CRN Exclusive: Dell EMC President and Chief Commercial Officer Haas On Tripling Channel Sales, Lenovo's Tough Times, And Meg Whitman's Election Distraction

Haas Takes Center Stage

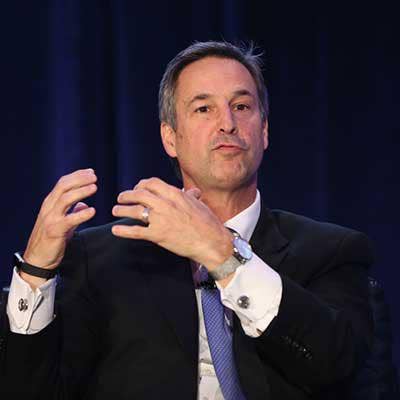

In an onstage interview Tuesday at the Best of Breed Conference in Atlanta, Ga. with The Channel Company CEO Robert Faletra, Dell President and Chief Commercial Officer Marius Haas discussed the explosive partner growth opportunity in the wake of Dell's $58 billion blockbuster acquisition of EMC.

Haas, a fierce channel advocate, promised to make the combined Dell EMC channel offering more profitable for partners than any and all competing programs. In addition, he discussed the strict Dell EMC deal registration process and the severe consequences for reps that ignore it, EMC's hard deck, Lenovo and Hewlett Packard Enterprise.

What is the channel growth opportunity with the new Dell EMC?

We are very motivated to get this right. The way I look at it is very simple: over 70 percent of the market with a total TAM of $2.7 trillion gets serviced through partners. Our share of that 70 percent is less than 10 percent. Why shouldn’t it be 20 percent? Why shouldn’t it be 30 percent? Just make it the same as it is through other routes to market and we will triple our business through the channel with you, with the largest technology portfolio in the industry. I would think that is a good, strong value proposition and we want you to be there with us on that journey.

How much in channel revenue do you think you can add to Dell EMC?

I think we could add billions of dollars. Billions. If you assume right now that it's well over $40 billion in revenue flowing through the channel and we're less than 10 percent of the market, why can't this be 15 [percent]? Why can't this be 20 [percent]? We're talking about an additional $40 billion. Where else are you going to get that kind of opportunity? Not very many places. When people ask me, 'Hey, Marius, you're in a big organization, your role has changed, why are you still excited about being here?' There is no opportunity that's bigger than this.

What is your channel philosophy?

There are three core tenets to what we want to do. We want to make the program simple, in the sense that you have to be able to understand it and you want to be able to make sure you can translate the value proposition to maximize the opportunity that is in front of you. Two, we have to have a predictable engagement model. If there is one thing that I hear every time, it is that Dell classic go-to-market model motion has not delivered a clear and predictable engagement model. We are going to go fix that. Third, it has to be profitable, and it has to be more profitable than what you can get from anyone else. ... Keep it simple, make the engagement model predictable like the EMC engagement model, and make sure it is profitable across the board. Those are the core design tenets.

Talk about the benefit of the size and scale of the new $70 billion Dell EMC?

Our R&D spend is going to be over $4.5 billion a year, double that of HP, double that of IBM. So I would say if you're going to bet on someone helping drive innovation for you and for your customers, that's a good place to start. You can't say there's going to be limited focus on innovation.

When your supply chain is the largest on the planet, so by definition, you've got economies of scale on any drive you buy, any processor you buy, any memory you buy, you're going to get preferential supply, and you should get preferential pricing if you're a good hard-core negotiator, that should benefit everybody.

Talk about the Dell philosophy and what that brings partners and customers going forward.

Our philosophy has always been transfer value to the customer as quickly as you can. We're going to commoditize some of the key areas we're in because if we don't do it, someone will do it to us. I have a mantra Michael's always saying: "Change or die." Clearly there will be more focus on the software side, clearly more focus on how do we create a single software-defined ecosystem. What was a big strong value proposition of EMC? A great sales force, especially a great enterprise sales force, a great support organization.

We're not going to throw that away, are you kidding me? So this is why one might say, look it's funky. How come you've got Bill Scannell running enterprise and you've got Marius Haas running commercial. Because EMC has done a phenomenal job with the enterprise selling motion, and I think we've done an okay job on the commercial selling motion. Let's go take advantage of that. It's a differentiator for us and our ability to reach a pretty broad audience.

