10 Cloud Predictions For 2016

What's In Store For Cloud In 2016

There's a distinction between going out on a limb to make a bold prediction and carefully projecting a trend into the future. Most prognosticators do the latter while presenting their conclusions as the former.

But when assessing the cloud, there's no such thing as safe prophecy.

Over the past few years, industry growth has been defined less by a steady evolution of technology and more by continual upheaval.

The brakes are off as the IT delivery paradigm rapidly morphs, driven not only by vendor whims, but also -- and to an unprecedented extent -- by shifting demands from line-of-business leaders and actual end users.

Industry experts helped CRN make a few calls on what major transformations might be in store for cloud in the coming year. Some of these indeed are simply projections of current trends -- but we've thrown in a few of those bold predictions just to keep things interesting.

10. Open Enterprise

Not so long ago it would have been unthinkable for large enterprises to build their IT infrastructures on the backbone of open-source technologies.

But solutions like OpenStack, Docker, Hadoop, Chef, Spark and Cloud Foundry are now fixtures in Fortune 100 clouds -- running in both private data centers and hosted environments.

Chief information officers had better start gaining a deeper understanding of how those open technologies can grow their businesses, says Derek Schoettle, IBM's general manager of Cloud Data Services.

’In 2016, technologies like Apache Spark, Kafka and System ML will make a real impact in the enterprise," Schoettle says. "Open source technologies allow enterprises to innovate faster and move quickly to stay relevant, without needing to build key infrastructure from scratch."

9. Oracle Cloud Booms; Skeptics Not Silenced

Oracle is pushing its diverse cloud services so vigorously, so doggedly, that it's hard to imagine the software giant's strategy -- one that leans heavily on a massive built-in customer base -- won't pay off.

But in Oracle's cloud-based broadside at competitors new and old, the company's critics see shenanigans at play.

Expect to see Redwood Shores, Calif.-based Oracle post impressive growth numbers for its many cloud services in 2016, from its dazzling array of enterprise Software-as-a-Service applications, to its nascent Infrastructure-as-a-Service offering.

But don't expect talk about the real significance of those cloud numbers to die down.

Lucrative incentives to salespeople, unused cloud credits and what some characterize as strong-arm tactics against customers will fuel suspicions that Oracle's cloud financials, no matter how impressive they appear at face value, are misleading.

8. Rackspace Starts Shapeshifting

Buoyed by the success of partnerships with Amazon Web Services and Azure, and seeing signs of greater potential in its private cloud business, Rackspace might find that 2016 is the year when it starts in earnest to transition away from an on-demand hosting model.

No one expects Rackspace to shutter or sell off its public cloud -- at least not in the near-term.

But the San Antonio-based cloud pioneer could start de-emphasizing that business by cutting investments in data centers, opting to focus on the higher margins that come from selling technical support, sans the headaches inherent in "coopetition" against its new hyper-scale partners.

7. Cloud Becomes The De Facto IoT Platform

The Internet of Things is a reliable stalwart on any year-end predictions list.

But the term, until recently familiar only among tech cognoscenti, has become common parlance of late, thanks to the smart devices that have exploded into daily life.

In the past year, most cloud providers launched specific feature sets and tool kits for building back-end IoT applications.

Marc Olesen, senior vice president and general manager of cloud solutions at Splunk, says that in 2016 the natural synergy with IoT will cement cloud as the backbone of those emerging networks of interconnected sensors and devices.

"As organizations increasingly bring IoT devices to market, cloud will be the de facto platform for collecting and analyzing data generated by these IoT devices and to ensure their uptime and performance," Olesen says.

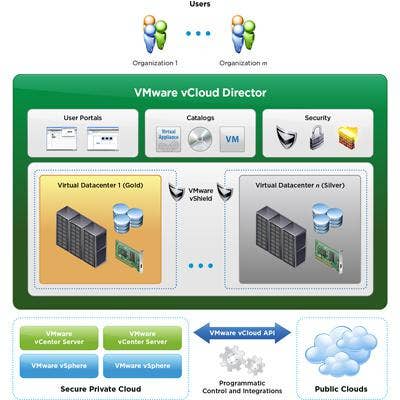

6. vCloud Air Evaporates

VMware launched its public cloud to much fanfare a couple of years ago, but vCloud Air could go the way of HP Helion in 2016.

