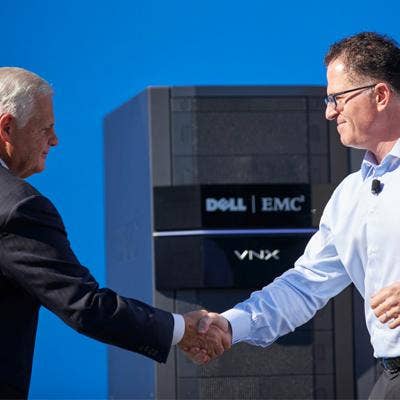

Dell Buys EMC: Top 10 Partner Takeaways

The Partner Impact

Dell's buying EMC raises a lot of questions for channel partners. There is the fate of VCE, a merging of channel programs, overlapping product lines and renegotiated third-party partnerships to consider. Partners, who'd been hearing whispers of the deal for weeks, got confirmation of the megadeal Monday when Dell made it official, and now are just beginning to digest the news.

The $67 billion acquisition makes Dell one of the biggest names in computer storage, servers, PC manufacturing, security and corporate software. The combined company would create a fortified Dell with the enterprise chops to go toe to toe with Hewlett-Packard, Oracle or IBM.

The transaction is expected to close next year sometime from May to October.

What does the Dell-EMC merger means to partners? Here is a look at the impact based on what Dell, EMC, competitors, partners and industry experts are saying.

EMC And Dell Product Portfolio

Many of Dell's and EMC's products are complementary, with some overlap in storage. In fact, Dell already resells EMC products. This makes the acquisition less disruptive. (Related slideshow: What Will A Merged Dell-EMC Look Like?)

Here is a rundown of EMC's main products and brands: VMAX enterprise storage, VNX midrange storage, XtremIO all-flash array, Big Data Pivotal (hardware and software), VMware virtualization, Virtustream cloud services, RSA enterprise security and VCE/Vblock converged solutions.

Here is a rundown of Dell's main products and brands: Compellent, EqualLogic and PowerVault storage lines; Compellent all-flash arrays; Statistica Big Data software; Enstratius cloud management; SonicWall client and midmarket security software; Z-Series networking hardware; and converged solutions with partners Nutanix and VMware EVO:RAIL.

Birth Of A Storage Giant

Dell's acquisition of EMC would make it the world's largest storage vender. The combined company would own close to 30 percent of the storage market, with EMC owning 21 percent of the pie and Dell about 10 percent, according to market research firm IDC.

Dell and EMC have a relationship that goes back years. Dell sold EMC's high-end storage products and midrange products such as EMC's midrange Clariion line of SAN arrays. EMC purchased downstream storage products from Dell. But eventually both filled out their product portfolios and competed more squarely.

Compared with EMC's 20 percent market share, HP is No. 2, at 14 percent, followed by Dell, with 10.2 percent. NetApp and IBM take the No. 4 and 5 spots, with a combined market share of 14 percent, IDC reported.

What Happens To The VMware-Cisco-EMC Partnership?

Six years ago, EMC partnered with Cisco and VMware to create a company called VCE, which sold a hyper-converged solution that combines compute, network and storage in preconfigured blocks under the brand name Vblock. A Dell-EMC merger will likely mean rival Cisco will leave the VCE alliance, and be replaced by Dell's core technology. But according to EMC CEO Joe Tucci, the VCE business will survive.

"Our VCE business, when connected to Dell's products and services, will grow faster and have a much larger impact on the industry than either one of us could individually," Tucci wrote in a blog post.

Cisco CEO Chuck Robbins told The Channel Company CEO Robert Faletra he was unsurprised by the Dell-EMC deal and he anticipates Cisco to continue its partnership with EMC.

Partners are skeptical that VCE has much of a life under Dell's leadership. "I can't see VCE as an entity anymore with Cisco if Dell follows through" on an EMC deal, said a Cisco partner who asked not to be identified.

Impact On VMware

A majority of EMC's value is tied to its 81 percent stake in VMware, the world's foremost provider of virtualization technology. EMC, which has a value of about $53.6 billion, has a stake in VMware worth about $27 billion.

VMware will remain an independent publicly traded company with Dell heavily influencing its direction. Dell gains an upper hand over longtime partner Microsoft, which sells a competing virtualization platform.

For partners, Dell's influence on VMware could shake things up at the virtualization company. One national enterprise solution provider that works with VMware told CRN that he thinks VMware's integration of NSX software-defined networking with security offerings from Palo Alto Networks and Check Point "may get stifled" if Dell tries to push SonicWall into NSX-related opportunities.

