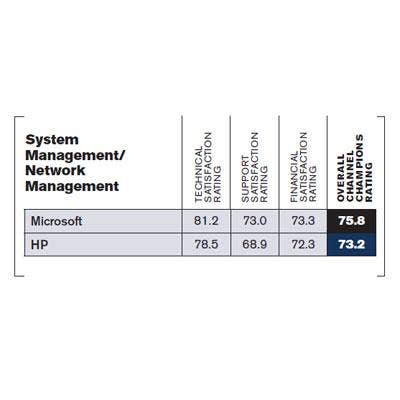

SYSTEM MANAGEMENT/NETWORK MANAGEMENT

Microsoft

Microsoft edged out Hewlett-Packard in the System Management/Network Management category in this year's Channel Champs awards. A good guess is that the Microsoft System Center 2012, launched in April, gave a boost to Microsoft's scores.

System Center 2012, chosen by the CRN Test Center as a 2012 product of the year, was a milestone for Microsoft. The software can recognize and manage multiple servers at once and offers a dashboard interface that provides IT administrators with a tree-style view of different types of servers. Another plus: Microsoft's decision to reduce the number of licensing options from more than 100 to just two.

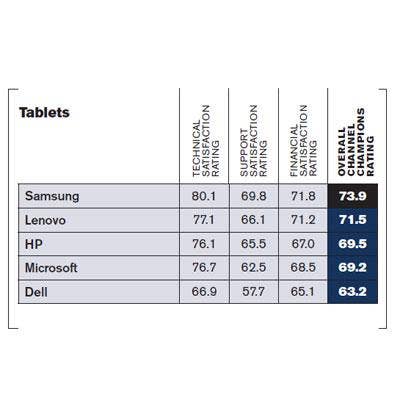

TABLETS

Samsung

Samsung was voted Channel Champ in the new category of Tablets, a space that's become more and more relevant to solution providers with the advent of the bring-your-own-device (BYOD) trend.

While Samsung tablets like the Galaxy Note may have risen to fame in the consumer market, they are quickly gaining traction in the enterprise, presenting an opportunity for partners to bolster their mobility play. Samsung also has rolled out an initiative called SAFE-or Samsung For Enterprise-so customers and partners alike can easily identify which of its tablets have business-ready features like VPN connectivity, multivendor mobile device management support and on-device AES 256-bit encryption.

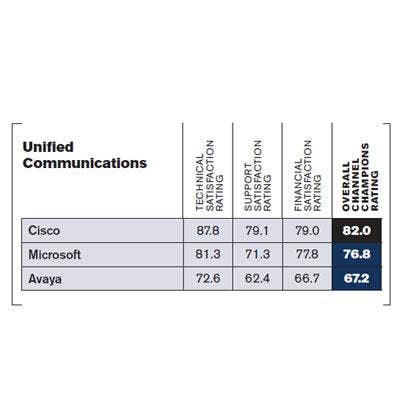

UNIFIED COMMUNICATIONS

Cisco

Cisco is this year's winner in the realm of Unified Communications, significantly beating competitors Microsoft and Avaya in the overall score, as well as in the technical, support and financial satisfaction ratings. But Cisco should take heed: While Cisco beat Microsoft by 11 points in technical satisfaction last year and almost 10 points in the overall score, Microsoft made significant headway this year.

Cisco, which also won this category last year, launched its UCS line four years ago-a move described by channel partners as a game-changer for the vendor and for them. Today 1,700 partners are certified for Cisco's data center networking infrastructure specialization.

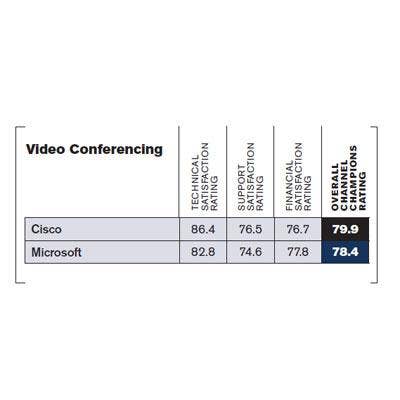

VIDEO CONFERENCING

Cisco

Cisco remains on top in its dogfight with Microsoft in the video conferencing market. This year, Cisco beat Microsoft in the overall partner satisfaction score by 1.5 points-about the same margin of victory as last year. While Cisco increased its scores in the technical and support satisfaction subcategories, its margin of victory over Microsoft was about the same. Microsoft, as it did in 2012, narrowly won in financial satisfaction.

