Behind The Numbers: Analyzing Gartner's Q2 Server Estimates

Digging Deep Behind The Numbers

Gartner on Wednesday reported that worldwide server shipments in the second quarter of 2013 rose an anemic 4 percent over the second quarter of 2012, while total server revenue fell 3.8 percent over the same period.

However, those numbers are only part of the story. The big drag on the server market continues to be the Unix part, where sales and shipments are down dramatically.

But other factors also play their part. Remember how blade servers looked to take over server business? No more. And anyone who thinks customers in the U.S. will pull the server market back into strong growth is mistaken.

There is a lot going on in the server market, according to Gartner. Turn the page for an in-depth look at what's really happening here.

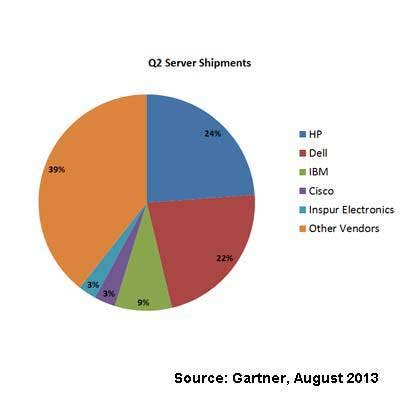

Total Server Shipments Up 4 Percent

The world purchased 2.5 million servers in the second quarter of 2013, up 4 percent over the 2.4 million purchased in the same period of 2012.

Hewlett-Packard continues to be the leading shipper despite a 13.6 percent drop in shipments to about 587,000 units. That still gives it some distance over second-place Dell, whose server shipments grew 1.7 percent, IDC said. IBM kept its third-place ranking, despite an 8 percent drop in shipments.

Two companies in the top five enjoyed strong growth in the quarter. Cisco with its UCS servers saw shipments grow 58.5 percent to 77,729 servers, while China-based Inspur Electronic came from almost nowhere to pop into the top five by shipping 65,350 servers, more than double what it shipped last year.

The "other" vendors also did well as a group, with shipments up 14.4 percent over last year to over 969,000 units.

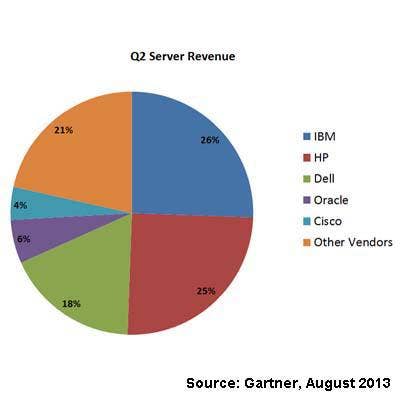

Total Server Revenue Down 3.8 Percent

On the revenue side, IBM was the leader with server sales of $3.2 billion, which was down 9.7 percent. Despite that fall, IBM took the No. 1 spot from HP, which saw its server revenue drop 17.5 percent to $3.1 billion.

Dell did well, with server revenue of $2.2 billion, up 10.7 percent over last year.

Oracle, which has de-emphasized its server business since its acquisition of Sun Microsystems, saw revenue fall 7.2 percent to $717 million. Cisco, on the other hand, continues its fast rise. Its revenue growth of 43.3 percent to $539 million could take it into the fourth place past Oracle in the next few quarters.

The "other" vendors also did well, with sales of $2.7 billion, up 7.9 percent over last year.

Where's Lenovo? And Who's Inspur?

Interestingly, for all the talk about the potential for Lenovo to purchase IBM's entry-level server business or otherwise grow its server market, Lenovo is not one of the top-five server vendors, according to Gartner.

Inspur Electronic Information Industry, based in China's Shandong province, is a $100 million-plus manufacturer of servers, storage, and other IT products, according to its company profile on Alibaba.com.

What About The Web Services Servers?

While the server business in aggregate is slowing down and even starting to shrink, one part of the market is ensuring that sales don't plummet.

That part is the Web services providers such as Google, Facebook, Baidu, and other Web-scale companies that are likely to design their own servers. Such servers are true bare-bones models, often connecting directly to a proprietary backplane instead of via standard networking and often with no enclosure or internal storage.

Jeffrey Hewitt, research vice president at Gartner, estimated that such Web-scale companies currently account for about 15 percent to 20 percent of total x86 server shipments.

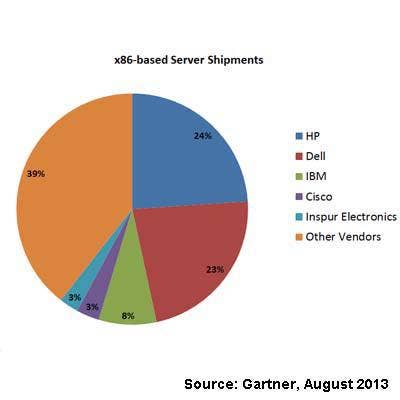

x86-Based Server Shipments Up 4.5 Percent

The industry as a whole shipped 2.4 million shipments in the second quarter of 2013, up 4.5 percent over the same period last year.

HP still remains the leading x86 server vendor in terms of shipments despite a huge 13.5 percent drop to just over 582,000 units. No. 2 vendor Dell, on the other hand, enjoyed a 1.7 percent rise in shipments to 551,000 units. A small increase, true, but it puts Dell within striking distance of the lead.

IBM's x86 server shipments fell 8 percent to just over 196,000 units, but Cisco's increased 58.5 percent to over77,000 units, giving Cisco an opportunity to break into the top three within a few quarters. Inspur Electronic's shipments rose by over 200 percent to over 65,000 units, helping it break into the top five for the first time. Even if Inspur's trajectory slows, it could easily overtake Cisco and IBM for third place in the next few years.

