The Best And Worst Technology Company Stocks In The First Half Of 2016

Tech Stocks: Decliners Outnumbered Gainers In The First Half Of 2016

The first six months of 2016 have certainly been a mixed bag for the 42 publicly traded solution providers on our watch list. Only 19 saw the value of their shares increase while 22 recorded share price declines. (One recorded no change.)

How does that compare to the stock market indexes overall? While the markets got off to a lousy start in 2016 and seemed to be in turmoil for much of the first half of the year (can you say "Brexit"?), the Dow Jones Industrial Average was actually up just shy of 2.9 percent in the first half of the year, but the Nasdaq was off 3.29 percent.

Here's a look at who was up and who was down in the first half of the year, starting with companies with the biggest gains in share price, based on stock closing prices between Dec. 31, 2015 and June 30, 2016.

Advanced Micro Devices

CEO: Lisa Su

Dec. 31, 2015: $2.87

June 30, 2016: $5.14

Change: +79.09%

In June, AMD acquired software developer HiAlgo in a move the chip maker said laid the groundwork for future gaming technology innovation with AMD's Radeon RX series of GPUs (graphical processing units). Earlier, in February, the company unveiled what it called the first "hardware virtualized" graphical processing units, the AMD FirePro S-Series with Multiuser GPU technology.

For its first quarter, which ended March 26, AMD reported revenue of $832 million, down more than 19 percent from $1.03 billion in the same quarter in 2015. But the company's $109 million net loss for the quarter was an improvement from $180 million.

AT&T

CEO: Randall Stephenson

Dec. 31, 2015: $34.41

June 30, 2016: $43.21

Change: +25.57%

In May, AT&T announced a deal to acquire Quickplay Media, a video streaming service company that AT&T said would help customers stream video content to any device, including mobile phones. The acquisition was completed in late June.

For its first quarter ended March 31, AT&T reported revenue of $40.5 billion, up 24.4 percent year over year from $32.6 billion, largely due to the company's July 2015 acquisition of DirecTV.

Verizon Communications

CEO: Lowell McAdam

Dec. 31, 2015: $46.22

June 30, 2016: $55.84

Change: +20.81%

Verizon's wireline business weathered a seven-week strike by nearly 40,000 employees that ended May 31.

In late February, Verizon struck a deal to acquire fellow telecom company XO Communications for its fiber-optic network assets in a deal worth about $1.8 billion. Earlier in the month, Verizon announced that it was exiting the public cloud service market.

For its first quarter, which ended March 31, Verizon reported revenue of $32.17 billion, up 0.6 percent from $31.98 billion in the same period a year before. Meanwhile, net income was $4.43 billion, up 2.1 percent from $4.34 billion.

Hewlett Packard Enterprise

CEO: Meg Whitman

Dec. 31, 2015: $15.20

June 30, 2016: $18.27

Change: +20.2%

As of Nov. 1, 2015, industry giant Hewlett-Packard Co. became two Fortune 50 companies: HP Inc. focused on the PC and printing business, and Hewlett Packard Enterprise, focused on enterprise computing. Hewlett Packard Enterprise trades under the new stock symbol HPE.

In May, HPE surprised the industry when it announced a deal to spin off its Enterprise Services operation, merging it with CSC to create a $26 billion systems integrator – the third largest solution provider in the industry.

F5 Networks

CEO: John McAdam

Dec. 31, 2015: $96.96

June 30, 2016: $113.84

Change: +17.41%

In early June, F5 Networks hired investment bank Goldman Sachs to explore a potential acquisition by another firm or a private equity company, according to a Reuters report. F5 has reportedly received a number of buyout offers in recent years.

News of the move sent F5's share price soaring more than 13 percent on June 7. That came on top of an increase of more than 25 percent since the stock bottoming out in February. But by June 30, the price had fallen back from a June 23 high of $121.44.

