Xerox CEO: Split Was Board's Call, Not Icahn's

Burns: Decision To Split Made By Xerox Board

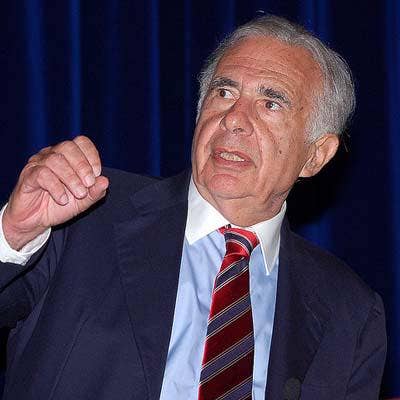

Xerox Chairman and CEO Ursula Burns said the vendor's board of directors -- and not activist investor Carl Icahn -- decided to break up the company into two parts, But Icahn, whom she called a "very nice gentleman," supported the split, she said Friday morning in an interview with CNBC after Xerox disclosed the plan.

Stamford, Conn.-based Xerox -- whose Global Services division ranks No. 7 on CRN's 2015 Solution Provider 500 list -- will split into a document technology business, which generated about $11 billion in revenue in 2015, and business process outsourcing business, which took in about $7 billion, according to company figures.

The separation is expected to be completed by the end of 2016, subject to customary reviews and closing conditions.

Icahn, who said in November that he had purchased a roughly 7 percent stake in Xerox, will control three of the company's nine board seats.

Here is a recap of the interview between Burns and CNBC.

What does it mean and how did it happen?

Early in October, our board and management team initiated a structural and portfolio review of the company … trying to see how we can respond to some of the shifts and changes that we saw in the market around us. We … came to a conclusion in early January. Mr. Icahn [bought his stake] after we initiated the review.

After we made our decision, I spoke to him … and we told him [about the decision to split the company]. He was pleased with the outcome. We're happy that he is in support of it. But he had nothing to do with the initiation, the contemplation, the analysis or any discussion around the deal. … We are happy that he is in agreement with it, but he did not drive it.

So, just to put a fine point on it, [Icahn] did not talk to the company before you initiated the review. And do you look at this and say that he saw that you were going to pursue the review and jumped in afterwards to take advantage of it?

He did not speak to the company before he initiated the review. I don't know when he jumped in, when he started to buy our stock. But he did not speak to us when we initiated the review; he did not speak to us before we made our decision on the review.

He has been a very nice gentleman and has given us his opinion.

Has your role in either company for the future been determined yet?

No, one of the things that … was important when I decided to actually head down this path was that we remove that variable from the discussion. But [what] I wanted our board and our management team and me to do was [to figure out] the best path for the company going forward, not what the best [role] is for me.

Now that we've made that decision, and we're into the implementation phase, I will have some recommendations for the board and we'll discuss that. Obviously, one of the discussions will be my role going forward.

Do you anticipate staying with one of the companies?

I will not comment on that, primarily because, as I said, we need to actually discuss it more with the board … we'll have great leadership on both sides, we'll have a great board on both sides. Both sides of the company have great management teams … so I'm very confident about the future.

Y ou said part of the reason that you went ahead and initiated this review was because you saw some shifts in the marketplace. Can you describe what those shifts are?

There are a couple that are pretty significant. One is around health care. We are a major provider of health-care solutions … and we saw a pretty big change, a big shift, in the health-care market: [In addition to the effects of health-care reform in the U.S.] we saw massive shifts in how quickly the markets outside the United States were developing, particularly around services, and how just unsettled the environments were: the strengthening of the dollar, how technology is used … and our … services business and a technology business were impacted by all of those shifts -- interestingly enough, many of them to our benefit. And what we found was that having two companies that have fundamentally … different ethos, different movements – one grows a little bit slower than the other, one needed a little bit more investment in development and developing its market than the other -- … [it's better] that we split so we can be more flexible, more responsive, and essentially more fit and focused for the markets that we're attacking.

Can you just explain how the shift in the dollar affects both companies that will exist after the split?

The strengthening of the dollar makes some of our products significantly more costly in markets that they go after, and the impact on our services business from a wage basis is a big move as well. We have over 100,000 employees in our services business and more than half those employees work outside the United States.

So we have businesses that are kind of moving in different ways. In the past, seven or eight years ago, that would have been a benefit to have that kind of portfolio view. But as competition is becoming more focused, as customers are becoming more significantly acute and specific about what their needs are, and as investors are becoming more focused, we found that this 'averaging' of this story [in one company is not as good] as having two distinct stories.