5 AWS Repercussions From Amazon's Blockbuster Planned Acquisition of Whole Foods

Amazon's Latest Gambit

Amazon might be the only company in the world broad and diverse enough in scope to achieve business synergies between Whole Foods, with its bustling grocery stores across the country, and the highly secluded data centers that house the AWS public cloud.

Amazon's $13.7 billion planned acquisition of the high-end organic grocery retailer clearly isn't a cloud play. The deal is intended to accelerate a burgeoning grocery delivery business through AmazonFresh.

But scratch a little under the surface and you realize the deal is chock-full of repercussions for AWS. That's because the beating heart of all Amazon's businesses is the world-beating infrastructure that powers its own products, not to mention much of the global IT market.

The seismic shake-up of the increasingly technology-driven grocery industry Amazon triggered Friday will almost certainly pulse through the cloud market.

Can I Have More, Please

The AmazonFresh grocery delivery business relies on a complex distribution network, which would swell with the integration of Whole Foods stores, warehouses and products.

That network leans heavily on AWS computing to power logistics. Even the new Dash Wand home barcode scanner that simplifies ordering on AmazonFresh is powered on the back end by AWS Internet of Things' services like Lex.

An expanded, more-logistically-complex grocery delivery business means a larger internal customer for AWS.

And the acquisition would almost certainly stanch Whole Foods increasing its current Microsoft cloud spend.

Go Where?

The acquisition of Whole Foods and its hundreds of stores could jump-start expansion of the still-nascent Amazon Go brick-and-mortar chain.

Go, still only a prototype in Seattle, implements customer tracking technology to deliver an in-person shopping experience, sans checkout lines.

In theory, a Go store can operate with no service workers, meaning advanced Internet of Things capabilities running on the AWS platform are critical to making the whole thing work.

Whole Foods outposts could provide sandboxes for Amazon Go experimentation with new IoT services that will ultimately make their way onto the AWS feature set.

Instacart Headaches

Whole Foods owns a piece of Instacart and has a freshly signed five-year deal in place giving the grocery-delivery startup, founded by a former Amazon employee, exclusive rights to deliver its products.

Instacart is also signing other grocery partners with the promise of helping them compete against Amazon's rival business, AmazonFresh.

Add to the equation the fact that Instacart happens to be a large AWS cloud customer and you see why Whole Foods becoming a division of Amazon creates a head-scratching dynamic rife with potential for conflict on multiple levels.

Or cooperation.

The Competition's Next Move

Amazon announcing its intention to buy Whole Foods shook the industry to its core.

Stocks for traditional grocers like Kroger plunged, and those looking to grow their online businesses in competition with Amazon, especially Walmart and Target, also took severe hits to their share prices.

Those companies, especially Walmart, are unlikely to ignore Amazon's shot across the bow.

The Whole Foods deal is bound to provoke a strong reaction that could lead other retailers to boost their online capabilities and attempt to introduce new technologies integrating in-store and online shopping experiences with new apps and services.

Nervous retailers could be turning to AWS competitors for large cloud deals.

Give Me Some Slack?

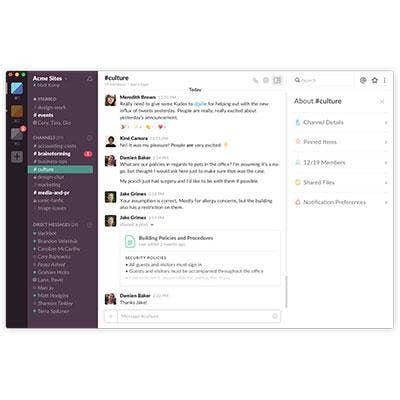

The M&A speculation this week that piqued channel interest was that Amazon was bidding to acquire enterprise collaboration superstar Slack.

Bloomberg reported negotiations in the works, pegging the cost of Slack somewhere around $9 billion—a significant premium from Slack's last round that imparted a $4 billion valuation.

If Amazon was making cash deals, Whole Foods, with its nearly $14 billion price tag, could disturb the Slack equation. Amazon reported more than $21 billion cash on hand at the end of the last quarter.

But the Whole Foods deal, according to a statement to the Securities and Exchange Commission, is being financed by a bridge loan from Goldman Sachs, meaning the money is still there should Amazon want to spend it.

Amazon doesn't really like dropping cash to begin with, although it did pay $970 million cash for video game streaming service Twitch in 2014, its largest closed deal to date.

When Amazon acquired online shoe retailer Zappos in 2009, the second largest acquisition in the company's history, it transferred 10 million Amazon shares, at the time worth $880 million.