6 Things To Know About SoftBank's Blockbuster Acquisition Of ARM

More Internet Of Things Consolidation

SoftBank Monday unveiled plans to acquire mobile semiconductor design company ARM Holdings in an all-cash transaction valued at $32 billion as it aims to become a leader in the Internet of Things.

SoftBank Chairman and CEO Masayoshi Son stressed in a presentation that his company was drawn to ARM because of its unique foundational technology and its growth potential in the IoT market.

"[SoftBank] intends to sustain ARM's long-term focus on generating more value per device, and driving licensing wins and future royalty streams in new growth categories, specifically 'Enterprise and Embedded Intelligence,'" SoftBank said in a statement.

Following are six things to know about the ARM acquisition as it relates to the Internet of Things.

ARM Positioned For Internet Of Things Growth

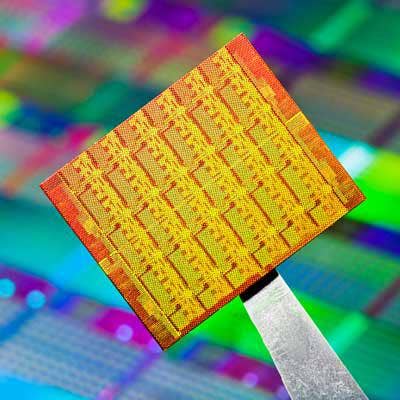

Cambridge, U.K.-based ARM got a head start in the mobile segment, and its chip designs are in most smartphones, tablets and mobile devices across the world. However, the company also has placed big bets on the Internet of Things as it devises chips that use less power so they can be used in smaller gadgets or devices.

ARM's Cortex-R and Cortex-M designs present opportunities in the smart automotive industry in particular, and its TrustZone technology is essential for IoT device security, according to Tokyo-based SoftBank.

In the past year alone, ARM has invested millions of dollars in IoT-related chip designs and acquisitions, including Sunrise Micro Devices and Wicentric.

Apple Suggested As Potential Bidder For ARM

It is still possible for other companies to make their own bids for ARM – including Apple, according to speculation.

ARM designs many of Apple's A-series processors, so analysts say the company would be a good fit for Apple's mobile hardware.

"That would be a defensive move," said Patrick Moorhead, president and principal analyst of Moor Insights & Strategy. "The industry would go crazy because it would mean that the No. 2 global smartphone provider (behind Samsung) would be in charge of the No. 1 architecture in mobile."

Smartphone Market Slowdown

SoftBank, a computer software company, first broke into the mobile phone industry in 2006 by acquiring Vodafone's Japanese unit for $15 billion and digging deeper into telecommunications.

However, the company has been looking to expand its horizons to the Internet of Things as the smartphone market begins to slow down. Smartphone vendors are struggling as the market becomes more saturated, according to IDC, which reported that worldwide smartphone market growth was flat in the first quarter of 2016.

EU Brexit Implications

The deal, one of the biggest so far this year, is the first major cross-border transaction in the U.K. since last month's Brexit vote to pull the country out of the European Union.

After this decision, the value of the pound was pushed down, making British companies potentially more attractive for buyers from overseas in terms of acquisitions, according to analyst Moorhead. In a press conference Monday, Softbank's CEO said he wasn't influenced by the Brexit considerations.

"This has nothing to do with Brexit," Moorhead said. "These acquisition deals take multiple months."

IoT Buying Spree

The acquisition comes amid a slew of Internet of Things-related purchases in 2016. According to a study released by Strategy Analytics in April, there have been nearly two dozen major IoT-related mergers and acquisitions in the first four months of 2016.

Other IoT-related acquisitions in 2016 include Microsoft's acquisition of Italian IoT service company Solair, Cypress Semiconductor's announcement it would acquire Broadcom's wireless IoT business, and Cisco's acquisition of cloud-based IoT provider Jasper.

"I don't think consolidations [in the IoT space] will slow down until the cement starts to harden a little bit," said Moorhead.

Japan Back On The Scope For The Technology Market

SoftBank's acquisition of ARM also puts Japan back onto the map as a major brand in technology.

While Japanese companies Sony and Toshiba were leading brands for memory and storage technology in the late 1980s, SoftBank's acquisition could mark a re-emergence of the Japanese brands.

"I see this as Japan getting back into a leadership position for technology," said Moorhead. "For years in the '80s, Japan was a serious player in intellectual property for storage and memory, and Sony was the amazing brand before Apple, so I see this as a nationalistic play."