The core channel principles were laid out at Dell EMC World last week. When can partners expect more details?

In December, we will roll out the next level of details. The savvy partners are saying we get this, we get the structure and the tiering, but tell me exactly what it means to qualify for that tiering and make sure the investments I make as a partner are commensurate with the benefits I get from that tiering.

Talk about the plan to make sure there is no conflict with Dell direct reps?

As part of the predictability model ... within Dell EMC it is a fire-able offense if you don't honor the registration process. We are going to be really clear about that. A lot of the partners I met with today still have some examples of engagements where they were just not fully in it because they aren’t 100 percent sure they have the trust factor…The engagement model needs to be predictable and, in order for it to be predictable, we need to execute to the program rules we put in place.

What about a hard deck? Will you put one in place?

We are going to lay that out. The first thing we wanted to do was make sure we had a line of business incumbency for all the EMC partners that came into the equation. Especially if you were an EMC partner and you were in the hard deck model, the fear was you were coming in, you weren't protected, and you would have to compete with another sales organization. We stopped that by saying: if you have this account, you have sold and registered deals on that account, then that account is yours. We went back three years … We will go even further. I might even introduce the whole data center to have that whole line of business incumbency program. We are working through it, but we are pretty close to getting something that we think this population will be very excited about.

What will the new combined Dell EMC program look like?

We want to take the best of the both programs. The feedback that we've gotten very clearly is that partners like the predictability of the engagement model that EMC provided in its partner program… Partners liked the economics they got from the classic Dell program. Why not take the best of one program and the best of the other program to create one world-class program with one set of great leaders that we bring together to help serve you so we can better serve our customers.

Dell talked about four tiers in the new program. Will that be too complicated?

We have three tiers today in either the EMC or the Dell programs. You have the gold, platinum, titanium. We have selected to keep an option [for titanium black], if there is a very, very special relationship. Think about it this way: you don't know what the criteria are for an American Express Black Card. You don't know, but once you get it you feel really special. There will be some instances where we have a very small group of partners that fall into that category. From a global perspective, they have to have a global ELA, something along those lines, to be defined and we will communicate that. But, assume it's the three tiers: titanium, platinum and gold.

You still don't have 50 percent or more going through the channel. Will that change?

It's awfully close … I have countries at 100 percent. I have countries at 30 percent. I have quota growth today in the channel at 18 percent on a big number. My direct rep is declining 8 [percent]. I'm okay with that. What's the most effective way to reach the broadest audience, in a cost effective way with a strong value proposition model? That's what you are going to go do. We want growth at all costs. That's why, I think, it’s a strong proposition for a partner ecosystem because, again, we have a breadth of technology that covers almost all of the spectrums of business challenges that customers are facing in one single partner. When we're all set and done with the program based on all the feedback, hopefully, it's the best program on the planet.

Is there one channel organization across all of Dell EMC?

There is one channel. There are a number of things that we know we need to do once and need to do it really well…All size accounts, both [Bill Scannell's] organization and what I have in commercial [report up to John Byrne]. There is a key philosophy – I grew up in a leveraged go to market model. I clearly understand the value of the reach and breadth you can have by leveraging a very strong channel ecosystem.

Should we expect over time that Dell becomes a partner-led, versus a customer choice, company?

I think the important part is the clarity of the engagement model. If a customer is absolutely adamant that they want to be served direct, it's hard for us to say no we won't take your business. However, EMC has practices where they have said we love your business and we can better serve you with this partner ecosystem and in this particular way. We will take some of those practices and incorporate them in.

Are EMC partners going to be in a more heavily competitive environment as Dell partners come in with EMC gear and vice versa?

Look line of business incumbency is important. You are protected by your deal reg process. Every day we match up Salesforce.com on both sides of the house to make sure that deal registration is up to date on a daily basis. So that is critically important. Line of business incumbency per section is critically important because that makes sure that if this is your account and you have been active in that account you are going to get preferential treatment. So you are going to get preferred pricing for that account.

What about partners competing with one another for an account?

If a partner decides they want to go make it an acquisition account we are going to have to manage that. That ultimately is competition within the partner ecosystem. We want to minimize that as much as possible. But I can't sit here and guarantee it is not going to happen because it happens today. This was the dilemma Cisco had five years ago when you had 10 partners bidding Cisco on every opportunity because that was the play to make.

