Dell Dozen: Who Are The Icahn/Southeastern Dell Board Nominees?

The Dell Dozen

Icahn Enterprises and Southeastern Asset Management each nominated six people to take positions on the board of directors at Dell, should their alternative offer to Dell's $24.4 billion deal with Silver Lake Partners be accepted by the current board.

But who are the Dell dozen? Their executive and board experiences range from Herbalife to Ruby Tuesday to running New York City's IT department. Here's a closer look at each of them.

Jonathan Christodoro

Nominator: Icahn Enterprises

Christodoro is a managing director of Icahn Capital and previously worked at P2 Capital Partners, SAC Capital/Prentice Capital and Morgan Stanley, according to his LinkedIn profile. In addition, he recently joined the board of directors at Herbalife. Icahn holds almost 14 percent of Herbalife, according to The Wall Street Journal's MarketWatch.

Harry Debes

Nominator: Icahn Enterprises

Debes has been an operating partner at Advent International, a private equity firm, since November 2011. Prior to that, he was president and CEO of Lawson Software from 2005 to 2011 and oversaw that company's sale to Infor. He also was president and CEO of SPL WorldGroup, an enterprise software developer acquired by Oracle in 2006.

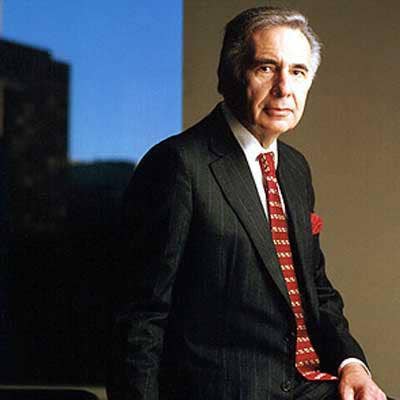

Carl Icahn

Nominator: Icahn Enterprises

Icahn is a prolific and highly visible investor who began his career as a Wall Street stockbroker in 1961. His companies have taken substantial interests in many big-name companies, among them RJR Nabisco, Texaco and Viacom. The head of Icahn Enterprises has been one of the most critical opponents of Dell's proposed leveraged buyout deal with Silver Lake Partners.

Matthew C. Jones

Nominator: Southeastern Asset Management

Jones is president and CEO of EOS Climate, a technology and service company focused on the management and destruction of refrigerants. Previously, he was president and CEO of CloudShield Technologies, which was acquired by SAIC.

Bernard Lanigan Jr.

Nominator: Southeastern Asset Management

Lanigan co-founded Southeastern Asset Advisors and has been chairman and CEO since 1991. He's also served as chairman of Lanigan & Associates, an accounting firm, since 1974 and has been on the board of Ruby Tuesday restaurants since 2001.

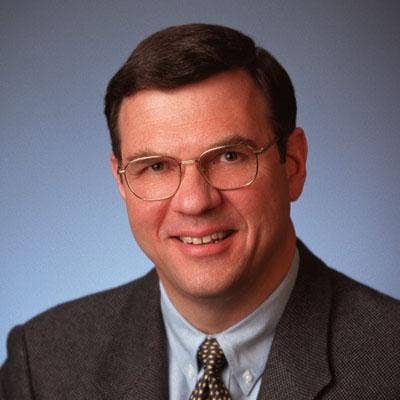

Rahul N. Merchant

Nominator: Southeastern Asset Management

Merchant was named New York City's first citywide chief information and innovation officer in April 2012. He's also the commissioner of New York's Department of Information, Technology and Telecommunications, where he heads a 1,200-person staff. Previously, he was CTO at Merrill Lynch, where he helped rebuild the company's IT following the Sept. 11 terrorist attacks.

Gary Meyers

Nominator: Icahn Enterprises

Meyers has been president and CEO of FusionOps, a business analytics software company, since April 2012. He previously was CEO of Synplicity, an electronic design application developer that was sold to Synopsys in 2008. He sits on the boards of directors at Exar and Oasys Design Systems.

Daniel Ninivaggi

Nominator: Icahn Enterprises

Ninivaggi is president and CEO of Icahn Enterprises, where he's served since 2010. He's served on numerous boards including Tropicana Entertainment and XO Holdings and was a senior executive at Lear Corp. from 2003 to 2009, with his last three years as executive vice president and chief administrative officer.

Howard Silver

Nominator: Southeastern Asset Management

Silver was the president and CEO of Equity Inns until its sale to Whitehall Global Real Estate Funds in 2007. He joined Equity Inns in 1994 and has served as a director of Great Wolf Resorts from 2004 until 2012. He currently is a director at Education Realty Trust and will complete a term as director of Capital Lease Funding in June.

Dr. Rajendra Singh

Nominator: Icahn Enterprises

Singh founded Telcom Ventures, a venture capital and private equity firm based in Alexandria, Va. He also is chairman of the board at NextNav, an indoor positioning services company. According to his bio on NextNav's website, he was an early stage investor in XM Satellite Radio and Aether Systems.

Peter van Oppen

Nominator: Southeastern Asset Management

Van Oppen is a partner in Trilogy Equity Partners, a venture capital firm based in Bellevue, Wash. He previously was CEO of Advanced Digital Information Corp., which was sold to Quantum in 2006 for nearly $770 million.

David A. Willmott

Nominator: Southeastern Asset Management

Willmott is president and COO of Blount International, a Portland, Ore.-based farm equipment manufacturer. He joined Blount in 2009 and has served on the company's board of directors since 2012.