In an increasingly dog-eat-dog public cloud environment, industry giants are cutting the leashes on big public clouds that haven't gained on hyper-scale competitors.

Palo Alto, Calif.-based VMware's recent 10-Q filing with the Securities and Exchange Commission included risk factor language that some partners and industry analysts found unusually detailed, including language warning that a joint venture with Virtustream, acquired by parent EMC, might not happen.

In the filing, VMware notes that "if we do not form a new cloud services business with EMC, our vCloud Air business may suffer, and it would be difficult to successfully execute a standalone hybrid cloud strategy."

5. Security Simplified

By now, just about every business leader understands that top-notch IT security is an essential component of his or her ability to sleep at night. They all are also starting to realize that the cloud, rather than a liability, can be a security asset.

But the crop of solutions on the market is immense -- it's no longer just about mounting a unified perimeter defense. Security has become a top-tier headache.

In 2016, expect to see a simpler paradigm emerge.

Samson David, senior vice president of cloud, infrastructure services and security at Infosys, sees security increasing in scale and decreasing in complexity.

"We'll see cloud security evolve into simpler, virtualized controls and solutions that will have embedded security processes to help map current IT systems," David predicts.

Expect to see more managed security solutions like one Rackspace recently launched.

Rackspace Chief Technology Officer John Engates explains why in his blog: "Security is simply not a core competency for most companies, and ensuring the right expertise against an always-evolving threat will become increasingly more difficult -- and expensive."

4. Communications Convergence

The IT and telecom channels are merging as businesses increasingly turn to cloud-based software to displace traditional communication technologies.

Software-as-a-Service packages like Microsoft's latest Office 365 E5 offer communications features partners can upsell to existing customers. Vendors are putting connectivity solutions -- everything from videoconferencing to hosted PBX and managed call centers -- in the hands of partners who never in the past sold a single telephony-related product.

Marcin Kurc, CEO of Orbitera, said that in 2016, he expects to see even more convergence across hardware, software and telecommunications portfolios.

"There also will be a blurring of lines in terms of product mix offered by various channel entities," Kurc says. "Telco agents are now looking beyond just telephony and communications products, adding cloud enterprise software to round out their offerings."

Partners would do well to bundle IT and communications packages and capitalize on the convergence.

3. Consolidation Continues

Public cloud giants -- most notably Amazon and Microsoft -- have proven that formidable business advantages come with massive scale.

Make that hyper-scale -- a scope at which commodity computing resources can be operated so efficiently that it becomes prohibitively difficult for upstarts to challenge existing hegemony.

It's because of that dynamic that public cloud has matured into a big man's game. So it's likely AWS and Azure will continue to gobble up market share between them in 2016, further consolidating the market.

Google, guided by recent hire and VMware co-founder Diane Greene, might find a way to vault back into contention for supremacy. And IBM SoftLayer, working a hybrid, open-source model, can still manage to maintain its presence in the narrow top tier of providers.

Everyone else had better find a nice niche, or another business model.

2. Channel Distinctions Fade

At The Channel Company's NexGen Cloud Conference in December, AWS Vice President David McCann told the partners gathered in San Diego that he thinks of them all, essentially, as systems integrators.

The realities of delivering cloud services have blurred the lines between distinct channel business models, but the taxonomies used in the industry, among both vendors and solution providers, still haven't caught up.

Expect to see channel companies stop explicitly defining themselves as resellers, IT consultants, managed services providers or even systems integrators.

Most partners bringing cloud to market will take steps toward becoming strategic service providers that resell services, manage those services and integrate them across vendors. But the key to success will be adding value -- as well as unique intellectual property and industry expertise -- to the mix.

Regardless of what they call themselves.

1. Financials Full Monty

Amazon raised the curtain on its cloud business in 2015 -- and expect rivals Microsoft and Google to also bare all this coming year.

Former Microsoft CEO and current top stockholder Steve Ballmer recently urged his former employer to break out the Azure financials. Microsoft had already divulged its cloud run rate, but Ballmer wants to see the Full Monty -- revenues and margins.

Google's new operating structure, which makes the At Work business that encapsulates Google Cloud Platform a more prominent piece of a smaller subsidiary, should also put pressure on new CEO Sundar Pichai to report the cloud numbers.

Forrester Research says both Microsoft and Google will break out the numbers in 2016. Forrester also warns other providers -- calling out IBM and VMware specifically -- that it would be unwise for them to resist that trend.