Lexmark International

CEO: Paul Rooke

Dec. 31, 2015: $32.45

June 30, 2016: $37.75

Change: +16.33%

Printer manufacturer Lexmark International is being acquired for $3.6 billion ($40.50 per share) by a group of investors under a deal disclosed in April. The acquisition, led by Chinese-based inkjet and laser printer hardware manufacturer Apex Technology, is expected to close in the second half of this year.

The sale follows Lexmark's announcement in October that it had begun an "exploration of strategic alternatives to enhance shareholder value." That followed a long period during which Lexmark was transitioning from a hardware-centric printer manufacturing company to focus more on document management software and print management solutions.

CA Technologies

CEO: Michael Gregoire

Dec. 31, 2015: $28.56

June 30, 2016: $32.83

Change: +14.95%

In May, CA Technologies said revenue in its fourth quarter, which ended March 31, was $1.01 billion, down 1 percent from just over $1.02 billion in the same quarter one year before. But net income for the quarter was up more than 13 percent, to $174 million from $151 million.

Revenue for all of fiscal 2016 was $4.03 billion, down 6 percent year over year from $4.26 billion in fiscal 2015. Meanwhile, net income was $783 million, down 7.4 percent from $846 million in fiscal 2015.

CA Technologies has been reinventing itself with a focus on systems and cloud management, security and DevOps software. In June, the company debuted new comprehensive cloud technology-monitoring capabilities in its CA Unified Infrastructure Management software.

Netgear

CEO: Patrick Lo

Dec. 31, 2015: $41.91

June 30, 2016: $47.54

Change: +13.43%

For its first quarter ended April 3, networking product manufacturer Netgear reported revenue of $310.3 million, up a fraction of 1 percent from $309.2 million in the same period a year before. But net income more than doubled to $16.6 million from $8 million.

Oracle

CEOs: Safra Catz and Mark Hurd

Dec. 31, 2015: $36.53

June 30, 2016: $40.93

Change: +12.04%

In June, Oracle reported that revenue in its fiscal 2016 fourth quarter, which ended May 31, was $10.59 billion, down 1 percent from $10.71 billion in the same quarter one year before. Meanwhile, net income was $2.81 billion, up 2 percent from $2.76 billion.

For all of fiscal 2016, revenue was $37.05 billion, down 3 percent from $38.23 billion in fiscal 2015. Net income for fiscal 2016 was $8.9 billion, down 10 percent from $9.94 billion in fiscal 2015.

On June 30, a superior court jury in Santa Clara County, Calif., ruled that Oracle had to pay Hewlett Packard Enterprise $3 billion in damages in a long-running contract dispute with HPE. Somewhat surprisingly, the news had little impact on Oracle's stock price.

IBM

CEO: Virginia Rometty

Dec. 31, 2015: $137.62

June 30, 2016: $151.78

Change: +10.29%

IBM was active on the acquisition front in the first quarter, snatching up eight companies to expand its product and service offerings. The biggest was Truven Health Analytics, a provider of cloud-based health care data and analytics services, for $2.6 billion. On March 31, IBM disclosed a deal to acquire Blue Wolf Group, a leading strategic service provider, for an undisclosed sum.

For the company's first quarter, which ended March 31, IBM reported revenue of $18.68 billion, down nearly 5 percent from $19.59 billion in the same quarter in 2015. Meanwhile, net income was $2.01 billion, down more than 13 percent from $2.33 billion.

CommVault Systems

CEO: N. Robert Hammer

Dec. 31, 2015: $39.35

June 30, 2016: $43.19

Change: +9.76%

CommVault, a developer of data protection and information management systems, reported sales of $159.6 million for its fiscal 2016 fourth quarter, which ended March 31, up nearly 6 percent from $150.7 percent in the same period in 2015. Meanwhile, net income was nearly $5.8 million, up 73 percent from $3.4 million.

For all of fiscal 2016, the company reported revenue of $595.1 million, down 2 percent from $607.5 million in fiscal 2015. Net income for the year was only $136,000, compared to $25.7 million in fiscal 2015.

HP

CEO: Dion Weisler

Dec. 31, 2015: $11.84

June 30, 2016: $12.55

Change: +6%

HP Inc. markets personal systems and printers. The company was created in November 2015 through the split of Hewlett-Packard Co. into HP Inc. and Hewlett Packard Enterprise.

