CRN Exclusive: Dell Channel Chief Cook On Cisco, The HP Split And IBM's Server Exit

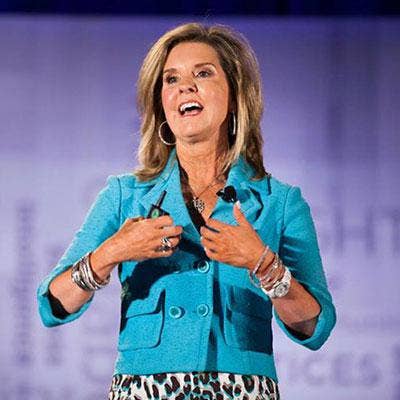

Cook Under The Spotlight

Cheryl Cook has acceleration on her mind. Dell's vice president of global channels and alliances said she is keenly focused on quickly growing the company's channel.

The need for speed comes from the opportunities Dell sees in the market. Strategic overhauls at IBM and Hewlett-Packard have left openings to take market share and partners from major competitors, and Dell is hungry to capitalize on those opportunities, Cook said in an interview with CRN.

Add to that Dell's recent hiring of former AMD CEO and channel heavyweight Rory Read and Cisco enterprise architecture guru Paul Perez, and the fuel is mixed for a push to make Dell "the only fully integrated IT company for our partners," Cook said, as well as a software-defined and enterprise architecture powerhouse.

The 51-year-old Cook has been at Dell for roughly three years, and her team is credited with growing the company's channel business to 40 percent of global revenue. Before taking on her channel responsibilities, Cook was vice president of enterprise solutions. She keeps tabs on a partner ecosystem that includes some 165,000 partners and registers 82,000 deals each quarter.

Dell appears to be making a big enterprise architecture play by hiring Paul Perez from Cisco. Will Dell be making a stronger push to recruit Cisco partners?

We're delighted to have Paul come to the business. It's another point of evidence for the leadership strength we have at the company, and the strong position Dell has with our strategy and our vision and our position in the market. Whether they're IBM partners, HP partners or Cisco partners, we are enjoying a high level of interest right now in the partner ecosystem on what a great opportunity they have to come team with Dell. The trends in the industry continue to point toward software-defined capabilities, and that's where we are focused. We're going to be an attractive place, and want to focus on giving attractive propositions to partners to come invest and team with Dell around that capability.

So it's not exclusive to Cisco partners, but we do have many partners that might have been doing networking with Cisco, but they were doing enterprise servers with Dell anyway. Some of those partners are already in our ecosystem. We're helping them see the broader opportunity in what our converged offerings are, and giving them the ability to leverage it. We're also enjoying success just in what the competition is doing in the marketplace with their own strategies ... it's creating a compelling opportunity to explore, have conversations about alternatives, and we can capitalize on bringing new partners into the Dell community.

Compare and contrast Dell's partner program with IBM's, Cisco's or HP's.

Our programs are simpler. They're cleaner and crisper, easier to understand. We desire to maintain that easy-to-do-business-with approach. They're also extremely competitive. Partners give us feedback over and over -- good feedback that our programs are competitive. The feedback we get from channel partners is the simpler we can keep it, the easier it is for them to understand. That's the benefit. It helps to drive and deliver and focus, rather than having to hire people to administer, navigate and track some of these other, more complex, programs.

When will you cross the 50 percent channel milestone?

I don't want to put a cap on what our revenue mix should look like. Our aspiration is to continue to grow faster than the market. The last couple quarters, we've outpaced the market. If my direct business and my channel business both continue to grow, then my mix may still stay similar while I enjoy hyper-market growth. For me, a better measure is, can I continue to grow faster than the other guys, and can I continue to take share from the other guys? In my software business, it's 60 percent channel. I think we could continue to see us climb. It could get as high as 50 percent [globally]. It's more in different parts of the world -- it's 60 in Europe. In some parts of the world, we're 85, 90 percent channel.

Does your strategy for the channel change at all along with the push to develop Dell enterprise architecture?

We've been focused on winning in the data center in our partner program for some time. I think you will see us respond to customer preference, which our partners need to also adapt to, which is more solution-focused. You'll continue to see us look at our programs, competencies, enablements on those trends to make sure our partners are equipped and able to respond to customer demand and requests that tend to be evolving to more workload-centric conversations. That's not unique. That's where the industry is going, so we'll be evolving and maturing our programs to reflect that. It's [more] market-oriented and industry-oriented rather than reacting to anything our competitors are doing.

How is Rory Read's appointment going to help the channel? Does it change what you're doing?

I think he brings great experience and insight and relationships to the channel. He's a channel advocate. What he's going to help us do is drive more global consistency and good, comprehensive strategy in our planning efforts and go-to-market. And the better we get as a company with our go-to-market, inclusive of our channel go-to-market, the better we can maintain velocity. It's just one more step in growing a leadership team that is very strong and very channel-experienced. It's a very proactive channel coverage strategy right along with our direct coverage strategy.

What kinds of incentives are you considering now?

We just launched our Q1 incentive announcements. We're always going to respond and react to the market, and we always have to be competitive. We're offering competitive takeouts, new business. We have to capitalize on opportunities we see with Windows 2003 coming up in July. Customers have to migrate. We also have ongoing client and server growth initiatives. We've seen good success in North America; for about a year, we've been offering a commission enhancement of 1.2 times for my Dell sales team, for partnering and working with the channel to help us drive complex solutions like networking, storage, converged infrastructure and security. That's driving growth for new customers for both partners and us in the channel. It's driving the right kinds of margin-rich, high-end solutions.

Does Dell have a sweet spot in the channel, or is it trying to be all things to all people?

One of our key differentiators is our comprehensive, end-to-end solutions portfolio. Contrast that to many of our contemporary competitors in the industry. After HP separates, we'll be the only fully integrated IT company for our partners. That, I think, has value for them. It gives them the opportunity to come to Dell for a broader range of solutions. Partners benefit from integration and simplicity. It allows them to narrow the number of vendors they do business with, while bringing complete solutions to customers. I would also say our partners are very good at working that SMB, midmarket customer base. The programs we have, the products, some of the offerings we have, cater to that part of the market. That's a differentiator that our partners resonate with and find value in.