Cisco's AWS Retreat: The Long Road From Public Cloud Disrupter To Multi And Hybrid Cloud Leader

History Of Cisco's Cloud Strategy

Cisco CEO Chuck Robbins is set to rally solution provider partners this week at the network leader's Cisco Partner Summit in San Francisco to take the cloud high road by focusing on multi and hybrid cloud.

The strategy is a shift from the Cisco cloud charge at the Cisco Partner Summit in 2014 when the "founding father" of Cisco's Intercloud cloud strategy Nick Earle promised that Cisco was taking its rightful place as a market disrupter with a public cloud offensive. At the time, Earle said partners were clamoring for Cisco to get into the public cloud market as an AWS alternative.

During Cisco's first Partner Summit this year, Intercloud wasn't top of mind for the network leader, although the company has since released some cloud solutions. CRN lays out a timeline of Cisco's cloud strategy beginning in March 2014 at Cisco Partner Summit in Las Vegas.

March 2014: Public Cloud Push -- Intercloud

Cisco launched its public cloud offensive in March 2014 during Cisco Partner Summit in Las Vegas. Cisco said it planned to disrupt the market and would offer partners greater opportunity and richer profitability models compared to selling Amazon Web Services or Hewlett-Packard's public cloud.

Cisco's cloud strategy involved a mix of public, private and hybrid clouds hosted within a network of Cisco and partner-owned data centers built on Cisco gear. Cisco also began working with a number of service providers who themselves would offer public cloud services on Cisco gear. These partners were dubbed "Intercloud providers" and together with the channel would form a "network of clouds."

March 2014: Cisco Versus Amazon

Cisco's top cloud leader at the time, Nick Earle, told CRN during the InterCloud launch in March 2014 that Cisco was ready to take on Amazon in the cloud. He said channel partners were clamoring for the Cisco to get into the public cloud space.

"We are now going to provide the partner profitability model for the cloud world that the market has been waiting for. The fact is it is not a great business just straight reselling AWS. It is a pretty low-margin business," said Earle, in an interview with CRN. "Nobody makes money competing with Amazon with their price cuts. That is a loser's game. What we are going to do is give our partners the ability to move up the stack into differentiation around application centricity and hybrid cloud. The fact is that is where the money is. That is where the margin is, and that is where the opportunity for differentiation is. AWS is a commodity play, which frankly in many cases is commoditizing the partners. I think it has been a big concern of the partner community."

September 2014: MetaCloud Acquisition

In September 2014, Cisco purchased OpenStack-based private cloud provider Metacloud in a move to enhance the company's Intercloud push. The company provided users with OpenStack APIs and integrated developer tools with the security and control of a private environment.

At the time, Cisco said it would use the Metacloud technology to create hybrid cloud environments, combining service provider public cloud deployments with remotely managed OpenStack private clouds, as part of its Intercloud strategy.

April 2015: Cisco's Private Cloud Push

In April 2015, one year after announcing its public cloud offense, Cisco planted a stake in the private cloud market by launching a new OpenStack-based managed services bundle and a new financing option aimed at jump-starting the channel's ability to make money selling private cloud and hybrid IT solutions.

The new OpenStack Private Cloud Bundle unveiled at 2015 Cisco Partner Summit in Montreal allowed partners to sell an offering that provides the hardware and subscription service necessary to run Cisco's OpenStack-based private cloud. Cisco touted the bundle, made possible through its acquisition of MetaCloud, as a way for solution providers to provide a "public cloud-like" experience behind the firewall, without the management complexities associated with OpenStack solutions.

April 2015: We're Cheaper Than Amazon

When the OpenStack bundles were announced, Cisco's cloud leader Earle took aim at AWS again. He said Cisco's bundles were upwards of 40 percent cheaper for heavy users compared with AWS -- defining heavy users as companies spending more than $40,000 per month.

"The pricing of the OpenStack private bundle is 30 to 40 percent cheaper than Amazon, and Amazon is known for being cheap," said Earle.

June 2015: Piston Cloud/OpenDNS Acquisitions

In June 2015, Cisco acquired OpenStack specialist Piston Cloud Computing in an effort to accelerate its Intercloud strategy. The San Francisco-based cloud startup was founded in 2011 by former NASA developers focused on building OpenStack solutions. Cisco said the startup would enhance its capabilities around cloud automation, availability and scale to complement its Intercloud strategy and OpenStack Private Cloud.

The network leader also acquired OpenDNS in June for $635 million, providing Cisco with advanced threat protection delivered via a Software-as-a-Service model. Cisco said the acquisition would boost Cisco's 'Security Everywhere' approach by adding broad visibility and threat intelligence from the OpenDNS cloud delivered platform.

March 2016: Robbins Defends InterCloud

During Cisco's 2016 Partner Summit in March in San Diego, Calif., CEO Chuck Robbins defended Cisco's InterCloud strategy when asked during a Q&A session with the media regarding his silence around InterCloud.

"So while you haven't heard me say, "InterCloud, InterCloud, InterCloud," … the underlying strategies in my view haven’t fundamentally changed," said Robbins.

March 2016: CliQr Acquisition

At the 2016 partner summit, Cisco revealed it has acquired cloud management startup CliQr Technologies for $260 million in a move to accelerate hybrid cloud adoption and bolster its own software-defined networking strategy. Cisco said it planned to integrate CliQr as part of its Cisco One Enterprise Cloud Suite, so channel partners would have the technology available as part of an integrated cloud stack for all of Cisco's data center product lines.