In May, HP CEO Dion Weisler told CRN that the $55 billion company was making "solid progress" in protecting its core PC and printing businesses while investing in potential growth areas like 3-D printing.

In February, the company accelerated a cost-cutting plan, including the elimination of 3,000 jobs in the current fiscal year rather than over three years as originally planned. And in June, the company sold off its multi-channel marketing software assets, deemed no longer core to its business, to OpenText for $315 million.

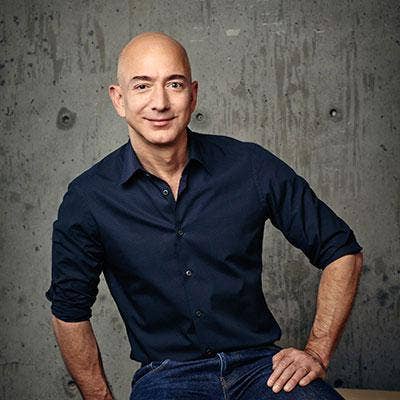

Amazon

CEO: Jeff Bezos

Dec. 31, 2015: $675.89

June 30, 2016: $715.62

Change: +5.88%

Amazon's stock was down more than 12 percent in the first quarter, so it made quite a recovery in the second quarter to finish the first half of the year on the plus side. The first-quarter decline might be blamed on stockholders selling to lock in their gains after the company's share price more than doubled in value in 2015.

In April, meanwhile, Amazon -- the parent of cloud behemoth Amazon Web Services (AWS) -- reported that sales reached $29.1 billion in the first quarter ending March 31, up 28 percent from $22.7 billion in the same period a year earlier. The company reported net income of $513 million, compared to a $57 million loss one year before.

AWS sales reached $2.57 billion in the quarter, up 64 percent year over year from $1.57 billion.

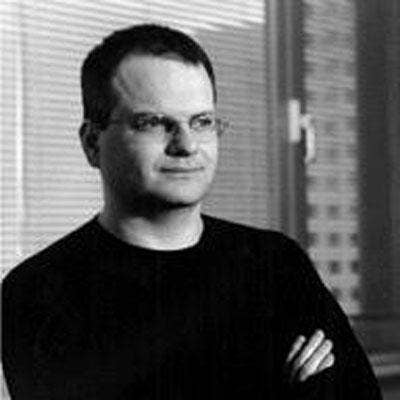

Citrix Systems

CEO: Kirill Tatarinov

Dec. 31, 2015: $75.65

June 30, 2016: $80.09

Change: +5.87%

In January Citrix named former Microsoft executive Kirill Tatarinov as its CEO. At Microsoft, Tatarinov managed the vendor's $2 billion Business Solutions division, including its Dynamics ERP and CRM software products, before leaving last June in an executive reshuffling.

Citrix reported revenue of $825.7 million for its first quarter, which ended March 31, up 8.5 percent from $760.8 million a year earlier. Meanwhile, net income soared 65 percent to $83.5 million from $28.9 million.

EMC

CEO: Joe Tucci

Dec. 31, 2015: $25.68

June 30, 2016: $27.17

Change: +5.8%

EMC has been moving ever closer to its proposed acquisition by Dell for more than $62 billion.

Under the acquisition deal, EMC shareholders are to receive $24.05 and 0.111 share of Dell holding company Denali Holding tracking stock, tied to the performance of VMware, for each share of EMC stock. Dell shareholders are scheduled to vote on the acquisition July 19. The companies expect to complete the acquisition sometime before October.

Cisco Systems

CEO: Chuck Robbins

Dec. 31, 2015: $27.16

June 30, 2016: $28.69

Change: +5.63%

In June, Cisco struck a deal to acquire CloudLock, a developer of cloud-based security technology, for $293 million. That was Cisco's fourth security-related acquisition in the previous 12 months.

