5 Facts About The Overseas Tax Rate

How To Handle All That Cash?

U.S. multinationals have made a lot of money overseas, but bringing their overseas earnings to their U.S. headquarters subjects that cash to corporate taxes of 35 percent. Because of this, U.S. IT businesses are holding over half a trillion dollars in cash overseas. That results in such behavior as Apple borrowing $17 billion to fund a return of capital to shareholders instead of tapping its estimated $145 billion in cash overseas.

U.S. companies say a permanent or temporary tax slash would allow them to invest that cash in their businesses and create jobs domestically. The U.S. government, however, is loath to give up the potential tax revenue on that income. Furthermore, the last tax break resulted in companies mainly increasing shareholder payouts.

Here's a look at the magnitude of how much cash is waiting to be repatriated. Also, check out the rest of CRN's special report on overseas profits, available exclusively on the CRN Tech News App.

How Much Cash?

Moody's Investors Service in March reported that U.S. non-financial companies had $4.45 trillion in cash at the end of 2012, up 10 percent from late 2011. Of that cash, tech companies hold about 38 percent of the total, or $556 billion.

By the end of 2012, the amount of cash those companies stockpiled overseas reached $840 billion, or about 58 percent of their total cash holdings, Moody's reported. That was up from $700 billion at the end of 2011.

How much cash individual companies are holding varies according to how it is measured and who is doing the measuring.

US Congress: Companies With Foreign Cash Balances Of Over $5 Billion

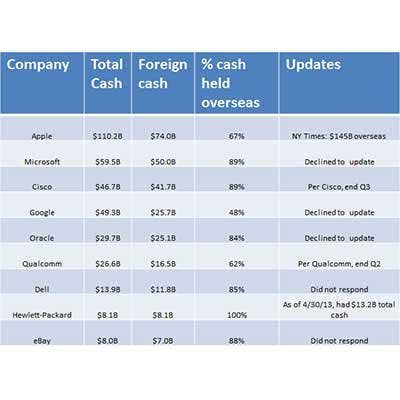

The U.S. Congress late last year published a list of the top companies holding at least $5 billion in cash overseas, based on JP Morgan and Bloomberg data and company reports.

Of the 18 companies on the list, half were IT companies.

The original data for the nine IT companies is shown here, plus updates as provided by those companies that responded to CRN's request for updates.

Image Source: U.S. Congress, JP Morgan, Bloomberg, Company Reports, CRN

Moody's: 10 Largest Corporate Cash Piles

Moody's Investors Service in March of 2013 reported that U.S. non-financial companies were hording $1.45 trillion in cash as of the end of 2012, with about 58 percent, or $840 billion, held overseas. The total cash held was up about $130 billion over the prior year, Moody's reported.

Moody's list of the top 10 holders of U.S. cash, including total cash holdings and the percentage held overseas, is shown here.

Image Source: Moody's, March 2013

The Most Untaxed Overseas Profits

Bloomberg, in an August 2013 report, took the 70 companies in the S&P 500 Information Technology Index, added the five companies in the S&P 500 Internet & Catalog Retail Index, and ranked them on how much undistributed earnings they hold outside the US.

Not included in the ranking were TE Connectivity and Seagate Technology, as both have headquarters outside the U.S., Bloomberg said.

Image Source: Bloomberg, August 2013

How About Tax Havens?

The U.S. Congress, as part of its push back against requests for cutting corporate taxes on overseas earnings, published a list of countries with low or no taxes, including a number of tax havens.

Interestingly, for some of those countries (pictured), U.S.-controlled corporation profits account for as much as 6.5 times those countries' total GDP.

Image Source: Congressional Research Service, June 2010