CliQr has been integrated with several of Cisco’s data center switching and cloud solutions, including Application Centric Infrastructure (ACI) and Unified Computing System (UCS).

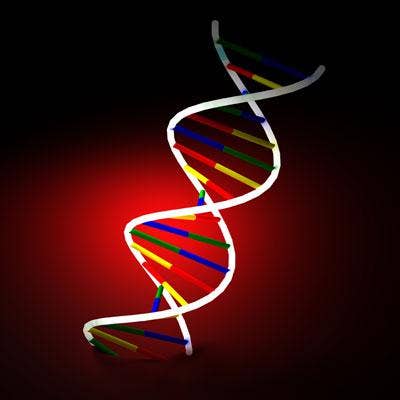

March 2016: Cisco's New DNA

Another significant cloud announcement at Partner Summit 2016 in San Diego., was Cisco's launch of its Digital Network Architecture that set the stage for a new enterprise networking sales motion. DNA is a software-driven, cloud service-centric solution based on automation, virtualization, analytics, managed services and open APIs that is aimed at enabling digital business.

DNA is the base of the Cisco ONE intelligent network software layer that will power a new generation of cloud-era Internet of Things applications that could "dynamically influence the infrastructure based on the needs of the application at any given time," said CEO Chuck Robbins, in an interview with CRN in June.

March 2016: Massive Engineering Shake Up; Singh Takes Over Intercloud

Just weeks after partner summit in San Diego, Cisco said it was reorganizing the company's 25,000-member engineering unit in an effort to better align to customer's needs. Cisco place its new Chief Technology Officer Zorawar Biri Singh (pictured) as head of the company's new Cloud Services and Platform organization, which would lead Cisco's Intercloud team.

"As cloud applications/services evolve to loosely-coupled microservices, API-enabled, and container-enabled frameworks, we are evolving the Cisco Intercloud mission to drive a broader solution ecosystem for customer and partner developers," said Robbins in an internal memo obtained by CRN.

May 2016: Intercloud Leader Earle Heads For The Exit

Two months after the engineering shakeup, Earle -- which some partners called the "founding father" of Cisco's cloud strategy -- revealed that he would be leaving the networking giant later this year after a 12-year stint.

"It's been a wild ride and after two years running the worldwide Field Cloud, Software and Managed Services team and 10 years in sales management roles, I've decided to step out of the Corporate world and go back to working with startups," Earle said in a post on LinkedIn.

Earle told CRN in April that Intercloud is undergoing a transformation and expected CTO Singh to push forward Cisco's strategy.

May 2016: Intercloud Poster Child Moves To AWS-Ericsson

Telstra, the Melbourne, Australia-based service provider considered the flagship partner for Cisco's Intercloud initiative moved to rival AWS and Ericsson's cloud. Ericsson formed a partnership with AWS in February through which the two companies are developing solutions to accelerate cloud transformation for telecom service providers, which won over Telstra. The technology is seeking to create portability between Ericsson's telecom customers' infrastructure and AWS' data centers.

June 2016: CloudLock Acquisition

Cisco continued its aggressive acquisition tear under Robbins with the purchase of cloud-based security specialist CloudLock for $293 million, a provider of technology that Cisco said will help channel partners accelerate cloud adoption for customers.

Waltham, Mass.-based CloudLock specialized in cloud access security broker technology that provides enterprises with visibility and analytics around user behavior and sensitive data in cloud services – including Software-as-a-Service and Infrastructure-as-a-Service.

September 2016: New Cloud Services

Last month, Cisco unveiled several new cloud professional services to help better enable the channel to build more holistic, customized services. Solution providers can white-label or resell Cisco’s new cloud services or co-develop and co-deliver customized services with Cisco. Partners can also leverage the Cisco services team to get the training needed to eventually sell the professional services themselves.

The new Cisco professional services include Cloud Acceleration, which accelerates the design and deployment of both traditional private clouds and cloud-native solutions; IT Transformation services for DevOps; a multicloud managed and orchestration service for Cisco’s Cloud Center; as well as enhanced application and cloud migration services to automate the complexity in on-boarding and migrating applications and workloads to the cloud.

October 2016: Intercloud Leader Singh Departs

After only 15 months at the networking giant, CRN discovered in October that Cisco's top technologist and cloud executive, Zorawar Biri Singh, was leaving the company. Singh was responsible for Cisco's overall technology strategy and the alignment of its architecture and product portfolio.

Cisco have yet to refill Singh's position. "As part of this simplification of development efforts, a number of engineering leaders -- who previously reported to Singh -- will now report to David Goeckeler and Rowan Trollope," said Cisco.

Partners Await Cloud Clarity

CRN recently discovered that Cisco has eliminated its lucrative Value Incentive Program (VIP) rebate incentive for partners selling Cisco Powered Cloud Services. Partners are clamoring for clarity around Cisco's cloud strategy looking forward as its cloud leaders are gone and the company is pulling resources away from partners selling Cisco Powered Cloud Services.

Cisco also confirmed that it is no longer using the term Intercloud. "While Cisco no longer uses the term Intercloud, the core concept is still very relevant to the industry and our customers," said in a statement to CRN. "At its core, it represents a cloud of clouds and the desire for organizations to move and manage workloads between clouds in a growingly complex world of many clouds. Powerful technologies like Cisco’s CliQr, a hybrid cloud management platform organizations rely on to model, migrate and manage applications across a multitude of clouds is a great example of this."

"It looks like they're pivoting from Intercloud and what they were trying before for the past two years to building hybrid clouds and managing them," said a one top executive from solution provider who is a Cisco Gold partner. "There's still a lot of confusion though."