Behind The Scenes Of Dell's Decision To Go Private (Part II)

More Behind The Scenes

When Dell and Silver Lake Partners made public their leveraged buyout agreement on Feb. 5, it was the culmination of eight months of behind-the-scenes meetings and planning, but it was far from the end of the story. Since then, more players have gotten involved, and there's still no definitive word on what the future holds for Dell. Here's a look at what's transpired since the Feb. 5 announcement.

Not All Positive

Almost immediately after the $24.4 billion deal was proposed, it was criticized by some of Dell's biggest investors, including Southeastern Asset Management, which owned 8.5 percent of all shares in February.

Southeastern reiterated in an April 9 letter that it thinks Dell could do better than the $13.65 per share that would come as a result of the deal with Silver Lake.

More Interest

According to the proxy, members of the board raised concerns about future revenue projections and asked CFO Brian Gladden (pictured) to "consider more conservative sensitivities" for the board in early March. Meanwhile, Dell entered its "go-shop" period in which the company could entertain alternative offers for the business.

Evercore, a financial advisor hired by the special committee, contacted 67 parties during the go-shop period to solicit interest. Evercore also received unsolicited inquiries from four other groups. Of the 71 total parties, 11 expressed interest in a transaction, according to the proxy.

Getting Serious

In the first week of March, groups representing The Blackstone Group and Icahn Enterprises each began communications with Dell about submitting proposals. Meanwhile, reports surfaced that Hewlett-Packard and Lenovo were among the other companies to take a sniff at Dell's books.

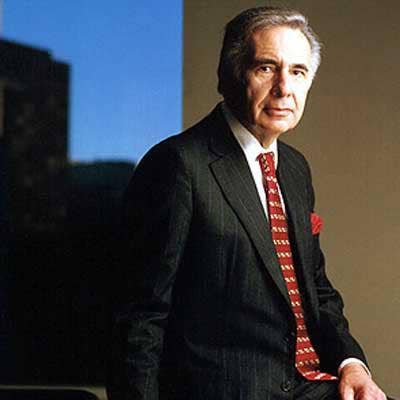

Expect 'Years Of Litigation'

Icahn Group, led by billionaire investor Carl Icahn (pictured), sent a letter to Dell's board stating that Dell could expect "years of litigation" if it continued with the proposed buyout by Silver Lake. Icahn countered that Dell should declare a $9 per share special dividend.

On March 14, Icahn notified Dell that it had filed a notification under the HSR Act with the United States Department of Justice and the Federal Trade Commission relating to Icahn Enterprises' potential acquisition of up to 25 percent of the company’s outstanding shares.

An Offer For Dell Financial Services

On March 21, Evercore received an indication of interest from one group, identified in the proxy as Strategic Party A, for a proposed acquisition of Dell Financial Services to be included in any other proposals to be considered.

'Go-Shop' Closes

The go-shop period ended on March 22, with two alternative proposals: from groups led by Blackstone and Icahn, respectively.

No Change

On March 25, the special committee announced it had received the Blackstone and Icahn bids, but the committee had not determined that either was a superior offer nor changed its recommendation. "The special committee intends to continue negotiations with both the group that made the Blackstone Proposal and the group that made the Icahn Proposal," according to the proxy.

CEO's View

In a letter to employees, CEO Michael Dell (pictured) said a leveraged buyout would allow the company to invest more in its Partner Direct program as well as in its PC and tablet business.

(Not) The End

The Dell go-private story hasn't been completed yet. The special committee is reportedly still talking with Icahn and Blackstone. Meanwhile, Dell's stock continues to trade above the current $13.65 offer, closing at $14.20 on April 8. Investors certainly expect the final price to increase, but what it will be -- and who it will be -- have yet to be determined.