Intel Earnings Preview: 5 Things Partners Want To Hear

Intel Continues Struggle With PC Market, Narrowed Focus On Products

During Intel's first-quarter results Tuesday, partners hope to hear how the company is dealing with the sluggish PC market and getting ahead of the game with its data center products.

The Santa Clara, Calif.-based company will break down results for its Nonvolatile Memory Solutions Group, Security Group and Programmable Solutions Group, in addition to reporting results for its Client Computing Group, Data Center Group and Internet of Things Group.

Intel is expected to report earnings of 47 cents per share on revenue of $13.84 billion for the most recent quarter, according to analysts surveyed by Thomson Reuters. Following are five things partners want to hear more about during Intel's first-quarter earnings call.

Executive Management Shakeup

Intel has seen a number of executive changes as the company deals with the challenges resulting from a weak PC market.

A few weeks ago, Intel CEO Brian Krzanich said two top executives are departing the company: Kirk Skaugen, Intel's senior vice president for its Client Computing Group, and Doug Davis, general manager of Intel's Internet of Things Group.

Partners interviewed by CRN said they are confused by Skaugen's abrupt departure and anxious to know more about Intel's plans for spearheading channel initiatives in the Client Computing Group. Partners told CRN they would like Krzanich to address what these executive changes mean for Intel's channel program.

Intel's Reported Layoffs

In addition to executive shakeups across the company, Intel Technology Providers want Krzanich to address reports that the company will cut a significant number of jobs.

According to a report by The Oregonian newspaper last week, Intel is preparing for significant job cuts across the U.S. -- the layoffs reportedly would surpass last year's 1,100 U.S. job cuts and could hit double-digit percentages in some business segments.

In addition to job cuts, Intel reportedly will consolidate operations and close smaller facilities as the company tightens its focus on new products such as programmable chips (field-programmable gate arrays).

PC Market

The weak PC market contributed to the Client Computing Group's revenue being down 1 percent year over year in the fourth quarter of 2015.

Partners want to hear more about Intel's new products -- particularly its sixth-generation Skylake processors -- and how they will help the Client Computing Group going forward.

Memory

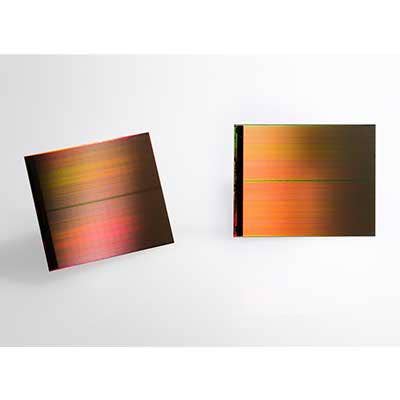

Intel has said it will focus on three pillars of growth in 2016, including Data Center, Internet of Things, and memory technologies.

Over the past year, Intel has invested heavily in memory technology -- at Intel's Developer Forum last year, the company unveiled 3-D Xpoint Technology, or non-volatile memory that Intel claims will deliver up to 1,000 times the performance of NAND flash.

In breaking down results for its Nonvolatile Memory Solutions Group, Intel partners will have a better idea of how the company's memory segment is performing.

Data Center

All partner eyes will be on the company's Data Center Group, which includes chips for server systems that help power the cloud computing segment.

Revenue from Intel's Data Center Group rose 5 percent in the fourth quarter over the same quarter in 2014. Partners hope that Intel's data center prospects in the first quarter of 2016 will be strong enough to offset any potential first-quarter struggles in the Client Computing Group.

Intel is facing increased pressure in the data center space, as Google earlier in the month revealed it has teamed up with Rackspace to develop a new server based on IBM Power chips.