Cisco has been expanding into such areas as hyper-converged computing, security and the Internet of Things. But an IDC report in June said the company was losing market share in its bread-and-butter networking equipment business, particularly to Hewlett Packard Enterprise in Ethernet switching and Huawei in routers.

Meanwhile, Chuck Robbins, who took the reins as CEO last year, launched a reorganization of the company's 25,000-member engineering operations into four groups, targeting networking, security, cloud services and platforms.

Fortinet

CEO: Ken Xie

Dec. 31, 2015: $31.17

June 30, 2016: $31.59

Change: +1.35%

In March, Fortinet acknowledged that Chief Marketing Officer Holly Rollo and Pete Brant, senior vice president of Americas enterprise sales, had left the company, the latest of several top executive departures over the past year.

In April, the company said that changes in its sales force structure and product lineup resulted in double-digit sales growth in the first quarter. Revenue for the quarter ending March 31 was $284.6 million, up 34 percent from $212.9 million in the same quarter a year before. But the company reported a $3.4 million net loss for the quarter, compared to net income of $1.6 million in 2015.

In June, Fortinet jumped into the market for security information and event management technology with its $28 million acquisition of AccelOps.

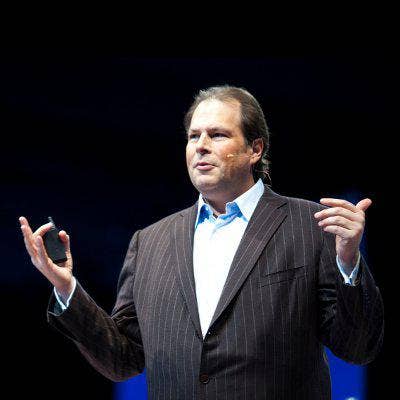

Salesforce.com

CEO: Marc Benioff

Dec. 31, 2015: $78.40

June 30, 2016: $79.41

Change: +1.29%

For its first quarter of fiscal 2017 (which ended April 30), Salesforce.com reported revenue of $1.92 billion, up 27 percent from $1.51 billion in last year's first quarter. Net income was $38.8 million, up more than 847 percent from $4.1 million a year before.

The company is forecasting that revenue for the year will be in the range of $8.16 billion to $8.20 billion. Last year, CEO Marc Benioff vowed to be the fastest software company – and the first cloud company – to hit $10 billion in revenue.

Salesforce is also developing an alliance with cloud hosting giant Amazon Web Services, with details to be announced at the annual Dreamforce conference in October.

VMware

CEO: Pat Gelsinger

Dec. 31, 2015: $56.57

June 30, 2016: $57.22

Change: +1.15%

Given that EMC owns 80 percent of VMware's stock, the virtualization technology company's share price has fluctuated in the last six months as Dell's planned acquisition of EMC moves closer to fruition. VMware shares lost more than 31 percent of their value in the last quarter of 2015, and the slide continued into the first quarter of this year. But the stock recovered enough in the second quarter to put it in the "plus" column for the first half of 2016.

In April, VMware's top cloud computing executive, Bill Fathers, left the company – the latest in a string of executive departures. In March, president and chief operating officer Carl Eschenbach suddenly left the company, one month after Martin Casado, VMware's top software-defined networking executive, left to join a venture capital firm.

On April 19, VMware announced a $1.2 billion stock buyback program, a move that may have given the company's stock a boost.

Brocade Communications Systems

CEO: Lloyd Carney

Dec. 31, 2015: $9.18

June 30, 2016: $9.18

Change: 0.00%

On March 29. Brocade announced that it had acquired StackStorm, a provider of software for automating data center operations, for an undisclosed sum.

Two months later, on May 27, Brocade closed its acquisition of wireless technology supplier Ruckus Wireless for $1.2 billion, a deal that was announced April 4.

Also in May, Brocade said revenue in its fiscal 2016 second quarter (which ended April 30) was $523.3 million, down 4 percent from $546.6 million one year earlier. Meanwhile, net income for the quarter was $43.1 million, down 44 percent from $77 million.