How important is account planning in future of Dell EMC?

It came up in three or four meetings today with partners I had a chance to meet with. That's a big part of the reason we went to a territory-based model this year.

For 30 years, we did it by global accounts, preferred accounts, SMB. We were flying people all over the place. On average we had account executives that were 166 miles from their customer. How often are you going to go make that visit? So we went down to the territory level – east, central, west, inside – to make it much more predictable. So partners know who do you go talk to, who do you go align with. Everyone in those territories has a commercial sector and a public sector. We'll match it up with the channel leadership teams assigned to each one of those territories and boom off we go! Let's look at exactly where we can do territory planning together because there are millions of accounts we are not covering today – millions. We need your help.

What can you say to all of those partners to repair any past reputational damage with Dell?

I came here to Dell with 20 odd years at Compaq and HP, so I understand what a leveraged model looks like and the value thereof. I've been pushing the agenda within the classic Dell ecosystem to leverage that knowledge base and leverage that reach that the partner ecosystem brings in a much more predictable manner. I would say we have made good strides, not great strides in the past couple of years. This is an unbelievable opportunity for me to reset the overall program by taking what EMC has done really well, match that up to the few things we have done really well and create a program that service providers and partners can get excited about…Come December we will lay these things out, and we will hopefully convince you that you should give us another opportunity for us to work together … If we lay out a program for you that is compelling and that you ultimately trust us and trust me, we think we can help you grow your business more so than any other partner. It is our job to convince you, but I would like to bet that we will get it done.

How is the new Dell organization structured?

The umbrella parent company is Dell Technologies. Within Dell Technologies, there are three strategically aligned businesses and one large, privately held company. The privately held company is what you've known for a long time: the classic or legacy Dell ecosystem and the legacy EMC business coming together as one technology company. The three strategically aligned businesses are VMware, Pivotal and SecureWorks. The reason why we kept them separate is because in some form or fashion they either are a public company, like VMware and SecureWorks are, or they have a foreign investment of an outside entity with foreign members sitting on the board, like for example Ford made an investment in Pivotal and they also have a seat on the board with observer rights only … Then, if I go back into the Dell-EMC side, clearly you have the client business, such as desktops, workstations and so forth, that is run by Jeff Clarke. Then, you have a division run by David Goulden that is the product division, so all data center solutions: server, storage, networking, converged, RSA, Virtustream... Then there is a third business unit, which are our services. That mostly is our support services and warranty services. There are three main divisions within Dell-EMC.

It sounds like, on the VMware side, they remain pretty autonomous.

Clearly, we want VMware to become the de facto standard on everything software-defined data center. Because of that, it has to work with everyone. It has to work with HP. It has to work with NetApp. It has to work with Dell-EMC … They need to make sure they provide an open ecosystem to provide virtualization across all pillars of the data center and try to drive any cloud, on any app, on any device … You saw an announcement not so long ago about what they did with AWS … That is necessary for them to be relevant in every cloud ecosystem there is.

With all of the storage options, from Compellent, to EqualLogic, to EMC. Can we expect a rationalization of the portfolio?

For this population, you have more storage now than anywhere else you can look at from a partner perspective. We are excited about the breadth that we have … What I drove [around Compellent and EqualLogic] was a platform architecture where I could consolidate into a single code base, so I had both file and block on one and I had both dedupe and compression, with consistent tiering across the board for channel. That was the promise and commitment made to drive the platform consolidation … We will do similar things with Unity, as an example. We are focused on the common management, common replication and common tiering across the mid-range storage platforms because that drives the most value for customers quickly, versus saying I'm going to sit here and say I have to end-of-life a product because I have to cut across. That is not the intent, whatsoever. I'm not saying that in three or five years that this road map might change – it might… But, as of right now, every product that we've announced and shown to partners and customers in the storage portfolio we are committed to in perpetuity.

I understand you're the son of an expatriate. Talk about that.

We moved around a bit. I was born in the Dominican Republic, moved to Honduras, moved to Mozambique and South Africa, moved to Holland, moved back to the Dominican Republic, moved to Venezuela, then came back to the US. I have seen a lot, but here's the big takeaway for me: when you experience that, the good and the bad, you don't take anything for granted. You truly see how 90 percent of the world lives, in many ways … You don't take for granted anything you've got, so every opportunity you have you say: 'This is an opportunity.' You have to take advantages.

