The Best And Worst Technology Company Stocks In The Third Quarter Of 2016

Tech Stocks: Most Companies See Price Increase In Q3

The third quarter of 2016 was a good one for technology company shareholders with 36 of the 42 publicly traded companies on our watch list recording stock price gains during the quarter and only six seeing their share prices decline. Several enjoyed share price increases greater than 50 percent.

How does that compare to the stock market indexes overall? While the markets got off to a rough start in 2016, the Dow Jones Index was up 2.11 percent in the third quarter, and the Nasdaq was up an impressive 9.69 percent.

Here's a look at who was up and who was down in the third quarter ended Sept. 30, starting with companies with the biggest gains in share price, based on stock closing prices between June 30, 2016 and Sept. 30, 2016.

Quantum

CEO: Jon Gacek

June 30, 2016: $0.42

Sept. 30, 2016: $0.74

Change: +76.19%

In a case of worst-to-first, data storage technology vendor Quantum saw the value of its stock "surge" by more than 76 percent in the third quarter. Of course, with the stock's price below $1 per share, it only took a per-share price increase of 32 cents to achieve that.

For its fiscal 2017 second quarter ended Sept. 30, Quantum reported that revenue grew 15 percent to $134.7 million from $117.0 million one year earlier. Net income was $3.8 million compared to a $11.2 million net loss one year before.

Seagate Technology

CEO: Stephen Luczo

June 30, 2016: $24.36

Sept. 30, 2016: $38.55

Change: +58.25%

The third quarter was obviously a good one for disk drive makers with Seagate coming in at No. 2 behind Quantum. Seagate's stock rebounded during the summer following a long decline that saw its shares fall below $21 per share on June 27.

On Sept. 9 Seagate announced that activist hedge fund management firm, ValueAct, would acquire 9.5 million shares of Seagate stock, making it one of Seagate's largest shareholders.

NetSuite

CEO: Zach Nelson

June 30, 2016: $72.80

Sept. 30, 2016: $110.69

Change: +52.05%

On July 28 Oracle and NetSuite announced an agreement for Oracle to acquire cloud application developer NetSuite for $109 per share or approximately $9.3 billion. On Nov. 5, after the period covered by this analysis, Oracle said a majority of NetSuite shares unaffiliated with Oracle CEO Larry Ellison and his family had been tendered and the acquisition was completed Nov. 7. NetSuite will be de-listed from the New York Stock Exchange on Nov. 18.

In its third quarter ended Sept. 30, NetSuite reported revenue of $243.9 million, up 26 percent from $192.8 million in the same quarter one year earlier. The company's net loss for the third quarter was $34.1 million compared to the $37.3 million loss reported one year before.

NetApp

CEO: George Kurian

June 30, 2016: $24.59

Sept. 30, 2016: $35.82

Change: +45.67%

After a turbulent 2015 that included declining revenue, staff cutbacks and the firing of its CEO, NetApp appears to have stabilized this year under CEO George Kurian and could be set for a rebound.

For the fiscal 2017 first quarter ended July 29 NetApp, a supplier of data management and cloud storage systems, reported revenue of more than $1.29 billion, down 3 percent from $1.34 billion in the same period one year earlier. The company reported income of $64 million, compared to a $30 million loss one year before.

Advanced Micro Devices

CEO: Lisa Su

June 30, 2016: $5.14

Sept. 30, 2016: $6.91

Change: +34.44%

On Sept. 9 AMD announced a public offering of $600 million in common stock and $700 million of convertible senior notes due 2026. The company said it would use the proceeds from the sales to repay borrowings under its credit facility and/or purchase outstanding senior notes.

Earlier in September AMD unveiled its Bristol Ridge seventh-generation processors for PCs with improved graphics capabilities and performance.

Palo Alto Networks

CEO: Mark McLaughlin

June 30, 2016: $122.64

Sept. 30, 2016: $159.33

Change: +29.92%

On Aug. 30 Palo Alto Networks reported financial results for fiscal 2016 and the fourth quarter, both ended July 31. Revenue for the fourth quarter increased 41 percent year-over-year to $400.8 million while revenue for the fiscal year grew 49 percent to $1.38 billion. But the security technology company reported a $54.5 million net loss for the quarter and a $225.9 million net loss for the fiscal year.