Check Point Software Technologies

CEO: Gil Shwed

Dec. 31, 2015: $81.38

June 30, 2016: $79.68

Change: -2.09%

Check Point is the first company on our index to record a decline in its stock price in the first half of 2016.

For its first quarter, which ended March 31, the security software developer reported revenue of $404.3 million, up 8.5 percent from $372.6 million in the same period one year earlier. Net income for the quarter was $167.4 million, up 4 percent from $160.9 million.

Symantec

CEO: Michael Brown

Dec. 31, 2015: $21.00

June 30, 2016: $20.54

Change: -2.19%

More than a year after announcing a plan to spin off Veritas, its data management technology unit, Symantec completed that split Jan. 29 by selling Veritas to a private equity firm and emerging as a company focused solely on its security products.

On June 13, Symantec announced a deal to acquire security software developer Blue Coat Systems for $4.65 billion. The companies also said that Blue Coat CEO Greg Clark would become Symantec's new CEO – succeeding the outgoing Michael Brown – when the acquisition is completed sometime in the third quarter. (On July 11, Symantec said Blue Coat president and COO Michael Fey would assume the same posts at Symantec once the acquisition is complete.)

Intel

CEO: Brian Krzanich

Dec. 31, 2015: $34.45

June 30, 2016: $32.80

Change: -4.79%

Stagnant PC sales have meant slower revenue growth for Intel in recent years given its dependence on selling processors for that market. The company has struggled to compete in the market for chips for mobile devices, but it has been growing its sales of processors for data center systems, the nascent Internet-of-Things market and other emerging areas.

For its first quarter, which ended April 2, Intel reported revenue of $13.7 billion, up more than 7 percent from $12.78 billion in the same quarter one year before. Net income for the quarter was $2.05 billion, up nearly 3 percent from $1.99 billion a year earlier.

In May, Intel acquired Itseez, a company that develops computer-vision algorithms and implementations for embedded and specialized hardware, technology with potential applications in the Internet of Things market.

SAP

CEO: Bill McDermott

Dec. 31, 2015: $79.10

June 30, 2016: $75.02

Change: -5.16%

SAP has been undergoing a massive transformation from its core business of selling on-premise applications to providing cloud-based applications and services to customers of all sizes. In the first quarter, which ended March 31, cloud subscription and cloud revenue grew 33 percent year over year.

At SAP's Sapphire conference in May, the company unveiled a relationship with Microsoft to integrate some of their key products, including Microsoft Office 365 with SAP's cloud applications, and to develop support for SAP's HANA data management and application platform on Microsoft's Azure cloud platform.

Qlik Technologies

CEO: Lars Bjork

Dec. 31, 2015: $31.66

June 30, 2016: $29.58

Change: -6.57%

Qlik Technologies, a developer of data analysis and visualization software, announced June 2 that it would be acquired by private equity firm Thoma Bravo. Bravo is paying $30.50 per share of Qlik stock, putting the total value of the acquisition at $3 billion.

The companies expect to complete the acquisition in the third quarter. The move wasn't a complete surprise; in March, Reuters reported that Qlik, facing pressure from activist investor Elliott Management, had retained investment bank Morgan Stanley to explore a possible sale.

In its first quarter, which ended March 31, Qlik reported revenue of $138 million, up nearly 15 percent from $120.3 million in the same period one year earlier. But the company reported a $27 million net loss for the quarter.

NetApp

CEO: George Kurian

Dec. 31, 2015: $26.53

June 30, 2016: $24.59

Change: -7.31%

NetApp is another company coming off a turbulent 2015, which included declining revenue, staff cuts and the firing of the vendor's CEO, Tom Georgens. George Kurian, executive vice president of product operations, was named to replace him and has been working in 2016 to get the company back on track.

In February, NetApp, a supplier of data management and cloud storage systems, completed its acquisition of all-flash storage array startup Solidfire in an $870 million deal announced at the end of 2015.

In May, NetApp reported that revenue in its fiscal 2016 fourth quarter, which ended April 29, was $1.38 billion, down nearly 15 percent from $1.54 billion in the same quarter one year earlier. The company reported an $8 million loss for the quarter, compared to net income of $135 million a year before.

