10 Channel Predictions For 2017

What's Next for Partners?

Solution providers will embrace applications and Software-as-a-Service, shift resources away from legacy data center hardware, and attract attention from private equity or activist investors in the coming year.

While consolidation will be rampant everywhere, expect to see the most action from born-in-the-cloud solution providers looking to get more scale to sustain high levels of growth, and from legacy firms looking to unload low-performing business units.

Also watch for channel partners to place bets on telecom services, application development, managed security services, automation and artificial intelligence as off-premise, recurring revenue services continue to gain a greater share of the market.

Take a look through the crystal ball with CRN's 10 channel predictions for 2017.

10. Solution Providers Will Invest Heavily To Achieve Automation, AI Mastery

Solution providers, distributors and vendors alike are turning to artificial intelligence and automation to streamline routine processes, reduce data center downtime and sell multi-sourced cloud offerings.

CompuCom, No. 23 on the 2014 CRN Solution Provider 500, launched in July what it said was the first-ever artificial intelligence (AI)-based managed service aimed at preventing midmarket data center downtime. The new offering runs on Amazon Web Services and uses machine learning and cognitive computing to uncover IT problems and quickly remediate them.

Kaseya released a platform in September that allows its users to buy and sell the scripts, reports, templates and agent procedures needed to automate processes. This will help MSPs better allocate their resources by having staff do things that automated procedures can't address on their own.

And Ingram Micro launched an automated offering in April that enables partners to sell both distributor-sourced and vendor-sourced cloud offerings off a single platform. The on-premises software needed to do this can be configured in less than five hours and runs on a single solution provider server.

9. MSPs, IT Services Vendors Will Tap Into Managed Security Services Goldmine

Managed security services are one of the channel's largest untapped areas, and distributors and IT service management vendors will take bold action to ensure a leadership position in the market.

Remote Monitoring and Management (RMM) vendor Continuum said in September that it plans to build out a security operations center so that it can quickly remediate customer issues. That same month, Professional Services Automation (PSA) vendor Autotask launched a fully automated endpoint backup offering in September that will address the heightened vulnerability posed to endpoints by ransomware such as CryptoLocker.

In November, Avnet launched a managed security service focused on providing SMB and midmarket customers with intrusion detection, vulnerability assessments, and security incident and event management (SIEM).

Meanwhile, NTT unified its security subsidiary brands into a single managed security services company in August, and standardized its capabilities around asset inventory, vulnerability management, policy compliance and web app security in October.

8. Solution Providers Will Build Out App Dev Practices To Get A Leg Up In IoT

Solution providers will position themselves for success in the lucrative Internet of Things market by bolstering their application development teams.

Staffing up with IoT application developers is critical for tackling middleware issues around interoperability, security, and data management. Development resources will be needed to meet the growing demand for packaged IoT solutions for specific business processes and vertical industries, as well as for providing app dev services for clients' custom IoT development projects.

A July survey by market research firm Evans Data Corp. found that the number of developers currently working on IoT apps has increased 34 percent year over year to more than 6.2 million developers today.

And a study by The Channel Company, the publisher of CRN, found that IoT application development ranked fifth in providing the greatest opportunity for channel companies – behind only the sale of IoT hardware and software, installation and maintenance of IoT hardware, IoT consulting services, and sales of network infrastructure to support IoT deployments.

7. Born-in-the-Cloud Partners Will Be Gobbled Up By Channel Goliaths

Expect some of the most successful independent cloud partners to find a home inside solution provider behemoths in the coming year.

IBM Global Services, No. 1 on the CRN SP 500, kicked things off in March by purchasing one Salesforce's longest-standing partners in Bluewolf, No. 240 on the CRN SP 500, for a reported $200 million. And business process services giant Wipro spent $500 million in October to purchase cloud services powerhouse Appirio and improve its market share around Salesforce and Workday.

And Accenture, No. 2 on the CRN SP 500, grew its Workday practice by 50 percent by purchasing 400-person partner DayNine in September.

Many leading cloud partners want established relationship around the world, but realize they can't build the necessary scale and sustain high levels of growth without help from deep-pocketed industry giants.

6. The IT Channel Will Find A Way Into the Telecom Channel

With the rise of VoIP and cloud computing accelerating the convergence of IT resellers and agents, distribution and solution providers alike are looking to stake a claim in the telecom space.

Distributor ScanSource led the way in August with its purchase of master agent Intelisys for $83.6 million plus earn-outs to bolster recurring revenue telecom and cloud services among its traditional communications resellers.

ScanSource CEO Mike Baur described the $150 billion SMB telecom services market as "the biggest opportunity in years" for the channel, with just 10 percent of the telecom services market is served by the indirect channel today.

Getting into telecom services will allow the channel to dramatically boost its operating earnings, Baur said, since agents and master agents don't have to carry any inventory or accounts receivable.