Demonstrating its technical prowess, Cisco in March integrated its TelePresence and WebEx web-conferencing systems in a move the company said creates a joint conferencing environment that enables more collaboration and content-sharing.

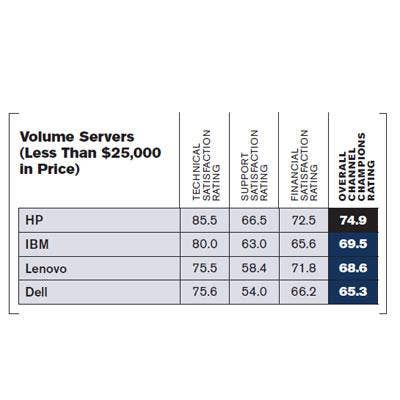

VOLUME SERVERS (LESS THAN $25,000 IN PRICE)

Hewlett-Packard

Hewlett-Packard stayed at the top of the pack in the category of Volume Servers priced below $25,000. HP retained about the same scores as last year-technical satisfaction scores did slip a point to 85.5-but were good enough to beat out rivals IBM, Lenovo and Dell. (Dell fell from second to fourth as its overall score plunged more than six points, including a disconcerting 8.5-point drop in its technical satisfaction scores.)

HP for years has remained at the top of the volume server market thanks to its wide range of blade, rack-mount and pedestal servers. HP's server business remains a channel-focused play and the company relies on its partners for growth in both its installed base and in new customers, especially with its latest models, the HP ProLiant Gen8 servers launched in 2012.

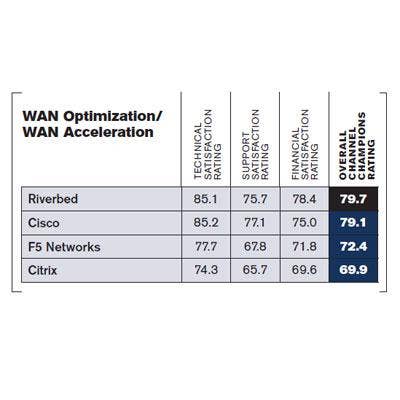

WAN OPTIMIZATION/WAN ACCELERATION

Riverbed Technology

Riverbed Technology took the prize in the WAN Optimization/Acceleration category this year in a nail-biter with the much larger Cisco. Riverbed actually lost two of three sub-categories by narrow margins to the networking giant, including a defeat in the technical satisfaction subcategory by a mere one-tenth of a point. But Riverbed staged a comeback by winning the financial satisfaction rating by more than three points to help it edge Cisco for the overall category win.

Riverbed has established itself as the dominant player in the WAN optimization/acceleration market in recent years even in the face of larger competitors like Cisco-a notable achievement considering Riverbed just turned 10 years old last spring. Now the company is looking to expand further into the application performance management space following last year's Opnet acquisition.

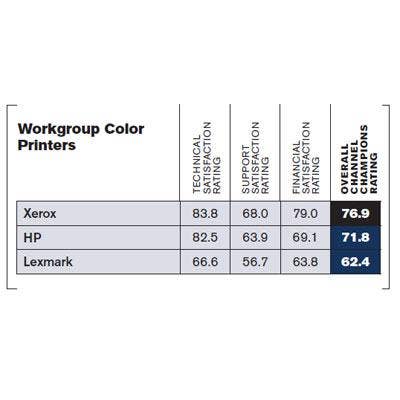

WORKGROUP COLOR PRINTERS

Xerox

For the second year in a row, Xerox is the Channel Champ in Workgroup Color Printers, beating rivals Hewlett-Packard (the category winner two years ago) and Lexmark across the board in technical, support and financial satisfaction subcategories.

Xerox modestly increased its scores in partner satisfaction in technical and support criteria, but boosted its financial satisfaction rating by a significant 6.5 points. Xerox generally wins kudos from the channel for its partner feedback mechanisms, including its advisory council that convenes annually in face-to-face meetings and in quarterly phone conferences.