Microsoft's Nadella On The Blockbuster LinkedIn Deal: Integrating Office365 And Dynamics CRM, Machine Learning And Security Implications

Nadella on combining Office 365 and Dynamics CRM with LinkedIn

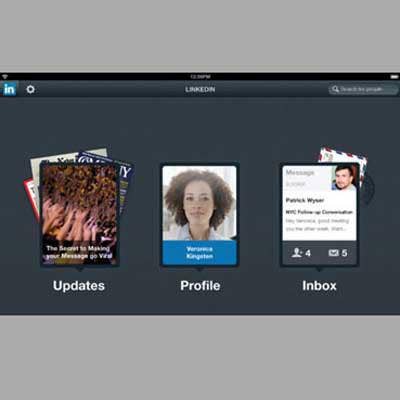

Microsoft CEO Satya Nadella says the technology giant's $26.2 billion acquisition of LinkedIn opens the door to tighter integration between Office 365 and Dynamics ERP/CRM with the 433 million member-strong social media platform.

"This is about being able to take [what Microsoft has] and then bring insights at the next level," said Nadella. "Now you combine that with [what LinkedIn has] and the combination of the two can give a lot of data and information, and that's where some of our best machine learning and [artificial intelligence] work will happen."

Under the terms of the deal, Microsoft will pay $196 per share in an all cash transaction – a roughly 50 percent premium for LinkedIn shareholders.

Nadella has promised that LinkedIn will retain its "distinct brand, culture and independence" with Jeff Weiner remaining as CEO of the social media networking site.

Speaking with analysts after the deal was announced, Nadella addressed the product integration roadmap, how it will help the value proposition around machine learning and analytics, and post-merger performance metrics.

What's your roadmap for integrating some of the different pieces across the portfolio?

The core capability of being able to create value … comes from being able to do machine learning and AI at scale. That's really what this next wave of technology innovation is about. But in order to be able to do that you need data, and LinkedIn represents that when it comes to the professional network.

[Office 365 and Dynamics] represent the other side of it. Your ability to add intelligence and insight and the ability for people to, most importantly, take intelligent action, gets very enhanced. That's where we will sell the solutions, whether it be [organizational] analytics, whether it be analytics and recruiting, whether It be analytics and sales efficiency. Those are the things which people want, and we are really excited about driving that piece.

How do you see this helping the value proposition around machine learning and analytics both for Office customers and LinkedIn?

It's a tremendous opportunity for us. Think about the [organizational] analytics we have today inside Office 365. It's one of the big differentiators of what we call Office 365 [Enterprise 5]. This is about being able to take [what Microsoft has] and then bring insights at the next level. Now you combine that with [what LinkedIn has] and the combination of the two can give a lot of data and information, and that's where some of our best machine learning and [artificial intelligence] work will happen.

The other piece that I'm very excited about is the [LinkedIn] news feed. … Just imagine now that you combine that with additional [functionality] such as My Projects, My Calendar; all the people and companies I'm going to meet over the next month. … We're well suited to solve that.

How will Microsoft approach security in bringing together the two firms' technology?

The key here is that we keep these two worlds separated because there's public information, there's "tenant" information [the customer's own data] and nothing gets linked, nothing gets connected without customers opting in, without provisioning of IT principles around it. So in other words, customers decide what to connect, and we believe customers will connect these because of the value it generates for them. But even when it generates that value, it's their data, it's their insights. So we're very, very clear and very, very principled about how we will approach security.

How will this deal potentially impact Microsoft's channel?

I'm very, very excited about the potential here of thinking what Microsoft does with Dynamics [its ERP and CRM applications] and Office 365 and our channels as fundamental accelerants to the core sales motion that LinkedIn already has. So as we plan the integration, that's clearly going to be one of the big dimensions where we can really drive a lot of increased growth for both sides.

Are there any sort of performance metrics the deal is predicated on prior to the close?

We'll have KPIs that we will talk about in terms of how we'll track progress once the deal is closed. As we get close to that, we'll talk more about that. But one of the things that's really important to us is – whether it be Office 365 or Dynamics or now LinkedIn – … is really usage and satisfaction. LinkedIn has had a culture of "member first," and I talk about "customer first" … when it comes to our products, we measure by usage, satisfaction and engagement intensity, and that's what's going to be driving [our] product agenda, because monetization is naturally built into that intensity of usage, and that's how we will go.

I don't expect anything to change, per se, but these will get enhanced. … If anything [we'll add] more value to being a LinkedIn member, … more value to being an Office 365 customer, and more value to being a Dynamics customer.

Talk about how you evaluate acquisitions?

[First.] what is the total addressable market opportunity? Is any deal helping us get into new markets or more successfully operate within markets? Second, [are there] tailwinds both in terms of usage as well as technology, and then third, is this something that's at the core of Microsoft? Is this something that we can really bring together, both our structural position as well as what we focus our best execution against?

And when I look at it in that dimension, this … acquisition really checks all those boxes.

We'll learn from the past. I want us to have LinkedIn retain its culture, its brand, the way they go about building its network, and do that independently while achieving the integrations for our customers. We can do that.