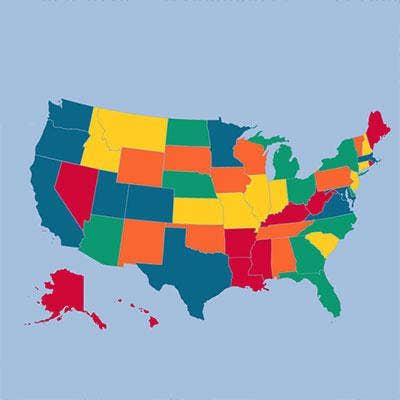

The 10 Best States For Channel Growth

Open For Business

As the economy shakes off the last vestiges of the Great Recession and kicks into higher gear, many solution providers are thinking about growth. While companies have a lot of control over their growth through their strategy, product mix, financing and other factors, the location where a solution provider does business can have a significant impact on how fast -- or slowly -- a solution provider grows.

CRN has analyzed data on all 50 states on worker education and experience, labor and business costs, taxes and regulations, growth and innovation potential, business opportunities and other criteria to identify the states with the best and worst environments for solution provider growth.

Here are the 10 states that have the most to offer when it comes to boosting a solution provider's growth prospects, starting with No. 10 and wrapping up with the best state for growth.

No. 10: California

California is the epicenter of the U.S. IT industry. So it's no surprise the Golden State ranks No. 1 in growth and innovation in our analysis, including high scores for entrepreneurial activity and the number of issued patents. And it's No. 2 in business opportunities, given the large number of businesses -- and fast-growing businesses -- in the state that offer solution providers a potential customer base.

But California is No. 46 in overall labor and employment costs. It's a lackluster No. 17 in worker education and experience (it's a big, diverse state, after all). And, perhaps not so surprisingly, it's No. 43 in taxes and regulations: Its 8.84 percent corporate income tax is among the nation's 10 highest, as is the state's 8.44 percent combined state and average local sales tax. Its real GDP growth in 2014 was 2.8 percent, putting it in the top 10 states.

California also has many solution provider companies relative to potential business customers within the state, ranking a poor No. 44 in a solution provider saturation index, meaning solution providers doing business in the state have a lot of competition.

No. 9: New York

New York ranks No. 6 in innovation and growth and No. 12 in business opportunities -- as part of the latter it's second only to California for the number of businesses within the state. And it's a respectable No. 10 in workforce education and experience.

Where the Empire State loses some of its luster is the expense of doing business there. The Empire State is No. 47 in labor costs and related expenses. And it's No. 29 in taxes and regulations, a ranking pulled down by high property taxes and high combined state and average local sales tax (8.48 percent). New York registered a healthy 2.5 percent real GDP growth in 2014.

No. 8: North Carolina

North Carolina has a lot of growth potential: The CNBC America's Top States for Business report ranked North Carolina No. 1 for economic expansion and development. Our analysis ranks the state No. 9 for business opportunity and No. 15 for innovation and growth.

The Tar Heel State, however, is No. 31 for the education and experience of its workforce and No. 20 for its labor and related business costs. But it's No. 10 for taxes and regulations: Forbes Best States for Business ranks the state No. 2 for its business-friendly regulatory environment.

No. 7: Massachusetts

Massachusetts ranks high for the education and experience of its workforce, behind only Virginia, Maryland and Vermont. The Bay State, in fact, is No. 1 in many workforce criteria, including the number of managerial, professional and technical jobs as a share of the total private-sector workforce.

"We're in one of the best parts of the country for college-educated people," noted Kevin Routhier, CEO of Coretelligent, a fast-growing Needham, Mass.-based solution provider.

The Bay State is likewise ranked No. 4 for innovation and growth, given its high scores for information technology jobs as a share of all non-IT industry private-sector jobs and number of scientists and engineers in the workforce. And Massachusetts' business opportunity rank (No. 10) gets a boost from high grades for the number of fast-growing firms and economic climate, including 2.3 percent real GDP growth in 2014.

But Massachusetts ranks No. 40 for its high labor costs. And the state is a disappointing No. 45 for its taxes -- especially its high property taxes and moderately high 8.0 percent corporate income tax rate -- and its burdensome regulatory environment.

No. 6: Georgia

Georgia has a lot going for it as a place for a solution provider to set up shop and grow. The state ranks No. 8 for business opportunity, including being No. 10 and No. 11, respectively, in the number of businesses and number of fast-growing companies in the state. And CNBC America's Top States For Business ranks Georgia's economy at No. 4: Its real GDP growth in 2014 was a solid 2.3 percent.