On Aug. 26 the company's board authorized a $500 million share buy-back program, lasting through Aug. 31, 2018.

On Aug. 22 Palo Alto Networks promoted Mark Anderson, the company's top sales executive, to company president with overall responsibility for sales, go-to-market strategy, customer support and business development. To replace him the company hired Dave Peranich, a nine-year executive at Riverbed Technology, as executive vice president of worldwide sales.

VMware

CEO: Pat Gelsinger

June 30, 2016: $57.22

Sept. 30, 2016: $73.35

Change: +28.19%

With Dell's blockbuster acquisition of EMC a done deal, Dell now owns EMC's 80 percent stake in VMware. Dell CEO Michael Dell, speaking at VMworld in August, promised to keep the VMware ecosystem open.

For its third quarter ended September 30, VMware reported revenue of $1.78 billion, up more than 6 percent from $1.67 billion in the same quarter last year. Net income for the quarter was $319 million, up almost 25 percent from $256 million one year before.

Netgear

CEO: Patrick Lo

June 30, 2016: $47.54

Sept. 30, 2016: $60.49

Change: +27.24%

For its third quarter ended Oct. 2, Netgear reported revenue of $338.5 million, down 1 percent from $341.9 million in last year's third quarter. Net income for the quarter rose nearly 40 percent, however, to $21.1 million from $15.1 million one year earlier.

Hewlett Packard Enterprise

CEO: Meg Whitman

June 30, 2016: $18.27

Sept. 30, 2016: $22.75

Change: +24.52%

We're approaching the one-year anniversary of the split of industry giant Hewlett-Packard Co. into two Fortune 50 companies: HP Inc. focused on the PC and printing business, and Hewlett Packard Enterprise focused on enterprise computing. Hewlett Packard Enterprise trades under the stock symbol HPE.

In May, HPE surprised the industry when it announced a deal to spin off its Enterprise Services operation, merging it with CSC to create a $26 billion systems integrator – the third largest solution provider in the industry. The deal, which led to a surge in HPE's stock price in the second quarter, is expected to be completed in March 2017.

For its fiscal 2016 third quarter ended July 31, HPE reported sales of $12.21 billion, down more than 6 percent from $13.06 billion in the third quarter one year earlier. But net earnings increased more than 10-fold to $2.72 billion from $224 million one year ago.

HP Inc.

CEO: Dion Weisler

June 30, 2016: $12.55

Sept. 30, 2016: $15.53

Change: +23.75%

And HP Inc., the other company created through the split of Hewlett-Packard, is also enjoying a stock bounce one year after its launch.

On Sept. 12, HP announced a deal to acquire rival Samsung Electronics' printer business for $1.05 billion. HP expects to complete the acquisition by September 2017.

For its fiscal 2016 third quarter ended July 31, HP reported revenue of $11.89 billion, down nearly 4 percent from $12.36 billion in the third quarter one year earlier. Net earnings for the quarter were $783 million, down more than 8 percent from $854 million one year ago.

Western Digital

CEO: Steve Milligan

June 30, 2016: $47.26

Sept. 30, 2016: $58.47

Change: +23.72%

In May disk drive manufacturer Western Digital completed its $19 billion acquisition of SanDisk, a leading manufacturer of flash memory storage microprocessors. Western Digital acquired SanDisk's outstanding stock for $67.50 per share in cash, plus 0.2387 shares of Western Digital common stock.

On July 6 Western Digital appointed Mark Long as executive vice president of finance, in addition to his role as chief strategy officer. As of Sept. 1, he succeeded Olivier Leonetti as the company's CFO, who left the company to pursue other opportunities.

For its fiscal 2017 first quarter ended Sept. 30, Western Digital reported revenue of $4.71 billion, up more than 40 percent from $3.36 billion in the first quarter of fiscal 2016. But the company reported a net loss of $366 million compared to net income of $283 one year earlier. The loss included charges associated with the company's recent acquisitions and debt extinguishment charges related to its re-pricing and repayment of outstanding debt.

