8 Signs That Amazon Is In Other Cloud Vendors' Heads

Inside The Heads Of A Panicked Cloud Market

Amazon Web Services is the undisputed top dog in cloud computing Infrastructure-as-a-Service, so it's not surprising that everything it does is closely watched -- and sometimes mimicked -- by its rivals. Some want to be like Amazon, others want to compete with it on price, and still others are trying to head it off at the pass with emerging IaaS services. Most, at some point or another, have probably wondered if this runaway train can even be stopped.

Following are eight examples of things Amazon competitors are saying and doing that exhibit a borderline obsessive level of scrutiny.

Microsoft Vows To Match Amazon's Pricing With Windows Windows Azure IaaS

Amazon has a huge head start on Microsoft in the IaaS space, but the software giant doesn't seem worried about it. When Microsoft rolled its Windows Windows Azure IaaS into general availability last week, it slashed pricing on its cloud services by 21 percent to 33 percent and vowed to keep pace with Amazon's frequent pricing cuts for its compute, storage and bandwidth services.

Microsoft also played up its enterprise background as a differentiator from what Amazon offers. "We’ll never tell you that a Microsoft app inside your virtual machine is 'up the stack' and we don’t support it -- we’ll support it and make sure you're successful. And we'll back it with monthly SLAs that are among the industry’s highest," Bill Hilf, general manager of Azure product marketing, said last week in a blog post.

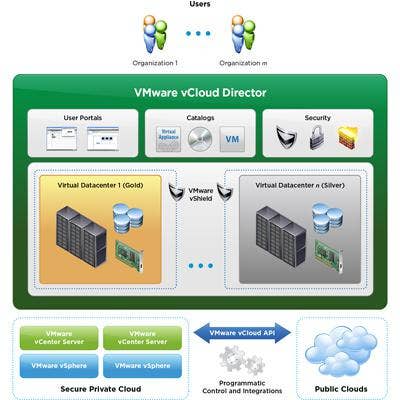

VMware Plays Up Enterprise Angle With vCloud Hybrid Service

VMware says its forthcoming vCloud Hybrid Service, which has a public cloud IaaS component, will include orchestration, automation, management and security features. These are clearly aimed at enterprise customers, a bloc that VMware wants to keep away from Amazon. At VMware's partner conference in February, COO Carl Eschenbach described Amazon as "a company that sells books." The idea behind vCloud Hybrid Service, according to VMware, is to let customers "reap the benefits of the public cloud without changing their existing applications, while using a common management, orchestration, networking and security model." Customers can't do these things with Amazon, so expect VMware to keep hammering these points.

Google Opens Compute Engine IaaS To More Users, Cuts Pricing

Google, which debuted support plans for its cloud services in February, last week opened its Google Compute Engine IaaS to a wider set of users. Google also added new features and cut pricing by 4 percent across the board. Hear that, Amazon? Those are the hefty-sounding footsteps of a deep-pocketed cloud rival behind you -- one that is pretty good at data center design as well. Google has been aggressively raiding talent from Amazon Web Services. Sunil James, former senior product manager at AWS, is now a product manager at Google responsible for networking products and technologies on the Google Cloud Platform, as noted by GigaOM earlier this month.

Oracle Enters IaaS Space To Keep Customers Away From Amazon

It wasn't that long ago that Larry Ellison (pictured) would poke fun at cloud computing on the regular. Now Oracle is taking on Amazon and other cloud players with its own IaaS offering.

Well, kind of. Unlike Amazon's public cloud IaaS, Oracle's IaaS is installed in a customer's data center, and customers pay Oracle a monthly fee for its use. So while Oracle has made noises about competing with Amazon in IaaS, this looks more geared toward keeping Oracle customers from drifting over to Amazon.

Oracle in March acquired Nimbula, a cloud infrastructure startup whose founders Chris Pinkham and Willem Van Biljon were in charge of development for Amazon EC2.

Citrix Says It Will Build 'True Amazon-Style Clouds'

When Citrix launched its OpenStack compatible CloudStack 3 product last February, it gushed about how the release would "bring the power of true Amazon-style clouds to customers of all sizes." In April last year, this description took on greater significance as Citrix split from OpenStack, moved CloudStack to the Apache Software Foundation and pledged its support for Amazon's APIs. In May, Citrix unveiled Project Avalon, a platform that uses Citrix Cloud Platform, running on open-source Apache CloudStack, and is closely aligned with Amazon's cloud infrastructure.

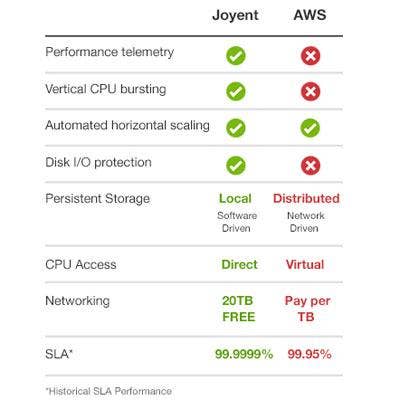

Joyent Takes On Amazon In Head-To-Head Comparison

Joyent, a VC-funded cloud infrastructure player founded in 2004, has dedicated an entire page on its website to outlining the advantages it holds over Amazon Web Services.

Joyent claims its cloud is set up so that a failure of one component doesn't impact the rest of its infrastructure, while a similar occurrence in Amazon's cloud can "debilitate an entire cloud." Joyent also boldly claims cost advantages over Amazon and every other cloud vendor in the industry.

"We don't force customers to buy more images or machines every time demand or system load spikes. And we don't force customers to compromise cost for performance consistency," Joyent says on its website.

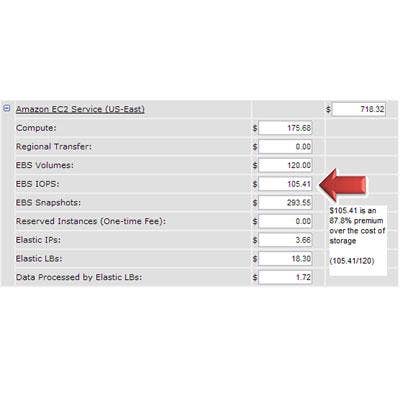

Rackspace Offers Free I/O For Cloud Storage Service

In February, Rackspace cut its bandwidth pricing for its entire cloud portfolio, including Cloud Servers, Cloud Files, Cloud Load Balancers and content delivery network by 33 percent. As part of that move, Rackspace also began offering free I/O for its Cloud Block Storage service. Amazon, Rackspace suggested, isn't as cheap as it looks when the cost of storage I/O is factored in (pictured). "Storage is one of the cost variables you would know before deploying your application. Unfortunately for many, I/O is complex and less predictable," Rackspace said in a February blog post explaining the move. "This fact makes it hard to understand the price you are actually signing up for when you launch a service. It also makes it difficult to perform an 'apples to apples' comparison among providers."

{C}

IBM Throws Its Support Behind OpenStack

IBM, which partnered with Amazon in 2009 to run its DB2 database, WebSphere Portal and other software products on Amazon's cloud, said it will move all its public and private cloud initiatives to OpenStack. Just like that, IBM has become one of the biggest players in a project that was founded as a counterbalance to Amazon's influence.

IBM and Amazon fought a heated patent battle in 2006, then settled it the following year when Amazon agreed to license IBM's technology.