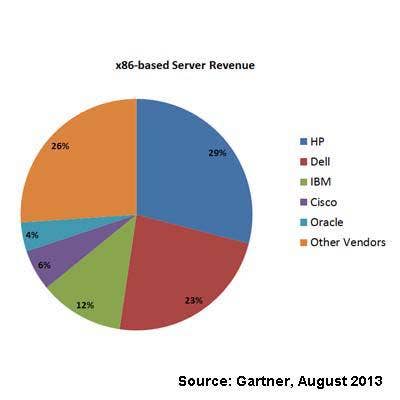

x86-Based Server Revenue Up 2.1 Percent

Total x86-based server revenue for the second quarter rose 2.1 percent over last year to $9.4 billion, according to Gartner.

HP retained its traditional lead with revenue of $2.7 billion. However, that figure was down 14.9 percent over last year. That drop, combined with Dell's 10.7 percent rise in x86 server revenue to $2.2 billion, means that Dell has a chance to be the No. 1 x86 server vendor in the not-too-distant future.

IBM remains in its comfortable No. 3 spot with x86 server revenue of $1.1 billion despite a 10.8 percent drop over last year. Cisco saw its second-quarter 2013 x86 server revenue rise 43.3 percent to $539 million. Oracle, which has not been keen on focusing on the x86 server market, nevertheless saw a 20-percent increase in revenue to $379 million.

The "other" server vendors enjoyed a 17.5 percent rise in revenue to nearly $2.5 billion.

Blade Server Sales Slipping? Say It Isn't So!

x86-based blade server shipments fell 3 percent over last year, Gartner said. That translated into a 4.5 percent drop in revenue over the same time period.

Meanwhile, rack-optimized x86 server shipments rose 3.9 percent, while related revenue rose 2.4 percent.

This is a break form the recent past in which blade servers have been among the fastest-growing part of the business.

The increase in cloud computing and the rise in servers built specifically for large-scale Web services companies likely explain the slight fall in the blade server business.

Unix Servers Continue Fading Away

The Unix server business is still a big part of the overall server business, but it is continuing to gradually decrease as customers continue to increase their adoption of industry-standard servers and/or cloud computing for their mission-critical applications.

Unix server shipments fell 27.4 percent to 27,415 units in the second quarter of 2013, Gartner reported. That equated to a 25.3 percent drop in Unix server revenue to $1.6 billion.

IBM is still top dog in the Unix server business, with shipments down "only" 8.6 percent and revenue down by 24.4 percent. Oracle, thanks to its legacy Sun business, is maintaining its No. 2 position despite a 45.7 percent drop in shipments and a 26.1-percent drop in revenue. No. 3 HP only ships about half as many Unix servers as Oracle does. However, its Unix server revenue, which fell 26.8 percent over last year, is only $36 million lower than Oracle's revenue, giving it a chance to catch up.

Mainframes Still Doing Well

Gartner reported revenue for servers based on "other" CPUs as rising 44.3 percent over last year. This category consists mainly of the mainframe market, where platform refreshes drove double-digit revenue growth.

That's good news for IBM, which in July unveiled the zEnterprise BC12, or zBC12, an entry-level mainframe with an entry price of about $75,000.

IBM, in its second-quarter 2013 financial report, said its System z mainframe sales rose 10 percent over last year.

US Not Leading The Server Charge

The U.S. server market grew 1.9 percent in terms of shipments over last year, but it saw revenue drop 5.1 percent, Gartner reported.

That was puny growth compared to the rest of the world.

Canada's server shipments rose 2.7 percent and revenue rose 6.3 percent, Asia/Pacific saw a 21.7 percent growth in shipments and a 10.0 percent growth in revenue, and Latin America had a 1.0 percent drop in shipments but flat revenue growth, Gartner said.

Things could be worse. Europe, the Middle East and Africa, known collectively as EMEA, suffered a 5.9 percent drop in server shipments and a 4.6 percent drop in server revenue, Gartner said.

Recap: IBM

IBM remained the top server vendor in terms of revenue on the strength of its mainframe business and the relative strength of its Unix and x86 server business. However, IBM is not known as a price leader, and as a result it is in third place in terms of shipments.

Recap: HP

HP is barely hanging on to its top position in terms of server shipments and its second-place ranking in terms of server revenue. However, unless it can arrest its double-digit decreases in both measures, its chance of keeping those positions seems slim.

HP is counting on the launch of its HP Project Moonshot server line as a way to take the lead in the server market. However, how quickly the Moonshot servers launch and how strong the uptake by customers and channel partners will be remain to be seen.

Recap: Dell

Dell has shown just enough growth in server shipments and sales to coincide with HP's decreases to bring it to within striking distance of HP in both server shipments and revenue.

Dell shipped 551,000 servers in the second quarter, just shy of HP's shipments of 586,857 units. Dell also had server revenue of $2.2 billion, which is still some distance from HP's $3.1 billion, according to Gartner. But, overtaking HP in both could be just a matter of time, depending on how HP fares in the near future.

Recap: Cisco

Cisco, in partnership with top storage vendors including EMC and NetApp, has been riding the Cisco UCS server wave, with a 58.6 percent rise in shipments and a 43.3 percent rise in revenue during the second quarter compared to last year, Gartner said.

Can it last? Given that Cisco USC servers are mainly sold as blades, and that the blade server business is slipping, Cisco will have to take serious market share away from HP, which leads the blade sever business, if it wants to enjoy that kind of growth going forward.