Commvault Systems

CEO: N. Robert Hammer

June 30, 2016: $43.19

Sept. 30, 2016: $53.13

Change: +23.01%

Commvault, a developer of data protection and information management systems, reported sales of $159.3 million for its fiscal 2017 second quarter ended September 30. That was up more than 13 percent from $140.7 percent in the same period one year before. The company reported a net loss of $562,000 for the quarter, a significant improvement from the $2.6 million loss in the same quarter one year before.

Symantec

CEO: Michael Brown

June 30, 2016: $20.54

Sept. 30, 2016: $25.10

Change: +22.20%

On June 13 Symantec announced a deal to acquire security software developer Blue Coat Systems for $4.65 billion, and the acquisition was completed Aug. 1. Blue Coat CEO Greg Clark became Symantec's new CEO while Blue Coat president and chief operating officer Michael Fey took on those same posts at Symantec.

For the company's fiscal 2017 first quarter ended July 1, Symantec reported revenue of $884 million, down 3 percent from $912 million in the same quarter one year earlier. Net income was $135 million, up 15 percent from $117 million one year ago.

SAP

CEO: Bill McDermott

June 30, 2016: $75.02

Sept. 30, 2016: $91.41

Change: +21.85%

SAP's cloud subscription and support revenue surged 28 percent in the company's third quarter ended Sept. 30, and the vendor's next-generation S/4 HANA line of business applications continued to attract new customers.

SAP reported total revenue of 5.38 billion Euros (U.S. $5.85 billion) for the quarter, up 8 percent from 4.99 billion Euros (U.S. $5.43 billion) in the same quarter one year earlier. After-tax profit was 725.0 million Euros (U.S. $788.9 million), down 19 percent from 895.0 million Euros (U.S. $973.2 million) one year earlier.

In September SAP announced a plan to invest $2.2 billion over the next five years to expand its portfolio of Internet of Things products.

BlackBerry

CEO: John Chen

June 30, 2016: $6.71

Sept. 30, 2016: $7.98

Change: +18.93%

In September BlackBerry said the company would no longer undertake any hardware development work itself, and would instead outsource design and manufacturing to other companies. The company will continue to sell BlackBerry branded phones running Android software and is ramping up its security software business.

For its fiscal 2017 second quarter ended Aug. 31, BlackBerry reported revenue of $334 million, down nearly 39 percent from $490 million in the same quarter one year earlier. The company reported a net loss of $372 million for the quarter compared to net income of $51 million one year before.

On Sept. 28, the same day of the Q2 earnings announcement, BlackBerry named Steven Capelli as the company's chief financial officer. Capelli was president of worldwide field operations at Sybase, now owned by SAP. He replaced James Yersh, who left the company for personal reasons.

Apple

CEO: Tim Cook

June 30, 2016: $95.60

Sept. 30, 2016: $113.05

Change: +18.25%

Apple began selling the iPhone 7 and 7 Plus in September. Product reviewers were lukewarm on the product due to its lack of innovative new features.

Apple's fiscal 2016 (ended Sept. 24) revenue came in at $215.64 billion, a 7.7 percent decline from $233.72 billion in fiscal 2015 – the first decline in the company's annual revenue since 2001. The company reported falling sales of iPhones and iPads and a significant drop (10.3 percent) in sales of the company's aging Mac laptop and desktop computers.

Amazon

CEO: Jeff Bezos

June 30, 2016: $715.62

Sept. 30, 2016: $837.31

Change: +17.00%

For its third quarter ended Sept. 30, Amazon reported sales of $32.71 billion, up 29 percent from $25.36 billion in the same quarter one year earlier. Net income was $252 million, up 219 percent from $79 million one year before.

During the quarter Amazon Web Services racked up sales of $3.23 billion, up 55 percent from $2.09 billion in last year's third quarter.

Fortinet

CEO: Ken Xie

June 30, 2016: $31.59

Sept. 30, 2016: $36.93

Change: +16.90%

For its third quarter ended Sept. 30, Fortinet reported revenue of $316.6 million, up 22 percent from $260.1 million in last year's third quarter. But net income fell 23 percent to $6.3 million from $8.2 million a year ago.

