Xerox Split: 5 Facts Partners Need To Know

Another Major Split In The Works

There are a lot of details behind Xerox's announcement this week to split into two companies. Xerox – whose Global Services division ranks No. 7 on CRN’s 2015 Solution Provider 500 list – has enjoyed a long and storied history as a manufacturer of photocopiers, printers and other business products. In 2010, it bought Affiliated Computer Services (ACS), a services and outsourcing company, for $6.4 billion. But in 2014, it sold its IT outsourcing business to French services company Atos for $1.05 billion.

Here are five things you need to know about the proposed split, from what each of the entities will do, to what’s driving it, and how they will be governed.

How will the company split and when will it happen?

The company will break into two publicly owned companies: one focused on services, or business process outsourcing; the other on hardware, or document technology.

The split is expected to be completed by the end of the year, pending final approval by Xerox's board of directors and customary regulatory approvals.

How much does each side bring in?

The BPO, or services, organization is a $7-billion-a-year business, with more than 90 percent coming from recurring revenue, and 44 percent coming from the commercial sector. The BPO side has about 104,000 employees globally.

Meanwhile, the document technology, or hardware, group brought in $11 billion in 2015 and employs about 40,000. More than 70 percent of the division's revenue is annuity driven and 40 percent is generated from mid-market companies. The unit's document outsourcing segment generates 31 percent of its revenue.

What brought us to this announcement?

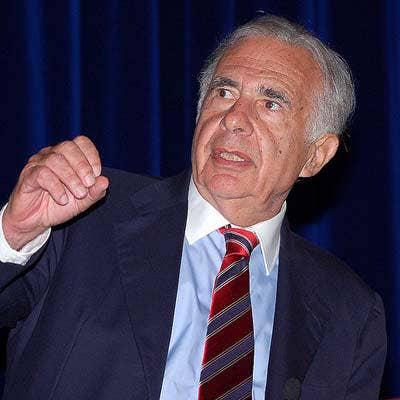

The announcement comes nearly three months after activist investor Carl Icahn (pictured) announced he bought more than 7 percent of Xerox stock and said he intended to talk with company representatives about potential operational improvements and strategic alternatives.

But according to Xerox Chairman and CEO Ursula Burns, the decision to split the company was not forced by Icahn and was made by the company's management and board of directors.

Meanwhile, Icahn has negotiated an agreement with Xerox over the governance of the BPO side. The deal gives him the authority to appoint three of that company's nine board members and allows him input into the selection of its CEO.

What about Xerox's purchase of Affiliated Computer Services in 2010?

This split basically undoes Xerox's $5.6 billion purchase of Affiliated Computer Services in 2010, which later became the BPO business for Xerox. The business, which brought in $7 billion in 2015, claims all of the top 20 U.S. managed health care plans as customers and is the country's largest electronic toll collection service provider, with more than 50 percent market share.

What about Ursula Burns's future with the company?

Burns's role in the future of either company has not been determined and it's not clear if she will stay following the split. In an interview Friday with CNBC, she said Xerox deliberately left her role in the new companies out of previous discussions about the split, and the governance of the companies will be hashed out while the split is being implemented.