For all of fiscal 2016, NetApp reported revenue of $5.55 billion, down more than 9 percent from $6.12 billion in fiscal 2015. The company reported net income of $229 million for the year, down 59 percent from $560 million the year before.

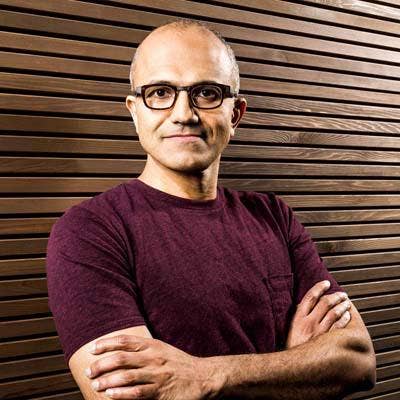

Microsoft

CEO: Satya Nadella

Dec. 31, 2015: $55.48

June 30, 2016: $51.17

Change: -7.77%

On June 13, Microsoft stunned the industry when it announced a deal to acquire LinkedIn for $26.2 billion, or $196 per share. The software company plans to develop links between its Office 365 and Dynamics cloud applications and LinkedIn's business-focused social media site.

For its fiscal 2016 third quarter, which ended March 31, Microsoft reported revenue of $20.53 billion, down 5.5 percent from $21.73 billion in last year's third quarter. Net income in the quarter tumbled nearly 25 percent to $3.76 billion from $4.99 billion a year earlier.

Microsoft will report its fourth-quarter and fiscal 2016 results July 19.

The news on July 7 that Chief Operating Officer Kevin Turner is leaving Microsoft to become CEO of Citadel Securities came after the period covered in this stock price analysis.

Splunk

CEO: Doug Merritt

Dec. 31, 2015: $58.81

June 30, 2016: $54.18

Change: -7.87%

For its fiscal 2017 first quarter, which ended April 30, Splunk, a fast-growing developer of real-time operational intelligence software, reported revenue of $186 million, up 48 percent from $125.7 million in the same quarter a year earlier. But the company's net loss of $100.9 million for the quarter exceeded a $71.2 million loss from a year before.

Alphabet (Google)

CEO: Larry Page

Dec. 31, 2015: $758.88

June 30, 2016: $692.10

Change: -8.8%

In 2015, Google created a new operating structure that included Alphabet, a holding company that includes the traditional Google business, along with other nascent operations and projects. The new structure took effect Oct. 2, with every share of Google stock automatically converting to Alphabet stock.

Alphabet reported revenue of $20.26 billion in its first quarter, which ended March 31, up 17 percent from $17.26 billion in the same period one year earlier. Meanwhile, net income was up nearly 20 percent, to $4.21 billion from $3.56 billion.

Alphabet is scheduled to report its second-quarter results July 28.

Apple

CEO: Tim Cook

Dec. 31, 2015: $105.26

June 30, 2016: $95.60

Change: -9.18%

While it may not have directly impacted the company's finances or stock price, the big news surrounding Apple in early 2016 was its very public fight with the FBI over the law enforcement agency's demands that Apple help it unlock an iPhone owned by one of the attackers in the San Bernardino, Calif., shooting late last year that left 14 people dead and seriously injured 22 others.

Apple reported revenue of $50.56 billion for its fiscal 2016 second quarter (ended March 26), down nearly 13 percent from $58.01 billion in the same quarter one year earlier. Net income was $10.52 billion, down more than 22 percent from $13.57 billion year over year.

Xerox

CEO: Ursula Burns

Dec. 31, 2015: $10.63

June 30, 2016: $9.49

Change: -10.72%

On Jan. 29, Xerox unveiled a plan to split into two companies, one focused on printers and document technology hardware and the other on business process outsourcing services. Once the separation is complete later this year, the new companies will have annual sales of $11 billion and $7 billion, respectively.

On June 13, Xerox announced that Ashok Vemuri, former CEO of solutions provider iGate, would lead the new Conduent business services company. A little more than a week later, Xerox named Jeff Jacobson, a veteran of the printing and graphics industry who joined Xerox in 2012 and managed the company's technology division, as CEO of the new document technology company.