The Peach State also ranks an impressive No. 11 in innovation and growth. Even more impressive is Georgia's No. 7 rank for taxes and regulations. Its corporate income tax (6.0 percent) and combined state and average local sales tax (6.96 percent) are about average or below.

Georgia's workforce ranks only No. 35 for its education and experience. But it's also ranked No. 19 for its lower labor costs.

No. 5: Texas

Texas has been on an economic tear in recent years: Its 5.2 percent real GDP growth last year was second only to oil-boom-fueled North Dakota.

Our analysis ranked Texas No. 1 for business opportunity, largely on the Lone Star State's top scores for its booming economic climate and job growth. Our analysis ranked it No. 3 (behind only California and Washington) for innovation and growth.

Still, Texas ranked only No. 40 for the education and experience of its workforce and No. 24 for its labor costs.

And Texas ranked a somewhat surprisingly low No. 28 in taxes and regulations. While the state boasts that it has no corporate income tax, it does have high property taxes and a combined state and average local sales tax rate (8.05 percent) that's among the dozen highest in the country.

No. 4: Utah

Utah, our No. 1 state in this analysis in 2013, remains a strong candidate for growing a solution provider business. The Beehive State continues to combine a business-friendly economy with an educated workforce and opportunities for innovation and growth.

Utah ranks No. 4 for business opportunity in our analysis, fueled by its 3.1 percent real GDP growth in 2014 (putting it in the top 10 of all states). And while it's only No. 31 in the number of companies in the state, it's ranked No. 5 for the number of fast-growing companies that make the best customers for solution providers.

"Our economy is not very dependent on any one particular sector. I think that helps [the Utah economy] be more resilient," said Spencer Ferguson, president and CEO of Wasatch I.T., a Salt Lake City area solution provider.

The state is ranked an enviable No. 3 for its low-tax, limited-regulations business environment. It has a low 5.0 percent corporate income tax and low property taxes, while its 6.68 percent combined state and average local sales tax is about average for all 50 states.

No. 3: Virginia

Virginia, last year's No. 1 state in our analysis, is still a great place for growing a solution provider business. It's ranked No. 7 for business opportunity, including being ranked No. 3 for having lots of fast-growing companies. And it's No. 13 in innovation and growth potential, despite zero real GDP growth in 2014.

"We are geographically close to a large percentage of federal government customers and buyers. The federal IT marketplace is an $80-billion-per-year business," said Tom Deierlein, CEO of ThunderCat Technology, a Reston, Va.-based solution provider.

The Old Dominion State is No. 9 in taxes and regulations -- it's No. 1, in fact, for having the most business-friendly regulatory environment. The state's combined state and average local sales tax is a low 5.63 percent while the corporate income tax is a moderate 6.0 percent.

Virginia really shines for its highly educated and experienced workforce (ranked No. 2, behind only Vermont), and the Information Technology & Innovation Foundation ranks the state No. 1 for the number of people employed in IT occupations in non-IT industries as a share of total private-sector jobs. But those workers have a big price tag as Virginia is ranked a poor No. 43 for its high labor costs.

No. 2: Washington

Washington ranks No. 2 in innovation and growth (behind No. 1 California), not surprising since it's No. 1 in technology and innovation (according to CNBC America's Top States For Business 2015), No. 1 in the share of the private sector employed as scientists or engineers, No. 1 in the number of awarded patents, and No. 2 for the number of people employed in IT occupations in non-IT industries as a share of total private-sector jobs (just behind Virginia).

The Evergreen State is No. 11 for its highly educated and experienced workforce.

Washington is also very business-friendly, ranked No. 2 for its taxes and regulatory environment. That's largely based on the lack of a corporate income tax -- one of only six states without such a tax. But its combined state and average local sales tax, 8.89 percent, is among the five highest in the country.

No. 1: Colorado

Colorado was in the top three states the first two years we conducted the Best States analysis, but this year it takes the No. 1 spot.

The Centennial State is No. 3 in business opportunity, given its 4.7 percent real GDP growth in 2014 (putting it in the top five states) and its high scores for economic expansion and development. The state also has many smaller, fast-growing businesses (No. 9) that provide solution providers with a pool of potential customers.

Colorado is ranked No. 5 for innovation and growth with good scores for both the number of scientists and engineers in the state and the number of IT workers as a share of the total workforce. It's not surprising the state is No. 7 for its educated and experienced workforce.

"We have a strong higher-education system that is becoming more and more aligned with the needs of technology companies," said Steve Shaffer, founder, president and CEO of Zunesis, a Denver-area IT service and business solution provider.

What may be surprising is the state's business-friendly No. 4 rank for its taxes and regulatory environment, including low corporate income taxes (4.63 percent) and moderate combined state and average local sales taxes (7.44 percent).