Dell At A Crossroads: 7 Earnings Takeaways

Income Down, Revenue Flat

Dell is at a crossroad. Thursday could be the last time Dell reports its quarterly earnings as a public company. A $24.4 billion leveraged buyout vote looms with shareholders, and the PC market is on the skids. Meanwhile, the next big question is, what is Carl Icahn's next Dell earnings-related tweet going to be? Here is the recap of Dell's financials. The Round Rock, Texas company's fiscal second-quarter earnings were mixed. The company reported Thursday its net income dropped 72 percent, while revenue inched up a nose to $14.51 billion from $14.48 billion. How does this fit into the larger Dell machinations? Let's take a look.

PC Slump

Sales in Dell's PC business fell 5 percent, beating a larger 11 percent downward trend in global PC shipments, according to market research firm IDC. But selling PCs with razor-thin margins came at a cost, driving down operating income 71 percent for Dell's PC division.

That doesn't bode well for Dell considering more than half the company's revenue is tied to its PC business. But a contracting PC market comes as little surprise to anyone -- especially Dell. That's why it has been cutting prices and sacrificing profit margins. Dell is pinning its hopes on that the PCs it sells to companies will lead to more lucrative software and services sales.

Dell is the No. 3 PC seller, owning 12 percent of the market, followed by Lenovo with 16.7 percent and Hewlett-Packard with 16.3 percent, according to IDC.

Server Market Share Comes With A Price

Its aggressive sales tactics have paid off when it comes to market share. Dell's worldwide server unit shipments rose in the second quarter as rivals Hewlett-Packard and IBM lost ground, according to preliminary data from market researcher IDC. But, according to Dell, server revenue rose 8 percent, but operating income dropped 9 percent.

Dell Bets On Future, Not Present

Dell's shrinking PC business is dragging it down. Meanwhile, the bright spot for Dell was its enterprise solutions business, which saw an 8 percent boost in revenue to $3.3 billion. Those gains are tempered by Dell's software business, which posted a $62 million operating loss.

Dell's strategy is to wean its balance sheet off PC hardware revenue and refocus on cloud computing and selling networking hardware, servers, storage and software. In the interim, Dell executives say they are willing to sell PCs and servers at aggressive price points in hopes those customers will buy more profitable services in the future.

Dell's Chief Financial Officer Brian Gladden (pictured) explained its strategy this way in a prepared statement: "As we have adjusted our pricing, margins have declined, but we continue to make key strategic investments, and we are tightly managing our discretionary operating expenses."

Buyout Backdrop

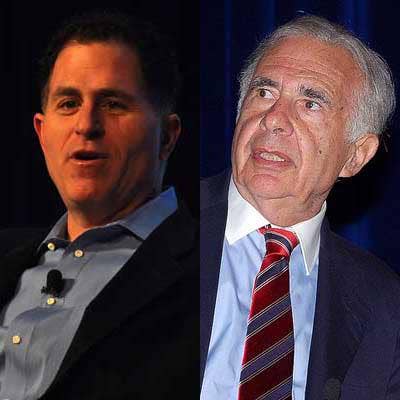

Dell's earnings come amid a tense battle between Michael Dell and corporate raider Carl Icahn. Dell and his financial partner Silver Lake want to take the company private in a $24.4 billion leveraged buyout. Carl Icahn and his financial partner Southeastern Asset Management say CEO Dell is trying to buy the company back for less than it's worth. Icahn and Southeastern recently sued Dell's board of directors for saying it was willing to consider Michael Dell's buyout offer in exchange for changing the rules for voting on the deal.

Icahn and Southeastern sued Dell in an attempt to, among other things, stop a change in the record date -- the date shareholders must have owned shares to be eligible to vote -- and force Dell to hold the annual meeting and the shareholder vote on the same day.

A hearing is set for Friday, Aug. 16 to determine if Icahn's lawsuit can be expedited.

Go Private

Dell's financials make a strong case for the company to go private, say analysts.

"These numbers show exactly why Michael Dell wants to take his company private," said Roger Kay, principal analyst at Endpoint Technologies Associates. With its legacy PC business in decline and its enterprise solutions business up, said Kay, it bolsters Michael Dell's case that the company needs to be able to focus on new business and not the legacy PC business.

Kay and other analysts say Michael Dell needs to be able to focus less on the short game of primping itself up every quarter for Wall Street investors, and worry more about the long game of reinvesting capital in areas of potential strong growth.

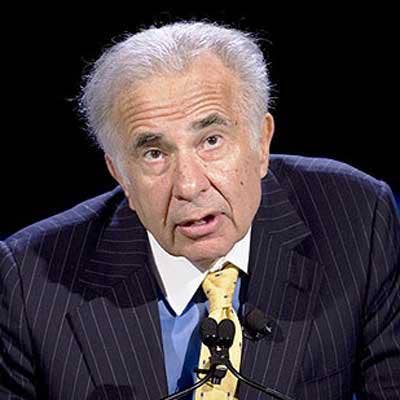

Guessing Icahn's Next Tweet

Icahn hasn't commented (or tweeted) yet, regarding Dell's earnings. But financial partner Southeastern issued a statement to shareholders basically stating Dell is too strong to be sold to Michael Dell for so little. Its statement reads:

"Southeastern has reviewed Dell's fiscal second-quarter earnings results and we are once again encouraged by the strong performance of the Enterprise Solutions, Software and Services business. Dell generated nearly $0.83 per share ($1.5 billion) of free cash flow during the quarter and approximately $2.22 per share of free cash flow over the trailing 12 months, despite its strategy of sacrificing margins for market share. Stockholders should note that this additional $0.83 per share in cash, which is far greater than the $0.13 special dividend being funded off Dell's balance sheet, results in an immediate accrual of $0.70 per share in value to the buyout group. This further supports our belief that the Michael Dell/Silver Lake freeze-out transaction drastically undervalues the business and its future prospects."