Fortinet, which has struggled through a year of layoffs and restructurings, stunned analysts in early October before announcing third quarter results when the company acknowledged that it had fumbled earlier forecasts for the quarter.

Intel

CEO: Brian Krzanich

June 30, 2016: $32.80

Sept. 30, 2016: $37.75

Change: +15.09%

On Sept. 7 Intel completed a deal to sell its Intel Security business to TPG Capital for $4.2 billion, essentially undoing the company's 2010 acquisition of McAfee for $7.7 billion

On Sept. 19 Intel announced that it had appointed Bob Swan, an operating partner at private equity firm General Atlantic, to be the chip manufacturer's new CFO. He replaced Stacy Smith who took on a broader role overseeing manufacturing, sales and operations.

For its third quarter ended Oct. 1, Intel reported revenue of $15.78 billion, up 9 percent from $14.47 billion in last year's third quarter. Net income was $3.38 billion, also up 9 percent year-over-year from $3.11 billion.

Tableau Software

CEO: Adam Selipsky

June 30, 2016: $48.92

Sept. 30, 2016: $55.27

Change: +12.98%

Tableau's stock has been on a roller coaster this year, hitting the mid-$90s at the start, plunging below $40 in early February after what Wall Street viewed as weak financial guidance, and then staging a steady recovery through the year.

On Aug. 22 Tableau named Adam Selipsky to be the new president and CEO of the business analytics software developer, replacing co-founder and CEO Christian Chabot, who continues as company chairman. Selipsky joined Tableau from Amazon Web Services where he was vice president of marketing, sales and support.

Microsoft

CEO: Satya Nadella

June 30, 2016: $51.17

Sept. 30, 2016: $57.60

Change: +12.57%

In late September Qi Lu, the executive in charge of Microsoft's Applications and Services Group, stepped down to continue recovering from injuries reportedly suffered in a serious bicycle accident.

For its fiscal 2017 first quarter ended Sept. 30, Microsoft reported revenue of $20.45 billion, up less than a point from $20.38 billion in last year's first quarter. Net income actually declined more than 4 percent to $4.69 billion from $4.90 billion one year earlier.

Alphabet (Google)

CEO: Larry Page

June 30, 2016: $692.10

Sept. 30, 2016: $777.29

Change: +12.31%

For its third quarter ended Sept. 30 Alphabet, Google's parent company, reported revenue of $22.45 billion, up 20 percent from $18.68 billion in last year's third quarter. Net income was $5.06 billion, up 27 percent from $3.98 billion one year earlier.

During the quarter reports surfaced that Google was pulling back on Google Fiber, the company's high-speed Internet initiative, due to its high costs and slow deployments. In October, after the term covered in this analysis, the company said it was halting Google Fiber deployments and laying off 9 percent of its Google Fiber workforce.

Red Hat

CEO: James Whitehurst

June 30, 2016: $72.60

Sept. 30, 2016: $80.83

Change: +11.34%

For its fiscal 2017 second quarter ended Aug. 31, Red Hat reported revenue of $599.8 million, up 19 percent from $504.1 million in last year's second quarter. Net income for the quarter was $58.8 million, up more than 14 percent from $51.4 million one year earlier.

Cisco Systems

CEO: Chuck Robbins

June 30, 2016: $28.69

Sept. 30, 2016: $31.72

Change: +10.56%

Cisco Systems has been expanding into such areas as cloud computing, security and Internet of Things. But market researcher Synergy Research Group said in September that the networking giant is losing market share in its core switching and routing equipment business to competitors like Arista Networks, Hewlett-Packard Enterprise and Huawei.

In early September Robert Soderbery, Cisco's enterprise engineering leader who spearheaded the development of the company's Digital Network Architecture, disclosed that he was leaving the company after seven years. His departure followed a major reorganization of Cisco's 25,000-member engineering operations.

In August, Cisco launched a company-wide restructuring to focus resources on fast-growth businesses like security and IoT and eliminate up to 5,500 positions or about 7 percent of its workforce.

