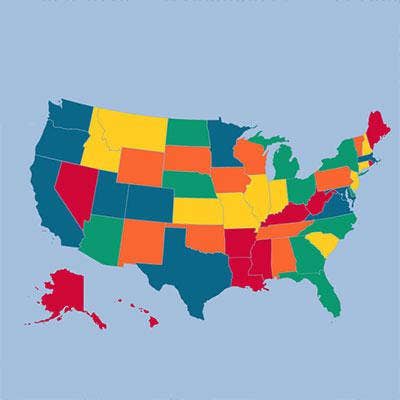

The Best And Worst States For Quality Of Life/Personal Cost Of Living

The Top And The Bottom Five

Entrepreneurs searching for the best state in which to start a solution provider business certainly have to consider business criteria such as the pool of experienced workers and corporate tax rates. But if you're going to live there, the personal cost of living and quality of life also need to be considered.

As part of its 2014 analysis of the best and worst states for starting a solution provider business, CRN examined such criteria as a state's cost of living, including personal income and sales taxes, median household income (from 2012) and crime rates. The analysis is based on data from a variety of sources including the U.S. Census Bureau, The Council for Community and Economic Research, the FBI and the Tax Foundation.

The first five states have the highest scores (No. 5 through 1) followed by the worst five states (No. 46 through 50).

Best States No. 5: Montana

Montana has no sales tax. The Treasure State has a personal income tax rate scale ranging from 1 percent (for income up to $2,800) to 6.9 percent (for income of $16,700 and up).

Montana's cost of living is ranked at No. 25 by The Council for Community and Economic Research, while the state's median household income of $45,088 puts it in the bottom 10 among all states.

Best States No. 4: Utah

Utah has a 5.95 percent sales tax and a personal income tax rate of 5.0 percent.

The Beehive State's cost of living is ranked below-the-median No. 20 while the state's median household income stands at a very respectable $58,341.

Best States No. 3: Colorado

Colorado has a 2.9 percent sales tax and a personal income tax rate of 4.63 percent of federal taxable income.

The Centennial State is becoming a more expensive place to live, however, given its No. 34 ranking for cost of living. The state's median household income stands at a healthy $57,255.

Best States No. 2: Minnesota

Minnesota can be expensive, taxwise, with a 6.875 percent sales tax and a personal income tax rate that ranges from 5.35 percent (for income up to $24,680) up to 9.82 percent (for income above $152,540).

The North Star State is ranked a middle-of-the-road No. 28 for cost of living (with No. 50 being the highest). The state's median household income is in the top 10 among all states at $61,795.

Best States No. 1: Texas

Texas has no state personal income tax. The Lone Star State has a 6.25 percent sales and use tax.

Texas is ranked No. 18 for its relatively low cost of living. But at $51,926, the state's median household income is also comparatively modest. And Texas earns a relatively poor ranking (No. 39, with No. 50 the lowest) in the crime rate department.

Worst States No. 46: New Jersey

New Jersey is ranked No. 48 for its personal income tax burden, with a tax rate scale that ranges from 1.4 percent for income below $20,000, to 8.97 percent for income higher than a half-million dollars. (Residents with income of $40,000 to $75,000 pay 5.53 percent and those with income above $75,000 pay 6.37 percent.) The state also has a 7.0 percent sale tax.

The Garden State loses points for its relatively high cost of living (No. 44 with No. 50 the lowest). But its $66,692 median household income is among the highest of the states.

Worst States No. 47: New York

New York is ranked No. 49 for its personal income tax burden. The Empire State's tax scale ranges from 4.00 percent to 8.82 percent with most residents falling into the 6.45 percent or 6.65 percent brackets. New York also has a 4.0 percent sales tax.

New York is dead last (No. 50) for its expensive cost of living. But its median household income ($47,680) also is surprisingly low.

Worst States No. 48: Louisiana

Louisiana is ranked No. 25 in the personal income tax department, with a tax scale that runs from 2.0 percent for income up to $12,500, 4.0 percent for income up to $50,000, and 6.0 percent for income above that. The Pelican State has a 4.0 sales tax.

The good news is that Louisiana, at No. 4, has one of the lowest cost-of-living ranks in the country. But its median household income, $39,085, beats only Arkansas and Mississippi. And the state ranks poorly for its high crime rate.

Worst States No. 49: Arizona

Arizona has a personal income tax rate scale that ranges from 2.59 percent to 4.54 percent, with most taxpayers falling in the 3.36 percent ($25,000 to $50,000) or 4.24 percent ($50,000 to $150,000) brackets. That puts the state at the lower end of the personal income tax scale among all states. But the Grand Canyon State also has a 5.6 percent sales tax.

Arizona's cost-of-living rank is No. 27. But its $47,044 median household income is nothing to brag about and the state loses points for its high crime rate.

Worst States No. 50: New Mexico

While New Mexico has multiple tax brackets, anyone earning more than $16,000 pays 4.9 percent. And the state's sales tax is 5.125 percent.

While New Mexico is ranked No. 26 in cost of living, the median household income in the Land of Enchantment is a less-than-enchanting $43,424, putting it in the bottom 10 among all states. The state also ranks No. 49 in overall crime rates.