5. Channel Mainstays Will Shed Low-Performing Business Units

Solution providers will continue separating the more robust areas of their business from the less robust ones by splitting, selling off or shutting down struggling practices.

Dell, Xerox and Hewlett Packard Enterprise all announced plans in 2016 to spin off or sell their IT outsourcing practices, essentially undoing acquisitions that occurred less than a decade ago.

Avnet in September said it would unload its Technology Solutions group, which suffered an 8.8 percent sales decline and 2.4 percent operating income decline in its most recent fiscal year, by selling the business to Tech Data for $2.6 billion.

One company to watch is Greenwood Village, Colo.-based Ciber, No. 43 on the CRN SP 500, which brought on a strategic adviser in October to assess whether the firm should sell out or sell off a portion of the company. Ciber's CEO said in August that the company will explore potential business divestiture opportunities in Europe as international revenues fell by 28 percent in the first nine months of 2016.

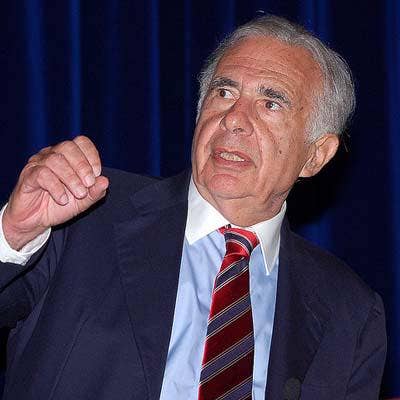

4. Activist Investors Will Pressure Solution Providers To Improve Their Performance

Activist investor Elliott Management's November letter to Teaneck, N.J.-based Cognizant, No. 7 on the CRN SP 500, calling for a share buyback and board of directors shakeup should put the rest of the channel on notice.

Activist investors such as Elliott and Carl Ichan (pictured) have previously taken action against IT vendors such as Citrix Systems, Xerox, Riverbed Technologies and BMC Software. The Cognizant letter marks the first high-profile case of an activist investor going after a solution provider.

Solution providers can avoid Cognizant's fate by bringing new blood onto their boards and investing aggressively in next-generation technologies.

Elliott's letter dinged Cognizant for having turned over less than half of its board seats over the last nine years and for making just eight acquisitions between 2014 and late November of this year, during which time rival Accenture dramatically expanded its cloud services footprint by carrying out 45 acquisitions.

3. Data Center Firms Will Accelerate Their Shift Away From On-Premises Hardware

Arrow Electronics has remade its core data center business in recent years, with software surpassing hardware as the largest component of the Centennial, Colo.-based distributor's technology business and Internet of Things expected to contribute as much as half of Arrow's revenue within the next half-decade.

Other data center players have needed to resort to inorganic action to break out on the spiral of declining sales and diminishing margins for traditional server and storage products.

Avnet sold its $9.65 billion Technology Solutions business to Tech Data, with CEO Bill Amelio saying that without an acquisition, Avnet would have needed to make a massive investment in software skills in order to thrive in a cloud-centric world.

Meanwhile, Datalink enjoyed robust technical and architectural capabilities around the public cloud, but the storage pioneer lacked e-commerce and digital marketing capabilities, as well as relationships with public cloud players. The company will gain access to a broader set of skills through its $258 million sale to Insight Enterprises, which is expected to close in early 2017.

2. The Onslaught of Outside Investment in the Channel Will Continue

Channel firms have remade their businesses to focus on recurring revenue services and CIO-level conversations, and deep-pocketed investors outside of IT have taken notice.

Over the past year, outside equity has taken a stake in distributor Ingram Micro, security solution provider Optiv, Indian solution provider Mphasis, cloud business applications provider Intermedia and Microsoft Azure superstar 10th Magnitude.

And with owner-operated solution providers continuing to struggle with landing public financing – no company has gone public since CDW in July 2013 – tapping into private equity or outside investors is still a great way to access additional capital.

Solution providers looking to attract private investors should look to get their combination of EBITDA and revenue growth above 30 percent, focus on cloud, telephony and application services, and create a staff heavy in account executives, system engineers and client advocates.

1. MSPs Will Move Away From Infrastructure And Into Software and Applications

Houston-based managed services provider Aldridge has seen its Infrastructure-as-a-Service business slashed in half over the past two years as clients moved their workloads from Aldridge's virtual infrastructure to the public cloud. As a result, Aldridge expects its cloud business to go from 50 percent Software-as-a-Service (SaaS) today to 80 percent SaaS two years from now.

The need to move beyond infrastructure will be accelerated by Amazon Web Services launching their own managed services program in December, which will provide enterprises with a toolkit to manage their AWS infrastructure on their own, as well as services such as monitoring and incident investigation provided directly by Amazon's internal engineers.

Managed services provided through a network operations center (NOC) such as patch management or incident escalation are of far less value in the cloud world since they can be automated. Therefore, in order to stay relevant and avoid commoditization, MSPs must invest in managing the customer applications that are on top of AWS or the operating system.