Lenovo Group

CEO: Yang Yuanqing

June 30, 2016: $12.08

Sept. 30, 2016: $13.30

Change: +10.10%

Lenovo remains the No. 1 PC company, holding onto a 21.2 percent market share in this year's second quarter, according to IDC. But Lenovo has taken a hit from the global slowdown in PC sales – its Q2 shipments of 13.2 million units was down from 13.5 million in the same quarter one year earlier. The bigger narrative is Lenovo's efforts to expand into servers, storage and other systems to become a broad-based data center system supplier.

In August Lenovo announced that revenue for its fiscal 2017 first quarter ended June 30 was $10.1 billion, down 6 percent year-over-year, while net income rose 64 percent to $173 million. The company expects to release its second quarter results Nov. 3.

F5 Networks

CEO: John McAdam

June 30, 2016: $113.84

Sept. 30, 2016: $124.64

Change: +9.49%

In early June F5 Networks hired investment bank Goldman Sachs to explore a potential acquisition by another company or a private equity company, according to a published Reuters report. The company has reportedly received a number of buyout offers in recent years.

For its fiscal 2016 fourth quarter ended Sept. 30 F5 reported revenue of $525.3 million, up 6 percent from $496.5 million in the same quarter one year earlier. Net income for the quarter was $108.9 million, up nearly 19 percent from $91.8 million one year before.

For all of fiscal 2016 revenue was $2.00 billion, up 4 percent from $1.92 billion in fiscal 2015. Net income for the year was $365.9 million, virtually flat with $365.0 million one year earlier.

Splunk

CEO: Doug Merritt

June 30, 2016: $54.18

Sept. 30, 2016: $58.68

Change: +8.31%

In late September Splunk, a fast-growing developer of real-time operational intelligence software, debuted a new release of its flagship Splunk Enterprise software with new machine learning capabilities. At the company's annual conference the company also unveiled plans to expand its investments in its developer ecosystem.

For its fiscal 2017 second quarter ended July 31, Splunk reported revenue of $212.8 million, up 43 percent from $148.3 million one year earlier. The company reported a net loss of $86.6 million compared to a $55.3 million net loss one year before.

Juniper Networks

CEO: Rami Rahim

June 30, 2016: $22.49

Sept. 30, 2016: $24.06

Change: +6.98%

On Aug. 2 Juniper Networks announced a deal to acquire Aurrion, a developer of silicon photonics technology that Juniper is incorporating into its products, improving their efficiency and reducing the costs of its networking systems.

For its third quarter ended Sept. 30 Juniper reported revenue of $1.29 billion, up nearly 3 percent from $1.25 billion in the same quarter one year earlier. But net income was $172.4 million in the quarter, down almost 13 percent year-over-year from $197.7 million.

EMC

CEO: Joe Tucci

June 30, 2016: $27.17

Sept. 6, 2016: $29.05

Change: +6.92%

Nearly one year after announcing a deal for the biggest acquisition in the history of the IT industry, Dell completed its $60 billion buyout of EMC on Sept. 7, becoming the new Dell Technologies in the process.

The acquisition is expected to boost Dell's efforts to become a supplier of a full range of IT systems for the enterprise data center.

EMC's stock closed at $29.05 on Sept. 6, the last day it was publicly traded.

Xerox

CEO: Ursula Burns

June 30, 2016: $9.49

Sept. 30, 2016: $10.13

Change: +6.74%

During the third quarter Xerox continued its preparations to split into two companies, one focused on printers and document technology hardware and the other on business process outsourcing services. Once the separation is complete later this year, the new companies will have annual sales of $11 billion and $7 billion, respectively.

In July the company said that expenses associated with the split are expected to be between $80 million and $100 million.

Citrix Systems

CEO: Kirill Tatarinov

June 30, 2016: $80.09

Sept. 30, 2016: $85.22

Change: +6.41%

On July 26 Citrix and LogMeIn announced a deal for LogMeIn to merge with Citrix's GoTo business in a "Reverse Morris Trust" transaction valued at $1.8 billion based on the shares to be issued and LogMeIn's July 25 closing price of $65.31.

Citrix and LogMeIn shareholders will each own approximately 50 percent of the combined company, which will be led by LogMeIn president and CEO Bill Wagner. The company is expected to have annual revenue of more than $1 billion.