Red Hat

CEO: James Whitehurst

Dec. 31, 2015: $82.81

June 30, 2016: $72.60

Change: -12.33%

Red Hat cracked the $2 billion threshold in its fiscal 2016 (ended Feb. 29) with the open-source software developer reporting that revenue reached $2.05 billion during the year, up nearly 15 percent from $1.79 billion in fiscal 2015. Net income for the fiscal year was $199.4 million, up more than 10 percent from $180.2 in fiscal 2015.

For its fiscal 2017 first quarter, which ended May 31 Red Hat reported revenue of $567.9 million, up 18 percent from $481 million in the first quarter of fiscal 2016. Net income for the quarter was $61.2 million, up 27 percent from $48.1 million a year before.

On June 22, Red Hat announced a deal to acquire 3scale, a leading developer of API management technology. That same day, the company unveiled a $1 billion stock repurchase program.

NetSuite

CEO: Zach Nelson

Dec. 31, 2015: $84.62

June 30, 2016: $72.80

Change: -13.97%

On March 2, NetSuite acquired IQuity's cloud business in a move that allowed NetSuite to add next-generation manufacturing capabilities to its ERP cloud application suite and meet the needs of both discrete and batch process manufacturers. Terms of the deal were not disclosed.

For its first quarter, which ended March 31, NetSuite reported revenue of $216.6 million, up 31 percent from $164.8 million in the same quarter one year earlier. But the company's net loss for the quarter widened to $29.7 million from $22.7 million.

Juniper Networks

CEO: Rami Rahim

Dec. 31, 2015: $27.60

June 30, 2016: $22.49

Change: -18.51%

In January, Juniper Networks struck a deal to acquire software networking specialist BTI Systems in a move that Juniper's channel partners said would boost the vendor's software sales.

For the company's first quarter, which ended March 31, Juniper reported revenue of just under $1.1 billion, up nearly 3 percent from $1.07 billion in the same quarter one year earlier. Net income was $91.4 million, up 14 percent from $80.2 million.

Despite the gains, CEO Rami Rahim called the results "disappointing" and Wall Street analysts downgraded their 2016 outlook for the vendor.

FireEye

CEO: Kevin Mandia

Dec. 31, 2015: $20.74

June 30, 2016: $16.47

Change: -20.59%

After four years at the helm of FireEye, CEO Dave DeWalt announced May 5 that he would step down and become the security vendor's executive chairman. Kevin Mandia, who joined FireEye in 2014 when it acquired Mandiant and has been serving as the company's president, became FireEye's new CEO effective June 15.

For its first quarter, which ended March 31, FireEye reported revenue of $168 million, up 34 percent from $125.4 million in the same quarter one year earlier. The company's loss grew to $155.9 million in the quarter from $134 million one year before.

Western Digital

CEO: Steve Milligan

Dec. 31, 2015: $60.05

June 30, 2016: $47.26

Change: -21.30%

In May, disk drive manufacturer Western Digital completed its $19 billion acquisition of SanDisk, a leading manufacturer of flash memory storage microprocessors. Western Digital acquired SanDisk's outstanding stock for $67.50 per share in cash, plus 0.2387 shares of Western Digital common stock.

Western Digital said the acquisition makes the company "a comprehensive storage solutions provider with global reach, and an extensive product and technology platform that includes deep expertise in both rotating magnetic storage and non-volatile memory."

On June 8, Western Digital said it received an unsolicited "mini-tender offer" from TRC Capital to purchase up to 2.5 million shares for $42.95 a share. Western Digital has recommended that shareholders reject the offer.

BlackBerry

CEO: John Chen

Dec. 31, 2015: $9.28

June 30, 2016: $6.71

Change: -27.7%

For its fiscal 2017 first quarter, which ended May 31, BlackBerry reported revenue of $400 million, down 39 percent from $658 in the same quarter one year earlier. Even more significant was the $670 million loss the mobile communications company recorded in the quarter, compared to the $68 million profit reported a year before.

