Michael Dell On Double-Digit Channel Growth In Year One Of Dell Technologies, The Rise Of AI, And The Partner Opportunity In Pivotal Container Service

Pleased, But Never Satisfied

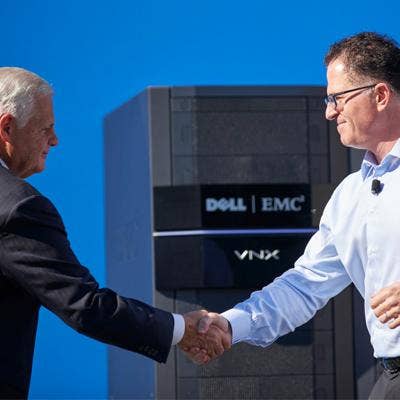

It's been a year since Dell closed the landmark $58 billion acquisition of data storage giant EMC, and Chairman and CEO Michael Dell says the combined company is growing beyond expectations and focused on taking share from the competition.

"We had about $2 billion more revenue than we planned for, and a lot of it was in the revenue synergies across Dell Technologies," Dell said. To maintain that pace, the Round Rock, Texas, company is relying on its $35 billion channel business, and its ability to sell a broad portfolio of products and services to customers looking to buy more solutions from fewer vendors. Dell said a significant part of the growth the company has seen since the acquisition is from storage partners selling servers to their customers.

The time has come, as well, for solution providers to begin pushing into new technologies like artificial intelligence and containers, Dell said. Pivotal Container Service, a partnership between Pivotal, VMware and Google Cloud, was introduced at the recent VMWorld conference, and Dell said traditional virtualization partners will have to get into the container business to remain relevant in the market.

"It is going very well, but we have a saying around here when things are going well," Dell said. "It's PBNS, pleased but never satisfied. It's all about continuous improvement and doing more."

What follows is an edited excerpt of CRN's conversation with Dell.

It's been a year since you completed the acquisition of EMC. Are you seeing what you'd like to see as far as cross-selling opportunities for the channel?

It is going very well, but we have a saying around here when things are going well: It's PBNS, pleased but never satisfied. It's all about continuous improvement and doing more. There are more opportunities, more share to gain. We've never been more relevant than we are now in terms of the big things that are happening with our customers, the digital transformation, the IT transformation, the workforce, the security transformation. Those are the big four that we consistently talk about. These are the things we're engaged with with partners. The level of excitement, engagement; we've got a $35 billion channel program. Last week I was in Europe and met with lots of partners, our distributors; they're totally engaged and activated. We had double-digit growth in the first half with channel partners, and for a business of our size that's extraordinary.

Are you getting what you need from partners as far as cross-selling the Dell Technologies portfolio is concerned?

When you look at it from the overall Dell Technologies level, we had a pretty aggressive plan, and for the first half of the year, we had about $2 billion more revenue than we planned for, and a lot of it was in the revenue synergies across Dell Technologies. What I've seen more broadly is a portfolio effect. In any one of the different areas, whether it's unstructured data, all flash, high end, midrange storage, servers, workstations, commercial PCs, virtualization, software-defined, networking, security, mobility management, Platform-as-a-Service, on and on, we're number one. There's a portfolio effect, which is to say that when a decision-maker looks at the total portfolio, they say I'm going to bet on you guys, I'm not going to bet on the other guys. A large portion of that growth we're seeing – the double-digit growth in the first half with the channel – is share shift against some of the others, and there's a lot more where that came from, so we're excited.

The structure of the company has remained remarkably stable since the acquisition. Are you following EMC's ’Federation’ strategy, the loose group of companies that run autonomously?

No. The 'F' word you mentioned is he who will not be named around here. We don't do that anymore. What we do are strategically aligned business. This means a business like VMware or Pivotal or Secureworks, Virtustream, RSA, Boomi, they can have open, independent ecosystems. A good example of this is when you go to VMworld, you see everybody in the industry, so that open ecosystem is incredibly important. The strategically aligned part, we can be super strategically aligned with VMware and our other businesses in the family. We don't want to be competing with each other. We can create deep technical integration and innovation. A few weeks after we closed the combination a year ago, we were introducing new versions of VxRail. VxRail growth was 400 percent. You saw what we did at VMworld with Pivotal Container Service. We're getting the members of the family to work together in a very strong way. That's what we mean by strategically aligned. It's not a holding company type strategy.

When containers first came out, people were saying that technology is clearly a problem for VMware. How does the container business play out, and what's your advice for the channel on how to make money with Pivotal Container Service?