Citrix reported revenue of $841.3 million for its third quarter ended Sept. 30, up 3 percent from $813.3 million in the same quarter one year earlier. Net income for the quarter was $131.9 million, up 136 percent from $55.9 million one year before.

Lexmark International

CEO: Paul Rooke

June 30, 2016: $37.75

Sept. 30, 2016: $39.96

Change: +5.85%

Printer manufacturer Lexmark International is in the process of being acquired for $3.6 billion ($40.50 per share) by a group of investors under a deal announced in April. The acquisition, led by Chinese-based inkjet and laser printer hardware manufacturer Apex Technology, is expected to close by the end of this year.

The sale follows a long period during which Lexmark was transitioning from a hardware-centric printer manufacturing company to focus more on document management software and print management solutions.

For its third quarter ended Sept. 30 Lexmark reported revenue of $843.9 million, down 1 percent from $851.1 million in the same quarter one year earlier. The company's net income of $18.3 million for the quarter compared to a $15.2 million net loss one year before.

IBM

CEO: Virginia Rometty

June 30, 2016: $151.78

Sept. 30, 2016: $158.85

Change: +4.66%

IBM has been in a race to expand into fast-growing areas such as cloud services, the Internet of Things and "cognitive solutions," even as sales of its legacy products and services decline.

For its third quarter ended Sept. 30, IBM reported revenue of $19.23 billion, down nearly 3 percent from the $19.28 billion reported in last year's third quarter. Net income for the quarter was $2.85 billion, down 3.6 percent from $2.96 billion one year before.

Qlik Technologies

CEO: Lars Bjork

June 30, 2016: $29.58

Aug. 19, 2016: $30.50

Change: +3.11%

Qlik Technologies, a developer of data analysis and visualization software, announced June 2 a deal to be acquired by private equity firm Thoma Bravo for $30.50 per share of Qlik stock, putting the total value of the acquisition at $3 billion.

Qlik shareholders approved the deal Aug. 17 and the acquisition closed Aug. 22. Qlik's stock stopped trading on Aug. 19.

CA Technologies

CEO: Michael Gregoire

June 30, 2016: $32.83

Sept. 30, 2016: $33.08

Change: +0.76%

CA Technologies has been reinventing itself with a focus on systems and cloud management, security and DevOps software.

On Sept. 20 CA announced a deal to buy BlazeMeter, a developer of continuous application performance testing technology, in a move that will expand the company's DevOps product portfolio. Terms of the acquisition, which is expected to close by the end of the year, were not disclosed.

For its fiscal 2017 second quarter ended Sept. 30, CA reported revenue of $1.02 billion, up more than 1 percent from $1.01 billion in the same quarter one year earlier. Net income was $212 million, up 22 percent from $174 million one year before.

Brocade Communications Systems

CEO: Lloyd Carney

June 30, 2016: $9.18

Sept. 30, 2016: $9.23

Change: +0.54%

During the quarter Brocade was focused on integrating Ruckus Wireless, the wireless hardware and software company Brocade acquired in May for $1.2 billion.

For its fiscal 2016 third quarter ended July 30 Brocade reported revenue of $590.7 million, up 7 percent from $551.8 million in the same quarter one year earlier. But net income was only $10.5 million, a fraction of the $91.7 million net income in the same quarter one year before. The company said earnings were reduced by acquired inventory and deferred revenue, acquisition and integration costs, and increased amortization of intangible assets and stock-based compensation.

On Nov. 2, after the quarter covered in this analysis, semiconductor maker Broadcom struck a deal to acquire Brocade Communications for $12.75 per share or approximately $5.9 billion. Broadcom plans to retain Brocade's Fibre Channel SAN switching business and divest Brocade's IP networking business – including the recently acquired Ruckus Wireless.

Check Point Software Technologies

CEO: Gil Shwed

June 30, 2016: $79.68

Sept. 30, 2016: $77.61

Change: -2.60%

Check Point Software Technologies is the first company on our index to record a decline in its stock price in the third quarter of 2016.

In July CEO Gil Shwed said on an earnings call that his company was "looking very actively at acquisitions," both large and small, to accelerate the company's expansion.

For its third quarter ended Sept. 30, Check Point reported revenue of $427.6 million, up 6 percent from $403.9 in last year's third quarter. Net income was $169.7 million, up 1.1 percent from $167.7 million one year earlier.