How many languages do you speak?

I speak three fluent languages and then I get along with a few others…Spanish, Dutch English … I try [to speak in those languages when I meet with partners and customers].

Does Michael Dell manage differently than other CEOs you've worked for?

They are all different. I could tell you Carly, Mark and Michael stories. The Mark and Carly stories would be more fun but I probably shouldn't go there.

Talk about what Michael Dell is like?

Michael is a techie at heart. He is passionate and he is absolutely 100 percent committed to helping change the world and the industry.

He was the first ambassador to the United Nations for Entrepreneurship. A big part of it was the United Nations was going to vote on what are the core, key priorities the United Nations was going to focus on for the next 10 plus years – one of which was around economic development. That was actually below the cutline. Think about it global leaders coming together deciding on what the priority is around the world and driving economic growth was below the cutline.

Michael took it upon himself to say – 'Look I am going to go champion this thing. I am going to help drive this thing." The whole company rallied around making it a cause. It was known as Goal 8. It was all around job creation, economic development in every country around the world.

You have got to take share to grow in PCs. How are you going to do that?

We have 15 consecutive quarters of PC share gain. So we feel good about where we are with the product portfolio and what we are doing. If you just look at the PC market in and of itself- the top three players are growing and taking share. Everyone else is losing. It is HP, Lenovo and us that are gaining share. We have outpaced the other two which is good. But we are still fighting for that number one and two spot. We are number three today growing faster. We think we'll catch up here very soon.

What is the server market situation?

It is actually a market that is diversifying. What is happening in the China ecosystem is you have Tencent and Alibaba. Those players are spending an enormous amount of money and the OEM providers in China are fighting for that share. You have got Lenovo, Huawei, Inspur. We are playing. There is no money to be made in that ecosystem, but everyone is fighting. If you want share and you want to grow you have to go play in that space. It is those players that are creating a market environment in the server ecosystem that is bifurcating versus consolidating.

The other shift that you see taking place is a buyer shift toward service provider, SaaS, cloud providers. The data shows the following: $43 billion server market globally is going to grow by $11 billion over the next three years, but $12 billion of that growth is all in the cloud ecosystem- public cloud providers, SaaS providers, service providers. That means the traditional data center ecosystem is declining.

What are the challenges to that server business model?

It is all moving toward that more density optimized, web architecture which also brings with it a very different business model. We have got a couple of challenges here emerging and a lot of things that we need to think about as we together go after that space- How do we do that and make sure that we attach the right services offerings and provide the total value proposition both for on-prem, off-prem, hybrid into a public cloud, with seamless hybrid cloud management.

If getting bigger didn't work for HP and HPE why will it work for Dell?

I was there when we did pull it off. I was head of strategy and corporate development for (former HP CEO) Carly (Fiorina) for one year and worked four years for (former HP CEO) Mark Hurd.

We felt pretty good at where we were. What happened was subsequent changes in leadership and a lack of focus on the operational execution in my opinion (hurt HP). I have got tremendous respect for the brand and for the individual that are there. But when you get that kind of churn at the top of the house getting continuity in business results is really hard.

At that point in time, I took some time off and went to KKR. That is when I decided it was time for me to leave: too much blood, sweat and tears was put into putting that company into the right direction with the right size and scale. I just didn't want to see it go into a different direction.

Who is the weakest competitor you are going up against?

If I put it in the realm of who is having a tough time economically- creating economic value- Lenovo is clearly in a tough spot with the mobility business taking on a $250 million a quarter cash flow loss. Try to absorb that when you also not that long ago bought the IBM server business. Good technology but just not profitable. So now you've got another unprofitable business. The PC business can't carry that. So I think there are some changes coming there.

What about HPE?

I can't believe that the end game for (HPE CEO) Meg (Whitman) is to just keep getting smaller. There has got to be another play that she has got up her sleeve or she is deciding it's time to go somewhere else- which one might assume when you see some of the activities she has in the public sector.

It's funny the individual that kept saying that we would be distracted and or unfocused is the individual that four years ago ran for Republican governor of California and is now supporting the Democratic presidential candidate publically in the debates. Focus maybe? Other interests maybe?