It's simple. Sell the Pivotal Container Service. VMware financial results for the last several quarters have been getting stronger and stronger. [VMware CEO] Pat [Gelsinger] and team are doing a great job leading the business. The products and offerings are really resonating with customers. NSX and vSAN are growing very fast. In this multicloud, cross-cloud world, virtualization is incredibly important. Containers is a new way to deal with new applications, the cloud-native application. You've got 500,000-plus VMware customers around the world. This is a super easy way for all those customers to manage, deploy and utilize Linux containers in ultramodern fashion with Kubernetes, with Pivotal technologies, with VMware NSX, and it totally integrates with everything they have. That's going to be a monster product. That's a big opportunity for all the partners. There's also an opportunity beyond that to sell Pivotal Cloud Foundry. The two fastest-growing open-source projects in the world are Cloud Foundry, which is sponsored by Pivotal, and Kubernetes, which is sponsored by Google. With the Pivotal Container Service, we're bringing it all together.

Containers and virtual machines can co-exist?

Containers versus virtual machines is totally wrong. Who uses more containers than anyone? The answer is Google. If you go to, and say you guys use lots of containers, what do you do with your containers [They say] we put them in virtual machines. Why do you put your containers in virtual machines? Because it's easier to manage, because if we didn't, if you're running on bare metal, it's not working so well. When you think of the management of things, you end up not with containers versus virtual machines, it's containers and virtual machines. That happens to be very good for VMware now that it has Pivotal Container Service. We couldn't be more excited about this. Our competitors are not doing this kind of stuff.

It sounds like if you're a big virtualization partner, you'd almost be crazy to miss the container opportunity because they go hand in hand?

If you want to be relevant in the future, absolutely. It's completely integrated into the VMware architecture, so for all 500,000-plus VMware customers, it'll be completely familiar to them. It'll be super easy to use.

In artificial intelligence, are we headed to a time when we interact with the computer in a voice-activated way rather than a keyboard and screen? What's Dell's play there?

I don't think it's one or the other. It's both. People want to use voice, that's great. In AI and machine intelligence, what's really going on is you've got this incredible increase in the number of smart, connected things. If I have a fantastic AI or machine intelligence, and I give it three pieces of data, the AI isn't going to get very smart, because I only gave it three pieces of data. If I give it 1,000 pieces of data, it'll do a little better. But if I give it a billion, or 10 billion or a trillion, all of a sudden it becomes super intelligent. That's the plot. The supremacy of data in the discussion with customers is coming up more and more.

And Dell Technologies is in a good position to capitalize on that?

The plot inside companies is with all this data, how do I use this new computer science, the increases in computing power, increases in bandwidth and decreases in latency, with the computer science applied to not just the real-time data, but to historical and time series data? Across Dell Technologies, we have a unique and unmatched set of infrastructure solutions to enable this, whether it's gateways, software elements that go inside embedded nodes. We're by far, by far the leader in unstructured data, and that's growing incredibly fast. Pivotal is the operating system for digital transformation, IoT. The fuel for AI and MI [machine intelligence] is the data. Dell EMC is storing more than half the mission-critical data in the world is super relevant.

How do partners play with Dell to take advantage of AI in delivering solutions to customers?

You'll see a wide variety of offerings there across the spectrum. Those are all things our partners can go sell. The way to think about computing is you have cloud computing, then you have edge computing, all these nodes and things that are becoming intelligent. It's important to recognize that the growth in the edge and the fog is enormous. Think about a car traveling down the road at 85 mph and the LIDAR sees something. Do you want it to go back to the cloud to get the answer? No, of course not. The answer has to be inside there. Edge computing combined with the fog, and all these smart machines could be 10- to 100-times bigger than the internet as we know it today. That's not going to happen in a year, or two, or three, but five, 10 years out, the sky's the limit when you look at how fast our customers are putting sensors and intelligence into everything they make.

What's the future of storage, and where should partners be increasing their skills and knowledge base?

We love our storage partners, and we're continuing to enhance the product range. Our SC series continues to advance. We've got some new all-flash configurations. We're adding dedupe into our Unity platform. The midrange continues to be important. There's lots of growth in hyper-converged, lots of growth in converged with VxBlock and VxRack. At the high end, we just did an XtremIO refresh. VMAX continues to do well. Software-defined with VxRail, ScaleIO, ECS. For storage partners, there are two choices: one is continue with what you're doing and grow in the faster-growing areas like converged, hyper-converged, unstructured data, Isilon, software-defined. Then, the other choice is you can add servers from the number one provider of servers in the world, and it's all Dell EMC. A lot of partners that were selling storage now are selling storage and servers. They go together really well, and that's one of the reasons you're seeing upside on revenue synergies.

Is the flexible consumption model something partners should be trying to sell a lot more of moving forward?

I think it's going to grow a lot, and we're embracing it. One of the things we saw in the second quarter is 57 percent growth in Dell Financial Services originations, which is pretty staggering. Partners that don't know about Cloud Flex, or don't know about flexible consumption, or don't know about DFS, they're missing out. It obviously allows us to move to more of an Opex model than a Capex model, but 57 percent growth at our scale in origination, that's awesome. I just want to say a huge thanks to all our partners that have come along with us in the first year. We're extremely happy with how things are going, and we see tons of upside going forward.