5 Key Points From Gartner's Q2 Server Market Report

Surveying The Server Scene

Dell made gains while Hewlett Packard Enterprise saw steep year-over-year declines but retained its position atop the revenue mountain in the global server market in the second quarter, according to research firm Gartner.

Worldwide server revenue declined nearly 1 percent year over year in the second quarter, but shipments grew 2 percent over the same time as x86 servers continue to gain traction in the market, Gartner said.

Dell capitalized on the strength of the x86 market, moving into the top spot in server shipments for the quarter, displacing HPE. HPE, despite declines in both revenue and shipments, held its position as the top server vendor by revenue for the quarter. Cisco Systems' revenue results were flat year over year. IBM, which sold its x86 business to Lenovo in late 2014, claimed a 9 percent revenue market share.

Still, while the battle between Dell and HPE rages, Chinese manufacturers Lenovo, Huawei and Inspur made significant shipment gains in the quarter. Click through to see five key stats from Gartner's second-quarter worldwide server report.

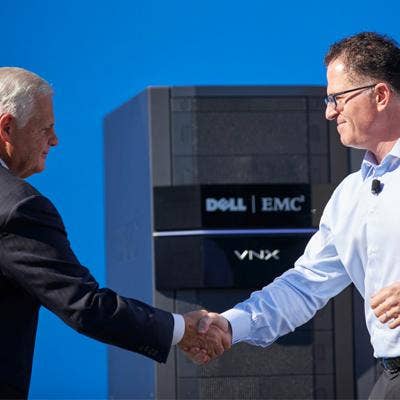

Dell Takes No. 1 Spot In Shipments

Dell finished the quarter with a 19.3 percent market share in server shipments, enough to land itself in the No. 1 position worldwide, Gartner said. Dell shipped more than 529,000 servers worldwide during the quarter, an increase of nearly 9 percent year over year and good for more than 19 percent market share. Dell saw growth primarily in the Asia-Pacific region, most notably in China, Gartner said. Dell booked $2.6 billion in server revenue in the quarter, an increase of nearly 10 percent, but not enough to displace HPE atop the worldwide server revenue heap.

HPE Tops In Server Revenue, Slips In Shipments

With $3.2 billion in second-quarter server revenue and nearly 24 percent market share, HPE again dominated the server market from a sales perspective. However, while its chief rival Dell grew revenue 9.9 percent during the quarter, HPE’s server revenue declined 6.4 percent, according to Gartner. Still, that decline is only one-third the size of the decline HPE saw in server shipments. The company, led by CEO Meg Whitman (pictured), shipped 474,803 servers during the quarter, an 18.7 percent year-over-year decline.

Widespread Declines Offset By Strength In North America, Asia, Europe

On a global level, the second quarter showed growth compared to the first quarter, but results varied by region, Gartner said. In shipments, all regions saw declines except Asia-Pacific and North America, Gartner said. Server revenue declined in every region except Asia-Pacific, which grew 6.1 percent, and Eastern Europe, which saw 1 percent revenue growth.

Lenovo Boosts Shipments, But Revenue And Market Share Remain Flat

Lenovo has made no secret about its willingness to touch off a price war in its effort to take on the likes of Dell and HPE head-to-head. The Chinese PC giant’s efforts showed in Gartner’s second-quarter results. The company shipped 235,267 servers during the quarter, a 6 percent year-over-year increase. Still, revenue for the quarter was about $968 million, a year-over-year increase of less than 2 percent.

Cisco Market Share Flat

As if to underline the ascendance of the x86 server, Cisco’s second-quarter server revenue was almost completely flat. The company, headed up by CEO Chuck Robbins (pictured), booked about $859 million in server revenue worldwide during the quarter, a decline of about 0.9 percent, according to Gartner. Market share was 6.3 percent, unchanged from the same period a year ago.