Oracle

CEOs: Mark Hurd and Safra Catz

June 30, 2016: $40.93

Sept. 30, 2016: $39.28

Change: -4.03%

On September 19 Oracle acquired Palerra, a developer of security technology for automating threat detection and incident response in the cloud and Software-as-a-Service systems such as Microsoft Office 365 and Salesforce. Terms were not disclosed.

For its fiscal 2017 first quarter ended Aug. 31 Oracle reported growth in its cloud system revenue, but flat software sales and declining hardware sales. Total revenue for the quarter was $8.60 billion, up 2 percent from $8.45 billion in the same quarter last year. Net income was up 5 percent year-over-year to $1.83 billion from $1.75 billion.

AT&T

CEO: Randall Stephenson

June 30, 2016: $43.21

Sept. 30, 2016: $40.61

Change: -6.02%

For its third quarter ended Sept. 30, AT&T reported revenue of $40.89 billion, up nearly 5 percent from $39.09 billion in the same quarter one year earlier. Net income for the quarter was $3.33 billion, up 11 percent from $2.99 billion one year before.

On Oct. 22 AT&T announced a deal to acquire Time-Warner for $107.50 per share or $85.4 billion. The announcement, coming after Sept. 30, was after the period covered by this stock price analysis.

Verizon Communications

CEO: Lowell McAdam

June 30, 2016: $55.84

Sept. 30, 2016: $51.98

Change: -6.91%

On July 25 Verizon announced a deal to acquire the operational assets of Yahoo for $4.83 billion in a move to bolster its media, search and communications assets. While the companies expect to complete the deal in the first quarter of 2017, there have been reports Verizon might be renegotiating the price following the revelation that a large-scale security breach at Yahoo compromised more than 500 million Yahoo user accounts.

For its third quarter ended Sept. 30, Verizon reported revenue of $30.94 billion, down nearly 7 percent from $33.16 billion in the same quarter one year earlier. Net income for the quarter was $3.75 billion, down 10 percent from $4.17 billion one year earlier.

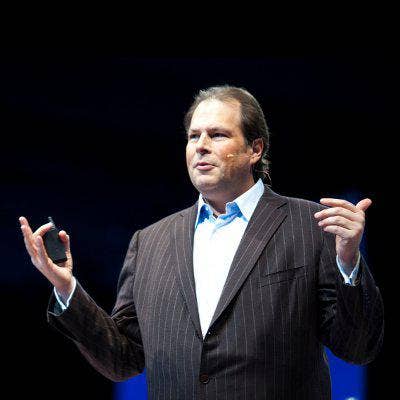

Salesforce.com

CEO: Marc Benioff

June 30, 2016: $79.41

Sept. 30, 2016: $71.33

Change: -10.18%

In September market researcher Synergy Research Group issued a report saying that Microsoft had surpassed Salesforce as the Software-as-a-Service market leader, with Microsoft accounting for 15 percent of the $11 billion SaaS market and Salesforce 14 percent.

On Aug. 1 Salesforce signed an agreement to acquire Quip, a developer of team-based productivity software, for about $585 million.

For its fiscal 2017 second quarter ended July 31, Salesforce reported that revenue grew 25 percent to $2.04 billion from $1.63 billion in last year's second quarter. Net income was $229.6 million compared to the $852,000 loss it reported in the same quarter one year earlier.

FireEye

CEO: Kevin Mandia

June 30, 2016: $16.47

Sept. 30, 2016: $14.73

Change: -10.56%

Advanced threat-detection technology developer FireEye has had a tough year as it has faced increased competition in its core security markets.

In early August the company said it would lay off about 10 percent of its workforce, about 400 employees, in a major restructuring after the company reported a $139.3 million loss for its second quarter. The company is due to report results for its third quarter later this week.

On Sept. 7 founder and technical visionary Ashar Aziz resigned from the company with the stated reason to spend more time with his family and to pursue new projects. That follows CEO Dave DeWalt's decision in May to step down, leading to the appointment of Kevin Mandia who joined FireEye in 2014 through its acquisition of Mandiant.