Impact On Dell, EMC Partners

Marius Haas, Dell's chief commercial officer and president of Dell Enterprise Solutions, told CRN on Monday that a merged Dell-EMC will be able to deliver products that are more easily integrated, from virtualization to compute, storage, cloud and security.

Dell and EMC together, Haas said, have an "unbelievable portfolio of technology and intellectual property that comes together to solve an end-to-end business problem for customers in traditional and new IT." He said EMC's sales team and Dell's midmarket strength create a "powerhouse in the market."

Can SonicWall And RSA Coexist Under One Roof?

EMC and Dell both have security offerings. Dell is client- and midmarket-focused, with its SecureWorks, SonicWall and AirWatch solutions. EMC's RSA is an enterprise-class security solution. While there is little overlap between the security markets that Dell and EMC serve today, CEO Michael Dell was vague about the company's plans for RSA after the Dell-EMC acquisition. In a media conference call, Dell said there have been a "number of discussions about security" and what the combination of RSA, SecureWorks, SonicWall and AirWatch capabilities could look like.

"We have great partners within the system integrator community. Their reach gives us great opportunities," Dell said. "As we go ahead and compete this transaction, we'll tell you more about our plans."

That leaves room for doubt among some partners, who told CRN that EMC had been in serious discussions to either sell or spin off RSA as an independent company, with an aim for an IPO in 2017.

Impact On Competing Partners

Chris Pyle, president of Champion Solutions Group, a Boca Raton, Fla.-based solution provider and IBM and NetApp channel partner, said the Dell-EMC deal creates new opportunities for him.

He told CRN his firm's Dell business is minimal and sees the EMC acquisition creating new non-Dell storage opportunities for his company. "I come across a lot of EMC in the market. But now that competition is going to be Dell," Pyle said.

"With any big deal like this, there are going to be some customers that are going to want reassurance that Dell and EMC won't take their eye off the ball," Pyle said. "For Champion, that creates a crack for me to exploit, allowing me to ask customers if it might be time to reconsider their EMC relationship and move to IBM and NetApp," he said.

Cisco And Hewlett-Packard Turn Up The Fear

Both Cisco and HP, which many argue have the most to lose with Dell acquiring EMC, contend that the acquisition will cause mayhem and instability for Dell and EMC partners and customers.

In an exclusive interview with CRN, Cisco CEO Chuck Robbins said the time that's already gone into Dell-EMC deal and the time it will take to get the deal done are bound to cause disruption.

"I think it just creates this massive period of instability in a world that's moving faster than we've ever seen," Robbins said.

HP's CEO Meg Whitman on Monday told Hewlett Packard Enterprise employees that Dell's acquisition of EMC is sure to cause a lot of pain for Dell-EMC channel partners.

"This move is going to cause chaos in the channel as they bring together two different programs and approaches," said Whitman in an email.

EMC Partner Lenovo: Partnership Likely Will Change

World leader in PC sales Lenovo said its relationship with EMC would continue, but it would "likely" change. Since 2012, EMC and China-based Lenovo have had a relationship in which Lenovo servers would be used in some EMC storage systems. Conversely, Lenovo agreed to resell EMC storage solutions in the Chinese market. The two also had an SMB product offering building NAS devices.

Lenovo has since extended its agreement to resell EMC storage not just in China, but also in the rest of the world.

When asked about its storage partnership with EMC, Lenovo issued the statement: "We prefer not to speculate on what this acquisition means to our business relationship going forward, though it is likely to change."

Who could Lenovo's new storage partner be? That question may already be answered: In May, Lenovo partnered with IBM to sell Lenovo Storage S2200 and S3200 arrays to the enterprise.

Dell Boosts Its Cloud Strategy With Virtustream

The EMC acquisition includes Virtustream, an enterprise computing cloud services provider. EMC bought Virtustream in July for $1.2 billion.

Virtustream's focus is on mission-critical SAP applications. It gives Dell access to a network of data centers in the U.S. and Europe, and an A-list of customers such as Coca-Cola Co., Domino Sugar, Heinz and Hess Corp. EMC's cloud portfolio also includes VMware's vCloud Air, a public cloud platform. It's long been speculated that EMC will bring vCloud Air and Virtustream into one product.

Dell's current cloud offering is Enstratius, a cloud management offering, which supports more than 20 public/private cloud platforms, including Amazon Web Services, Windows Azure, OpenStack, VMware and Rackspace.

For Dell partners, the EMC acquisition creates a stronger cloud strategy, said John Dinsdale, a chief analyst at market research firm Synergy.

"They'll have some organizational and product wrinkles to work through, but the result will be a company with a much stronger play in servers, storage and cloud software -- which should help it to grab the attention of public cloud operators and enterprise CIOs that may not have considered Dell previously," Dinsdale told CRN.