The loss included a $501 million long-lived asset impairment charge, a $57 million goodwill impairment charge, an inventory write-down of $41 million, $23 million in restructuring charges, and other write-offs.

For all of fiscal 2016, which ended Feb. 29, BlackBerry reported revenue of $2.16 billion, down 35 percent from $3.34 billion in fiscal 2015. The company reported a loss of $208 million for the fiscal year compared to a loss of $304 million in fiscal 2015.

Palo Alto Networks

CEO: Mark McLaughlin

Dec. 31, 2015: $176.14

June 30, 2016: $122.64

Change: -30.37%

For its fiscal 2016 third quarter, which ended April 30, security technology developer Palo Alto Networks reported revenue of $345.8 million, up nearly 48 percent from $234.2 million in the same quarter one year earlier. But the company's net loss widened to $70.2 million from $45.9 million one year ago.

Seagate Technology

CEO: Stephen Luczo

Dec. 31, 2015: $36.66

June 30, 2016: $24.36

Change: -33.55%

While Seagate's stock has rebounded somewhat in mid-July to around $30 per share (beyond the timeframe in this analysis), it had been on a downward trajectory for some time, even falling below $21 on June 27.

For its fiscal 2016 third quarter, which ended April 1, Seagate reported revenue of $2.6 billion, down 22 percent from $3.33 billion in the same period a year ago. The storage technology developer reported a $21 million loss for the quarter compared to net income of $291 million one year earlier.

But business appears to have improved in the fourth quarter (ended July 1): A preliminary reading of the quarter's results showed revenue reaching $2.65 billion, the company said July 11, better than earlier guidance of around $2.3 billion.

Lenovo Group

CEO: Yang Yuanqing

Dec. 31, 2015: $20.08

June 30, 2016: $12.08

Change: -39.84%

Lenovo has been hit hard by the worldwide slowdown in PC sales, which took a toll on the company's revenue and earnings in the last year. In March, the company announced a corporate restructuring that saw the departure of Motorola Mobility president Rick Osterloh.

In May, the company reported that revenue in its fiscal 2016 fourth quarter (ended March 31) was $9.13 billion, down 19 percent from $11.3 billion in the same quarter one year earlier. But the company reported net income of $180 million, up 80 percent from $100 million.

For all of fiscal 2016, revenue was down 3 percent year over year to $44.9 billion, while the company recorded a loss of $128 million for the year.

Tableau Software

CEO: Christian Chabot

Dec. 31, 2015: $94.22

June 30, 2016: $48.92

Change: -48.08%

Tableau is a leading player in the highly competitive market for data visualization and analytics software, going up against major vendors like Microsoft and Qlik Technologies. And the level of that competition has put pressure on the price of Tableau's stock in recent quarters. Its shares lost nearly 50 percent of their value on Feb. 5 because of what financial analysts viewed as weak guidance for future growth.

In March, Tableau acquired HyPer, a developer of a high-performance, main-memory database technology, for an undisclosed amount.

For its first quarter, which ended March 31, Tableau reported revenue of $171.7 million, up 32 percent from $130.1 million in the same quarter one year before. But the company reported a net loss of $45.6 million for the quarter compared to the $10 million loss reported a year earlier.

Quantum

CEO: Jon Gacek

Dec. 31, 2015: $0.93

June 30, 2016: $0.42

Change: -54.84%

While Quantum's stock price declined by only 51 cents in the first half of 2016, that accounted for more than half its value, putting the data storage technology company at the bottom of our list.

For its fiscal 2016 fourth quarter, which ended March 31, Quantum reported revenue of $120 million, down nearly 19 percent from $147.8 million in the same quarter one year before. The company also reported a loss of $52.4 million compared to income of $12.9 million one year earlier.

For all of fiscal 2016, Quantum reported revenue of just under $476 million, down 14 percent from $553.1 million in fiscal 2015. It reported a net loss of $74.7 million for fiscal 2016, compared to net income of $16.8 million in fiscal 2015.